Pinch me.

Those words describe exactly how I feel when I see the number above.

Never in my wildest dreams did I ever think I could build multiple businesses that would allow me to generate that much money in a single month.

Never.

Heck, when I graduated college, I wasn’t sure if I ever truly believed I could make that in a year.

A few things you have to realize is that my path as a child didn’t exactly prepare me for success. Both my parents struggled with debt and filed bankruptcy not once, but twice. Further, neither of them was experienced with investing or business and they never once encouraged me to be an entrepreneur.

Some other factors not exactly on my side include:

- I dropped out of college my first semester in (all because of a $75 parking ticket), and it took me 4 years just to get my associate’s degree.

- I, too, struggled with debt and graduated college with over $20,000 of student loans and credit card debt.

- During my first year as a financial advisor, I made a whopping $24,000 BEFORE TAXES, including one month where my paycheck was a measly $800 even after I worked 70 hours.

So yeah, I wasn’t set up for success by any means. But I didn’t get successful by accident, either. There has definitely been a lot of hard work involved, and possibly some luck.

Still, I attribute all of my successes to two amazing things in my life:

- God has had my back for a very long time.

- I’m not the smartest man in the world, but I hustle the hardest. That’s it.

God + Strategic Hustle = Whole Lot of Awesome

You’re probably wondering why I’m taking the time to write this post. The reason I’m sharing this is to offer some insight into what goes on underneath the hood of my businesses.

My wife and I used to share monthly income reports for our online businesses on our old blog, Dollars and Roses. (You can see our last income report here.)

We had a blast encouraging aspiring bloggers to launch their own and find a way to monetize their passion. But as we kept up the blog and podcast, we started to lose our passion for online business – at least for teaching it.

That’s when we made the tough decision to pivot from Dollars and Roses to Marriage More, which we are much more passionate about. With this new project, we focus on helping married couples build a stronger connection and strengthen their marriage.

Even though we shut D&R down, I still have the itch to share what I’ve learned in online business and entrepreneurship. Mostly because I know if you’re reading this –yes, YOU – then you can achieve some of the same success I’ve had.

Okay, so let’s break down my main sources of revenue.

For the purpose of simplicity, I’m going to break my business down into 5 different businesses:

- Alliance Wealth Management – my wealth management firm that I launched in 2011

- Good Financial Cents Blog – the site you’re currently reading, which I launched in 2008 🙂

- Life Insurance – this is a combination of my other site, LifeInsurancebyJeff.com (which launched in 2012), and leads generated from GFC

- The Online Advisor Growth Formula – this is a course I created to help financial advisors grow their businesses through strategic online marketing.

- Media/Brand Sponsorships – speaking and other brand sponsorship opportunities

Here’s a video where I go into greater detail about my multiple income sources:

June Revenue Report

Now that you understand my business, let’s take a closer look at the numbers.

Alliance Wealth Management

- Gross Revenue: $57,164.10

My financial planning practice has been my baby for over 5 years (I started my own firm in 2011 and have worked diligently with the public since 2002). It’s truly an honor to help people achieve their financial goals and make a very good living while doing it.

Last year was a pivotal point in my business when I added Andrew Rogers, Director of Financial Planning, to the team.

I almost thought I could never find a “mini-me” that was just as motivated and passionate about financial planning as I am.

Then I met Andrew. He’s been a huge reason for the growth of the firm, as he spends his time creating financial plans for clients, performing extensive portfolio x-rays, heading our retirement planning strategy sessions for new clients, and delivering webinar content to our clients and GFC readers. You name it; he’s done it.

Having an employee has been huge because it’s given me the space I needed to focus on bigger projects for the firm and my other businesses.

Good Financial Cents

- Gross Revenue: $48,697.38

- Affiliate Earnings: $39,888.47

- Ad Networks: $8,808.91

When I launched my blog in 2008, I never fathomed I could earn extra money from it. The phrase “making money online” wasn’t even in my vernacular. Fast forward to present day, and my online business has made me over $1 million.

The crazier pill I’m still struggling to swallow is that my online businesses are reaching the point where they will generate over $1 million in revenue in one year.

I know. It’s crazy. For real…

It’s truly a reminder that anybody – yes, ANYBODY – can start an online business and make money if they have the grit to stick it through.

Why do I believe that?

Hello!?

Look at me!

I knew nothing about blogging when I started, and even to this day, I couldn’t code HTML if you paid me $5,000 an hour to do so.

I have always figured out what I could do and learned as much as I could while slowly outsourcing the rest. At this point, I can honestly say that the strategy works.

Life Insurance

- Gross Revenue: $18,321.53

- Insurance Commissions: $8,854.58

- Lead Sales: $9,500

One of the best terms I gained from the Strategic Coaching program is “strategic by-products.” Strategic by-products are unexpected surprises we encounter after exploring and implementing new ideas.

After the blog launched, I encountered plenty of strategic by-products. One of them has been generating a significant amount of revenue from life insurance.

I’m a big believer in life insurance (especially term), and because of that belief, I have a $2.5 million dollar term policy on myself. So if I can help a family obtain an affordable life insurance policy, I’m all about it.

When I first started offering life insurance online through my other site, LifeInsuranceByJeff.com, I had an advisor handle all of the leads in-house. Unfortunately, he moved on to a new profession, and I had trouble finding an agent that could handle the workload.

Once we reached that point, we made the decision to sell the leads (we’ve seen a pretty large uptick in leads from both my insurance site and on GFC) to an agent that can handle the work, and that’s what you see reflected in the revenue above.

I think what excites me the most about my life insurance business is that I consider this my “muse.” Tim Ferriss, the author of one of my favorite books, The 4 Hour Work Week, defines a muse as “a low-maintenance business that generates significant income.”

Well, this business is definitely a muse because I spend less than 4 hours a week managing it. I would be surprised if I even spent an hour working on it during an average week.

I just wish I could duplicate this success! =)

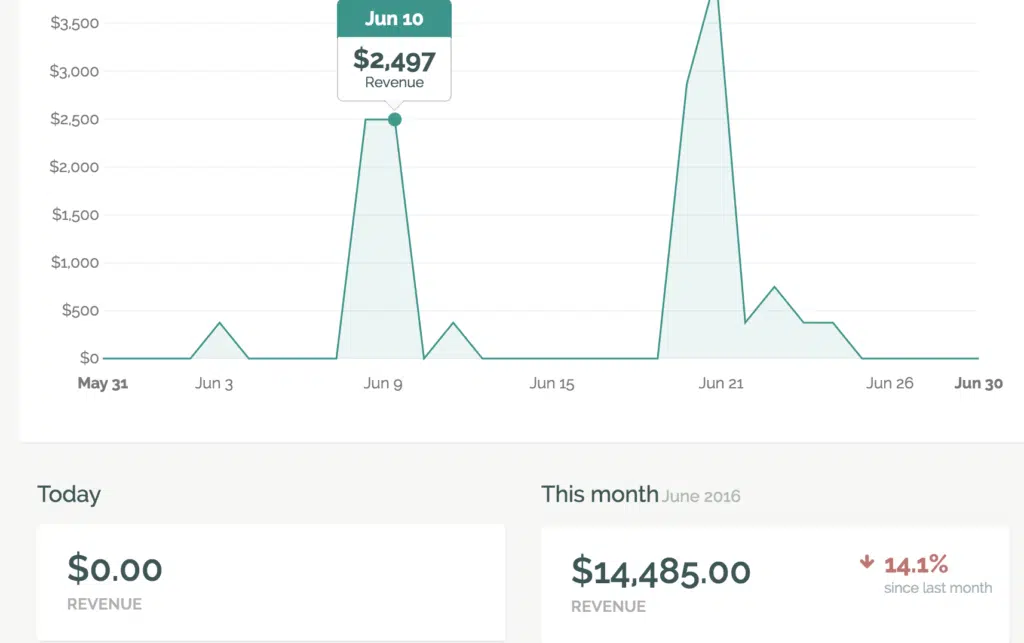

The Online Advisor Growth Formula

- Gross Revenue: $14,485.00

So, this is the fun one for me.

For over five years, I have dreamed of creating a course and selling it online.

The biggest problem was, I couldn’t fully commit to what the course was going to be. I’ve considered courses on building wealth, blogging, building a brand, financial freedom, and on and on and on….

I then saw how my buddy Grant Baldwin was doing with his speaking course and how my new buddy Brian Harris from Video Fruit was crushing it with online courses. After that, I knew I needed to buckle down.

Big shoutouts to Grant for giving me the nudge on what my course topic was going to be (more on that in a sec). I also want to thank a low-maintenance business that generates significant income (we’re in a mastermind group together) for helping me outline the course material and holding me accountable to finish it.

And finally, thanks to Bryan Harris for creating this epic post on how to launch an online course that I’ve bookmarked and read at least 37 times.

So how did I choose the course topic?

It all started by asking myself, “What is the #1 question you get asked the most?” While tons of people want to “pick my brain” about investing, financial planning, blogging, and online business, there’s no question about what I get asked the most and who asks it.

Most of the time, it is financial advisors who ask me how I’ve grown my online platform the way I have. I’ve talked to many advisors who have discovered my blog and contacted me saying, “I want to be the next Jeff Rose.”

Seriously, people, I’m that cool! Haha…

In the past, financial advisors have paid me up to $500/hour to share how I’ve grown my blog to what it is today. That’s when I knew I had the potential for a course.

The first step was to see if I could build up any interest. With a small email list of advisors, I was able to pitch the concept of my course fairly easily. To get the ball rolling, I wrote up a good outline of what the course would cover and offered them complete access to the course at a discounted price if they were interested.

The catch was, the course hadn’t even been created yet.

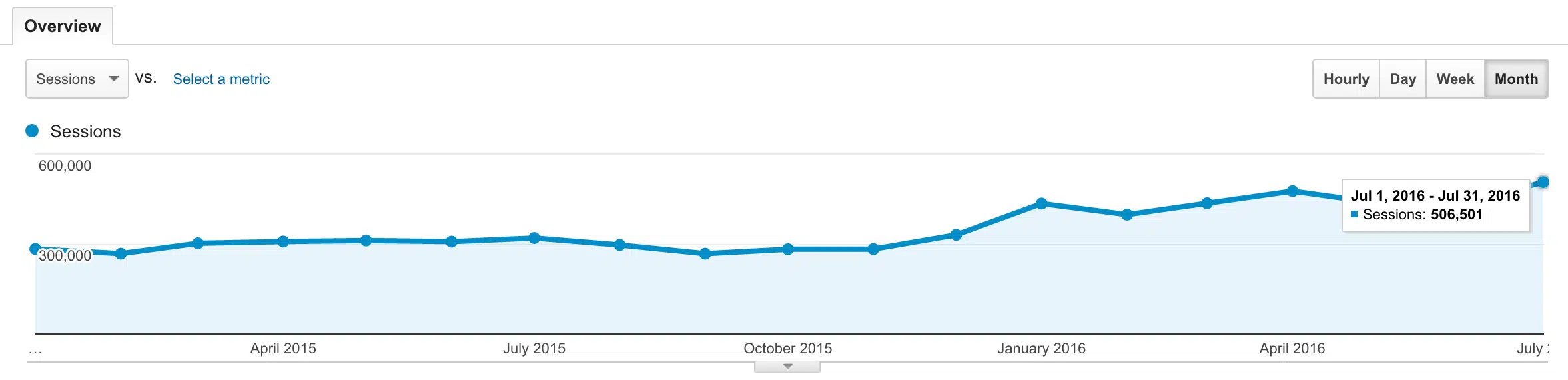

So I was basically asking advisors to pay $500 for a concept. Because really, this was nothing more than an idea and experience I had in my head of creating a blog that generates 30-40 new leads every day with over 400,000 new visitors to my site every month.

Would they bite? The only way I could find out was to ask.

Well, I asked this group of 180-ish advisors if they were interested, and I had 28 advisors buy.

Whoa.

I was blown away.

This, my friends, is commonly referred to as “proof of concept.” Before I invested tons of time and resources into creating this course, I was able to have my customers prepay. I don’t think it gets any better than that.

From there, it took me over 4 months to create the course using an amazing platform called Teachable.

Once the course was complete, it was time to market it to advisors at the increased price of $2,500.

Looking back, I have to laugh at some of the concerns I had before my course went live. Here are a few thoughts that crossed my mind:

- “Who are you to offer a course on online marketing?”

- “Do you really think people are going to pay you for this course?”

- “If nobody buys, you’re going to look stupid.”

Even after 28 advisors paid and the concept was proven, those same doubts crept in when I launched the completed course:

- “Sure, they paid $500 for the course, but they’ll never pay $2,500!”

- “There are so many other courses on online marketing, why would they buy yours?”

- “You’re going to be seen as another spammy online marketer selling some bogus get-rich-quick scheme.”

These kinds of doubts can be toxic. I’m thankful to have a good group of friends and mentors who gave me the encouragement to push through.

Since I launched the course officially in April, I’ve added 21 new advisors. Between those sales and the pre-sales, I’ve produced over $66,000 in revenue. This screenshot is from last month’s sales.

Now that those doubts are totally squashed, we have some big plans on launching the course on an even grander scale. I can’t wait to see how it does!

Media Brand Sponsorships

- Gross Revenue: $12,500

This is another fun one for me. These types of opportunities don’t come around too often, but when they do, it’s a lot of fun.

This year I’ve been able to partner with two big brands and get paid more than I ever have (part of that payment is reflected above).

While I can’t disclose the brands here due to my contracts, I can say I’m excited to work with both.

One project involves a ton of videos, and I can’t wait to share it with the GFC community when it’s live.

Last year I had the opportunity to work with John Hancock when they released their partnership with Vitality on a revolutionary new life insurance product.

I also got a chance to meet actor Chris O’Donnell, which was totally cool.

The cool thing about all of these opportunities is they all found me because of my online presence. Whether it was my blog or YouTube channel, it’s just a reminder that if you work hard and put yourself out there, good things can find you.

7 Key Insights for a Six-Figure Month

It’s been a long time coming to have such a successful month. Here are 7 key insights I attribute to having a record month:

1. 10x Mindset

A strategic coach first introduced this concept to me. The basic premise is looking at your current business structure and asking yourself what it would take to multiply it by 10.

What that doesn’t mean, however, is you also work 10 times as much.

This exercise was powerful for two reasons:

- It allowed me to dream about the possibility of actually growing my business 10x, which was a huge mindset shift for me.

- It allowed me to brainstorm on what would have to change for me to grow my business 10x. What tasks am I doing now that I can improve upon? What key additions to my team would I need to grow accordingly? This part of the exercise was a lot of fun for me.

2. Building the Right Team

I already mentioned how integral it was to add Andrew to AWM. In addition to him, I have a killer Director of Client Relations as well. Together, we’re able to offer rockstar service to our clients as well as grow the business.

With the blog, I finally had to recognize that I was holding myself back from the true revenue potential my site possessed.

Through a mutual connection, I met Jason Patterson, who runs the SEO agency Growth 360. Jason loved my site and my message, but he was floored when I told him my site was only making around $16k per month (this was back in late 2014).

He felt that with the authority of my site and the traffic I had, I should be earning way more than that.

I couldn’t argue with him.

The truth was, while I was making very good money on the site, I didn’t have a passion for figuring out ways to optimize my revenue potential.

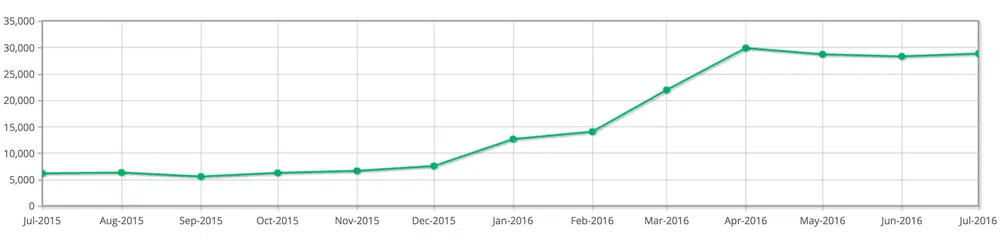

So in January 2015, I brought Jason and his team on to improve the SEO of my site and also identify strategic revenue opportunities.

Here’s a look at the traffic growth of my blog:

As the income reflects above, he’s done a pretty dang good job of it.

3. Creating My First Product

As I have already shared above, creating the online advisor growth formula was a huge milestone for me. Not only did I erase all those doubts I had about creating a product that people would actually pay for, but I also gained a sense of confidence that I had been searching for quite some time.

When you talk about doing something, anything, for a long period of time but don’t take any action on that thing, you may start to feel inadequate.

When I say that I have been talking about creating a course for over five years, I’m not exaggerating. I kept talking about it and talking about it, but never did anything about it. Just completing the course was a milestone in itself. The fact that people pay money for it is just icing on the cake.

With this new sense of confidence and the fact that I committed to completing this course, I now have capabilities that I didn’t have before.

I’m 100% confident that this will not be the last course that I create.

I already have tons of course ideas that I know I could implement, but since ideas are nothing without action, I know that I have to choose one of those ideas and just commit to getting it done.

If you want in on a little secret, I already know what the next course idea is going to be. I wish I could tell you now, but I’ll have to keep you in suspense.

4. Creating Space

This is a term that I picked up from Stu McClaren, an entrepreneur, creator of the WordPress plug-in WishList, and a leading expert in building membership communities. I met Stu through Michael Hyatt, as Stu was instrumental in exponentially growing Michael’s membership community, Platform University.

Stu stepped away from that business relationship, but not on bad terms. He stepped away because, in his own words, he needed to “create space.” Stu is working on his next idea, and even though he loved the relationship between him and Michael, he knew that space was needed if he was going to dive in head first.

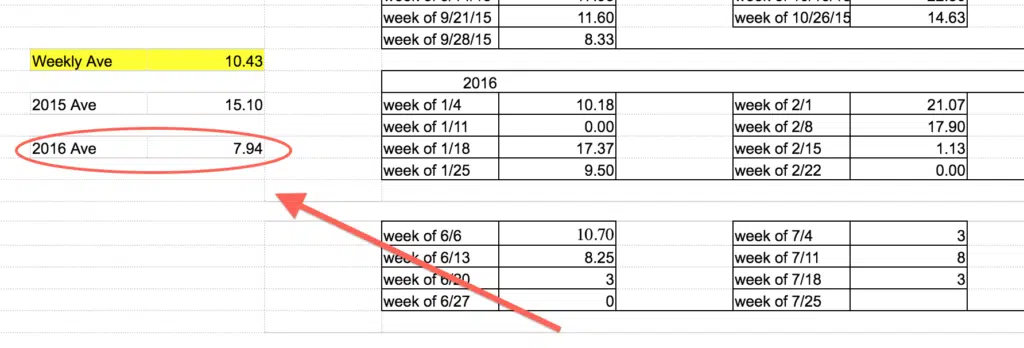

Even though I was only initially introduced to this concept, reflecting back, I realized it was me creating space that allowed a lot of the growth I’ve seen in the last few years. One of the commitments I made last year, for example, was a plan to decrease the amount of time I spent at the office to 16 hours per week.

My reasoning for this was I felt I was so much more productive when I was either working from home or from a coffee shop. There were so many different distractions that occurred while at the office; I constantly felt that, if I could just create space, I could be much more productive. I was right, so as 2016 rolled around, I decided to drop from 16 hours a week to just 12. Believe it or not, that became a lot easier than I ever dreamed.

The next goal was to reduce my time to eight hours per week. I can proudly say that, in 2016, the average time I spent in the office was 7.94 hours per week. I haven’t quite achieved the four-hour workweek like Tim Ferris, but I’m pretty dang close.

Don’t get me wrong. Just because I’m only in the office eight hours a week doesn’t mean I’m not working. There are still a lot of things I have to keep my eye on. I’ve just been able to minimize the time in my office and optimize that time for team and client meetings only.

Because of that space, I was able to focus that wasted time on completing my course. It gave me more time to be strategic about this blog and launch new projects such as Good Financial Cents TV. Overall, it has definitely been a win-win across the board.

5. Free Time

Do you want to know a pet peeve of mine – especially when it comes to entrepreneurs that love the hustle?

It’s when they take a picture of their laptop at the beach or at some outdoor location, bragging about how that’s such an awesome place to work. Don’t get me wrong. If you have a location-independent business, that is something pretty sweet to brag about.

Your business isn’t everything. You have to take some time away and dedicate that time to friends, family, and yourself.

When I first joined the Strategic Coaching program, one question asked was how many free days each of us had taken during the last year. Free days are defined as a 24-hour period where you do nothing related to work. That means no research, no reading, no emails, nothing.

At the time, I was pretty good at shutting down my financial planning practice on Fridays. I can’t remember the last time I met with a client after 5 p.m. or on the weekends.

What I did struggle with was shutting down and removing myself from my online business. Whether it was writing a blog post, checking email, utilizing social media, or something else, I was doing it.

So I had to answer the question truthfully about how many free days I had taken in the last year. The answer was zero.

[Tweet, “When was the last time you really unplugged from your business for 24 hours?”]

In the last year, there hadn’t been a single day where I hadn’t checked my email or done something with my blog. And just the thought of trying not to do something with my blog every day was a tough pill to swallow.

Fast forward to present day, and I now know the importance of unplugging. I now know the importance of coming home from work and removing yourself, disconnecting from your business.

I now understand what it means to go on vacation and truly be present. To not have my phone stuck to my side so I can check my email non-stop. I can confidently say now that I can actually unplug.

Sure, there are days when I still have to remember that it doesn’t all have to be done today. Still, it feels so good to escape the stress of my former workaholic lifestyle.

6. Let Go

Due to the strategic byproducts of creating space and taking more time, I was able to have a 1,000-foot view of my business. As an entrepreneur who is as self-driven as I am, it is so easy to get caught up doing a bunch of stuff that you really shouldn’t be doing. When I made the decision to spend less time at the office, I had to take a serious look at all the things I was committing time to.

And when I wasn’t in the office to take care of these things, I then had to train Andrew or my director of client relations on how to get it done. It became quite evident how many tasks were occupying my time each day that I shouldn’t be doing. I then applied the same concepts to my online business.

It was crazy when I realized how many unnecessary tasks were clogging up my day. There were so many little things I had written off that I “had to do.” But the reality is, I didn’t need to complete 95% of them myself.

Many people fall into the trap of believing that it is just easier to do everything themselves than to take the time to teach someone else to do it. For such a long time, I was guilty of this very thing. Yes, it does take time to teach somebody to complete a task that you’ve been doing yourself for many years, but once you show them how to do it once, you never have to show them again.

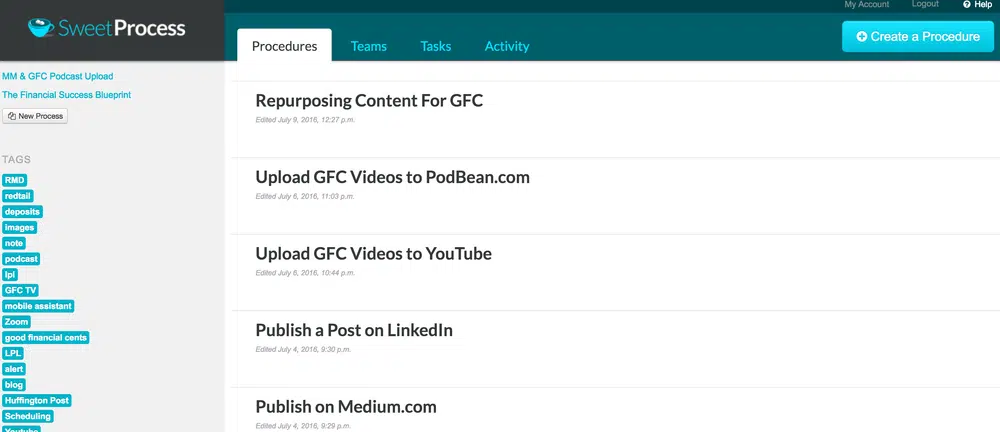

One tool that I started using was Sweet Process. Sweet Process is an amazing tool that allows you to document all the procedures that keep your business running. I use this both for my financial planning practice and my online businesses. You can do the exact same thing in a Google Doc or Microsoft Word.

What intrigued me about Sweet Process was the simplicity of adding each step to every process that you own.

What also saved time was when I would record a video of walking through a basic procedure that I would do on my own. One example was syndicating my content to the Huffington Post. This is a task that I just wrote off as “I need to do myself,” but I finally had to ask myself why.

Once I created the Sweet Process and shared it with my executive assistant, that task was off my plate forever. I was able to apply that same concept to over three dozen tasks that I had previously convinced myself that I had to do.

In essence, what I was doing with all my businesses was letting go. It was the same thing with the revenue opportunities I had with my blog. Deep down, I knew that if I wanted more growth than I was currently seeing, I had to bring somebody else in.

But since I invested almost eight years into building it, there was that fear of giving somebody else access who might not quite have the same passion and drive that I did for my own baby.

It was quite evident that I had to let go. In doing so, I have freed up my life in so many ways than I ever could have imagined.

Not only has this allowed me to focus my time where it matters most in my business, but it has also allowed me the freedom to spend time with my family. The cool thing about June being my highest revenue month ever (to this point at least, the sky’s the limit) is that in that month, I probably worked the least that I have over the last year and a half.

In the month of June, we traveled to the Philippines to pick up our daughter, whom we had been in the adoption process for over four and a half years. However, the trip happened a week later than we had initially planned, which meant our schedules got turned upside down.

As it turns out, I had already scheduled my time out of the office the week before. Plus, when I got home, I cleared my calendar so I could spend time with my new daughter and also be there for the family.

For almost three weeks, work-wise, I wasn’t very productive. But family-wise, I was super productive. And because of the key procedures I put in place over the years, not only was my business able to sustain itself, but it was also able to grow. That is a beautiful thing.

7. More Money, More Impact

Guilt.

Even though I know that nothing has been handed to me, I still experience guilt.

When you see people around you who are struggling financially or having difficulty making ends meet, there is a sense of guilt that inevitably comes with this type of income.

Many people look at the 1% and assume that they’re greedy and don’t care about anyone other than themselves. That fixed mindset tends to creep in and could potentially be dangerous.

At this stage in my career, there’s no question that I don’t need to make more money. Still, here is the honest truth: It’s a lot of fun. It’s a lot of fun making little tweaks to your business and seeing the results.

I compare it to a farmer making small tweaks to his soil or adding new fertilizer and sitting back and watching the new crops roll in. While it is a lot of fun, there has to be a bigger purpose. Making more money shouldn’t be about just making more money because, let’s face it, it’s not like you can take it with you after you die.

Recognizing that and realizing that my income would continue to increase, I started thinking about ways that we could have an impact on others.

First off, it was with our church. Tithing was the easy first step. Our church also does an amazing job of sending out church plans across the United States, which is great. And with any of these church plans, they need a lot of money to be successful. So, over and above our tithe, we’ve been able to offer an offering to each of these church plans.

Another amazing experience for us was adopting our daughter from the Philippines. Adopting, especially internationally, is a huge financial commitment that many people cannot afford. I’m so thankful we are in a financial position to adopt and open our home and our family to this amazing little girl.

In addition to adopting her, we were also able to raise over $28,000 for her orphanage. It was things like this that got me excited about the idea that more money equals more impact.

My wife and I are currently brainstorming about other people and causes we can positively affect with our money, and because of that, I feel good and confident about seeing my revenue go up.

Enjoy The Journey

As I conclude, I want to assure you that I’m still pinching myself. What’s even crazier is that my July revenue numbers surpassed these numbers, and August is looking good, too.

For those that feel they could never achieve this, I want to remind you that this growth has all happened in the last few years, and that was after putting in hours upon hours of hard work for the first 13 years of growing my financial planning practice and 6 years of growing my online business.

It’s easy to get caught up in the success of others and convince yourself that you are not capable of achieving similar results. I fell into that crippling mind trap several times through the years. I kept reminding myself to enjoy the journey along the way and focus on the small wins. But to celebrate any wins, you first have to start.

Jeff, this is so fantastic! I’ve been following you for awhile now, and love your stuff. I’m so glad to see things going well for you and your family.

My wife and I also hope to adopt one day, that’s so cool to see you doing it!

Keep up the great work and know that you’re inspiring the next generation every single day.

Nick

Another great guide to badassery. Thanks for posting Jeff!

And…I’m a special education teacher struggling to get by on $2100 a month…with a Master’s degree and 27 YEARS of teaching. How depressing.

Hi Aslf – What you’re saying is a valid point. Unfortunately, when you work for someone else your income is limited. The higher amounts usually go to people who run their own businesses. It may not be fair, but it’s the way the world works. But please keep in mind that you have job security and benefits in a way that a self-employed person doesn’t, so it’s always a trade-off, one way or another.

This was a good read. I’m at the beginning of my journey and I’ve learnt a lot so far. You’re right – self doubt can derail any goals and dreams that you have. You just have to dig deep and keep going.

Thanks for the encouragement Jeff! Love what you are doing and the impact you are having.

Very awesome and inspiring post. Being able to make money like that while having a full family life is an absolutely incredible achievement.

Awesome Jeff. So glad to be on the journey with you… great job!