Debt is a part of life, but when debts careen beyond control to a point where you can no longer repay, filing for personal bankruptcy is a way out. However, before you file for bankruptcy, there are important repercussions you should consider, especially facts related to your life insurance premiums.

Table of Contents

- Understanding Bankruptcy

- Direct Impacts of Bankruptcy on Life Insurance Rates

- Indirect Impacts of Bankruptcy on Life Insurance Rates

- How to Obtain Life Insurance After Declaring Bankruptcy

- Tips for Managing Life Insurance Costs After Bankruptcy

- Bottom Line: Bankruptcy’s Impact on Life Insurance Rates

Understanding Bankruptcy

Types of Bankruptcy

There are several forms of bankruptcy, with the most common for individuals being Chapter 7 and Chapter 13. Chapter 7, often referred to as “liquidation bankruptcy,” involves the sale of the debtor’s non-exempt assets to pay off creditors. On the other hand, Chapter 13 allows debtors to retain their assets while restructuring their debt to make it more manageable.

Reasons People Declare Bankruptcy

Individuals might declare bankruptcy for a variety of reasons. These can range from sudden medical expenses to unemployment, or poor financial decisions. Whatever the cause, declaring bankruptcy is a significant decision with long-lasting implications, especially concerning financial products like life insurance.

Duration of Bankruptcy on Credit Report

Bankruptcy is not a fleeting mark on one’s financial record. Typically, a Chapter 7 bankruptcy can stay on a credit report for up to 10 years, while Chapter 13 can remain for 7 years. This long duration means that the effects of bankruptcy can linger, influencing decisions related to loans, mortgages, and, as we’ll discuss, life insurance rates.

Direct Impacts of Bankruptcy on Life Insurance Rates

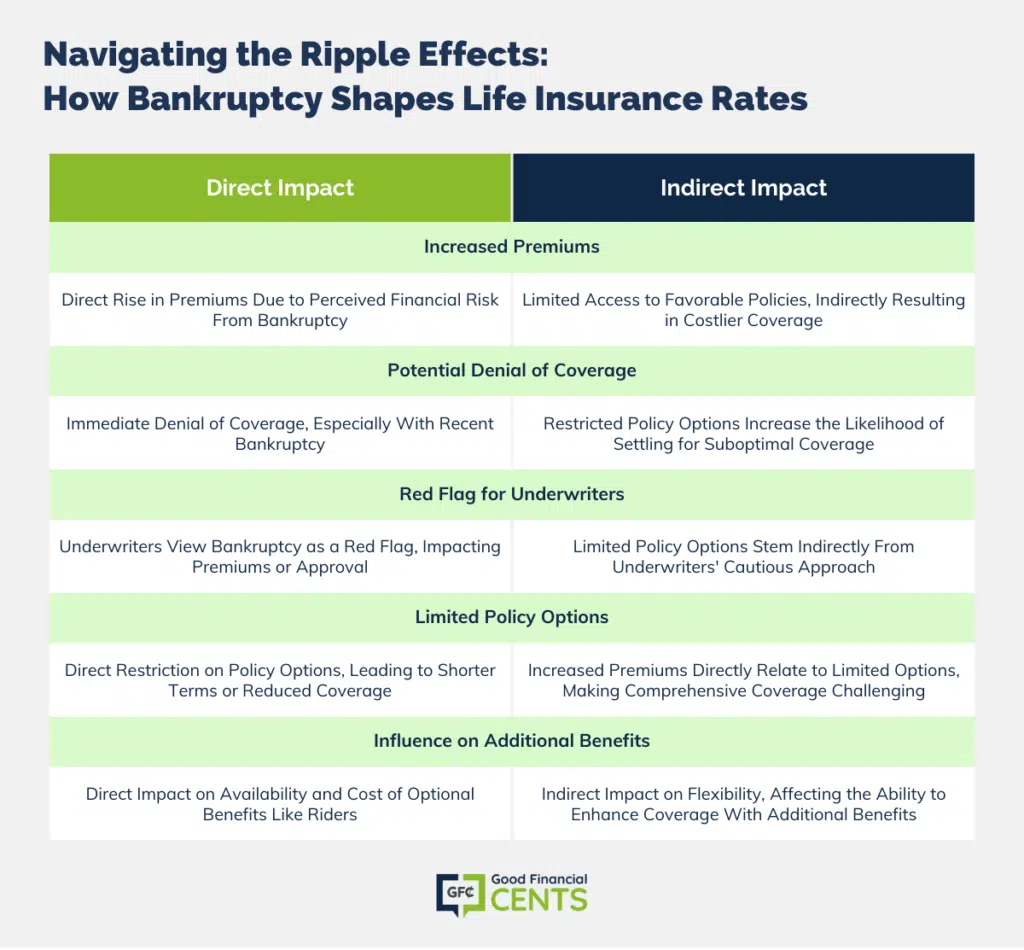

Perceived Risk by Insurance Companies

Bankruptcy, to many insurance providers, symbolizes heightened financial risk. The rationale is that someone who has declared bankruptcy may face challenges in consistently paying their premiums, potentially leading to policy lapses. This perception directly affects the policy’s terms and premiums.

Bankruptcy as a Red Flag to Underwriters

For underwriters, a bankruptcy declaration can be a significant red flag. Even if an individual is in good health and leads a safe lifestyle, their financial decisions and history can make them a less appealing candidate for coverage. This often means higher premiums or even potential denial of coverage.

Potential for Higher Premiums

As mentioned, bankruptcy can lead to elevated premium rates. This is because insurance companies need to offset the increased risk they’re taking by insuring someone with a shaky financial past. Unfortunately, this means that individuals who have declared bankruptcy may face prohibitive costs when seeking life insurance.

Possible Denial of Coverage

In extreme cases, especially when bankruptcy is recent, insurance companies might deny coverage altogether. This decision stems from the perceived instability in the applicant’s financial situation and the potential inability to maintain regular premium payments.

Indirect Impacts of Bankruptcy on Life Insurance Rates

Reduced Access to Favorable Policy Options

Apart from the direct implications, bankruptcy can also limit access to more favorable policy options. Individuals might find that they’re only eligible for policies with shorter term lengths or reduced coverage amounts. This can hinder their ability to secure the optimal level of protection for their loved ones.

Potential for Shorter Term Lengths or Reduced Coverage Amounts

Given the perceived risk associated with insuring someone who has declared bankruptcy, insurers might offer policies that have shorter terms or reduced coverage amounts. These limitations can prevent individuals from obtaining the comprehensive protection they desire.

Influence on Riders or Additional Benefits

Riders or additional benefits are optional features that policyholders can add to their life insurance policy, such as critical illness coverage or waiver of premium. However, a bankruptcy history can limit access to these beneficial additions or make them more expensive.

How to Obtain Life Insurance After Declaring Bankruptcy

Waiting Periods Post-bankruptcy

One strategy to improve the chances of obtaining life insurance post-bankruptcy is to wait. Many insurers have specific waiting periods after a bankruptcy discharge before they’ll consider offering coverage. Waiting until this period has passed can improve the terms and rates of the policy.

Working With Specialty Insurance Brokers

For those finding it challenging to secure life insurance through traditional channels, working with specialty brokers can be a beneficial approach. These brokers often have expertise in finding coverage for high-risk individuals, including those with a history of bankruptcy.

Consideration of No-Medical-Exam Policies

No-medical-exam policies, as the name suggests, do not require a medical examination for approval. While they typically come with higher premiums, they can be an option for those who have faced bankruptcy and are struggling to find coverage elsewhere.

Tips for Managing Life Insurance Costs After Bankruptcy

- Shopping Around for Competitive Rates: It’s essential not to settle for the first quote received. By shopping around and comparing various insurance providers, individuals can find competitive rates even post-bankruptcy. This ensures they’re getting the best value for their money.

- Being Transparent With Insurance Agents: Honesty is crucial when applying for life insurance. It’s essential to be upfront about any past financial troubles, including bankruptcy. This transparency can foster trust and might lead to more favorable terms than if the bankruptcy were discovered later in the process.

- Regularly Reviewing and Updating Policies: Life insurance needs and circumstances change over time. It’s beneficial to regularly review and, if necessary, update policies. This practice ensures that coverage remains adequate and that individuals are still getting the best rates possible, especially as the impact of bankruptcy diminishes over time.

Bottom Line: Bankruptcy’s Impact on Life Insurance Rates

Declaring bankruptcy offers financial relief but significantly impacts life insurance rates. While existing policies might remain untouched, the aftermath of bankruptcy often results in higher premiums due to perceived financial unreliability. Nonetheless, purchasing a 10-year term policy post-bankruptcy can offer interim protection.

Utilizing online platforms can help find insurers sympathetic to your situation. As your financial slate clears over time, revisiting and adjusting your policy could lead to more favorable rates, ensuring optimal family protection.