No-fault insurance” is strictly defined as any kind of insurance for drivers in which an insured person is paid for their own loss in an accident by their own insurance company, no matter whose fault the accident was.

In addition, provincial and state laws in Canada, Australia and the United States restrict the rights of anyone insured under “No-fault” to seek financial recovery from the other party.

Table of Contents

- Reasons for No-Fault Insurance

- The Way Insurance Companies See It

- No-Fault Insurance in the US

- Thresholds for No-Fault Insurance

- A Number as a Threshold

- A Subjective Threshold

- Current Status of No-Fault

- Collision Insurance

- Liability Insurance

- Liability and No-Fault

- The Bottom Line – How Does No-Fault Auto Insurance Work?

How does understanding what no-fault insurance is and how it works affect you? For one, an understanding of no-fault auto insurance laws in your state can help you to compare the best car insurance quotes and choose not only the best rate but the coverage that will best meet your needs. Read on to learn all about how no-fault auto insurance works and then put this newfound knowledge to good use saving you money.

Reasons for No-Fault Insurance

The chief reasons no-fault insurance was begun was to:

1.Facilitate quick payment to accident victims.

2. Avoid expensive civil litigation in which it must be determined which person caused the accident.

Each driver would be paid by their own insurance company for their losses. The insurance companies will determine which driver was at fault, and that driver would be classified as a higher risk, which would raise that driver’s premium.

The Way Insurance Companies See It

In theory, the insurance company of the driver not at fault might then be at a disadvantage, because that company will be paying out reimbursements for which it will not be able to charge a higher premium to recoup that outlay. However, all insurance companies should have roughly equal numbers of at-fault and not-at-fault drivers, and such a disadvantage would even out costs over all payments for all accidents.

No-Fault Insurance in the US

Many states in the US still have a liability system based on “traditional tort,” which emphasizes provable negligence. However, at least a dozen states have passed laws for no-fault auto insurance that limits financial recovery for medical expenses and loss of wages to an accident victim from other drivers involved in an accident only to those amounts not covered by the victim’s own insurance. When it comes to “pain and suffering” damages, an accident victim can only request financial rewards if the injury is deemed to be “serious.

Thresholds for No-Fault Insurance

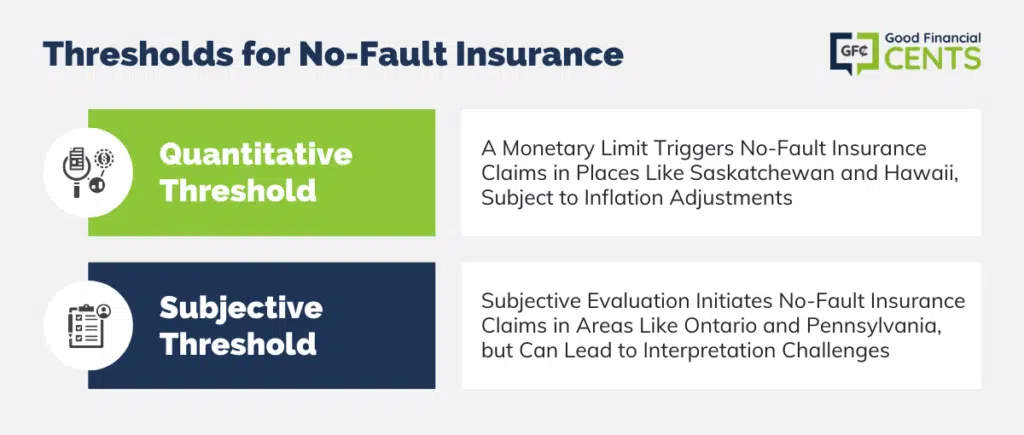

A ‘serious” injury can be defined in two ways, either as a monetary amount called a “quantitative threshold” for medical expenses or a subjective injury evaluation called a “qualitative threshold.” Once that threshold is met, then a legal proceeding may begin to recover economic losses.

A Number as a Threshold

The “quantitative threshold” was enacted in the Canadian province of Saskatchewan and in the following US states:

- Hawaii

- Minnesota

- Massachusetts

- Utah

- Kentucky

- Kansas

- North Dakota

Such a threshold must be allowed to increase over time to match inflation, or the number becomes useless. As a possible flaw, when this threshold is in effect, accident victims and their doctors seem encouraged to increase medical costs to reach that threshold by adding in un-needed tests and unnecessary procedures.

A Subjective Threshold

The “qualitative threshold” was enacted in the Canadian province of Ontario and in the following US states:

- New Jersey

This threshold eliminates both the need to match inflation and the incentive to multiply medical costs to reach a specific amount.

However, the subjective nature of this evaluation seems to lead to more words that must be defined, or left to interpretation by a court. For example, ‘death” is unequivocal. But, what amount of “disfigurement” is considered major? Is such a measure different between someone old and someone young, or between a man and a woman?

Current Status of No-Fault

Between 1970 and 1975, twenty-four states and several Canadian provinces enacted some form of no-fault law for driver’s insurance. The only “pure” no-fault legislation is in force in the Canadian provinces of Manitoba and Quebec.

In several states in the US, the consumer is given a choice when purchasing or renewing an insurance policy of either “full tort,” the traditional method of proving negligence, or “limited tort,” otherwise known as no-fault. The default, where the consumer makes no choice one way or the other, is “full tort” in some states and “limited tort” in others.

Collision Insurance

While we’re discussing no-fault insurance, a distinction must be made between liability insurance and collision insurance. In an accident, damage can be done to your car, to the other driver’s car, to the other driver, and to other property.

Collision insurance always pays for the repairs to your own vehicle, no matter what the situation is. If you do not have collision insurance and have an accident, then you pay the repair or replacement costs for your car yourself. Collision insurance never pays for repairs to the other driver’s car or to property — that is what liability insurance is for.

Liability Insurance

You are always required to have liability insurance on your vehicle in the US or in Canada.

If no-fault insurance is in effect for both drivers, then liability insurance will only cover damage to property and to the other driver, because each driver’s collision insurance, if any, will cover the damage to their own car.

If no-fault insurance is not in effect, then the liability insurance of the driver at fault will pay for the damage to the vehicle of the driver not at fault. If the fault is found to be 50/50, then liability insurance does not come into play at all for vehicle repair, and each driver’s own collision insurance, if any, will pay for the damage to a driver’s own car.

Liability and No-Fault

But we haven’t even counted in medical expenses for the other driver — this area is where the numbers mount up fast. The lesson to be learned here is that the mandated minimum of liability insurance is, even in a no-fault situation, not enough to cover the possible total cost of vehicle damages and medical costs resulting from an accident.

The Bottom Line – How Does No-Fault Auto Insurance Work?

Understanding the nuances of no-fault insurance is essential for every driver. In this comprehensive guide, we’ve explored the principles, benefits, and reasons behind this insurance system. It’s clear that no-fault insurance aims to simplify claims and reduce costly legal battles. However, variations exist, such as quantitative and qualitative thresholds determining “serious” injuries. The choice between “full tort” and “limited tort” options in some states gives consumers flexibility. Remember, collision insurance covers your vehicle, while liability insurance is crucial for property and other drivers. Overall, having adequate insurance coverage is vital, as accidents can result in significant costs beyond what minimum liability insurance may cover.