“I think I’m paying around $50 per year.”

That’s what I heard from one woman who actually paid a lot more on a variable annuity.

A whole lot more.

If you haven’t guessed it yet, I’m not a big fan of variable annuities.

I’ve seen too many investors who were sold this horrible product – having no clue what it does and why they should even own it.

They just know the advisor who sold it to them claimed it was some sort of “guarantee.”

What’s worse is the client typically has no idea what they are paying. This is why I recommend you check out our great reviews on different investing options such as our review on Motif Investing.

Table of Contents

Don’t believe so? Here’s an actual client scenario that shows just that.

The Details

For anonymity, I am changing a few details but you’ll get the gist.

A prospective client found my blog and was interested in working with me. When she came in I learned they were working with a local office of a big brokerage firm that rhymes with Bells Cargo – once again, I’m protecting anonymity here ;-).

She contacted me because she didn’t feel her current advisor was being straight up about her financial situation and wanted a second opinion. The advisor had sold her a variable annuity and also some mutual funds. She wasn’t as concerned about the mutual funds but confessed she didn’t exactly understand how the variable annuity worked. The advisor claimed the annuity had some sort of guarantee to it.

When I inquired how much she thought she was paying for her variable annuity she sheepishly admitted she really didn’t know. I did find out on one of her most recent statements she saw a fee of $50. I tried to probe a little bit to see if she truly believed that’s how much she was paying without making her feel stupid.

I could tell by the conversation she really didn’t think there were any additional costs just because of the guaranteed nature of the product. I think she thought of her variable annuity as a fixed annuity. When I asked her if she’d be curious to know how much she was really paying for her variable annuity, she was more than interested to find out.

Annuity X-Ray

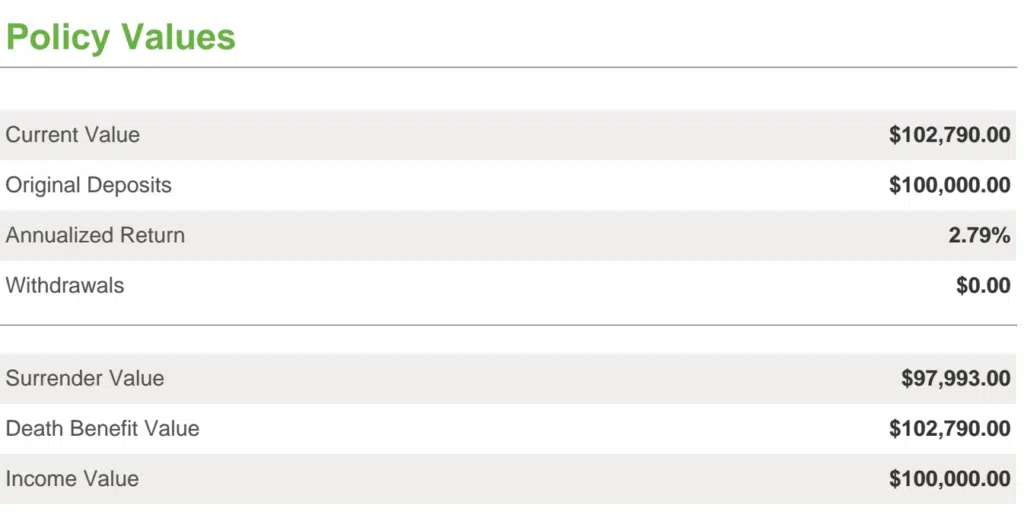

The client had deposited $100,000 into the annuity over the two years prior to our conversation.

As you can see by the illustration below, it had grown 2.79% to $102,790. Considering the market growth it had over those years this doesn’t seem like a lot, but that’s a conversation for another day. What we want to focus on is how much she was actually paying for the annuity.

Most variable annuities have several fees most investors aren’t aware of. By googling “SEC variable annuities” you’ll happen upon a long document produced by the Securities Exchange Commission warning prospective investors about the fees associated with variable annuities.

In fact, in that 12-page document, you’ll find five caution boxes all warning about the fees and complexities of variable annuities. Some of the fees you’ll encounter are:

- Mortality and expense risk charges;

- Administrative fees;

- Rider fees (which are typically death benefit and guaranteed minimum income benefit riders);

- Surrender charges; and

- And other fees.

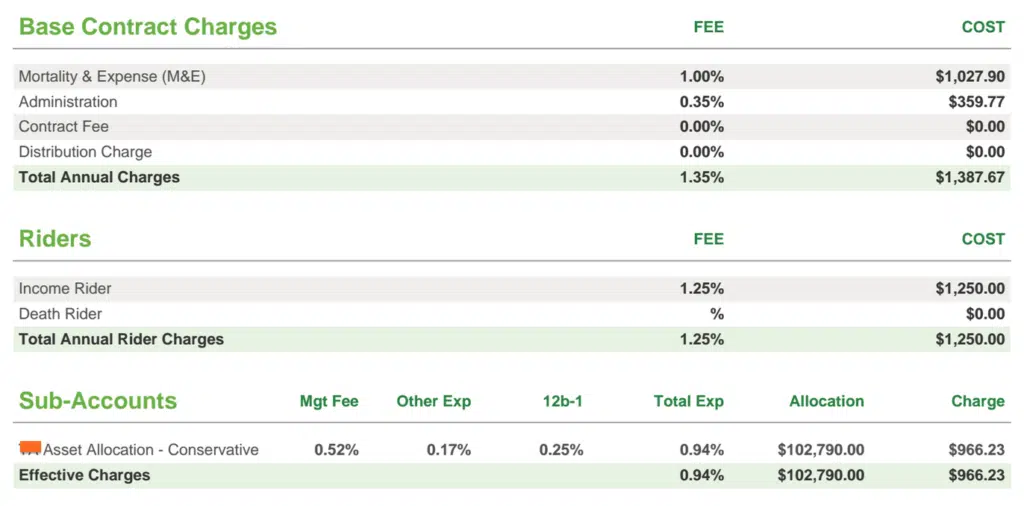

Below you’ll see the basic contract charges on her variable annuity contract:

- Her mortality and expense fee was 1%

- Her administration fee was 0.35%

- Her income rider was 1.25% (and that’s all before the cost of the subaccounts otherwise known as the mutual fund inside the variable annuity)

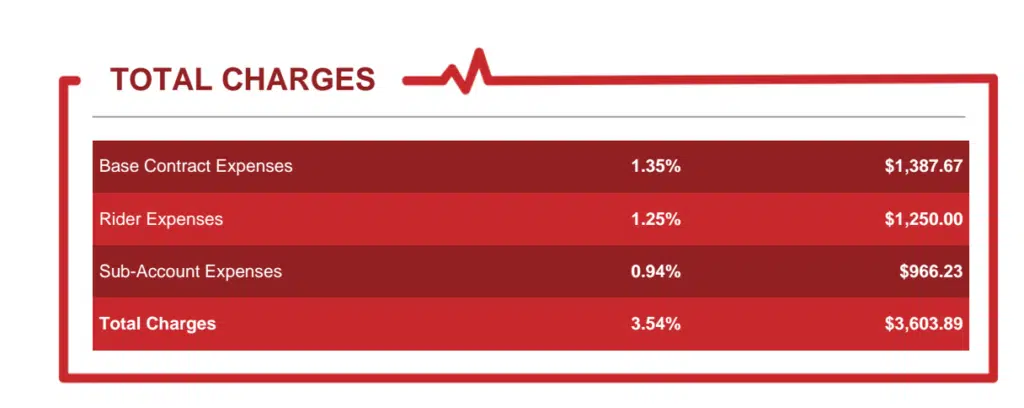

Those total fees were 0.94%. That brings the total charges up to 3.54% on the annuity contract, based on a $102,000 contract value.

The total fees per year were $3,603.89. I’ll let you digest that for a second . . . .

That’s not $3,600 upfront. That’s not $3,600 for the first year. That’s $3,600 per year for the life of the contract.

For an investor who truly believes they’re only paying $50 per year to have this investment that’s quite a big shock and reinforces why I hate variable annuities. I also have to admit I don’t hate the product as much as I hate the advisor who doesn’t disclose how much is being spent.

Let’s take a look at what an annual charge of 3.54% will do based on different annualized returns.

For example, if the mutual fund inside the variable annuity actually made 6% after fees and expenses, then an effective net return is only 2.25%. This is how you don’t make money in the stock market. See below.

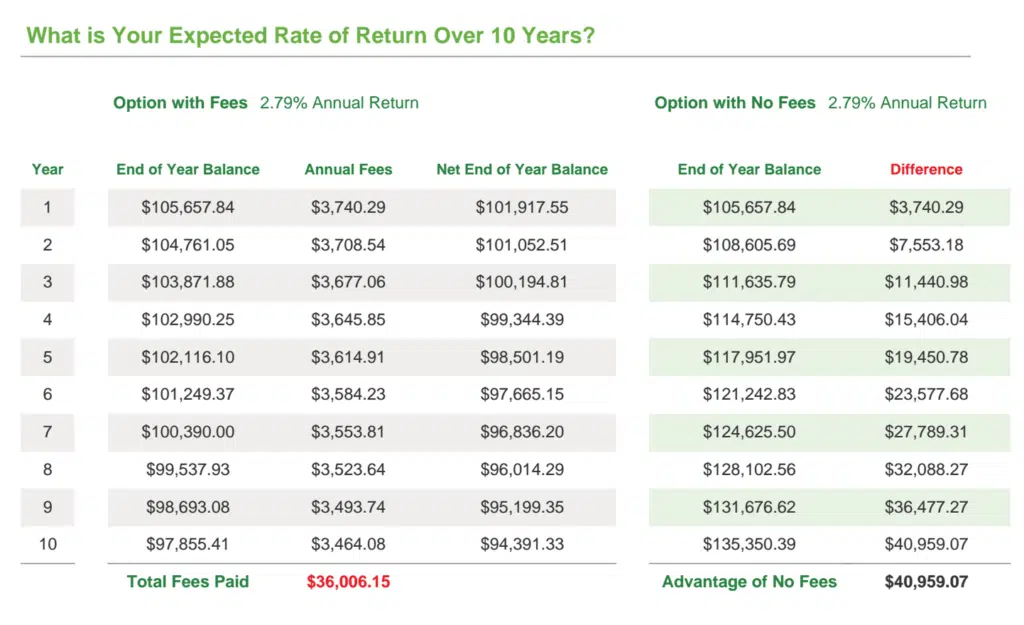

The final chart below shows the effective rate of return over 10 years of having the fee charge while only averaging 2.79% return based on what the contract has done at this point.

As you can see, there’s a huge benefit to eliminating all those fees: almost $41,000.

Did somebody say almost $41,000? Yes, I think they did!

How Much Are You Paying in Variable Annuity Fees?

Do you know how much you’re paying in annuity fees? No?

Well, it’s time to change that . . . and the good news is I want to help free of charge!

I’d like to give you the opportunity to discover exactly how much money you’re spending on annuity fees. You see, annuities are by far the most complex investment products available in the financial world. Their fees are often numerous and confusing. Their benefits are pretty difficult to understand.

Don’t get me wrong, some annuities are worthwhile . . . but many of them can hurt your financial situation without you even realizing it.

That’s why I created the Annuity StressTest. It’s a free report that will help you:

- Calculate all of your annuity’s fees;

- Identify the long-term impact of your annuity’s fees;

- Compare your annuity’s performance against other financial scenarios;

- See how your annuity performs against other annuities to ensure you’re getting the highest rates, we can help you get annuity quotes to make sure you are investing in the right plan for your needs; and

- Calculate how many years it takes for your annuity to “break-even” when selecting certain income riders.

some great stuff jeff…thank you!

That’s really horrendous. People at minimum need to understand the costs. They shouldn’t be hidden.

Jeff –

Kudos to you for breaking down the situation with an “Annuity x-Ray”. You have a knack for tackling more complex items and presenting them in a manner that positions the reader to more clearly understand your message. Sticking with the medical terminology, it always makes sense to get a second opinion – hopefully before a purchase is made so we as customers understand what you’re buying and that the product is suitable for our needs and financial goals. To that end, I also love the stress test concept and hope people take advantage of that offer. However, I would have liked to see your report call out that it also offers peace of mind for those (few) clients who may be in the right variable annuity as this is a possible outcome.

I’m 100% with you about the visceral reaction that variable annuities evokes inside of me as the product makes sense for a handful of people. I guess my point is that for some, albeit few, a variable annuity may be the best choice. I wish you had not called it a “horrible product” as there are some specific situations where this product does actually make sense. I get your point and don’t want to take away from it, as later you called out the real issue – those selling the product when it isn’t suitable for the client. I just personally feel it takes away from your creditability by painting a product with one brush stroke. After all, if it was such a “horrible product”, shouldn’t we be taking that up with FINRA? 🙂

I really respect and value your perspective and approach to helping people gain a better understanding of their finances and investment decisions. It works! If I did have one huge friction point – it would be that I don’t think it was necessary to call out the firm that employed/contracted the person who sold this particular annuity. In the end, I think you can still get your message across while not calling out a competitor. It’s a slippery slope and can offend your prospective customers, especially considering the myriad of products said competitor offers (that you don’t – eg mortgages, banking products, etc.) and the possibility of them owning another one of their products. Afterall, you’re one of the best because you’re a master of your craft. You are better than your competitors at solving customers problems and developing the best spectrum of solutions. No need to call them out in a published article. 🙂

Just offering some unsolicited advice, assuming your open and receptive to hearing my perspective.

@ Cara

All valid points! Unfortunately, this wasn’t an isolated incident. I’ve encountered this time and time again. Variable annuities are often the misrepresented and misused when another investment product could be used in its place.

As far as the variable annuity being a “horrible product”, there is a reason that the SEC gives 5 “CAUTION!” boxes in their 12 page report on variable annuities.

Hi Jeff – – –

That caution box you mentioned to Cara also pops up when looking at FINRA’s Index annuity guidance as well. See the bottom of this link: https://www.finra.org/investors/alerts/equity-indexed-annuities_a-complex-choice

I believe it should be noted that because a financial advisor “misrepresents” and/or “misuses” the product, that is a reflection of the financial advisor and not the product. The argument should either be against the product or the financial advisor and not a reflection of the other. In other words, arguing against va’s should not take into consideration the financial advisor. The financial advisor misusing or misrepresenting the product is not the products fault. That’s the FA’s fault. My point is not to say va’s are good. I just don’t want readers to judge either for the flaws of the other.

David

Great points David. An advisor needs to understand the goals, objectives, and especially the risk tolerance of the client in order to make a proper recommendation. For some, transferring risk to an insurance company is best. The stock market is risky. I met a couple last week that got out of the market in 2008 and never got back in. Perhaps, if they’d a guarantee, they’d still be in. I know clients that are very happy they had that guarantee in 2008, turned on their living benefit, and haven’t skipped a beat in getting their same “check” each month. Many insurance companies got out of the VA business. Why would they do that if VAs are so profitable? Because the benefits were TOO good, and they were on the hook when the market collapsed. There’s a reason that QLACs were approved by the IRS and Dept. of Treasury for use in 401(k)s. With pensions all but extinct, people need guaranteed options.

If a near-retiree or retiree can withstand the volatility, and willing to take the risk of a cyclical bear market when they’re ready to take withdrawals (sequence of return risk), or have more money than they’ll ever spend, then surely they don’t need a VA. But, there are some that need market growth, but cannot stomach the volatility. In these cases, an annuity may be best, variable or some other type. A good advisor is not going to place all of a client’s assets into a VA as they know the client a) needs liquidity and b) needs time to maximize the benefit of the guarantee.

The issue I have with Jeff’s analysis (in general) is that it rarely provides context. A VA is expensive compared to what? He writes as if the client will not pay fees in an alternative portfolio. If your’e hiring an advisor, you’re going to pay fees or commissions in some shape or form.

Take a “fee-only” advisor portfolio that I just reviewed the other day: 1.5% to the advisor, 1% expense ratio on of the actively managed funds employed, and .5% in turnover and cash drag costs. That’s 3% with no guarantee! Since 90% of the funds he used was from one fund company, I’d bet the advisor is getting some kick-back in the form of free lunches/dinners and monetary support for client events and marketing. It happens often. I see portfolios like this ALL THE TIME, but “holier-than-thou fee-only” advisors act as if they walk on water. Many of whom simply plug you into a cookie-cutter asset allocation model, rebalance once a year, and collect their fee, all while claiming “we’re on the same side of the fence”. Then, when the client adds $300,000 to their account (due to the client’s hard work and sweat equity, not the advisor) the advisor gets a $3000 raise forever. Don’t even get me started on portfolios with A-shares purchased at NAV, and the client unaware of the 12b-1 fee trail.

I’ve never seen an article “How One Man Paid over $3500 in Fees in His Wrap Account”. There just as much abuse in the wrap fee world, but the media doesn’t talk about it.

The question is not purely about expense, it’s “what am I getting for this added cost?” Is it worth it? What are the alternatives? Will the added features keep me invested in turbulent markets? Is building a personal pension or a risk-based portfolio more important?

There are situations where VAs are the right fit, and there are plenty of academics like Moeshe Milevsky, Michael Kitces, Wade Pfau, and Jim Otar whose research support the use of VAs in the certain client situations, and advocate transferring risk to an insurance company.

In the real world, there are trade-offs, and not everyone can stomach the volatility of the stock market. Additionally, a good advisor is doing a LOT more than simply managing a portfolio. He’s ensuing that estate planning is in order, analyzing insurance options, coordinating with other trusted advisors such as accountants and attorneys, help maximize Social Security benefits, minimize taxes, analyze employee benefits, and the list goes on an on.

What if she’s paying $3500 in fees, and the advisor showed her how to lower her taxes by $1500 a year using some strategic withdrawal strategies? Now, her “net fees” are $2000.

You can’t just look at the investments in a vacuum, and not the rest of the plan.

Hey Jeff – –

Let me start by saying I’m not a huge fan of any annuity…unless guarantee is all you care about. I don’t own any annuities and never will as I am willing to go with the flow of the market.

There are a few points in your article that I think should be further acknowledged:

1- “That’s not $3,600 upfront. That’s not $3,600 for the first year. That’s $3,600 per year for the life of the contract.” – – – – Variable annuity fee’s are typically charged on the value. Thus, $3600/yr for the life of the contract could actually be higher or lower depending on the true value upon the day of the fee’s being charged which is typically anniversary. I just want others to notice that it might be $3600 today, but could be different, for better or worse, in years to come.

2 – Who wants the risk? The client going into mutual funds with $100k could see their value go down, pass away, and only the declined value pass to beneficiaries. I 110% agree that if you are in the accumulation phase of investing, annuities are not the place to be. Too many fee’s (i.e. va’s) or ceiling’s (i.e. index annuities). Someone like my mom that just wants a set guarantee income stream or guarantee of death benefit via principal minus withdrawals, cash value, or max ann. value would fit into the annuity category. Why? She can’t stomach risk. She is better off having some guarantee’s than waking every morning worried that she doesn’t have a set income coming in.

3- The argument for index annuities over variable annuities (not that you are making that argument here in this post) is not straight-forward. Yes, index annuities can and usually have floor’s for returns thus no loss in value. However, they often have high surrender charges and long surrender schedules. I’ve seen 15 yr+ schedules with 10%+ surrender charges for years on some index annuities. Also, many index annuities have cap’s/ceiling’s on returns. Yes, you might have a floor of 0-1% so you don’t lose money, but a ceiling of 3-4% on an annual point-to-point could kill any argument for growth potential.

This diatribe I just wrote is not meant to sway people to VA’s. I try to look at everything in a there-has-to-be-a-positive-to-everything outlook. Yes, negatives may outweigh the pro’s, but most things have at least one positive. In this case, the VA guarantee’s could be considered that one positive.

In life, I always try to ask, “Okay, so what’s a positive you can tell me about the thing you despise?” This usually applies when talking politics, which I’m not here. If someone doesn’t provide me with one pro or benefit to the thing they despise, it’s difficult to whole heartedly agree with them. This applies to FA’s solely selling VA’s or solely selling Index annuities. Most FA’s often hate the one they aren’t selling. I believe the FA who says, “Look it has ‘X’ positive, but three negatives,” versus the FA who just says, “That’s the worst thing in the world and it has no positive.”

You are a successful guy that I look up to regarding your work ethic, determination and success. I can tell you are doing everything you can right for your clients. My goal in this way-too-long comment is more to point out that most everything has some positive.

Well wishes to you and your family

David