This is a guest post from Kyle Sellers, a College of Business student from SIU-Carbondale. Kyle was my intern this past semester and asked me to speak to his business fraternity. You may also want to check out my post on when I went to visit the local high school. I’ll let Kyle take it over from here…

I know what you are thinking. Who wants to hear more about why we youngsters think we should invest?

Last year Mr. Rose (the man who makes him sound old), was asked to be a guest speaker at a local high school.

This time Mr. Rose was asked by Alpha Kappa Psi, a professional business fraternity at Southern Illinois University-Carbondale, to share his insight and advice about financial planning.

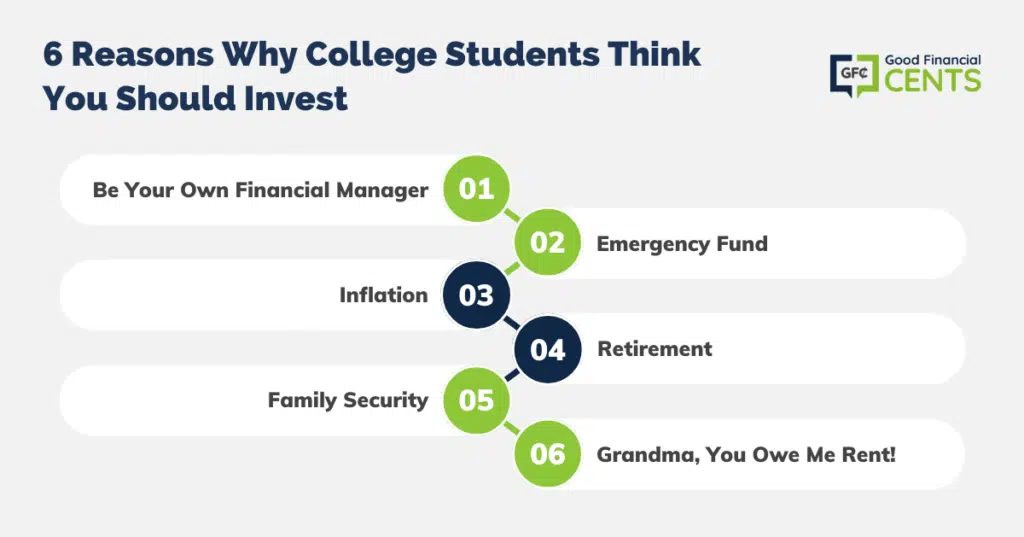

At the end of the meeting, Mr. Rose asked us our top 6 reasons why we think we should invest.

Table of Contents

Reasons Why You Should Invest

1. Be Your Own Financial Manager

Now I know not everyone is an expert in finance, investing, and the stock market, but you should still be very conscious of your financial situation, especially in this day in age.

For starters, you could keep track of all your earnings and expenses so you know where your paycheck is going each week. Also, you could start paying off all of your outstanding credit card debt. Or you could start an emergency fund…

2. Emergency Fund

You want your emergency fund for, just that, times of emergency. After all, how many of us have the psychic ability to predict our cars breaking down, or an appliance going ca-put?

Thus, this fund should be liquid (an asset that can be easily converted into cash). Having enough cash on hand will save you from digging deeper into debt. Some good places to put your money would be checking or savings accounts, CDs, or some short-term bonds.

If you do not know what to do with 1000 dollars one day, beginning an emergency fund for yourself or your family is a great way to start.

3. Inflation

You don’t necessarily notice this every day but the rate of inflation is constantly decreasing the value of your assets and increasing the cost of living.

If you don’t invest, the value of your money will sit around and be corroded down to nothing. Remember when you could get a cheeseburger, fries, and a drink for 15 cents? Me neither but it’s true.

College tuition is rising along with your favorite meals (in 2023 the cost of attendance was about $26,027 per year). According to FinAid the average tuition inflation rate is double the general inflation rate.

So if we use the estimated annual tuition inflation rate of 7%, then the cost of tuition in 10 years would be about $36,800. If we waited for 20 years it would cost almost $73,000 per year or roughly $321,000 for a four-year degree!

Even if you happen to have one of the highest-paying college degrees, inflation will still find a way to get you.

4. Retirement

Here’s one that high school students and college students agreed on. Although none of us students can understand the feeling of wanting to retire early, we can still understand that after working every day for 40 years, an endless vacation doesn’t sound too bad.

Saving for retirement early on is your best bet. If you are 21 years old and you started investing $2,000 a year at 8%, it would be worth over $773,000 in 45 years. If you didn’t start saving until you were 40 (26 years of investing) you would need to put almost $10,000 per year to get the same amount.

5. Family Security

Keeping your kids safe from the boogieman is a plus. But will you have enough saved for their college tuition? Do you have insurance coverage for any unpredictable emergencies?

Get life insurance so that your family can make it if something bad happens to you. This also ties back in with being your own financial manager as well as building an emergency fund.

6. Grandma, You Owe Me Rent!

We couldn’t be serious the whole time. I think I can speak for a lot of people by saying that I don’t want to be living on my grandkid’s couch when I retire. Wouldn’t you rather be lying on a beach sipping on your favorite beverage? That makes two of us.

I would personally like to thank Mr. Rose for taking the time to share your knowledge with us. And thank you to my fellow brothers in Alpha Kappa Psi.

The Bottom Line – 6 Reasons Why College Students Think You Should Invest

Beyond the apparent benefits of financial management, building an emergency fund, and combating inflation, these reasons underscore the significance of securing one’s future.

Investing for retirement from an early age, ensuring family security, and aiming for a comfortable retirement are all wise goals. This generation recognizes that taking control of their financial destinies is not just a practical choice but a path toward personal freedom and security.

The guidance offered and the exchange of ideas within Alpha Kappa Psi contribute to a brighter financial future for these young minds.