Remember that high school class you took on what is a good credit score range and how to build your credit score?

No? Of course you don’t remember. You didn’t take such a class.

Unfortunately, this kind of education isn’t normally offered in high school.

In fact, according to research released by Credit Karma and Qualtrics, only “one-in-four (28 percent) [young adults] had received any type of personal finance education before college.”

Um, yikes.

According to the same research, “68 percent of Americans made at least one major Credit Fumble before turning 30, with every form of major mistake common among people in their 20s.”

Um, double yikes.

What’s a Credit Fumble™? According to Credit Karma, it’s “the phenomenon where young adults, new to credit and many without any financial education, make largely avoidable financial mistakes.”

These credit mistakes could lead to years and years of consequences. It might be more difficult to get access to credit or services that depend on credit scores to price their services or qualify people for access to their services.

Table of Contents

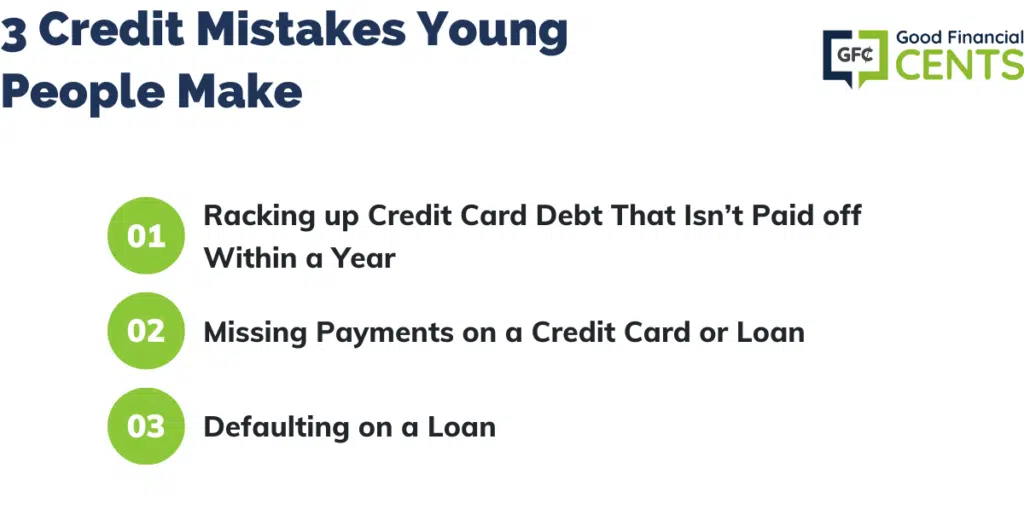

- 3 Credit Mistakes Young People Make

- 1. Racking up Credit Card Debt That Isn’t Paid off Within a Year

- 2. Missing Payments on a Credit Card or Loan

- 3. Defaulting on a Loan

- The Devastating Effects of These Credit Mistakes

- Simple Steps to Avoid Credit Chaos

- Final Thoughts on 3 Credit Mistakes Young People Make (and How to Avoid Those Mistakes)

Check Your Credit Score Now >>>

3 Credit Mistakes Young People Make

Today, I’d like to go over some of these credit mistakes so that you can avoid them and/or teach your kids to avoid them. These are some serious mistakes. Let’s do our best not to fumble the ball, people!

1. Racking up Credit Card Debt That Isn’t Paid off Within a Year

This is one Credit Fumble™ you should never make. Unfortunately, according to the research by Credit Karma and Qualtrics, over “half of young adults (54 percent) racked up debt on their credit cards that they were unable to pay off within the year.”

That’s horrible.

Credit cards might help you build up your credit score, and the cards with airline rewards can help you travel but if you hold debt for an extended period of time, even the most generous credit cards are going to hurt you.

While holding onto debt for just a few months might not do much damage to your credit score, you might want to reconsider holding debt longer than a month. Why? Well, my point has nothing to do with your credit score, my point has everything to do with making sure you don’t get into the cycle of debt that plagues so many Americans.

I recommend that you pay off your credit cards every month. And don’t use your credit cards unless you know you can afford to do so (that’s how you avoid this problem).

If you get in a bind try getting one of the best balance transfer cards and get your interest down to 0% so you can pay it off faster.

2. Missing Payments on a Credit Card or Loan

This one is bad, really bad.

According to the research by Credit Karma and Qualtrics, over “forty percent of young adults either missed payments on a credit card or loan (47 percent) or had an account sent to a collections agency because they were unable or unwilling to pay their debt (44 percent).”

It’s a whole other level of bad news when you miss your credit card or loan payments. Sure, if you can’t pay the normal amount, you can’t pay the normal amount. But that doesn’t mean that you should just sit back and do nothing!

Call your credit card or loan company and see if you can negotiate lower, minimum payments so you can remain in some good standing with the company. Then, make sure to actually follow through on your commitments and meet (or exceed) the expectations of the company.

But don’t stop there. Once you actually have the funds to make higher payments, do so! Don’t let debt sit around like it owns you or something. Kick it to the curb!

3. Defaulting on a Loan

Look, there’s a ball of fire rising into the stratosphere!

Okay, maybe that’s a little dramatic. But seriously, defaulting on a loan is one of the biggest credit mistakes you can make. And, unfortunately, a lot of young people have made this one . . . .

According to the research by Credit Karma and Qualtrics, “one-in-four consumers had defaulted on a loan before they were 30 (26 percent).”

This just keeps getting worse and worse. Again, the solution here is to not take out loans in the first place that you can’t pay off. Another great solution, again, is to call your credit card or loan company to negotiate some reasonable payments.

The Devastating Effects of These Credit Mistakes

You might be saying to yourself, “Well, it’s not so bad if I – or my kids – make one or two of these mistakes.”

Think again.

According to Credit Karma and Qualtrics, an “overwhelming majority (75 percent) felt that defaulting or having an account sent to collections had a negative impact on their quality of life. Roughly one-quarter of people who made a Credit Fumble had to move back in with their parents (26 percent), while slightly more than one-in-four had to move into a cheaper apartment (27 percent) and over one-in-five sold possessions.”

Moving back in with my parents, moving into a cheaper apartment, and selling possessions . . . these don’t sound like fun activities to me. I’m sure you feel the same way.

Unfortunately, the bad news doesn’t end there. According to the same research, 61 percent of those who defaulted or had an account enter collections were declined for a credit card. Plus, 31 percent of them cannot get a loan approval for a car and 16 percent of them were not approved for a mortgage.

That’s why it’s so very important to make sure you take some steps right now to ensure you or your kids get on a solid financial path – a road that leads to financial success instead of credit mistakes.

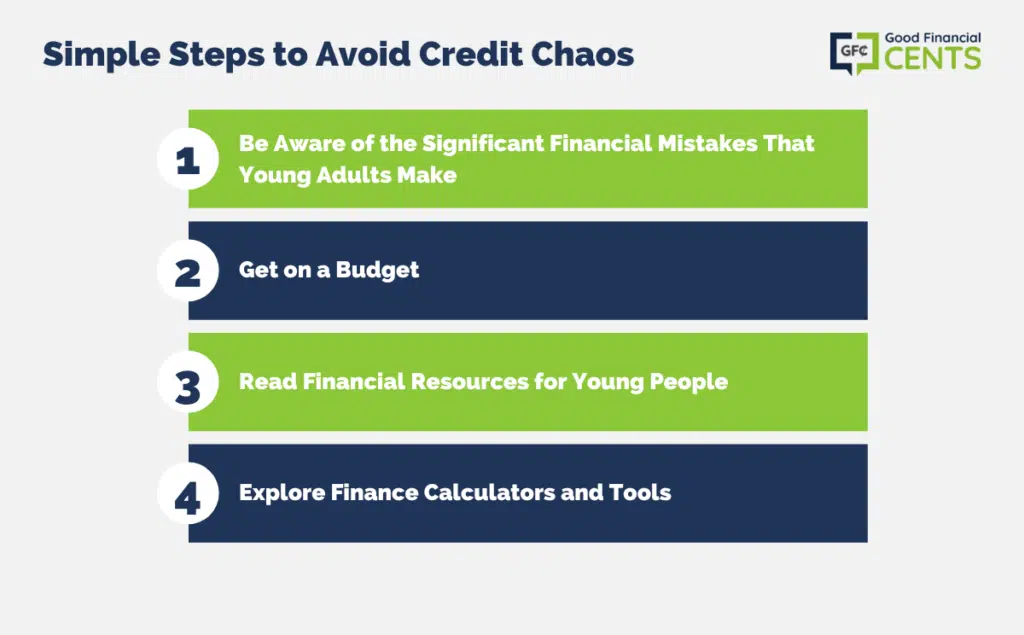

Simple Steps to Avoid Credit Chaos

Here are a few things you can do to further avoid credit mistakes.

1. Take a Look at Credit Karma’s Article.

Read The Credit Fumble: More Than Two-Thirds of Young Adults Make Significant Financial Mistakes.

There, you will learn more about these fumbles and dive into some additional key facts. There’s also a lot of educational content over at Credit Karma, so I encourage you to take a look.

2. Get on a Budget Already!

I’ve said this time and time again, but it might need repeating: get on a budget!

A budget will save you from overspending on your credit cards and it will help you be realistic with your finances. Spending aimlessly is a highway to making a credit mistake. Don’t go there.

3. Take a Look at My Resource for Young People.

Whether you’re entering college, in college, just out of college, or in your 20s, you can probably benefit from reading my resource page called Just Out of College. Parents, this is a good one for your young adult kids! (especially if they didn’t qualify for a student loan without cosigner parents)

I’ll show you how to deal with your student loans, save your own skin by setting up an emergency fund, and even show you how to save for retirement (while time is still on your side).

4. Take a Look at Credit Karma’s Tools.

Credit Karma gives you free credit scores, reports, and monitoring. It doesn’t get much better than that!

See what Credit Karma has to offer and take charge of your credit today.

Final Thoughts on 3 Credit Mistakes Young People Make (and How to Avoid Those Mistakes)

The lack of financial education in schools has led many young adults to make avoidable credit mistakes. This article highlights common credit fumbles among young people and offers advice to prevent them. Avoiding high credit card debt, making timely payments, and never defaulting on loans are essential steps to secure financial stability. The consequences of these credit mistakes can be far-reaching, affecting one’s quality of life and future financial opportunities. Educating oneself about personal finance, budgeting, and responsible credit management is crucial for avoiding such missteps and building a solid financial foundation early in life.

My 26 year old daughter has gotten in over her head with her first credit card; limits were increased and now maxed out at 9000.00. She cannot afford this and is barely making ends met. I am already helping with her student loans. Any advise?

Hi Margie – Unfortunately, her options are limited. Any solutions – short of her (or you) paying the debt off completely – will almost certainly hurt her credit, limiting future borrowing. I’d contact the lender and let them know what’s going on. They may offer a reduced payment, or they might allow you to settle the debt for less than the full amount owed. Failing that, I’d discuss it with an attorney and see what your options are. Since it’s only a single debt, she probably won’t be able to file for bankruptcy.

If her credit score is still good, she can try to do a balance transfer to another card, with a zero interest rate offer. That will buy some time to get the balance paid down, but it won’t make the problem go away.

Please avoid credit repair scams. They’ll only make her credit worse, and still not payoff the card.

These are all great suggestions Jeff. Payment history is the biggest factor when it comes to calculating your credit score, not paying your bills on time can have a huge, negative impact.

A lot of people don’t realize this, but when your credit score is low, it actually can cost you money – you end up with a much higher interest rate when you go to buy a home or a car & need a loan. It can also keep you from getting certain types of jobs!

Making these mistakes can cause some serious long term headaches!

My husband and I got into some credit card debt in our early 20’s. After we got it paid off though we decided we didn’t want to end up there again. Now we use our credit cards wisely.

I was lucky enough to pay off my debt in 4 years and not take on any new loans ever since. It’s really sad to see how a mistake can actually ruin your finances for years to come.

I was lucky in that I was able to avoid credit cards for most of my college years. I developed good habits with them and have always paid them off on time. I think folks that get trapped into maxing out their cards and find themselves unable to make payments are basically trapped. I think we need more protection from these types of loose money practices because many do not really understand what they are getting themselves into!

I have managed to avoid having a credit card altogether – yes, I’ve never had one! This is such a blessing for me because I’m a spender at heart. With a debit card, I’m never tempted to spend more than I have.

Hey Natalie – congrats on not getting sucked into credit card debt!

Out of curiosity, do you try to build your credit score in other ways?