This year the IRS announced there will be an increase to the maximum employee 401(k) contribution limit for 2024, increasing it to $23,000, a $500 increase from the 2023 tax season.

There will also be a change to the maximum allowed for catch-up contributions. Those represent the additional amount of contributions that you can make to a 401(k) plan if you are age 50 or older.

For 2025, that number will increase at $7,500. That means the total contribution for plan participants age 50 and older is $30,500.

Every year, in October, the 401(k) contribution limits are reviewed.

Table of Contents

- Everything You Need to Know About 401(k) Contribution Limits for 2025

- The Contribution Limits Also Apply to Roth 401(k) Contributions

- How Much You Should Contribute With the New Contribution Limits

- Tips for Contributing to Your 401(k)

- What We Can Expect of Contribution Limits in the Future

- Will Increased Taxes Impact 401(k) Contributions?

- Final Thoughts on 401(k) Contribution Limits for 2025

Contribution limits increase more during years when the inflation rate is higher, and less when it is lower, as it has been in the past few years. At times, there have even been concerns that the contribution limits might be reduced, based on a negative inflation rate.

Fortunately, however, that scenario has never played out, and the limits have either been increased slightly or left flat.

Everything You Need to Know About 401(k) Contribution Limits for 2025

The chart below shows the base 401(k) maximum contribution, the catch-up contribution for employees ages 50 and older, and the maximum allocation from all tax-sheltered retirement plans, from 2009 to 2024.

As you can see, the rate of increase over the past eleven years has typically moved at a snail’s pace. There has been only a $3,000 increase in the maximum contribution since 2009 and an even smaller increase in the catch-up contribution over the same space of time.

And as you can also see, contribution limits have stagnated in the past, such as 2009 through 2011, when they remain at $16,500 for three years in a row. Even more obvious is the lack of increase in the catch-up contribution for a full six years, when the amount remained at $5,500 from 2009 through 2014.

From 2009 through 2024, the maximum increased from $49,000 to $69,000. That’s an increase of $9,000 over 10 years, which works out to be over 2% per year.

401(k) Contributions Over the Years

| Year | 401(k) Maximum | Catch-Up Contribution | Maximum Allocation |

|---|---|---|---|

| 2024 | $23,000 | $7,500 | $69,000 |

| 2023 | $22,500 | $7,500 | $66,000 |

| 2022 | $20,500 | $6,500 | $61,000 |

| 2021 | $19,500 | $6,500 | $58,000 |

| 2020 | $19,500 | $6,500 | $57,000 |

| 2019 | $19,000 | $6,000 | $56,000 |

| 2018 | $18,500 | $6,000 | $55,000 |

| 2017 | $18,000 | $6,000 | $54,000 |

| 2016 | $18,000 | $6,000 | $53,000 |

| 2015 | $18,000 | $5,500 | $53,000 |

| 2014 | $17,500 | $5,500 | $52,000 |

| 2013 | $17,500 | $5,500 | $51,000 |

| 2012 | $17,000 | $5,500 | $50,000 |

| 2011 | $16,500 | $5,500 | $49,000 |

| 2010 | $16,500 | $5,500 | $49,000 |

| 2009 | $16,500 | $5,500 | $49,000 |

For each year, the maximum allocation is increased by the amount of the allowable catch-up contribution (which applies to workers 50 and older). For example, for 2025, the maximum allocation is $76,500. That is the maximum allocation of $69,000, plus the $7,500 catch-up contribution.

The Contribution Limits Also Apply to Roth 401(k) Contributions

Contribution limits for Roth 401(k) contributions are the same as they are for traditional 401(k) contributions. That means you can contribute up to $23,000 per year to either a regular 401(k) plan, or a Roth 401(k) plan.

More likely, you will want to contribute to both, in which case you’ll have to allocate how much of the $23,000 limit will go into each part of your 401(k).

Not coincidentally, the 401(k) limits are virtually the same as the limits for both the 403(b) plan and the Thrift Savings Plan (TSP).

In addition, any employer matching contributions to the plans are not included in the employee contribution limits listed above.

Your employer can contribute a matching contribution that exceeds the $23,000 regular contribution limit, or even the combined $30,500 limit if you are age 50 or older. It is always a good idea to figure out whether a Roth 401(k) vs Roth IRA is best for you.

How Much You Should Contribute With the New Contribution Limits

The IRS determines whether or not to increase its contribution limits based on an annual basis. Sometimes changes in the Consumer Price Index (CPI) have been very small, like on the order of 2% per year. Congress prefers to increase contributions in increments of at least $500, which they did this year.

If you divide that amount into monthly contributions, you’re making only slightly smaller payments which will benefit you in the long run. Continuing to max out your 401k at this level is an ideal strategy,

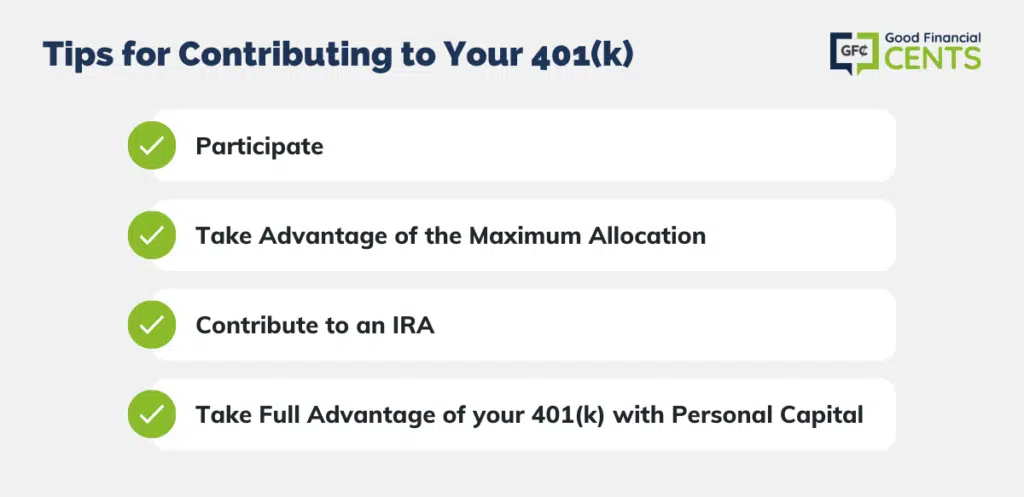

Tips for Contributing to Your 401(k)

Participate

For most workers, the flat or level 401(k) contribution limits over the past three years aren’t the real problem. The real problem is a lack of employee participation. A large percentage of employees do not participate in a 401(k) plan, even though one is offered by their employer.

How much are American workers contributing to their 401(k) accounts? Each age group has different tendencies, of course. Data from Fidelity shows Americans in their 30s have an average of $38,400 in their 401(k) accounts, with an average contribution rate of 8% of income. For Americans in their 40s, that number was $93,400, also with an average contribution rate of 8%.

The same data shows workers in their 60s contribute 11% of their income to a 401(k).

Contribution limits have only been increased by $500 in five years, but $19,500 still represents a lot of tax-deferred savings potential. Do what you can to get as close to the maximum contribution possible, especially as you move closer to retirement.

Take Advantage of the Maximum Allocation

The biggest number on the chart above for each year is in the Maximum Allocation column. That is the maximum amount of money that you can contribute to all tax-sheltered retirement plans that you have available to you. It’s actually a more important factor than most people realize.

Despite the increasing 401(k) contribution limits, the average person isn’t coming close to maximizing their potential contributions to retirement plans of all types. The 2025 maximum allocation for all plans is a very generous $69,000, or $76,500 for workers 50 and older.

That’s the amount of money that you can contribute even beyond your 401(k) plan. You may be able to make tax-deductible contributions to a traditional IRA, or non-tax-deductible contributions to a Roth IRA if your income is within the limits for either plan.

Contribute to an IRA

Even if your income exceeds the threshold for a tax-deductible contribution – in addition to being covered by an employer plan – you can make nondeductible contributions to a traditional IRA, regardless of your income.

A $7,000 IRA contribution, in addition to contributing $23,000 into a 401(k) plan, will increase your contribution to $27,000 per year (or $37,500 if you’re 50 or older).

But beyond IRAs, there are also several types of tax-sheltered retirement plans for the self-employed, including SEP and SIMPLE IRAs. If you have a side business, you can maintain these retirement plans for that business.

They will allow you to contribute more money to a tax-sheltered plan. You can go as high as $69,000 total, which gives you plenty of room to make more contributions.

Take Full Advantage of your 401(k) With Personal Capital

Aiming to make 401(k) planning more of a help and less of a headache, Personal Capital is an asset management software that steps in where your employer often falls short.

For instance, Personal Capital offers assistance with the following important tasks:

- Avoiding: unwanted hidden fees

- Evading: pesky account minimums

- Determining: accurate stock-to-bond ratios

- Assessing: whether your current plan meets your long-term retirement goals

- Shifting: full partnering responsibility to the employee instead of the employer

The free 401(k) analysis tool provides managing suggestions you must pursue on your own.

- Use their Fee Analyzer™ to find hidden fees

- The app is 100% free

- See all your money accounts in one place, in real-time

What We Can Expect of Contribution Limits in the Future

The good news is that we have been in a prolonged time of low inflation. That’s good news in regard to the cost of living, even though it has kept a lid on maximum 401(k) contribution limits.

Since that seems to be a long-term pattern, we should probably expect several more years of either low or nonexistent increases in the contribution limits.

But that makes an even stronger case for maximizing the contributions that you make within the limits that we have, as well as investigating the possibility of contributing to the other retirement plans, such as IRAs or the various plans that are available for the self-employed.

We have to work within the limits that we have and recognize that they are more than enough to help us reach our retirement goals. Those limits will allow us to do just that, even if they don’t increase significantly in the future.

Will Increased Taxes Impact 401(k) Contributions?

Concerned about how a potential tax hike could impact your 401(k) contribution? Some experts are expecting various tax hikes across the board due to COVID-19 expenses. Tax hikes could be passed to individuals as an increase in property taxes, income taxes or even business taxes.

Expert commentary on the 2017 Tax Cuts and Jobs Act also notes that there are federal tax increases every two years, starting in 2022 which could see even those earning below $75,000 annually facing a tax increase.

Since tax hikes could impact your monthly budget, it’s important to review your finances if these hikes come to fruition. Ensure you’re saving enough each month to make the retirement contributions you’re comfortable with.

Final Thoughts on 401(k) Contribution Limits for 2025

The IRS increased the 2025 maximum 401(k) contribution limit to $23,000, with a catch-up contribution of $7,500 for those 50 and older. Changes in inflation affect the limits, which have risen gradually. Consider factors like loan type, personal loan requirements, and loan terms before applying.

Roth 401(k) contributions share the same limit as traditional ones. To maximize contributions, participate, allocate funds effectively, and contribute to an IRA. Personal Capital offers 401(k) planning assistance. Despite low inflation, contributions within existing limits can still help reach retirement goals. Prepare for potential tax hikes that could impact 401(k) contributions.

If my employer matches 401k contributions, can I contribute $19,000 from my paycheck and they also contribute whatever percentage they match which will bring my 401k over $19,000 for 2019. Is that ok?

Yup!

As a physician, age 62, I currently max out my contributions to my retirement plans. If I take on a side job, could I max out another $54,000?

Hi Ed – Not another $54,000. But for 2018 the maximum contribution is $55,000, but may be $61,000 since you’re over 50.

First, I am unfamiliar with all of this so thank you! Say the end of the year is nearing, and I have contributed more than the max you are supposed to contribute. What happens to me/the money? Also, should I stop contributing short of the maximum contribution to ensure that I don’t go over?

Hi Ana – You should absolutely stop contributing. As to the amount you over contributed, contact your plan administrator and see what your options are. You may be able to correct this, but you have to move quickly to do this. If you do end up over contributing you’ll have to pay penalties.

I turned 50 this year. how do I plan my 401k deductions to max out my 18,500 + 6,000. Do I have to finish the 18,500 before the Catch up starts? or can I have my 401k% set to break out the 18,500 over all 12 months, and the 6000 also broken out? – ie. max out the first 7 months to get to 18500, and then use the last 5 months to add the 6000?

Hi Debbie – Check with your HR department or plan administrator. I suspect they’ll let you set your contribution for the higher amount.

Debbie,

I believe it would be in your best interest to spread out the $18,500 over all 12 months so you max out on your last paycheck. Typically companies provide an employee match only on the $18,500. If you max out the $18,500 before the end of the year, you’ll lose out on that company match for the remainder of the year. Companies typically don’t provide an employee match on the $6000 Catch-Up funds so get that in there as soon as possible. Also, you’re not required to do one at a time. You can allocate some funds towards the Primary and some towards the Catch-Up from each paycheck.

Hi Jeff,

if a person is earning, let’s say 50k a year, will he/she can contribute 18.5k and a person making 20k, can also contribute 18.5k? or there is a limit based on how much you make a year?

Hi Mani – Contributions aren’t defined by the amount that you earn, except that you can’t contribute more than you earn. In your example, both people can make the same size contribution. Now if the second person made only $15,000, the contribution limit would be $15,000.

That said, an employer does have the lattitude to limit contributions to a certain percentage. But per the IRS, you can contribute up to 100% of earned income.

Know About 401k Audits and Plans

The word “audit” whenever cited; raises questions and discomfort among people. The reason being; lesser knowledge of the audits which they are obliged to pay and which one doesn’t concern them. 401(k) Plan Audit is no less an exception which is complex for the people who are not familiar with it.

Are you required to pay 401(k) Audit?

A lot of non-public businesses are not indebted to audit their book annually. While figuring out if you are bound to pay an audit for your 401(k) plan; primary requirement is to determine the number of eligible participants in the plan at the outset of the plan year. Such plans are termed “Large Plan.”ERISA (Employee Retirement Income Security Act) of 1974 obligates a firm to have their financial statement’s annual audit attached to their Form 5500 through an independent qualified CPA to DOL.

Who is called an eligible participant?

When an employee meets the requirements mentioned in the plan documents i.e. 401(k) or profit sharing plan then only they are entitled to receive the benefits. The requirements of an employee are which might be less prohibitive:

Minimum age of 21

Minimum service year of 1

403(b) plan gives a power of “universal availability” to an employer where if you defer an employee’s income, it’s mandatory to provide the same endeavor to every employee.

But some exceptional employees exist in this plan; that are excluded, such as the employees who annually share $200 or less, have weekly working hours less than 20 and are the students who provide services under Internal Revenue Code Section 3121(b) (10). Along with this, non-resident employees and the ones taking part in 401(k), 403(b) or 457(b) plan are also excluded.

What are the exceptions in the” 100 eligible participants” rule?

80-120 Participant Rule: This rule lets the organization with participants between 80 and 120 since the first day of the plan year, to be filed under the same category. Whether a plan comes under a large plan or small plan depends on the strength of the participants.

When does SEC(Securities and Exchange Commission) consider a plan agreeable to reporting prerequisites?

SEC is diligent to demand a form to be filed by the plans that involve the stock purchase, savings and related plans having securities that are registered under the Securities Act 1933. The form i.e. to be filed is 11-K which is applicable to Section 15(d) of Securities Exchange Act 1934.

In spite of the fact that while filing for SEC rules, PCAOB standards audit a plan; to file with the DOL, the firm is also obliged to audit in compliance with GAAS (Generally Accepted Auditing Standards).

What is the objective of plan audit?

An audit brings to light the operational inaccuracies along with the transactions that are considered illicit. So it gives them a chance to redeem the damage by granting plan sponsors the key to gain success for their firm.

How is audit result beneficial for plan sponsors?

When one is through with the annual audit, the plan sponsor obtains multiple communications which prove advantageous as he gains more knowledge regarding his business. This can be used to:

strategize for the areas that are not yielding

Reform the processes

Empowering firm’s management

How should one plan for the audit?

Federal Government has stated some rules and regulations that are mandatory for both 401(k) plans, other retirement plans, and employer as well. It’s quite essential to have the understanding of the same which can be quite complex. So contact your accounting consultant if you face queries as to when your retirement plan needs an annual audit.

Hi Jeff,

Good article, very informative. I switched employers during 2017 in June. Here’s the situation:

Regular Catch Up

Employer A $4,630.73 $3,308.24

Employer B $11,460.76

————– ————-

Total $16,091.49 $3,308.24

With two paychecks left in 2017, my Regular 401K deduction is tracking toward $18,311.49, and Catch Up will be unchanged from above. My question is whether I need to stop funding the Regular 401K Regular deduction so it hits $18K exactly. I’m hoping since I have $24K total (Regular + Catch Up), that the IRS won’t care if my Regular is a bit over the $18K limit since my Catch Up is well under the $6K limit.

Thanks,

Mike

Hi Mike – Since you’re over 50 your limit is $24,000 between the two plans.

For 2017, I’m over 50 and want to max out my 401K at work. I have already maxed out my 2017 personal Roth. What is the total I can put in my 401K that is tax deductible?

Hi Brent – $24,000 for 2017.

I really tried to understand the ongoing questions regarding the $54K max contribution but I still have a couple of questions.

1. If I max out at 18K in my 401k with my current employer, can I also contribute into a 403b with a different employer?

2. I turn 50 next May, does the additional/make-up $6000 apply for the whole year?

Thank you,

Fern.

You can Fern, as long as your contributions – including employer matches – don’t exceed $54,000. And yes, at 50, the limit goes up to $60k ($61k in 2018).

Are the limits doubled for married couples? What if one spouse doesn’t have an income and the other spouse has two jobs? Can that spouse max out the investment in their 401k’s at each job?

Hi Luz – They’re not doubled for a married couple in the case of a 401(k). Each set of contribution limits applies to the individual’s spouse. It can apply in the case of an IRA, if you do a spousal IRA for a non-working spouse.

I’ve maxed out my 401K this year, but my employer only matches half of the 1st 6% max (3%). If the max allocation is $54K, would it be a good idea to talk to my employer about increasing my match at salary review time over the next few years? Have you ever heard of anyone doing this?

No I’ve never heard of it Lou, but it wouldn’t hurt to try. If it’s a small employer they might agree. Doubt a large one would though.

Can you provide a list of all the tax-deferred plans that are available that one can contribute to a maximum of $54,000 per year? I was not aware of any outside of the 401k and IRAs.

Hi Johnson – Yes, in addition to the 401k and IRA, there’s also the Thrift Savings Plan, 403b, 457, SEP IRA and SIMPLE IRA. The Keogh plan might still be floating around too.

I have work for a few different companies, in which a 401K planned was offered and with that being said…I am wondering how do I get a grand total for all employers to find out what is the total on my 401K.

Hi Katrina – You should get annual statements from each plan. If you haven’t, locate some old statements, and ask each trustee for an updated statement. You also might look into either rolling those plans into your current 401k, or rolling them into an IRA. It’ll be easier to keep track of them in one place.

My husband is at retirement but wants to work 2 more years. He’s been working at a mine that just shut down and his job ended. This is Aug and he maxed out his contribution for his 401k at that company. He’s now started a new job that also has an employer 401k plan. Can he start contributing to that plan or does he have to wait til 2018. His employer will match up to 6%.

Thank you

Hi Denise – Unfortunately, the 401k contribution limits are per taxpayer, just like IRA contributions. So if your husband has maxed out his contributions for 2017 on the previous job, he’ll have to wait until 2018 to begin contributing again in the new plan.

Couldn’t her husband contribute to the 401K, with after tax money (no real tax advantage) in order to receive the company match of 6%, which would be tax deferred? I know when I reach my $18k max, (plus $6k for over 50), my company continues to take the percentage out of my check, but it is after tax money. They continue to match that money as well.

Hi Tim – You can if the new employer will allow it. The IRS does, but it’s up to the employer as to whether or not they’ll actually do it. It’s an excellent question to ask, so thanks for suggesting it.

Is the $19,500 401k individual limit the max per couple as well? (or is it 19,500 x2 individuals = 39k per couple?) Thanks!

On the maximum allocation, is that number specific to limits on self-employed retirement accounts or all retirement accounts? More specifically, if I am not self employed does that maximum allocation apply to me and how would I reach it. We’re a single income household and by contributing max 401k and Roth IRA max for my wife and myself, we are still well under the maximum allocation numbers in your article. Without self-employment, I just am unaware of other tax-advantaged retirement accounts that I could use to get toward the maximum allocation.

Hi Brett – That’s the maximum that can be contributed to all retirement plans in your behalf, whether through an employer plan, a self-employed plan, or a combination of plans. So if you and your employer have contributed $54,000 to your 401(k) plan, you will not be able to make an IRA contribution on top of that. Make sense?

That does make sense. The question that remains is that if I am NOT self-employed and have maxed my 401k and both mine and my wife’s IRA, what additional options are available to me (if any) under this $54k maximum? I could see being close to the max if we each had a 401k to contribute to, but we’re a single income household.

You can’t go any higher than what you’re allowed in the plans available to you. So if you’ve contributed $18k to your 401k and $5,500 to your IRA, that’s as high as you can go. The IRS max in all plans is $54k, but you’re also limited by the plans you participate in. If you want to contribute more, you can start a side business, and add a plan for that business, like a SIMPLE IRA or a Solo 401k.

Thank you so much for taking the time to provide that clarity.

But Brett is only allowed to deduct the $18K from taxes, since he is under 50 years old. The $5500 traditional IRA will not be tax deductible, correct?

Hi Brent – It all depends on his income level. He can still make a deductible IRA contribution with an employer plan if he’s under the income threshold.

Hi Jeff,

I am over 50 years old. I contribute to my work 401(K) and my personal Roth IRA. My 401 (K) has three parts: pre-tax contribution, post-tax contribution (allowed in my plan), and Employer Match. My questions are: 1) Dose 401 (K) contribution limit of $60000 ($54000+$6000) for 2017 include Employer Match? 2) If I max out my 401 (K) at $60000 (pre-tax, post-tax and match together), can I still contribute $6500 to my Roth IRA (not Roth 401 (K))?

Thank you very much!

Frank

Hi Frank – If you’re 50 or older, $60,000 is the absolute limit for 2017 from all sources, including the employer match. If you’ve already hit $60,000 in the 401(k) you won’t be eligible to contribute to any other plans, including a Roth IRA.

I am self employed and have a bookkeeping/tax business where I make around $30,000 per year. My wife has a corporate job and makes $300,000/yr. She contributes the max to her 401k including the >50 contribution. Can I open a SEP IRA in my name and make a contribution of 25% of my earnings ($7500/yr) or am I precluded from this due to income limitations?

Hi Andy – The IRA income limits apply only to traditional and Roth IRA contributions. A SEP IRA is linked to your business so yes you can. BTW, the effective contribution is really 20%, or $6,000 based on $30,000. The IRS has this neat calculation where you must reduce your income by the SEP deduction before taking the SEP deduction. Crazy, I know, but that’s the tax code that we all know and love…sometimes.

Hi Jeff ,

I’m 61 years old and am maxed out at work my 401k plus make up.

Can I contribute to a Roth outside my plan and how much for 2012 and 2013 ?

@Ernest What you put in your 401k is irrelevant. The Roth limits are subject to your AGI solely. If you’re below the limits you can contribute to a Roth IRA.

http://www.dailyfinance.com/2013/01/10/fiscal-cliff-deal-401k-bonus/

Any info on this new relax of old 401 conversion to roth regs?

“The Roth 401(k) has been around for more than a decade, but old tax laws blocked workers younger than 59½ from making the switch. Thanks to the new deal, that little stipulation will be gone in a few months”

We have been looking forward to a higher 401K limit each year and we are taking advantage of it! Thanks for sharing.

Hi Jeff Rose,

Great post. Its good to hear the good news that COLA numbers are increased a bit this year and there is no fear that limits will be lowered as 401k remains flat. Thanks for the information Jeff 🙂

Higher limits are one way to keep money away from Uncle Sam/IRS. Sadly as you have pointed out a lot of people don’t take advantage.

Also – like the pic. What kind of apeture did you use for that? Nice.

@ Andy My buddy is a professional photographer and he took the pic. That means I have no idea! 🙂

23 year old here- new to this 401k thing. I have a question, are employers allowed to add above the 17,000 limit? say you personally put in $17,000, can your employer match that, or is it a combined (personal and employer) cap?

Yes, they sure can. The $17,000 is your personal 401k limit, but does not include what your employer can put in. That’s the beauty of having a 401k with a good match.

Is there such a thing as a once in a life time contribution over and above your annual and catch contribution ?

When do they increase the levels for the IRA’s is my big question….Feel like we have been stuck for too long at the $5K max…

I might have the worst retirement account company, so I need space in my IRA’s to increase…

It is important that every person tries to contribute as much as they can to their 401(k) and work to reach that contribution limit. The more you save now, the better your chances to see your nest egg grow!

Jeff,

I just came across your website and have been reading up on retirement. Just wanted to mentioned you have a great site and this is all good points. I have been contributing to my 401k and have taken an aggressive approach since I’m still young and single. You say that when you turn 50 – there is a catch up contribution. Does this hold true if I already have money invested in my 401k. So, when I turn 50 or 51 instead of contributing $16,500 – I can invest 22,500, are there any rules on how much I can invest?

Thanks,

Dan

It would have been great if they had increased the limits, but to your point if inflation isn’t increasing it isn’t really needed. And as you mentioned, the people that to be contributing likely still have upside.