I can’t believe the Grow Your Dough Throwdown is over!

It’s been an exhilarating ride, and I wish I could say that I was excited to share the results.

Alas, my portfolio got its butt kicked, while my wife’s portfolio, on the other hand, did rather well.

In fact, I think everyone kicked my butt.

Oh, well, life goes on…..

The exciting thing is that the Grow Your Dough Throw Down 2.0 is ready to launch, and I will have details at the end of this post.

Until then, let’s take a look at how I did.

Table of Contents

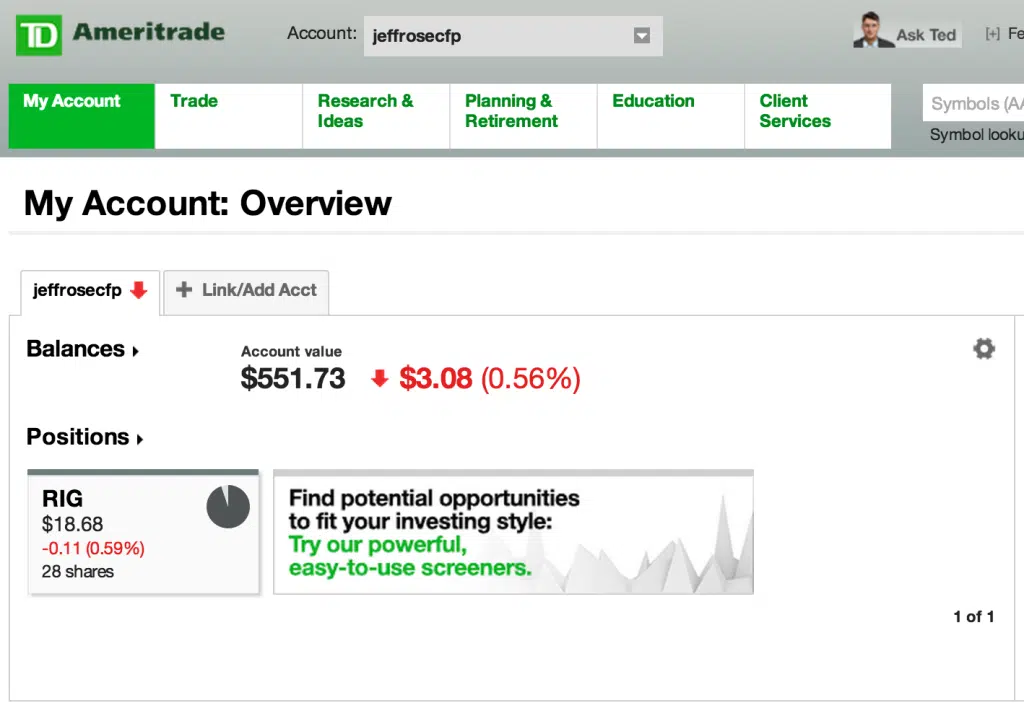

TD Ameritrade – My Lousy Portfolio

If you recall, previously, I had purchased five different stocks with my initial portfolio with TD Ameritrade. Two of my stocks have performed horribly: EHealthInsurance.com and Yahoo.com. My other three were doing okay but not great. Those were Fidelity Guarantee and Life (an insurance company IPO), Dunkin Donuts, and Bank of New York. After three-quarters of the year, my portfolio was down almost $100, and I knew there was no way that I would catch the leader, so I thought to myself, “Why not go big or go home?”

I sold all of my positions and then purchased RIG, which is Transocean, an offshore drilling contractor. I read about Transocean from another stock picker, and he absolutely loved it. and I thought with a 17% dividend and the potential to buy on a dip, I might have a chance to walk away with the Grow Your Dough Throwdown title.

My hope fell short. Really short.

As oil continued to drop, so did Transocean’s stock price. My total account value is down to $551.73, for a net return loss of 45% for the year. In case you haven’t figured this out yet, that is not how you Grow Your Dough, not at the very least. I went from having a balanced portfolio to becoming a speculative investor, which is basically what I warn all my clients against.

Luckily, it was only for $1000, and the stock still could come back… ha, ha, because you heard that one before. Either way, I definitely did not win the Throwdown, but I don’t think I took last.

Is there a trophy for next to last? 🙂

Ally Invest – The Blue Chippers

Ally Invest, then Tradeking, was the brokerage firm that I used to build a Blue Chip portfolio. The stocks I selected were General Electric, Coca-Cola, McDonalds, Microsoft, and Verizon. For the year, the account didn’t do as great as I had hoped, having a total value of $1,032.41 at year-end. Three of the stocks ended up being down for the year – General Electric, McDonalds, and Verizon – with the other two being up. Either way, we are still up, so I can’t be too unhappy about that.

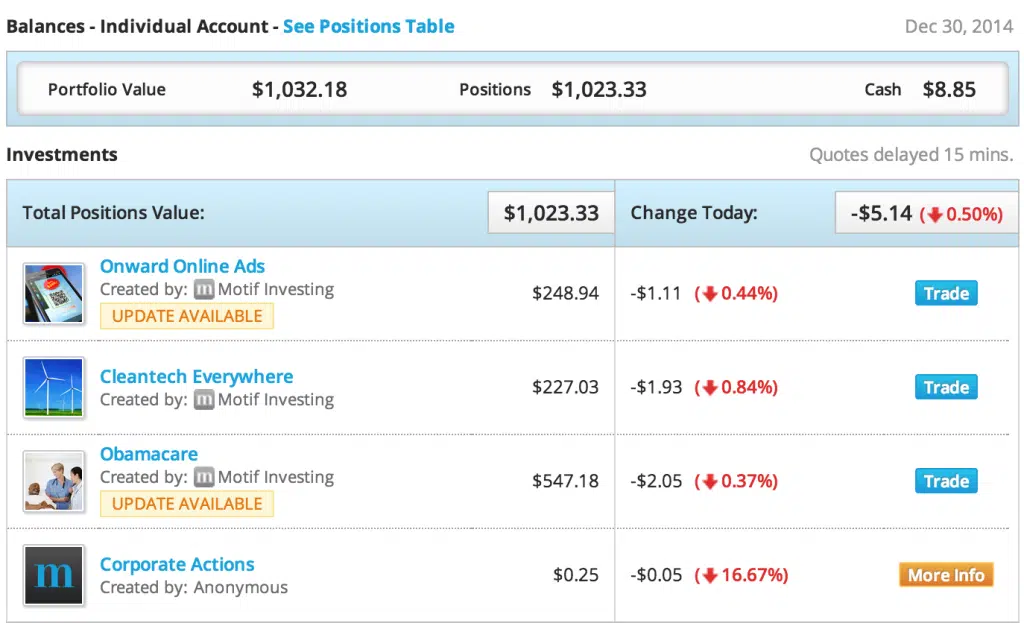

Motif – The New Kid on the Block

Motif, which you will hear more about in a second, was the investment platform that I was least familiar with. The more Motif investing reviews I read and how it is structured, the more I like it, especially for those who want to invest in a specific period over a sector in the market.

I purchased three different Motifs: the Onward Online Ad Motif, the Cleantech Everywhere Motif, and the Obamacare Motif. For the end of the year, my portfolio value is $1032.18, barely beating out the Blue Chip portfolio at TradeKing. Once again, I will share more about Motif here at the end of the post.

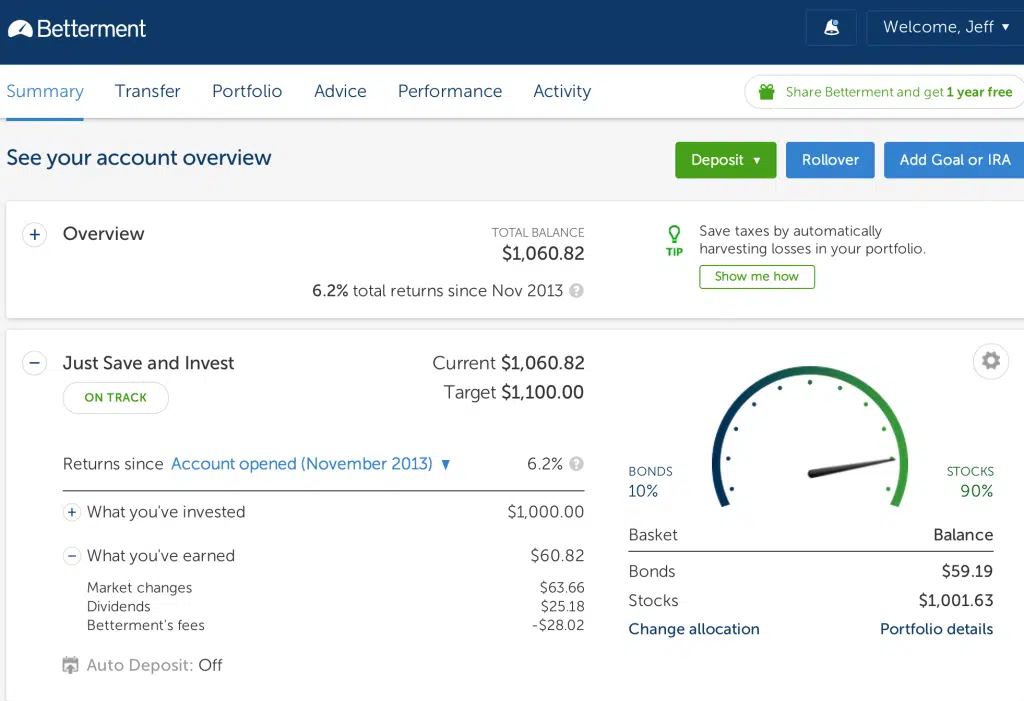

Betterment – So Easy

Out of all of the investment platforms I opened an account with, Betterment was no question the easiest one to get my money funded and then invested. It’s even easier than opening an account at Capital One 360.

For the year, my total account balance is $1060.82. With how Betterment investing works, I just selected my target goal, and then they constructed a portfolio that consisted of 90% stocks and 10% bonds, which are predominantly invested in ETFs. I’m still a big fan of Betterment, especially for those who know little about investing and want a super slick interface to get started.

Lending Club

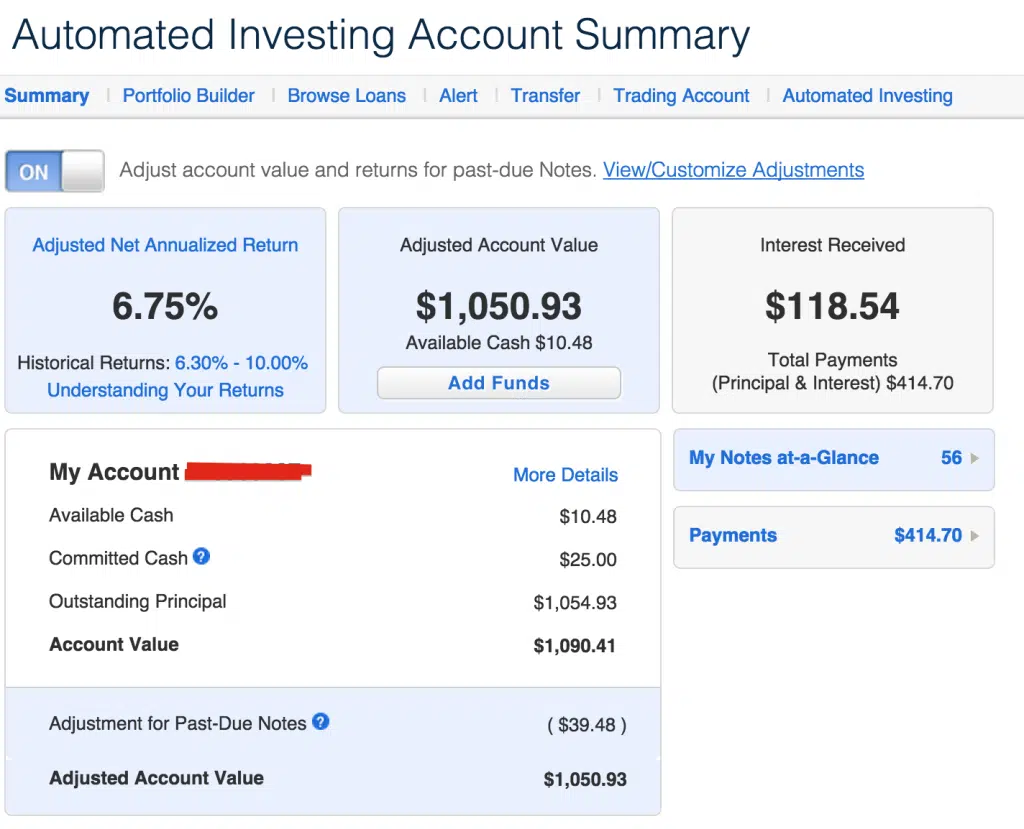

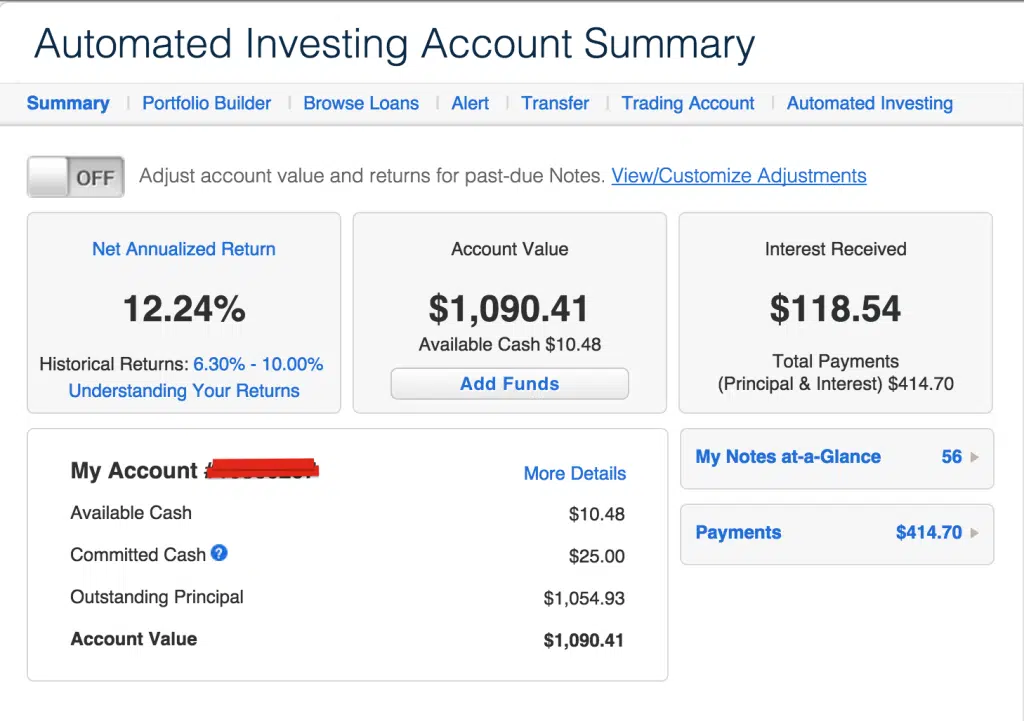

The two peer-to-peer platforms in Prosper and Lending Club fared well for the last part of the year as well. Lending Club has a new feature where you can see your account returns, and you can also adjust that for past-due notes. Basically, this feature is for those who make defaults on their loans. For the net annualized return with Lending Club, it was 6.75%, with an adjustment account value of $1050.93.

These notes are currently past due and haven’t defaulted yet, so if those happen to pay my net annualized return for the year, they would be 12.24%, with an account value of $1090.41. Considering how low interest rates are and having made money off your CDs, even the 6.75% is nothing to sneeze at.

Prosper

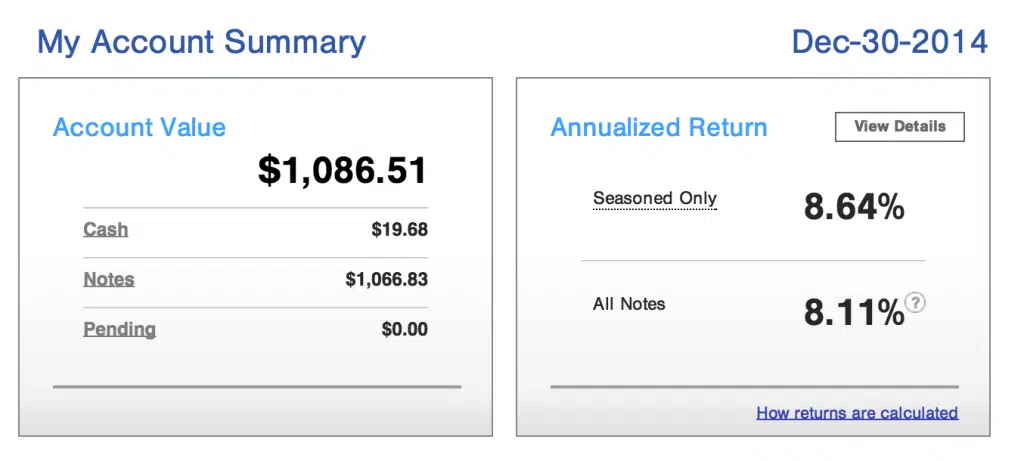

With Prosper, they currently don’t have the adjusted return, so the total value is $1,086.51 for an 8.64% return.

The Winners

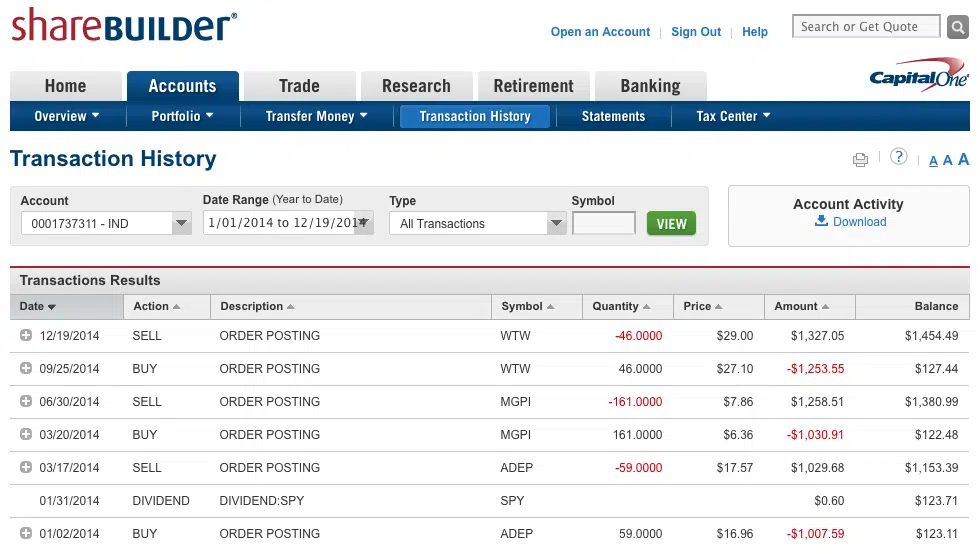

It definitely became a neck-and-neck race for who was going to win the Grow Your Dough Throw Down. Barely squeaking a victory by less than $14 was Phil Taylor from PTMoney.com. His total value was $1,327.05. Below is a screenshot of some of his holdings for the year.

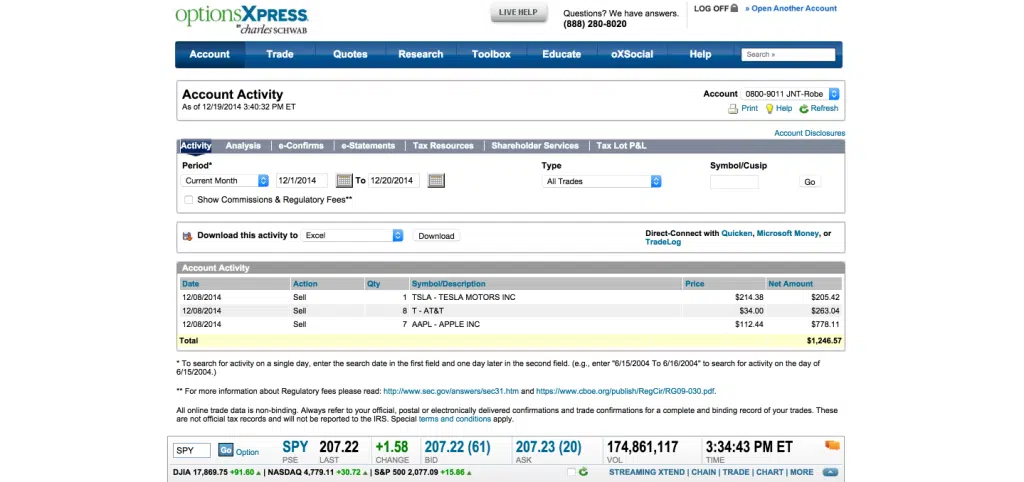

In a very close second place was Rob Berger from Doughroller.net. His account value year-end was $1,313.55. Rob went the Tesla, AT&T, and Apple approach to yield his return.

Congratulations, fellas, you both did well and definitely took down this CFP®.

Grow Your Dough ThrowDown 2.0

I am excited to announce we are going to continue the Grow Your Dough Throw Down into 2015. This time, we are going to have 20 different personal finance bloggers participate.

Motif, which I mentioned above, has agreed to be a sponsor for the event. They are going to create a custom leaderboard where you will be able to track my Motif, including the other 19 participant Motifs, to see how we are doing on a daily basis. I’m so excited that Motif was pumped about the Grow Your Dough Throw Down this past year, and when they approached me about creating the custom leaderboard and being a part of it, I was definitely all ears.

More to come!

The Bottom Line – Grow Your Dough Throwdown Final Results

The Grow Your Dough Throwdown has been a roller coaster of emotions, surprises, and lessons learned. Despite my portfolio taking a hit, the excitement and shared experiences among participants have been invaluable.

It’s a humbling reminder of the unpredictable nature of the stock market and the importance of strategy. As we conclude this year’s challenge, the competitive spirit remains ignited with the upcoming Grow Your Dough Throw Down 2.0.

With new participants and Motif’s enthusiastic involvement, we’re set for another thrilling year of investments. Congratulations to the victors, and cheers to embracing the unpredictability of the market!

This is great, good luck!

I have to give you credit, for being upfront with your dough throwdown portfolio. Many others in the financial industry would do everything possible to hide it, and just focus on gains. What you are showing is reality.

Jeff, it was lots of fun. Thanks for making it happen. And hats off to Phil Tayler for a remarkable performance.

Hey Jeff. Cool to read your throwdown results. I’m hoping to do something similar for my site as well after hearing about this at FinCon. Such a great idea.

For next time, know that p2p lending accounts are not diversified if less than 100 notes are held (and 200 is actually a better suggestion), particularly if you’re investing in the riskier loan grades that return 9% or more after becoming seasoned: http://www.lendingmemo.com/risk-diversification-p2p-lending/

Love the site and your message. Keep up the great work!

Simon

Great job Simon!

Wow this is such a cool idea! I’ve been using motif for a while now, and was wondering if there is any criteria for joining the Grow Your Dough 2.0 challenge. I just started on my personal finance blog journey and would love to join!

@The Lion’s Shares We already have 20 bloggers on board and that’s all I could handle this year. You’re more than welcome to track your progress and compare to the rest of us.

Sooo…you think it’s a good idea for people to seek investment advice from someone who isn’t good at investing money? I understand financial planning is different than investing, but someone with market insight, investment acumen, and analytical skills might be a better CFP than someone who doesn’t possess those skills/knowledge.

@ Investment Banker That’s why I don’t pick stocks for my clients. 😉