The top travel credit cards make it easy to earn travel rewards that can translate into free flights, luxury hotel stays, and more. With a solid plan in place, credit card rewards can even make your travel dreams come true.

Imagine flying business class to Tokyo for pennies on the dollar or spending five nights at a luxury resort in the Maldives for the cost of a boat ride to your secluded private island.

With travel rewards, all of that and more could be yours; all it takes is some planning, some time to build up your stash of points, and a few strategic cards that make sense with your travel goals.

Also remember that you don’t have to focus on luxury travel to make the most of travel credit cards. Many consumers find that these cards make it easy to take their kids on vacations further from home while stretching the family travel budget as far as it can go.

By putting almost all of your everyday spending on a top travel credit card, you can earn enough points to score free hotel stays, almost-free domestic and international flights, and plenty of other travel experiences your family might not be able to afford otherwise.

Table of Contents

Best Travel Credit Cards

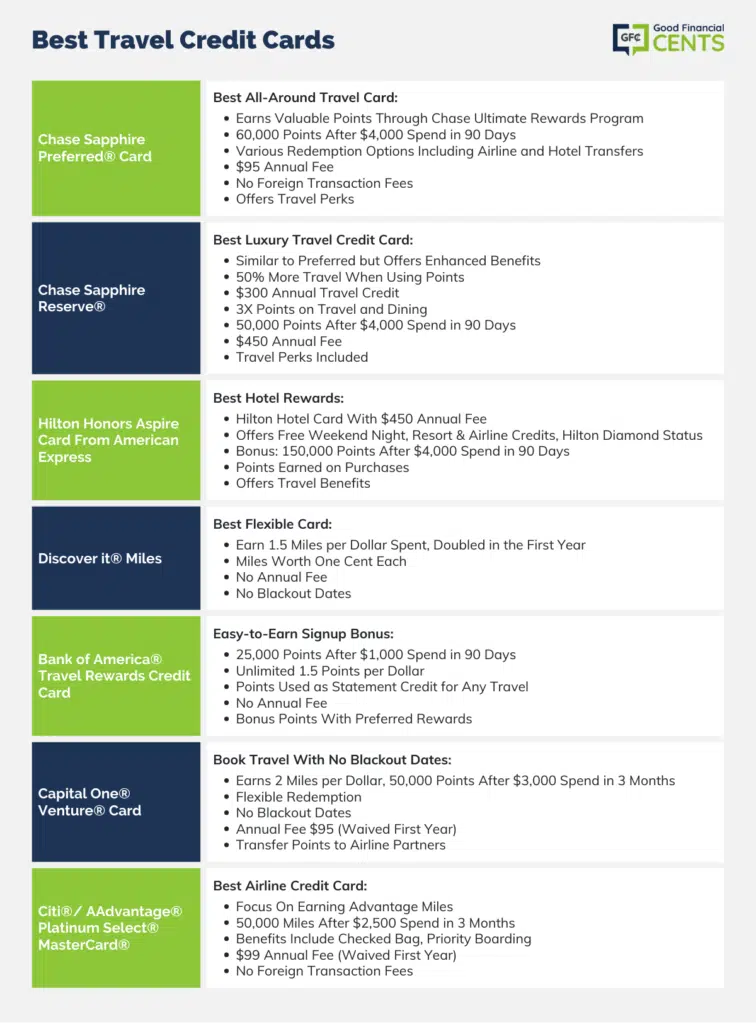

Before we dig into the details, let’s take a closer look at our top picks among all of the best travel rewards credit cards:

- Best All-Around: Chase Sapphire Preferred®

- Best Luxury Travel Credit Card: Chase Sapphire Reserve®

- Best Hotel Rewards: Hilton Honors Aspire Card from American Express

- Best Flexible Travel Card: Discover it® Miles

- Easiest Signup Bonus: BankAmericard Travel Rewards® Credit Card

- No Blackout Dates: Capital One® Venture® Card

- Best for Airline Miles: Citi®/ AAdvantage® Platinum Select® MasterCard®

Best All-Around Travel Card: Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card offers more than just a huge signup bonus. As part of the Chase Ultimate Rewards program, this card doles out points that are highly celebrated and touted as some of the most valuable in the industry.

After spending just $4,000 on your card within 90 days, you’ll earn 60,000 points worth $750 in travel if you book through the Chase Ultimate Rewards portal. And if you don’t want to book travel directly, you have several other options including transferring your points to the top airline and hotel transfer partners in the business or redeeming them for gift cards or cash back (if you are going to do cashback you should consider a cashback rewards card instead).

Transferring to one of Chase’s travel partners can be especially lucrative since all points transfer at a 1:1 ratio. Your current options include:

- United Airlines

- Southwest Airlines

- British Airways Executive Club

- Emirates

- JetBlue

- Singapore KrisFlyer

- Virgin Atlantic

- Aer Lingus

- Iberia Plus

- Air France/Flying Blue

- World of Hyatt

- Marriott Bonvoy

- IHG Rewards

If you want to earn flexible rewards without paying a huge annual fee, the Chase Sapphire Preferred® Card is probably your best bet. Here are the details you should consider before you pull the trigger and start racking up rewards:

- Earn 60,000 points after you spend $4,000 within three months of account opening

- Earn 2X points on travel and dining, plus 1X points on all purchases

- $95 annual fee

- No foreign transaction fees

- Free primary auto coverage, trip cancellation/interruption insurance, and other travel perks

Best Luxury Travel Credit Card: Chase Sapphire Reserve®

If you like the idea of earning points in the Chase Ultimate Rewards program but want a more comfortable travel experience, make sure to compare the Chase Sapphire Reserve® to the “Preferred” version of this card. The Chase Sapphire Reserve® has the same transfer partners and flexibility in how you redeem your rewards, although you’ll get 50% more travel for free when you use points to book. You’ll also get valuable travel benefits like a credit for Global Entry or TSA Precheck, a Priority Pass Select Membership, and a $300 annual travel credit in exchange for the $450 annual fee.

The Chase Sapphire Reserve® is also generous on the earning side of the equation, giving cardholders 3x points on all travel and dining purchases and 1 point per $1 on everything else. Currently, you can even earn 50,000 points when you spend $4,000 on your card within three months of account opening.

- Earn 50,000 points after you spend $4,000 on your card within three months of account opening

- Earn 3x points on travel and dining, plus 1X points on all purchases

- $450 annual fee

- Get a Priority Pass Select membership, $300 annual travel credit, credit for Global Entry or TSA Precheck, and valuable travel insurance

Best Hotel Rewards: Hilton Honors Aspire Card From American Express

If you’re looking for a hotel credit card, make sure you consider the Hilton Honors Aspire Card from American Express. This card does charge a $450 annual fee, but you’ll get benefits like a free weekend night each year (including your first year as a cardholder), a $250 annual resort credit, a $250 annual airline credit for an airline of your choosing, and automatic Hilton Diamond status.

You’ll also earn 14x points on Hilton purchases made with your card, 7x points on flights booked with airlines or through AmexTravel.com, car rentals, and U.S. restaurants, and 3x points on all other purchases. At the moment, the welcome bonus will also shower you with 150,000 Hilton Honors points after you spend $4,000 on your card within three months of account opening.

Before you sign up, consider these pertinent details:

- Earn 150,000 Hilton Honors points when you spend $4,000 on your card within three months

- $450 annual fee

- Get automatic Hilton Diamond status

- Receive an annual airline credit, a resort credit, a free weekend night each year, airport lounge access, and more

Best Flexible Card: Discover it® Miles

If you’re looking for a card that lets you earn miles good for anything, the Discover it® Miles is a smart option. With this card, you’ll earn 1.5 miles for every dollar you spend. Plus, Discover promises to double the amount of miles you earn after the first year!

After 12 months, you will have effectively earned 3 miles for every dollar spent. Since each “mile” is worth one cent, you can see how this could add up quickly. For example, $10,000 in annual spending would earn 30,000 miles worth $300 after the first year, while $20,000 in spending would equal 60,000 miles worth $600.

Better yet, you’ll never pay an annual fee. Keep reading for more details:

- Earn 1.5 points for every dollar you spend

- No annual fee

- Earn double the miles during your first year

- No blackout dates

Easy-to-Earn Signup Bonus: Bank of America® Travel Rewards Credit Card

While the Bank of America® Travel Rewards Credit Card isn’t one that would normally make our list, this card made the cut due to its increased signup bonus and low minimum spending requirement.

With this card, you’ll score an online bonus of 25,000 points after you spend just $1,000 on the card within 90 days. In addition to the bonus, you’ll also earn an unlimited 1.5 points on every dollar you spend.

Before you sign up, here are some more details to consider:

- Earn 1.5 points for every dollar you spend

- No annual fee and no foreign transaction fees

- Spend $1,000 on your card within 90 days to earn 25,000 bonus points

- Earn 25% to 75% more points on each purchase when you join Bank of America’s Preferred Rewards program

Book Travel With No Blackout Dates: Capital One® Venture® Card

The unique way the Capital One® Venture® Card doles out miles makes it one of the most transparent travel credit cards currently on the market. With this card, you’ll earn 2 miles per dollar spent on all purchases plus a signup bonus worth 50,000 points – or $500 in travel – after you spend just $3,000 within three months of account opening. That’s enough for at least one free round-trip domestic flight or several nights at your favorite lower-tier hotel or resort!

The cool thing about this card is that you can book any type of travel without worrying about blackout dates or capacity controls. Simply book any travel experience, flight, or hotel stay that works for your schedule with your card, then redeem your points as a statement credit. Interestingly enough, you can also transfer points earned with this card to a variety of airline partners.

Details you should know include:

- Earn 50,000 “miles” worth $500 in travel after you spend $3,000 on your card within the first three months

- Earn 2X miles for every dollar you spend

- Qualify for a credit for TSA Precheck or Global Entry

- $95 annual fee, waived the first year

Citi®/ AAdvantage® Platinum Select® MasterCard®: Best Airline Credit Card

The Citi®/ AAdvantage® Platinum Select® MasterCard® is the perfect card for anyone with a focus on earning free airfare. Whether your focus is on domestic or international destinations, the American AAdvantage program is known for offering plenty of availability (most of the time) and airline partners that make it easy to find award flights to nearly any destination in the world.

With this card, you’ll earn 50,000 American AAdvantage miles after you spend just $2,500 on the card within three months of account opening. That could be enough miles for two round-trip domestic flights. Beyond the signup bonus, this card awards you and four travel companions with a free checked bag on domestic itineraries, priority boarding on American flights, and no foreign transaction fees on purchases made abroad.

- Earn 50,000 American AAdvantage miles after you spend $2,500 on your card within three months

- $99 annual fee, waived the first year

- No foreign transaction fees

- Free checked bag for you and up to four travel companions

Getting Free Travel With Credit Card Rewards: How to Get Started

For the most part, the key to figuring out which card is best for your needs is deciding where you want to go. What does your ideal trip look like? Do you want to stay in a hotel or condo?

Do you want to fly all over the world or mostly stick to train travel?

Would you rather sink into a white sand beach with a cold drink or go hiking through the Swiss Alps?

When it comes to rewards, the sky is truly the limit. You can go almost anywhere and plan any type of trip you want, but your first step is figuring out a way to narrow your selection of destinations down. That way, you can focus on earning rewards that suit your specific travel tastes.

Aside from deciding where you want to go and when, here’s what you’ll need to get started:

- A Credit Score Over 700, But Ideally Over 720. The best travel credit cards are geared to individuals with good or excellent credit, which usually means a credit score over 720. Lower scores are occasionally acceptable if other employment and income conditions are met.

- A Debt-Free Lifestyle. If you are paying down credit card debt, you need credit card rewards like you need a hole in the head. Pay down your consumer debts and get on solid financial footing before you even consider travel hacking or pursuing rewards.

- A Plan To Stay Organized. While it’s easy to keep track of a single rewards card, having two, three or four can easily cause you to forget some of the important details. To stay on top of it all, you’ll want to keep a simple spreadsheet or list with details such as when you sign up, when you earned the signup bonus, and when (or if) an annual fee will be charged.

Rules for Getting the Most Out of Your Travel Credit Card

Before you sign up for any of the best credit card offers, it’s important to set yourself up for success. For most people, that means creating a long-term plan to pursue the upside of credit card rewards while minimizing your exposure to the downside.

Here are some tips that can help you earn an almost unlimited number of points and miles without getting in over your head – or worse, spiraling into credit card debt:

Rule #1 Only Spend What You Can Afford to Repay Right Away.

If you’re planning to use a credit card for the sole purpose of earning rewards, the most important thing you can do is avoid paying credit card interest at all costs! Paying interest will mostly likely cancel out the value of your rewards, which defeats the purpose of having a rewards card to begin with.

Rule #2 Use Your Credit Card as a Compliment to Your Monthly Budget – Not in Place of It.

If you’re worried paying with plastic might cause you to overspend, try using your credit card as a compliment to a monthly budget you create.

Write out a list of expenses you can charge on your credit card, then use your card to fulfill your spending plan for the month. Once you have put all of your planned monthly expenses on credit, feel free to pack your card away or stick it in the back of your wallet. The best way to make credit work in your favor is to only use it for planned expenses, and use it conjunction with a monthly budget or spending plan.

Rule #3 Rack up Extra Points by Using Your Card for Everyday Spending, but Pay It off Right Away.

The easiest way to rack up rewards quickly is to focus your credit spending on bills and expenses you needed to pay anyway – things like groceries, gas, and utility bills. However, some of these expenses tend to take on a life of their own if left unchecked.

If you want to stay on track, it might be smart to “check in” with your credit card bill at least once per week as the month progresses. That way, you won’t be surprised when your monthly bill arrives in the mail.

When it does, however, you should pay it off right away. Don’t let a balance carry over or you could easily wind up with a debt that will only grow over time.

Rule #4 Keep Track of Rewards Details in a Simple Spreadsheet.

If you get to the point where you’re juggling multiple rewards cards, it’s extremely smart to keep track of any pertinent details in a simple spreadsheet. Factors you may want to track include when you signed up for a new card, when you earned the signup bonus, and when the annual fee comes due.

Rule #5 Don’t Forget to Budget Your Entire Trip – Not Just the Parts You Got for Free.

The final rule to follow when using credit card rewards for travel is making sure you budget for your entire trip – not just the parts you paid for with rewards. If you’re flying somewhere on airline miles, for example, you’ll need to budget for hotel stays, food and drink, and entertainment once you arrive at your destination.

While travel rewards can make nearly any trip a lot more affordable, you shouldn’t let a lack of planning destroy your budget. Earning enough rewards for a free flight or hotel for a week is an awesome plan, but you still need to have money to eat, have fun, and enjoy yourself. And if you don’t plan ahead, you could wind up spending significantly more money than you ever dreamed.

Final Thoughts

If you’ve been trying to save for the perfect getaway but can’t seem to set aside the funds, it might make sense to look into airline miles, hotel points, and other types of rewards to see what kind of savings you can find. With the right strategy, you could even fly around the world, visit places you have never dreamed of seeing, or take your children or parents on a trip that will cause envy among even your closest friends.

With the right combination of cards, good or excellent credit, and some self-discipline, any trip you can dream up can be within your reach.

My Wife and I love our Chase Sapphire Preferred Card. We were able to take a 3-night trip to Rome (from Eastern Europe where we currently reside) mostly paid for with our sign-up bonus. Great to rack up points on business travel using this card as well.

You guys definitely have more options over there compared to the UK when it comes to Travel Rewards!