Every new client that that decides to work with me, I always have to give them the warning of the amount of introductory paperwork they will receive.

From prospectus’ to statements, many are initially overwhelmed on the amount that they receive.

In addition that, I wanted to also share how long you should keep some of the other important documents you receive such as tax returns, bank records and 401(k) statements.

I can’t reiterate enough how important it is to be organized.

Keeping a good filing system of all your statements will help you do a better job of investment tracking.

Before you read the post, you may want to get your shredder ready. 🙂

Table of Contents

Brokerage Statements

I tell clients that once they get a new statement, they can toss the old one. You, of course, are more than welcome to keep them all and I have plenty of clients that do. But in this day and age, we have everything on backup and can produce an old statement relatively easily. The one statement that you definitely want to hang on to is your December or annual statement.

For tax purposes especially in taxable accounts, you may want to hold on to investment purchases. But once again, most reporting methods in my firm will keep all that information on hand for you.

Keep in mind that if you sign up for online access, you will have the capability to log in and print off any forms that you will need.

IRA and 401(k) Statements

The same thing that applies to your brokerage statements applies to your 401(k) and IRA statements- the annual statement is the one to hold onto. Additionally, you want to hang onto your Form 8606, your Form 5498, and your Form 1099-R.

- Form 8606: The one you use to report nondeductible contributions to traditional IRAs.

- Form 5498: The one your IRA custodian sends to you – it is sometimes called the “IRA Contribution Information” or “Fair Market Value Information” form, and it usually arrives in May. It details a) contributions to your traditional or Roth IRA and b) the fair market value of that IRA at the end of the previous year.

- Form 1099-R: Of course, the one you get from your IRA custodian showing your withdrawals (income distributions).

Tax Returns

As a business owner, I’m definitely inclined to hang onto my tax returns and documents more so than in years past. Just so that I check if I was misinformed, I headed over to the IRS website to see what they had to say on the matter. Here’s what they have to say:

The length of time you should keep a document depends on the action, expense, or event the document records. Generally, you must keep your records that support an item of income or deductions on a tax return until the period of limitations for that return runs out.

The period of limitations is the period of time in which you can amend your tax return to claim a credit or refund, or that the IRS can assess additional tax. The below information contains the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.

Note:

1. You owe additional tax and situations (2), (3), and (4), below, do not apply to you; keep records for 3 years.

2. You do not report income that you should report, and it is more than 25% of the gross income shown on your return; keep records for 6 years.

3. You file a fraudulent return; keep records indefinitely.

4. You do not file a return; keep records indefinitely.

5. You file a claim for credit or refund after you file your return; keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later.

6. You file a claim for a loss from worthless securities or bad debt deduction; keep records for 7 years. This will typically include credit card statements and mortgage statements.

7. Keep all employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later.

I double-checked my with CPA and he resonated with what the IRS website had to say. He did add that while 3 to 7 years is standard, it’s advisable to keep your tax returns “forever”. Yes, forever. Although he has only had a few clients actually go through the audit process he noted that the standard IRS audit typically goes back three years. Keep in mind that if you are convicted of a tax felony, the IRS can open the doors and review all your past history. The easiest way to avoid this is to not commit tax fraud.

Bank Statements

Following the line with the IRS audit look back, it’s usually suggested to keep your bank statements for three years. Personally, we do all banking online so we just resolve to have our statements accessible that way.

Life Insurance

The life insurance policy is a prime candidate to keep locked up in a home safe or safety deposit box. You will want to keep the policy for the entire life of the contract plus three years.

Shred When You’re Done

Identity theft is the real deal nowadays. So when you do decide to get rid of your documents, do so very carefully. Proper shredding is an easy way to protect yourself from identity theft. If you are a small business, there are companies that specialize in destroying your sensitive information. Either way, those are two ways to help prevent identity theft.

What You Can Throw Away

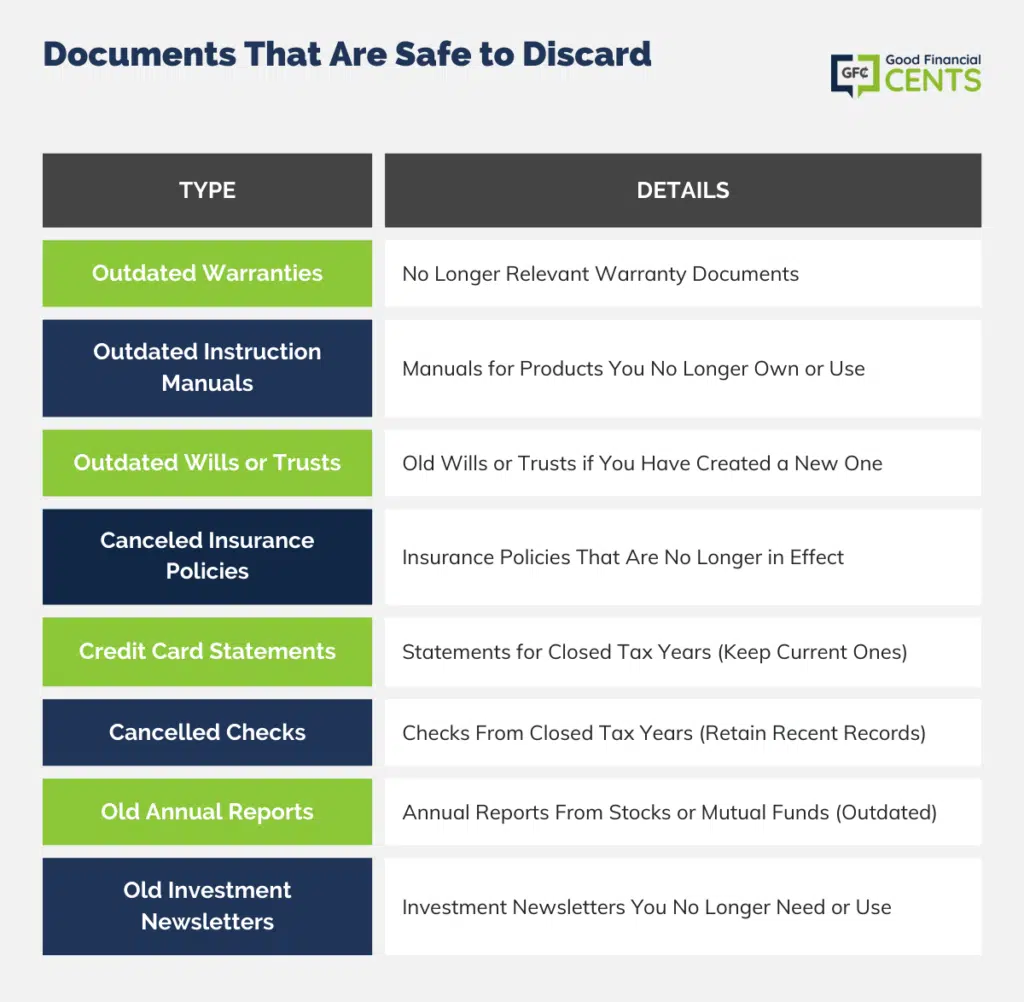

Now that you know the stuff that you need to keep, here’s some stuff that you can pitch:

- Outdated Warranties

- Outdated Instruction Manuals

- Outdated Wills or Trusts (Provided You Created a New One)

- Canceled Insurance Policies

- Credit Card Statements for Closed Tax Years

- Cancelled Checks for Closed Tax Years

- Old Annual Reports From Stocks And/or Mutual Funds

- Old Investment Newsletters (Some People Keep These Things for Years Because They Paid for Them–Let Them Go!)

The Bottom Line – How Long Should You Keep Your Financial Statements?

Managing and retaining financial documents is a delicate balance of prudence and organization. While digital backups and online access have modernized record-keeping, certain physical documents, such as annual statements and tax returns, remain pivotal. The IRS guidelines offer clarity, but personal preferences and business requirements can affect retention decisions.

Security is paramount; hence, careful disposal via shredding can mitigate identity theft risks. As you navigate your financial journey, prioritizing systematic organization, accessibility, and protection of these documents will ensure both compliance and peace of mind.

Okay, I have to LAUGH at #3 above: “If you file a fraudulent tax return, keep your records indefinitely.”

I’m guessing that most people would want to keep records to prove that they are INNOCENT! But in theory an innocent person doesn’t need to keep their records?

IRS: “Hello, we’re here to audit your fraudulent tax return from 10 years ago.”

Taxpayer: “What? I didn’t file a fraudulent tax return, so I threw out those records 3 years ago.”

IRS: “But you DID file a fraudulent return, so you have to keep them forever.”

Taxpayer: “But I’m innocent!”

IRS: “Did you keep your documents to prove it?”

Taxpayer: “No, because I’m innocent!”

It almost seems like the old “If she sinks, she’s not a witch” logic. If the person doesn’t keep the documentation to prove their innocence, they must be innocent? Or something…