Even though 30-year mortgages are much more common, financial experts often recommend a 15-year mortgage instead. Is that advice always right?

The best answer to that question is, sometimes! Even though, yes, you will pay off a 15-year mortgage in half the time it takes to pay off a 30-year mortgage, you’ll be trading off a much higher monthly payment to get that benefit.

Before taking the plunge into a 15-year mortgage, it’s best to know exactly what you’re getting into. With that in mind, let’s take a look at 15-year vs. 30-year mortgages to see which is better – and when.

Table of Contents

What Is the Difference Between a 15-Year and 30-Year mortgage?

15-year and 30-year mortgages have plenty in common. Each can be either a fixed-rate loan or an adjustable-rate loan (ARM). And either can be used to purchase a new home or to refinance an existing home. Closing costs are about the same between the two loans, and the application and closing processes are virtually identical.

With all they have in common, what’s the difference between the two?

- Loan Term: The 15-year mortgage runs only half as long as the 30-year mortgage.

- Monthly Payment: The payment on a 15-year mortgage can easily be 50% higher than on a 30-year mortgage.

- Interest Rate: You’ll generally pay a lower interest rate on a 15-year mortgage compared with a 30-year mortgage.

- Equity Buildup: Will be much faster on a 15-year mortgage than it will be on a 30-year mortgage

Pros and Cons of 30-Year Mortgage

Pros:

- A much lower monthly payment.

- The lower monthly payment will make it easier to qualify for a mortgage, particularly if you’re making a small down payment, you have high debt ratios or less-than-perfect credit.

- The lower payment may enable you to qualify for a larger loan to buy a more expensive home.

- Lower payments can also enable you to direct additional funds into paying off non-housing debt or even into savings and investments.

- Because it has a lower monthly payment, you’ll have the option to make additional principal payments much more easily than you would on a 15-year mortgage.

Cons:

- 30 years can seem like forever when you’re trying to pay off your home.

- If your plan is to own your home debt-free by the time you reach retirement, the 30-year loan won’t get the job done if you’re already over 35 years old.

- The slower amortization of the loan – resulting in slower equity buildup – will leave you with less cash if you choose to sell the home to buy another.

- Higher interest rates. Rates on 30-year mortgages are roughly 0.500% to 0.750% higher than they are on 15-year mortgages.

- Because it will take twice as long to pay off a 30-year mortgage, you’ll pay considerably more interest over the life of the loan.

Pros and Cons of a 15-Year Mortgage

Pros:

- You’ll cut the loan term in half, enabling you to reach mortgage-free status much more quickly.

- Even if you sell the home before the loan is fully paid, you’ll have more equity built up than you would with a 30-year mortgage.

- The interest rate on a 15-year mortgage is generally as much as 0.750% lower than it is on a 30-year mortgage, but…

- Because the loan will be paid off in half the time, you’ll pay substantially less interest over the life of the loan than you will on a 30-year mortgage.

Cons:

- A much higher monthly payment.

- The higher payment might make it more difficult to qualify for the loan.

- A higher payment may also limit your ability to purchase a higher-priced home.

- The income tax deduction for home mortgage interest will disappear much more quickly than it will on a 30-year mortgage.

- Because the payment is higher, you won’t have the extra funds available for other purposes, like paying off non-housing debt or investing.

Factors to Consider in Choosing a 15-Year vs 30-Year Mortgage

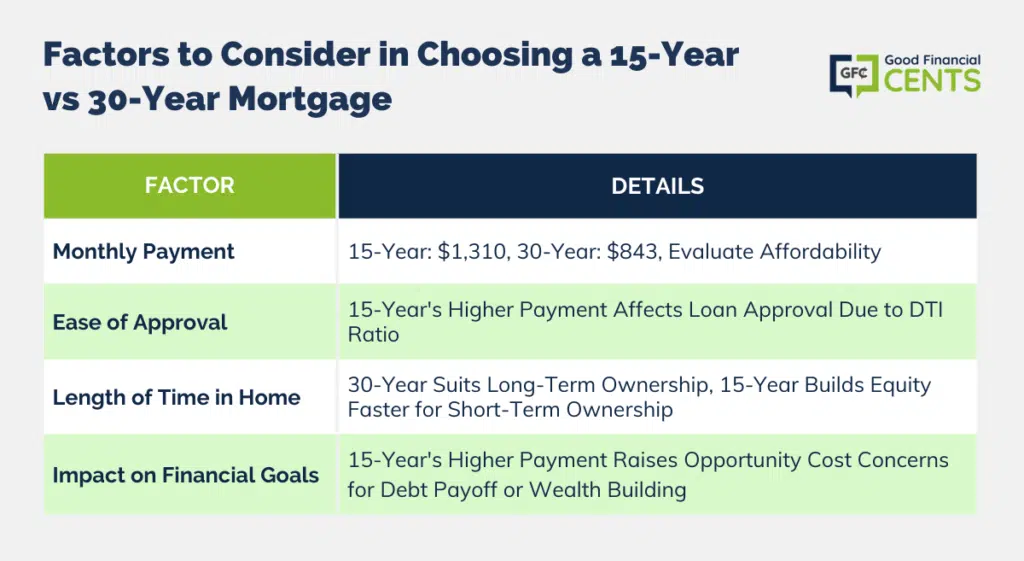

Many financial advisors, websites, and blogs recommend a 15-year mortgage over a 30-year mortgage, often as a “no-brainer.” Unfortunately, that’s an oversimplification. Before considering one loan term or the other, you should first carefully evaluate the following factors and how they apply to your own personal circumstances.

Your Monthly Payment

A 30-year mortgage for $200,000 at 3.00% (fixed rate) will have a monthly payment of $843. But on a 15-year mortgage – even with a rate of 2.25% – the monthly payment will jump to $1,310. That’s a difference of $467 per month or $5,604 per year.

Given the large difference in the monthly payment, you’ll need to decide if you have the ability to cover it throughout the full term of the loan.

Ease of Approval

As we just saw, the monthly payment on a 15-year mortgage is much higher than it is on a 30-year mortgage. That may have an impact on your ability to be approved for the loan you want to apply for.

For example, let’s say you have a monthly income of $5,000. If you apply for a $200,000 mortgage at 3.00% with a monthly payment of $843, adding $400 for real estate taxes and insurance will give you a total monthly payment of $1,243.

Let’s say you also have $600 in non-housing payments, including a car loan and credit card balances. When added to the total monthly house payment, you’ll have $1,843 in monthly recurring debt.

When that payment is divided by your $5,000 monthly income, it produces a debt-to-income (DTI) ratio of 36.8%. A lender is highly likely to approve your loan at that DTI.

But if you apply for a 15-year mortgage for the same amount (but with a fixed rate of 2.25%), your loan payment will be $1,310. When you add $400 in taxes and insurance, as well as $600 in non-housing debt, your total monthly recurring payments are $2,310.

When you divide that number by your $5,000 monthly income, your DTI increases to 46.2%. The lender may not approve your loan with a DTI that high.

Length of Time You Plan to Live in the Home

If the home you plan to buy (or are currently living in, in the case of a refinance) is your “forever home,” you may be better served with a 30-year mortgage. Since you have no plans of ever moving, your most important consideration may be maintaining a comfortable monthly house payment throughout the term of the loan.

Conversely, if you expect to move in a few years, the 15-year mortgage may be the better choice. Because the higher monthly payment results in a faster paydown of the loan balance, you’ll build equity more quickly. When you sell the home, the proceeds will be larger than they would be if you had taken a 30-year mortgage.

The Impact on Your Financial Goals

Once again, this factor gets back to the monthly payment. As we’ve already seen, the monthly payment on a 15-year mortgage is substantially higher than it is on a 30-year mortgage.

That opens the question of opportunity cost. Opportunity costs relate to the question, what else could I be doing with the money I won’t be spending on the 15-year mortgage payment?

As we’ve seen, the difference between a 15-year mortgage and a 30-year mortgage comes to about $5,600 per year in total monthly payments.

In most households, that’s a significant amount of money. It could be used to pay off non-housing debt, which will lower your overall cost of living. But it can also be invested to build wealth apart from your home.

In fact, $5,600 would give you almost enough money to fund an annual IRA contribution.

In a real way, taking a 15-year mortgage is an example of “putting all your eggs in one basket.” In this case, those “eggs” will be going into your housing basket. Might you be better off if you spread your money to other wealth-building ventures?

Who Is a 30-Year Mortgage Right For?

A 30-year mortgage will typically be the best choice if any of the following apply:

- You’re looking for the lowest monthly payment possible.

- Qualification may be tight, and you’re looking for the loan type most likely to result in an approval.

- You’re a first-time home buyer, and qualification is uncertain.

- You plan to live in the home for the rest of your life, and you’re not concerned about paying it off in 15 years.

- Your preference is to minimize the house payment so you’ll have extra funds for other purposes.

- You expect your income to increase in the future, enabling you to make additional principal payments to pay off the loan in less than 30 years.

Who Is a 15-Year Mortgage Right For?

A 15-year mortgage will typically be the best choice if any of the following apply:

- You can easily qualify for the higher monthly payment.

- Your income is sufficient that you will have plenty of extra funds for other purposes, even with the higher monthly payment.

- You’re interested in getting the absolute lowest interest rate possible.

- You plan to be in the home for only a few years, and your primary interest is building equity quickly to maximize cash proceeds upon sale.

- One of your primary motivations is paying off your mortgage as quickly as possible so you’ll be mortgage-free.

- You’re not far from retirement, and a 15-year loan will better enable you to pay off your home before you retire.

- You have other resources to draw on if your income is disrupted, minimizing the likelihood the higher payment will become a threat.

Where to Find a 15-Year or a 30-Year Mortgage

Quicken Loans/RocketMortgage

Quicken Loans and Rocket Mortgage are actually the same organization. Rocket Mortgage serves as the online face of Quicken Loans and is the side of the company most widely advertised in the media and on the web. But all loans originated through Rocket Mortgage are processed through Quicken Loans, which has grown to become the largest retail mortgage lender in America.

Rocket Mortgage is famous for quick pre-approvals and approvals, in large part because the entire process takes place online. They can often verify employment and savings information directly through employers and institutions, but you can also upload any required documents to the website. Both steps work to speed up the process, which can be critical if you are bidding on a home with other potential buyers.

Veterans United

Veterans United is America’s largest VA mortgage lender. They work extensively with veterans and current members of the US military, making the process as easy as it can be. They employ former senior enlisted members of each branch of the US military. These members act as advisors, ensuring that loan programs will best serve veterans and current military personnel.

Veterans United also has its own network of real estate agents,

Veterans United Realty. It includes participation by real estate agents who specialize in working with veterans and with VA loans. That familiarity is another way the process of working with Veterans United is streamlined in favor of the veteran, and especially for active-duty military personnel.

Paramount Bank VA Home Loans

Still another popular choice for VA mortgages is Paramount Bank VA Home Loans. Based in Hazelwood, Missouri, Paramount Bank offers all types of mortgage financing, including conventional, jumbo, and FHA mortgages, in addition to VA mortgages.

And as a bank, they offer complete banking services. That includes various deposit products, like interest-bearing checking accounts, other loan types, and even business banking services.

Freedom Mortgage

Freedom Mortgage is one of the top mortgage lenders in America and offers its lending services in all 50 states. It offers conventional and jumbo loans, as well as FHA, VA, and USDA government-backed loans. Programs are available for both purchase and refinance, and they provide the option of both fixed-rate and ARMs on most loan types. But if it does have a specialization, it’s VA mortgages.

One of the advantages offered by Freedom Mortgage is that it uses the old-fashioned process of live applications. Rather than going to a website and completing an application online, as well as supplying all necessary documentation, you’ll work with a live representative of the company. That can make for a more personal experience and be a real benefit if you have questions you want to ask before and during the application process.

15-Year vs 30-Year Mortgage: By the Numbers

By Monthly Payment

It’s number-crunching time, so let’s take a look at the difference between a 15-year and a 30-year mortgage based on monthly payment.

Once again, we’ll assume a $250,000 home with a down payment of 20% ($50,000) and a $200,000 mortgage.

Beyond those basic assumptions, let’s compare the monthly payment on a 15-year loan with a fixed interest rate of 2.25% to a 30-year loan with a fixed interest rate of 3.00%.

15-Year vs 30-Year Mortgage: Monthly Payment

| Mortgage Term | Monthly Payment |

|---|---|

| 15-Year Mortgage | $1,310 |

| 30-Year Mortgage | $843 |

| Difference | $467 |

By Overall Savings

Based on monthly payment alone, the 30-year mortgage looks to be a better deal than the 15-year mortgage. But what about the total cost of each loan over its full term?

Once again, we’ll assume a $200,000 fixed-rate mortgage with an interest rate of 3.00% on the 30-year mortgage, and 2.25% on the 15-year mortgage (both fixed rate).

Here’s how much the overall savings will be on the 15-year mortgage vs. the 30-year mortgage:

15-Year vs 30-Year Mortgage: Overall Savings

| Mortgage Term | Interest Rate | Monthly Payment | Total Monthly Payments | Total Principal Payments | Total Interest Payments |

|---|---|---|---|---|---|

| 30-Year Mortgage | 3.00% | $843 | $303,480 | $200,000 | $103,480 |

| 15-Year Mortgage | 2.25% | $1,310 | $235,800 | $200,000 | $35,800 |

| Difference | 0.750% | $467 | $67,680 | 0 | $67,680 |

Notice that the entire difference between the two loans is in the amount of interest paid. The lesser amount paid on a 15-year mortgage comes from a combination of the lower interest rate and a much shorter term.

The Bottom Line on 15-Year vs 30-Year Mortgage Comparison: Which Is Better?

When deciding between a 15-year and a 30-year mortgage, it’s essential to weigh the trade-offs. A 15-year mortgage offers quicker equity buildup and lower overall interest payments due to a lower interest rate.

However, it comes with a significantly higher monthly payment, potentially impacting qualification and financial flexibility. A 30-year mortgage offers lower monthly payments and can be suitable for those planning to stay long-term or seeking lower initial payments.

Careful consideration of factors like monthly payment, ease of approval, homeownership duration, and financial goals is crucial in making the right choice. Each option has its benefits and trade-offs, tailored to individual circumstances.