As a child growing up, I remember my father constantly eating Ramen Noodles in a Styrofoam cup.

It was pretty fascinating that all you had to do was add hot water, and presto, you had a ready-to-eat meal in a few minutes.

Perfect for an impatient kid!

As I got older I started to notice that the package of Ramen Noodles still existed in our kitchen.

My father had always struggled with money.

He had battled credit card debt and never really made good financial “cents” of his money.

Table of Contents

I guess I always just thought that he really liked the cup of Ramen Noodles.

I later found it there was much more to the story.

All Too Familiar Feeling

I remember my first year as a financial advisor. I was meeting with a couple in their early 60s. At the time, I was 24 years old, and already started a Roth IRA, and was quickly learning the proper ways to invest in my 20s. I remember this couple in particular because while many people get excited about retiring and starting a new venture in their life, with these folks, retirement was nowhere in the near future.

Combined, they had maybe $50,000 saved in their retirement investment accounts combined. Their jobs offered no pensions, so all they had was social security.

I remember looking at this couple, and eerily, I saw similarities with my father. They had no hope of retiring. They had done a horrible job of saving.

The Ramen Noodles Jolt

This meeting instantly made me realize that I did not want to follow in their footsteps.

I knew that I did not want to be in my early 60s and be forced to be eating cup of Ramen Noodle soup.

I didn’t want to have to worry about not ever being able to retire. I know at the age of 24, I was thinking much more differently than my peers. None of my friends talked about retirement. We talked about the next trips that we were going to go on, and what concerts we wanted to go see, still reflecting back on the good old college days.

Investing in Your 20s Isn’t Cool, It’s a Must

I write this because if you are in your 20s, I know you’re thinking the exact same thing, even if it’s just how to invest with 100 dollars. What’s the point of investing? What’s the point of saving? What’s the point of even thinking about retirement?

Here’s one thing I know, you don’t want to be eating Ramen Noodles for dinner for the rest of your life. It might be good every once in a while, but I promise you, you get sick and tired of it.

So, why is it so important to start investing early in your 20s?

Most young people just don’t get it. They think they have plenty of time to start thinking about retirement. While, yes that’s true, what most don’t understand or appreciate is that the sooner you start, the easier it is.

You don’t want to discover you’ve waited until it is too late to retire.

For Example

The chart has two young adults who should be investing in their 20s: Super Saver Parker who starts at the age of 25 and Super Slacker Sloane. Both graduate with good-paying jobs and have well enough income to start contributing to a Roth IRA.

| Super Saver Parker | 10 Years of Contributions | Super Slacker Sloane | 30 Years of Contribution |

|---|---|---|---|

| 25 | $2,000 | 25 | – |

| 26 | $2,000 | 26 | – |

| 27 | $2,000 | 27 | – |

| 28 | $2,000 | 28 | – |

| 29 | $2,000 | 29 | – |

| 30 | $2,000 | 30 | – |

| 31 | $2,000 | 31 | – |

| 32 | $2,000 | 32 | – |

| 33 | $2,000 | 33 | – |

| 34 | $2,000 | 34 | – |

| 35 | – | 35 | $2,000 |

| 36 | – | 36 | $2,000 |

| 37 | – | 37 | $2,000 |

| 38 | – | 38 | $2,000 |

| 39 | – | 39 | $2,000 |

| 40-65 | – | 40-65 | $50,000 |

| Total Contributions | $20,000 | $60,000 | |

| Ending Account Value | $340,060 | $266,427 | |

| *BIG* Difference | $73,633 |

Super Saver Parker starts putting $2,000 a year into his Roth IRA ($166.67 per month). He does this for a total of 10 years and stops for a grand total of $20,000 he put in. Why does he stop? Don’t ask. That’s just part of the illustration. 🙂

Super Slacker Sloane puts off saving because he wants to buy “stuff” (otherwise known as “crap you don’t need”). He finally gets it and starts putting in $2,000 a year starting at the age of 35. Wanting to catch Parker, he puts in $2,000 a year for 30 years contributing $60,000 in total – $40,000 more than Parker. *We’re assuming that they both average an 8% return on their money.

After they showed this chart to me in my finance class, the question that was then asked was,

“Who will have more money at the age of 65?”

I remember my initial thought was “Duh, the guy who put in $40,000 of course!“.

Hmmm…..oh how wrong I was.

The reality is that the person who started 10 years earlier (preferably in their 20s) had actually made $73,633 more even though they put in $40,000 less.

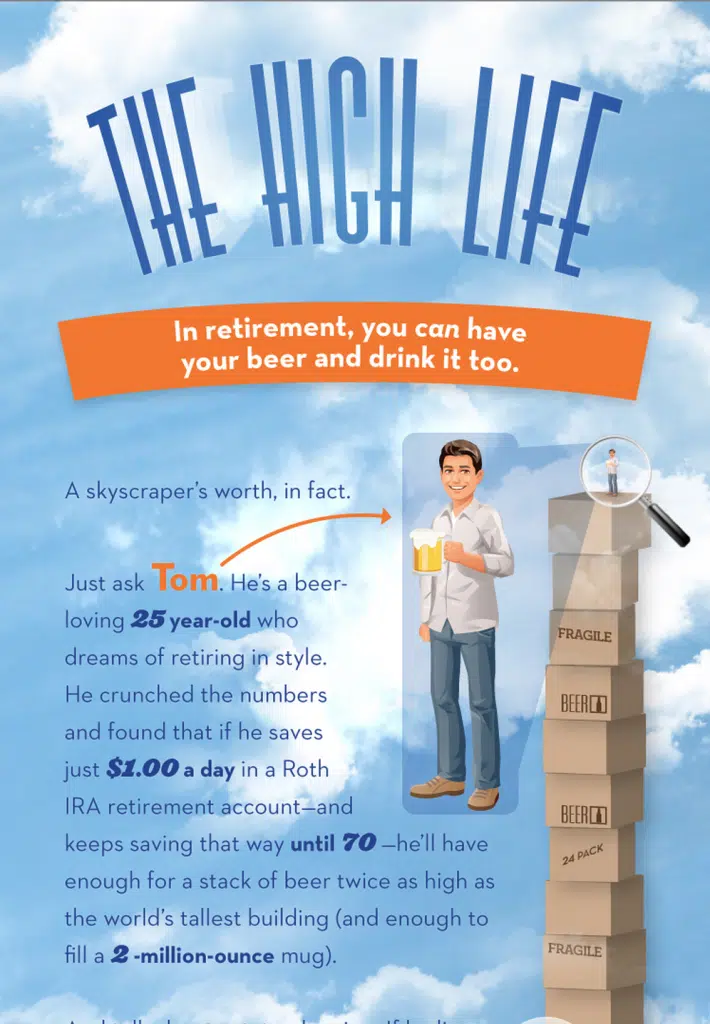

Maybe a Chart Involving Beer Will Help?

Not convinced? Here’s something else to look at:

Sounds great, right? Being able to retire, not having to eat Ramen, being able to drink a gigantic tower of beer… all wonderful.

But if I had to guess there are some of you out there in your 20s — just starting careers, just starting families, just really starting to get into the swing of things — that are wondering:

How the heck do I start? I have no idea what I’m doing!

Well, that’s hopefully one of the reasons you are reading my blog. I want every single one of my readers to be able to retire, and if I have to show each one how to do it then that’s what I’m going to do.

Resources for Getting Started on Your Retirement Saving

Here are some resources I’ve created to help you jump-start your retirement savings.

Best Online Brokers for Beginners

With the large number of brokerage firms out there it can be really confusing deciding where to open an account. There are some brokers out there that are only for “professional” investors who trade a lot and need all kinds of crazy chart tracking.

If you’re just starting and investing in your 20s then that isn’t you.

I’ve boiled down your best online broker options for you to make the selection that much easier.

- Stockpile: Buy fractional shares of stock for only 99¢ a trade

- E*TRADE: trade free

I like really simple, and beginner investors should too.

The Roth IRA is one of the best investment accounts to have to grow your nest egg for your retirement.

Last year I helped start the Roth IRA Movement to encourage young people to open and fund Roth IRAs. Over 140 bloggers jumped in to add their own articles and it was a huge success. The link above takes you to an easily accessible list of all of the posts. A lot of good reading here.

Start Saving for Retirement in Your 20s

No matter which broker you go with or what investment philosophy you end up selecting… please do not delay in starting your retirement savings. Investing in your 20s is the absolute way to go. Literally, every day that goes by without saving for the future the harder you will need to work and save to meet the same goal.

Let your money work for you by giving it the maximum amount of time to be invested. Don’t end up eating Ramen Noodles and waiting for your next Social Security check. That’s no way to live your golden years.

Bottom Line: Investing in Your 20s: Dodge the Ramen Dilemma

Starting early with investments in your 20s is essential to secure a comfortable retirement. This article underscored the dramatic difference between early and delayed investing through the contrasting examples of Super Saver Parker and Super Slacker Sloane.

The power of compound interest means early investors can accumulate more wealth, even with fewer contributions. With resources available to guide young investors, there’s no reason to delay. Embrace wise financial habits now to avoid future hardships like the “Ramen Noodle dilemma.” Secure your future; start investing today.

While my parents didn’t talk extensively about finances much growing up, I knew they would be fine in the end…. However–your sentence “I knew at 24 I thought differently than my peers” resonated with me. I felt the same way… I didn’t start working until 25 (grad school) but immediately that year I invested the full $5k. And have ever since! My husband is younger than I, but also started saving in his Roth. We both decided that we wouldn’t get engaged (therefore he buy a ring) without him fully investing in his Roth that year :). I sure do hope it pays off……. We sure do work hard! I’m so thankful I have a best friend and husband with the same mindset.

This is absolutely correct. I’ve encouraged my children to start investing their money at an early age. One son started at 15, one at 18, one daughter at 22 and another daughter has yet to take an interest. Make investing mistakes early when you have little money and you’ll avoid those mistakes later.

I didn’t invest in my early 20s and regret it. I won’t be eating ramen noodles in retirement, but I could be further ahead than I am now. I plan to have my kids open a Roth IRA as soon as they get their first jobs.

Excellent illustrations. Saving a lot in your 20s is way better than waiting until later in life. It’s easy to cut back savings if someone has too much money (is that possible), but hard to recover from a savings shortfall.

Wonderful article. I’m 23 and have been regularly saving/investing for years now… having a boring phone, a cheaper car, and skipping a vacation or two in my 20s can pay off huge over time. There’s no reason to spend money to have a good time, either. 🙂

I started saving in my first job post college and my goal was to max out my Roth IRA! Since then I have upped my goal with at least half of every raise and salary jump between jobs and it is working wonders already.

Jeff,

Incredible look at what that small amount per year can yield. And imagine if your hypothetical saver kept saving at 35, even if it was less than the previous $2,000/year.

As far as you know, do all financial institutions have a minimum with which you must start an IRA? Thanks, Jeff.

-Christian L. @ Smart Military Money