The Super Man complex most healthy people have has a kryptonite when it comes to life insurance options: the non-medical factors that affect your life insurance rates.

It’s a huge shock to many people who get a free life insurance quote who are in the best shape of their lives when they can’t qualify for the best life insurance rates because of non-medical factors. It usually goes something like this:

“I Crossfit 3 times/week and compete in Iron Man triathalons and you’re telling me that I can’t qualify for the best rates because I’m a rock climber?”

Table of Contents

Yes. That’s what we’re saying.

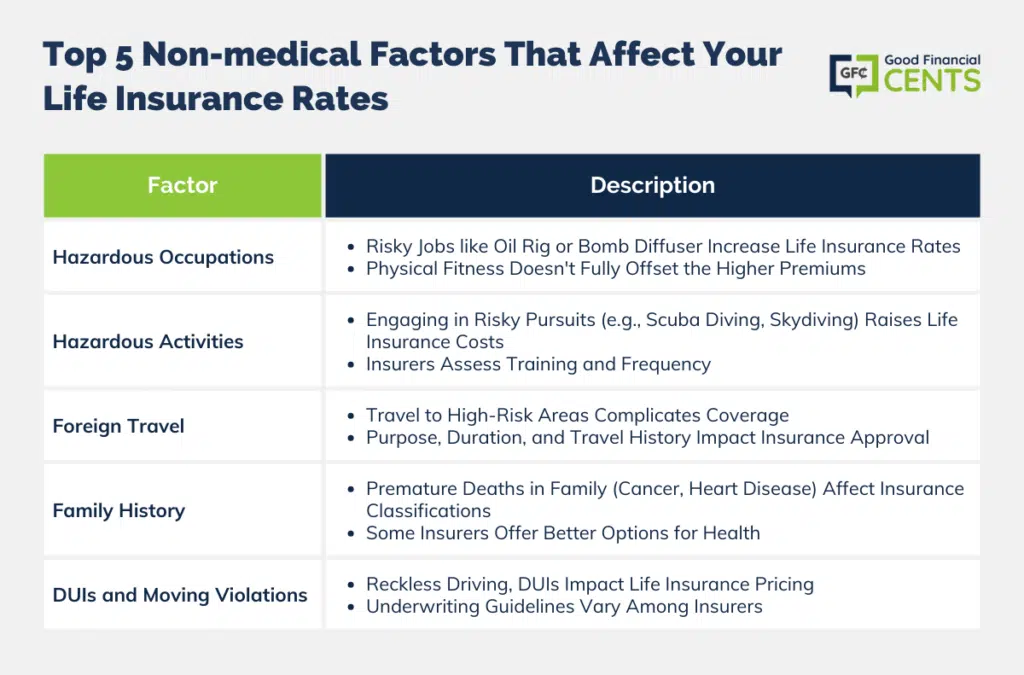

In our 8 years of helping consumers find the lowest life insurance rates available, here are the top 5 “non-medical” factors that affect your life insurance rates (in no particular order).

Non-medical Factors That Affect Life Insurance Rates

Hazardous Occupations

Have you seen “Deadliest Catch”? Those 700-pound steel traps on a boat being swung around by 25-foot waves aren’t really the ideal risk for life insurance companies. Expect to pay more… a lot more.

Again, most of these people are in great shape because of the nature of their occupations – but their non-medical factors come into play when underwriting their applications.

Hazardous Activities

In this group, the most common risks we see are deep-sea scuba divers, private pilots, motor racing, skydivers, and high-altitude rock climbers. Most of these people HAVE to be in great shape to perform these activities at a high level and most of them are. However, these risky activities come with increased premiums when it comes to life insurance no matter how fit you are.

Be prepared to fill out a questionnaire regarding the specifics of your hazardous activities as life insurance companies will determine your pricing based on many factors including your training, experience, and how often you perform these activities. If you are going to participate in high-risk activities don’t be surprised if you land in the high-risk life insurance premium bucket.

Foreign Travel

If you have any plans to travel abroad, your life insurance company wants to know about them. If it’s a high-risk area, like any of the places on this government Travel Warnings List, you’ll have a very hard time finding coverage until you come home from your trip.

Life insurance companies will also be looking at the purpose of travel and length of stay. For example – you may have a 2-week vacation planned to Bali, Indonesia, but Indonesia may be on the State Department “Travel Warnings” list or be a high-risk country in the company’s underwriting guidelines. Many companies won’t consider this risk after factoring in the purpose and length of stay.

Many companies will ask about previous foreign travel as well. If you show a pattern of traveling to potentially high-risk places, they may factor that into their underwriting decision.

Family History

This is the biggest disappointment to consumers purchasing life insurance because it’s something you have no control over. Generally speaking, if any of your parents or siblings passed away before the age of 60 with cancer, heart disease, or diabetes – most life insurance companies won’t offer their best health classification.

However, there are some highly rated and very well-known life insurance companies that don’t factor this in. If you’re in great health, make sure your agent provides you with these options.

DUIs and Moving Violations

Life insurance companies will pull your Motor Vehicle Report (MVR) and factor in any excessive moving violations and DUIs. A couple of speeding tickets usually isn’t an issue, but when you get a reckless driving ticket, DUI, or an excessive number of moving violations – it becomes a factor in your life insurance pricing.

Every life insurance company will have different underwriting guidelines for each specific high-risk activity.

The best advice we can give is to be open, honest, and detailed with your agent about your non-medical factors. It’s your life insurance agent’s job to find you the best life insurance rates available and the more information we have, the better chance you have of actually securing the best rates.

Lastly, if you have a family or anyone financially dependent on you – don’t be disheartened because of the higher pricing. Many people we speak with think it’s “unfair” that they have to pay more because of these “non-medical” factors that come into play when determining your life insurance rates. It’s unfair to your family if you don’t protect them.

Remember the purpose of this coverage. Tomorrow is promised to one, so protect your family today.

Jeff Root is an independent life insurance agent at Rootfin where he helps consumers across the nation find the lowest life insurance available.

Final Thoughts

Life insurance rates are influenced by a variety of non-medical factors. From hazardous occupations like bomb diffusers and oil rig workers to risky activities such as skydiving or rock climbing. Other determinants include foreign travel to high-risk areas, a family history of major diseases before age 60, and a history of DUIs or multiple moving violations. To secure optimal rates, it’s essential to disclose all relevant information to your agent. Despite potentially higher premiums, the primary aim remains the financial protection of one’s family. Always prioritize their security.

Great Post Jeff! What most people don’t realize is that getting life insurance can be much easier if you work with an agent who is used to high risk individuals and no exam life insurance policies. Many times the high risk occupation people can get really good rates this way.

Another non-medical factor, is of course the amount of in-force coverage you have. An unusually-high amount coupled with unverifiable income and/or assets could set off some red flags.

And somewhat related would be a situation where you have applied for numerous plans with different carriers within the last 30 days. Unless there’s a good reason, it typically is not viewed in a positive way.

Ed

Great points Jeff. The fact of the matter is, offering life insurance to someone with a high risk lifestyle for the same rate as a low risk client isn’t fair to the low risk client; they’re much less likely to make a claim. Understanding the process and reasoning behind the generation of rates is essential for understanding what constitutes “fair.”

It is true that you should not hide any details from your life insurance company. This helps you in claiming your money in future.

Life advisors aren’t just underwriting your health, but your everything you do. It can be hard for people to keep that in mind, or think that a hobby like rock climbing, which can sound pretty tame, would impact their life insurance rates.

I guess you’re right. But I wonder if people involved in some risky activity could get a life insurance without medical exam? Is that an option for them? I know that usually it’s the people with serious illnesses or seniors who use this kind of service. But, I mean, if those companies are willing to sell an insurance to abovementioned people without a question, would that work with totally heallthy but hot-headed people?

Yet another reason to NOT drink and drive! Great article.

I agree. It’s too risky, not just with the life insurance but also with your life. Never drink and drive because you never know when will an accident will happen.

Interested to see how the implementation of the Affordable Care Act will change some of these issues.