Many consider the 2000s to be a “lost decade” for stock market investors. This view is not surprising since the 2000s marked the biggest loss for the S&P 500 of any decade, including the 1930s.

However, it wasn’t what you invested, as much as how you invested that mattered the most in the 2000s.

Some investors found success in the 2000s and those lessons can be applied to the 2010s.

Table of Contents

What Is the Best Investment for the 2010s?

We Are Often Asked:

Instead, a consistent approach to saving and tactically buying and selling a number of investments suited to different environments and conditions is more likely to result in investment opportunities for the decade as a whole.

Our outlook for the 2010s is for modest buy-and-hold returns and the likelihood of volatility as many factors influence the markets. However, to illustrate our point about successful investing let’s look at the 2000s when positive returns were even harder to come by.

The 2000s offered tactical investors many opportunities to add value beyond the lackluster performance of the indexes; we expect the 2010s will also offer similar opportunities.

How Much of a Lost Decade Were the 2000s?

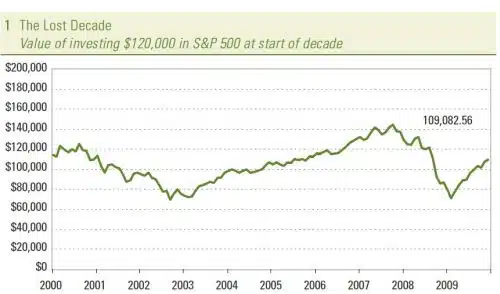

It depends on how consistently you saved and tactically you invested. As you can see in [Chart 1] with $120,000 invested in the S&P 500 at the beginning of the decade, it was only worth $109,082 (including dividends) 10 years later, for a loss of about $11,000.

Looked at this way, the 2000s were certainly a lost decade — or, at the least, a decade of losses.

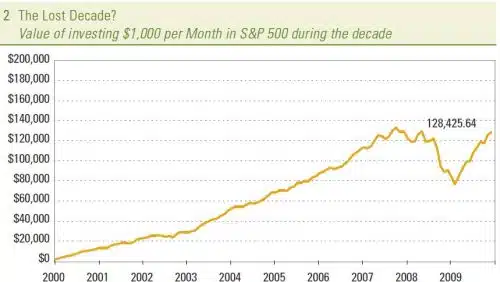

However, that wasn’t the only investor experience during the 2000s. It may seem that those investing money over the course of the 2000s probably wish that they hadn’t. In fact, for those who added to their investments over the course of the decade the experience was very different.

For those that consistently invested $1,000 per month in the S&P 500 the decade produced a modest gain of over $8,000 instead of an $11,000 loss.

The same $120,000 placed in the same investment provided very different results. While the gain isn’t big, it calls into question whether the 2000s were a lost decade. [Chart 2]

Source: LPL Financial, Bloomberg

- This is a hypothetical example and is not representative of any specific situation. Your results may vary. The rates of returns used do not reflect the deduction of fees and charges inherent to investing.

- The S&P 500 is an unmanaged index, which can not be invested in directly. Past performance is no guarantee of future results.

Source: LPL Financial, Bloomberg

- This is a hypothetical example and is not representative of any specific situation. Your results may vary. The rates of returns used do not reflect the deduction of fees and charges inherent to investing.

- The S&P 500 is an unmanaged index, which can not be invested in directly. Past performance is no guarantee of future results.

More importantly, those investors that used a tactical asset allocation approach (here represented by the performance for a decade of the LPL Financial SAM/Research Recommended Mutual Fund Models Growth with Income Diversified and Diversified Plus Portfolios) as they consistently invested $1,000 per month ended up with a gain of $41,000 over the decade.

This is $52,000 better than the $11,000 loss represented in the first example on the same $120,000. No lost decade here!

It’s How You Do It

In summary, it isn’t what you invested in; it is how you invested that mattered over the 2000s. We believe this is the secret to investing success in the 2010s, as well.

Even if the 2010s offer only a repeat performance of the “lost” 2000s, investors can find opportunities to invest and profit by consistently saving and tactically managing the investments in their portfolios.

Rather than look back with regret at what may have been a lost decade, we encourage investors to look forward with newfound wisdom and invest for success in the 2010s.

Important Disclosures

- This was prepared by LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested directly.

- Investing in international and emerging markets may entail additional risks such as currency fluctuation and political instability. Investing in small-cap stocks includes specific risks such as greater volatility and potentially less liquidity.

- Stock investing involves risk including loss of principal Past performance is not a guarantee of future results.

- Small-cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the small-cap market may adversely affect the value of these investments.

- Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise, and are subject to availability, and change in price.

Bottom Line: Was the 2000s a ‘Lost Decade’ for Investing?

The 2000s, often dubbed the “lost decade” for stock market investors, presented varied outcomes based on investment tactics. While a straight investment in the S&P 500 saw losses, consistent monthly contributions led to modest gains.

Tactical asset allocation yielded even more favorable results. The essence is not solely what you invest in but how you invest.