Unemployment can drastically change your finances — obviously. And with this drastic change comes a need to tweak your budget. Even if you have an emergency fund with a good bit saved up, it is still a good idea to tweak your budget.

This way, your emergency fund will be depleted at a slower rate, lasting longer and giving you the additional time you might need to find a job.

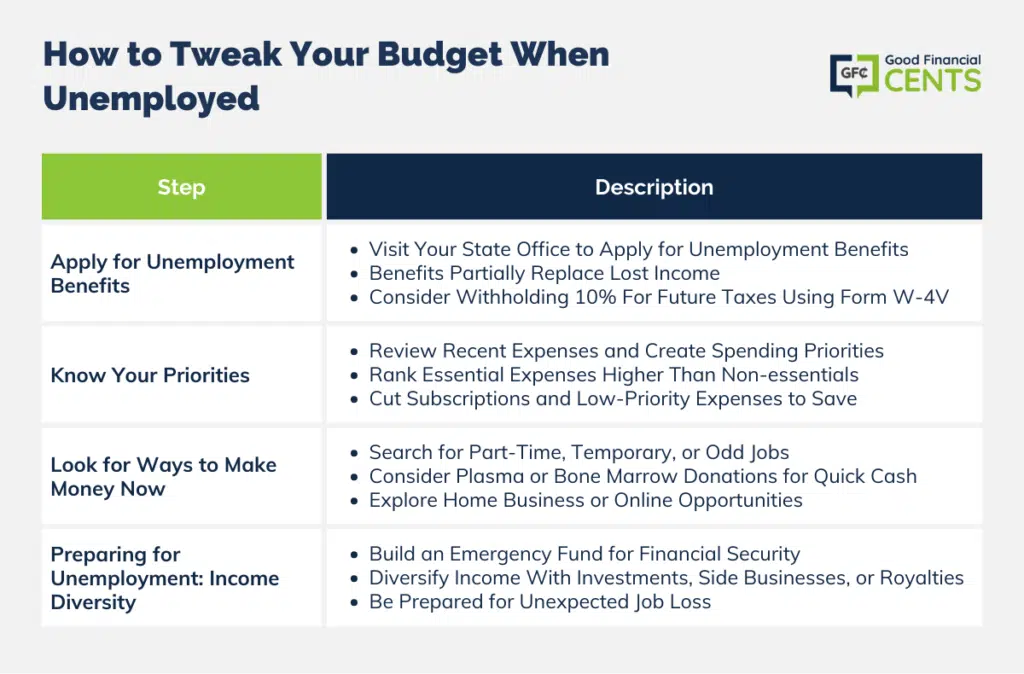

Here are some things to consider as you tweak your unemployment budget after you lose your job:

Table of Contents

Apply for Unemployment Benefits

The first thing you should do is head to the appropriate state office and apply for unemployment benefits. Unemployment benefits will replace a portion of income (but not all of it), helping ensure that there is some cash flowing into your household.

Remember, though, that you will have to pay income taxes on your benefits. Consider having 10% withheld (use Form W-4V) if you are concerned about paying taxes on the income later.

REMEMBER:

Know Your Priorities

Go through your last few months’ worth of expenses and see where you have been spending money. Create spending priorities. Groceries, of course, should be higher on your priority list than going to the movies.

Rank your regular expenses, with the most important expenditures at the top. Make cuts to the low priorities at the bottom of the list now.

You should also consider cutting subscriptions, memberships, and other expenses that can quickly drain your coffers during unemployment. This will help you stretch any income that you still have while reducing the impact on your emergency fund.

You should also prioritize your obligations. In a perfect world, you would be able to cut out your least important expenses and be okay.

However, you might have to make decisions about which bills to pay.

Yes, skipping credit card payments will lower your credit score. But when push comes to shove, you need to take care of your needs.

Look for Ways to Make Money Now

You should schedule in time to look for a job. However, you should also do what you can to make a little extra money now. Part-time or temporary work can help augment your monthly cash inflows, or you can do odd jobs.

Plasma and bone marrow donations can be sources of quick cash as well. Now might also be a good time to consider starting up a home business, or starting a website that can create cash flow.

You might still need a “job” of some sort for a while, but if you have a dream of making money from home, you can start that up.

Preparing for Unemployment: Income Diversity

Even if unemployment isn’t a problem for you now, it is still I good idea to prepare for the worst. Set aside money in an emergency fund, and cultivate income diversity. Look for ways to earn supplemental income so that you aren’t relying so much on your job.

Dividend investing, websites, a side business, or royalties can all be sources of alternative income that can help you in the event you lose your primary source of income.

Final Thoughts

In times of financial uncertainty or when in between jobs, it’s crucial to remain proactive and explore diverse avenues for income. From part-time roles to innovative at-home business ventures, opportunities abound for those willing to seize them.

While traditional job searching is vital, it’s equally important to think outside the box and capitalize on immediate, albeit unconventional, ways to generate income.

Whether it’s through donating plasma, taking on odd jobs, or launching an online business, the initiative is the cornerstone of financial resilience.

By diversifying sources of income and pursuing passion projects, not only can one maintain financial stability but also lay the groundwork for a potentially prosperous future.

This is a guest post Miranda Marquit is a journalistically trained freelance writer and professional blogger working from home. She is a contributor for Mainstreet.com, Personal Dividends, and several other sites. Miranda is not affiliated with or endorsed by LPL Financial.

The opinions voiced in this material are for general information and are not intended to provide specific advice and/or recommendations for any individual.