When it comes to our health, it is essential to obtain the best quality care possible. For some, employer-sponsored health insurance coverage is an option for this.

But for others, it is necessary to go out into the market and shop for either an individual or a family health insurance plan.

Because there are many options to choose from, it can be difficult. Therefore, it is important to have a good understanding of how health insurance works and which options are available to you.

Then, you can determine which may be the best choice for you.

We understand that any type of insurance purchase, from finding the best car insurance companies, best life insurance companies, or companies that offer burial insurance for seniors, can be a daunting task, that is why we are here to help you!

Table of Contents

Types of Health Insurance Plans

In its most basic sense, individual health insurance coverage is the alternative to purchasing via one’s employer on a group basis and can be purchased on either an individual or a family basis.

With an individual policy, the individual who is insured is fully responsible for paying the policy’s premiums. Therefore, if the person stops paying, the coverage will typically lapse (following a grace period).

There are several forms that individual health insurance can take:

- Fee For Service / Indemnity Plans

- HMO (Health Maintenance Organization)

- PPO (Preferred Provider Organization)

Fee for Service Plans

A fee-for-service plan – also referred to as an indemnity plan – is a type of policy where the insured individual pays a predetermined percent of the cost of his or her health care services, and the insurance provider pays the remaining amount.

With this type of coverage, the insurance company does not have any type of contractual agreement with medical providers or hospitals, nor does the insurance company have a “network” of providers that the insured must use in order to obtain benefits.

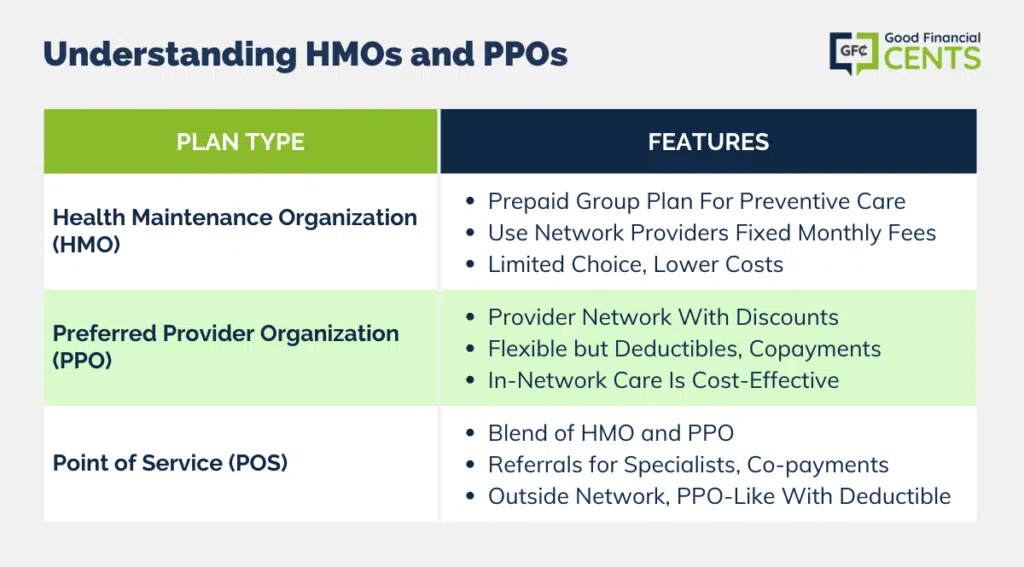

Understanding HMOs and PPOs

Managed care plans are a different way to obtain health insurance services. These types of plans are able to contain costs by taking certain measures.

One way of doing so involves controlling the behavior of the plan participants. This refers to both the members that are covered by the plan as well as to the medical service providers.

A managed care plan will typically have the following basic characteristics:

- Controlled access to providers

- Case management

- Preventive care

- Risk sharing with the providers of the services

- High quality of care

Some types of managed care plans include Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). These plans may also be self-funded, dual choice, or indemnity.

Health Maintenance Organization (HMO)

A health maintenance organization, also referred to as an HMO, is a type of prepaid group health insurance plan that entitles its members to services of participating physicians, hospitals, clinics, and other types of health care providers.

The emphasis in an HMO is on preventive care. In an HMO, the members are required to use contracted healthcare providers that are listed within a certain “network” of providers.

Health Maintenance Organizations represent what is known as “pre-paid” or “capitated” insurance plans in which individuals or their employers pay a fixed monthly fee for services instead of a separate charge for each visit or service.

The monthly fees will typically remain the same, regardless of the types or levels of services that are provided. The health care services that are provided through an HMO are provided by physicians who are employed by, or under contract with, the HMO.

HMOs can vary in design. Depending on the type of HMO, the services may be provided in a central facility or in a physician’s office.

Health Maintenance Organizations are the oldest form of managed care. They were created in the 1980s as an alternative to indemnity insurance.

HMOs are highlighted by their focus on preventive care and efficiency measures. HMOs usually offer lower rates on health care services than fee-for-service type of plans.

Although there are many variations of HMOs, these plans overall will typically allow members to have lower out-of-pocket health care expenses. However, HMOs may offer less flexibility in the choice of physicians or hospitals than other types of health insurance plans.

With an HMO, individuals will likely have coverage for a broader range of preventive health care services than they would with another type of plan.

In addition, with an HMO, an individual typically won’t have to submit any of their own claims to the insurance company.

It is important to keep in mind, though, that an individual will likely have no coverage at all for services that are rendered by non-network providers or for services that have been rendered without a proper referral from their primary care physician.

Because HMOs focus on preventative care, they seek to reduce healthcare costs by identifying and treating illness early on before it becomes a more serious and costly situation.

HMO plans usually do a good job of covering routine checkups and vaccinations. In addition, they frequently offer general well-being incentives such as smoking cessation or weight loss programs.

The HMO functions as a healthcare network. Aside from emergencies, a Primary Care Physician (PCP) serves as the primary and initial point of contact for all health concerns. The Primary Care Physician is oftentimes referred to as being a “gatekeeper.”

The PCP then refers participants to appropriate specialists if they are needed. If an HMO member opts to go to a doctor or hospital that is outside of the HMO network of care providers, they will have to pay the fees on their own.

The intent of having a primary care physician is to prevent unnecessary doctor visits, thus saving money for the HMO.

With HMOs, premiums are typically required to be paid monthly. Since HMOs are considered pre-paid health care, participants usually won’t have to pay a deductible, although the plans do vary.

When a person visits a doctor, goes to the hospital, gets a prescription, or receives other health services, they will have to make a small co-payment that will typically range from $10-$25 in most cases.

Preferred Provider Organization (PPO)

A preferred provider organization, or PPO, is a network of medical providers who charge on a fee-for-service basis but that are paid on a negotiated discounted fee schedule.

As a member of a PPO, individuals will be encouraged to use the insurance company’s network of participating doctors and hospitals.

These providers have been contracted to provide services to the plan’s members at a discounted rate. Individuals in a PPO won’t be required to pick a primary care physician, and they will typically be able to see doctors and specialists within the network at their own discretion.

The members of a PPO will likely have an annual deductible to pay before the insurance company begins paying their claims in the PPO. Once the deductible has been met, PPO participants will be required to make a co-payment for most doctor visits.

Some PPO plans may also require that participants cover a percentage of the total charges for their services that have been rendered.

With a PPO plan, services rendered by an out-of-network physician are typically covered – but at a lower percentage than services that are rendered by a network physician. Seeing an out-of-network provider, then, can become costly.

For example, if an individual visits an out-of-network provider for services that total $500, the PPO plan may cover the charge at only 60% of the amount that a network provider would charge for the same service.

If a network doctor would accept $250 as payment in full, this means that the insurance company would pay only $150, and the remaining $350 would come out of the PPO member’s pocket.

Additionally, if a person sees a provider outside of the plan’s network, he or she may have to pay the charges upfront and then submit their own claim for reimbursement.

PPO plans do offer more flexibility in choosing providers than do HMOs. For example, they do not require an individual to maintain a primary care physician, nor do they require them to use a primary doctor as a gatekeeper to other care.

This means that a participant in a PPO can seek care from a specialist without having to first get a referral.

While it is easy to confuse HMOs and PPOs, there are some key differences. For example, PPOs utilize a networking method similar to HMOs but with a much larger network and a smaller monetary penalty for seeking care outside the network.

As long as the provider is part of the network, the benefits are the same. In addition, in a PPO, the participants are free to use any provider that they choose, but they will likely have to pay more for it.

Point of Service (POS)

A point of service plan (POS) combines the formulas that are used by HMOs and PPOs. Like an HMO, a primary care physician must refer a person to an in-network specialist.

When receiving care from a provider that is within the network, the patient is responsible for a small co-payment, but there is no deductible.

When a participant goes outside of their network, a POS plan acts more like a PPO. A POS plan will allow a person to self-refer outside of the network.

In this scenario, the participant must first pay the deductible, then a co-insurance amount. In this way, the POS plan offers a strong financial incentive to remain within the network. However, it does not forbid it the way that an HMO would.

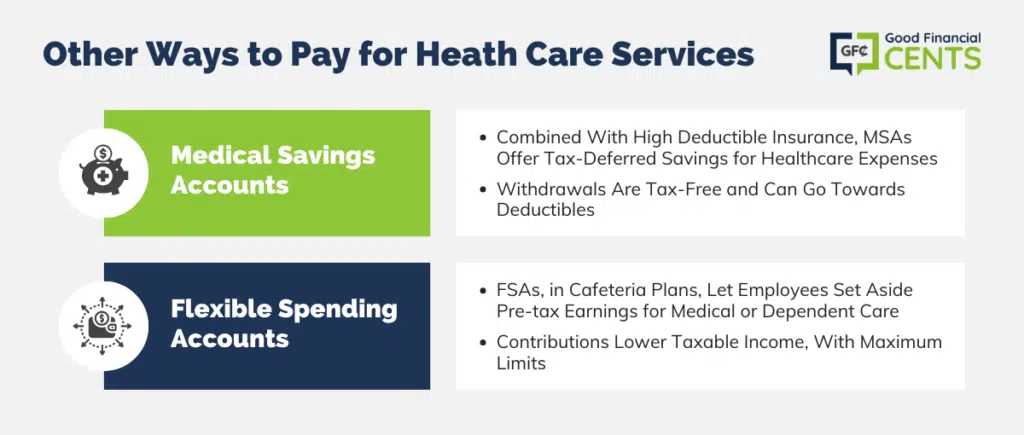

Other Ways to Pay for Health Care Services

Throughout the years, there have been other ways created to pay for health care services that are not covered by health insurance coverage but that work in conjunction with health insurance policies.

Some examples include Medical Savings Accounts and Flexible Spending Accounts.

Medical Savings Accounts (MSAs)

Medical Savings Accounts (MSAs) were typically combined with a high deductible medical insurance policy.

The MSA offers a way to save money on a tax-deferred basis whereby funds in the account can be withdrawn tax-free and used for paying qualified healthcare expenses that are not covered by the health insurance plan.

Withdrawals from an MSA can also be used towards paying the deductible expenses on the employee’s health plan in a given year.

Flexible Spending Accounts / Flexible Spending Arrangements (FSAs)

Flexible Spending Accounts (FSAs), also referred to as flexible spending arrangements, are a type of tax-advantaged financial account that can be set up through a cafeteria plan in the United States, much like a Health Savings Account or HSA.

An FSA can be set up by an employer for an employee. The account allows the employee to contribute a portion of their regular earnings to pay for qualified expenses such as medical care or dependent care costs.

One of the primary benefits of an FSA is the fact that the funds that are contributed to the account are deducted from the employee’s earnings before they are made subject to payroll taxes.

Therefore, the contributions that are made to an FSA can substantially lower an employee’s annual income tax due. There are maximum dollar amount limits as to how much can be contributed to an FSA account each year.

How and Where to Get the Best Quotes

When obtaining health insurance quotes, it is usually best to work with a company that has access to more than just one insurer.

This is because you will be able to get many competing quotes – oftentimes on very similar coverage.

If you’re ready to shop for top health insurance providers, you can get all of the information that you need – directly from your computer. No need to meet in person with an insurance agent or to go through the hassle of the HealthCare.gov website.

In order to get the process started, all you have to do is simply use the form on this page. You can get your quotes and speak with a health insurance specialist about your specific needs.

Bottom Line: Optimal Health Insurance Selection Guide

Navigating the realm of health insurance requires a clear understanding of available options. For those without employer-sponsored coverage, individual and family plans are essential considerations.

These encompass Fee For Service plans, HMOs, and PPOs. Health Maintenance Organizations emphasize preventive care through contracted providers, while Preferred Provider Organizations offer flexibility within their network.

Point of Service plans merge aspects of HMOs and PPOs, rewarding network usage. Beyond these, Medical Savings Accounts and Flexible Spending Accounts provide further coverage avenues.

Seek comprehensive quotes from diverse insurers for tailored solutions. Utilize online resources for convenience and connection with health insurance specialists, ensuring you find the best-fit coverage for your needs.