There’s no doubt it’s an exciting time to be alive. It’s also an exciting time to invest in cryptocurrency.

I was fortunate to start investing in crypto just over three years ago.

And there have been a few bumps along the way. You know… like NOT selling Dogecoin when it soared above $.70 before Elon Musk’s Saturday Night Live performance.

Despite that, I’ve made some good profits. And most importantly, I’ve had a lot of fun learning more about digital currency.

Some of you are completely new to the crypto space. If that’s you – welcome!

In this post, I’m sharing the four ways I’m currently making money with crypto. The fourth is the newest way and the one I’m most excited about. Why? Because it’s the most passive! More on that in a sec..

If you want to learn more about investing in cryptocurrency and the four ways I am learning and earning, keep reading.

By nature, I am typically a skeptic, especially when somebody shares something that ‘has worked for them’. Maybe it was a diet, maybe it was some sort of new investment strategy, a new app, or a new software program. I don’t care what it is.

Table of Contents

I Was Such a Skeptic!

When I hear those words, my brain goes through a certain B.S. filtering process, which typically asks this question:

Does anyone relate to this?

With cryptocurrency, I was a huge skeptic.

I had so many people commenting on my YouTube videos back in 2017 ‘saying such things as “You need to get into crypto!”, “You’re missing out!”, “Crypto is the future!” blah, blah, blah.

From what I could tell, most of these people had no idea what crypto even was. They just saw it as an opportunity to get rich.

This was more of the tame comments I received:

Bitcoin back then hit a high of around $19,000, and then it dropped down to under $3,000. That is when I finally decided I was going to stop being a skeptic or a critic.

I decided to educate myself to become a student of crypto. That’s when I made my initial purchase of Bitcoin and joined the HODL Army. The rest, as they say, is history.

Here’s how that initial Bitcoin grew into the other ways I’ve making money with crypto.

You can also listen to the four ways on the Good Financial Cents podcast here:

1. Buy and Hold

The first way is the traditional way that you make money with all types of investments – buying and holding. If I’m going to buy Bitcoin or any cryptocurrency, the belief was, and still is, I’m buying this because I believe in the technology.

I believe this has the potential to be something big. And if that’s the case, then I’m in it for the long haul.

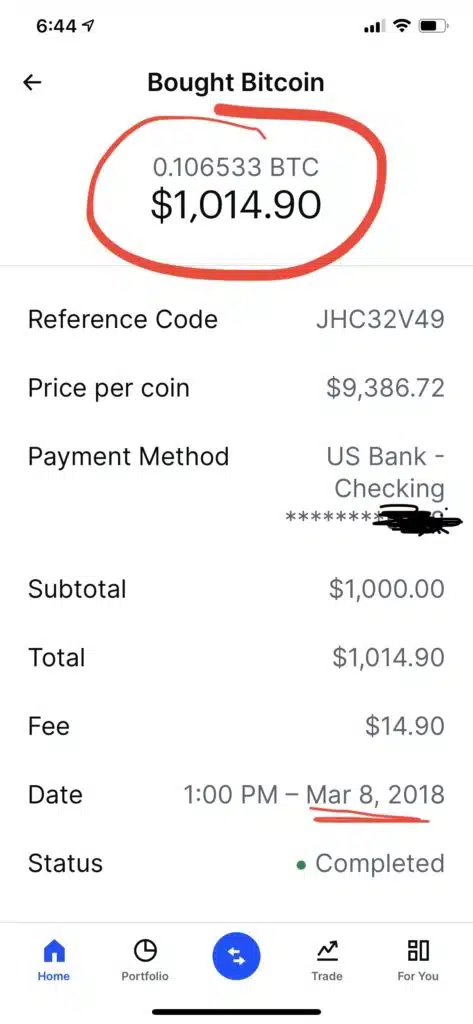

Okay, maybe I wasn’t there immediately. I first had to test it out. I did this by opening an account with Coinbase. This is where I made my initial purchase of Bitcoin, which was made in March of 2018.

I was so excited about the purchase I even took a screenshot:

Now from there, you’re probably guessing I dove in “full send” style and began buying crypto like crazy. It was actually just the opposite.

It wasn’t until November of 2019, almost two years later, I made my second purchase of Bitcoin. That was an $8,000 purchase. Then another $10,000 at the end of November and another $20,000 purchase in January of 2021.

I also purchased Ethereum in another crypto account. Initially, I was using some of my interest payments to purchase small, incremental shares of Ethereum. Finally, in the latter part of last year, I made a substantial purchase with $50,000 of Ethereum.

Both Bitcoin and Ethereum are the two coins I’m most bullish on.

2. Cryptocurrency Savings Accounts

The second way I’ve made money with crypto is by earning interest through stablecoins, or what is referred to as cryptocurrency savings accounts.

I kept hearing about cryptocurrency savings accounts and decided it was time to give them a try. My savings account at my bank was paying me pennies on the dollar, whereas crypto savings accounts can pay well above 5%.

I did my research and opened a Celsius account. Right now, at Celsius, stablecoins are paying over 10% and a bit higher on Bitcoin and Ethereum.

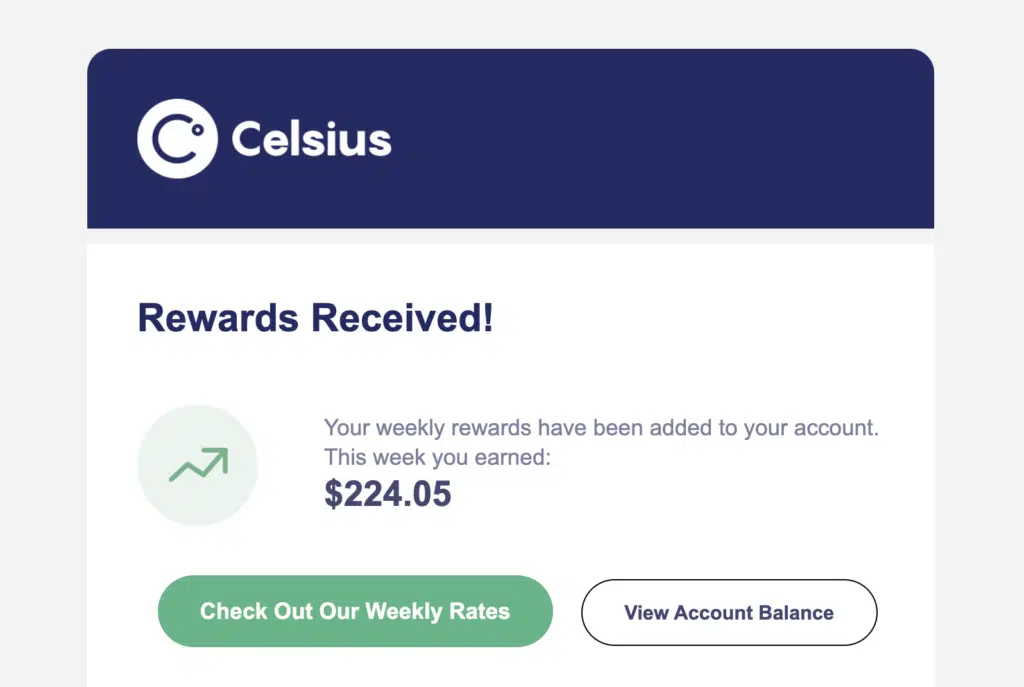

With Celcius, instead of paying you monthly, they pay you weekly. At the time of this post, I had just over $220,000 with Celsius.

Now, check out the latest interest payment that I received. Remember, this gets paid weekly! 🙂

Note:

Earn up to $50 in Bitcoin by using my link to try out Celsius here.

In my bank savings account with $330,000, I made $2.88 for the entire month Now, that being said, with a savings account at the bank, you have FDIC protection.

With an exchange like Celsius, there is no guarantee or FDIC insurance like your bank offers. You could put $25,000 in there, and it could be gone tomorrow.

3. Trading

If you are new to cryptocurrency, this is one way that I would not suggest and really something I shouldn’t even be messing with. Hahah… but it’s so tempting!

Now, I’m not talking about day trading. I have no interest in sitting behind my computer and checking charts and candle sticking and whatever day traders do. I mean, I don’t even have the lingo down so I definitely have no business day trading.

I have experimented with this before, and I’ve made some money, but I’ve also lost a lot of money. In both situations, It all happened really, really quick.

If you’re not able to sit behind a computer or have access to your phone, this is not something I would ever suggest.

This isn’t exactly what I did. Here’s what I mean….

What happens when you start researching cryptocurrency you’ll see how volatile it can be. When I saw Bitcoin take huge swings, I started to ask myself, “Why wouldn’t I buy at the dip and then sell at the high?”

Crypto Volatility Trading

It is so easy to get this confidence whenever you look at any sort of chart, stocks, ETFs, or crypto, and you can just see this pattern.

I didn’t start with Bitcoin, funny enough. I actually started trading Dogecoin.

I bought Dogecoin in my Robinhood account at 14 cents per coin, I put in $20,000. Fast forward, it wasn’t that much longer. Doge shot up to 75 cents a coin. I had a profit on paper, and I realized again, on paper, a $75,000 profit on a $20,000 investment in about 90 days, if I recall the time frame.

At that time, I would have had to pay short-term capital gains if I sold. I was not familiar with the cryptocurrency tax rules. I’m almost embarrassed to even admit this out loud, but, needless to say, I am very much familiar with the tax rules now.

So much, in fact, I recorded this video about it:

With cryptocurrency, as of right now, the SEC or the IRS, or any governing body does not recognize crypto as a security. And because of this, the wash sale rule does not apply!

The wash sale rule basically says if you sell something and you want to realize a loss, you have to wait at least 30 days to get back into that security. If you do, then the capital loss is literally “lost”.

But with cryptocurrency, that is not the case, so you can sell and buy on the same day.

I’ve since sold some of those positions and bought Bitcoin and Ethereum when the price dropped. I took advantage of this with my Robinhood account and also in Coinbase.

But I want to reiterate this is not the strategy I would ever suggest to anyone. Unless you’re an active trader and you want to monitor this day in and day out, then it is all based on a hunch.

That’s pretty much what I was doing. I know that in the long term, that is a surefire recipe for disaster. So yes, I’ve had some nice wins. But eventually, I’m going to get burned. 🔥

4. Crypto Bots

The following is something I would never have guessed in a million years I would hear myself saying:

I’m trading cryptocurrency using bots.

That was until I received a text from a friend of mine sharing with me a crypto bot strategy that somebody else turned him on to he’s been testing himself. If you know my friend then you would also know this is completely out of his comfort zone.

So, for him to be willing to test this out and also be making a profit, I knew I had to take a closer look.

I signed up for the training, and after an hour of devouring all the info, I was more than interested. I wasn’t 100% sold, but I was interested enough to begin testing out my own crypto bots.

Now, I’m not a coder and definitely not a day trader, so the only way I could possibly do this was if there was a software program that made this easy. Thank goodness there is, but more on that in a second.

First, let me explain what this is exactly.

Grid Trading With Crypto

Grid trading is a trading method that consists of placing a bunch of buy and sell orders at predefined intervals around a fixed price.

If you could think of it like this, let’s say that Bitcoin is trading at $55,000, and you can see that that price goes from 55,000 up to 57 and back down to 53. When you set up this bot within this grid trading platform, you’re placing several different limit orders.

When the price goes up, you buy a small percentage, depending on how much you have invested, but it could be like making a $25 to $50 purchase, as it goes up, you would sell, and as it goes down, you would buy.

When it goes back up, if there’s a profit then you would sell and then lock in that profit.

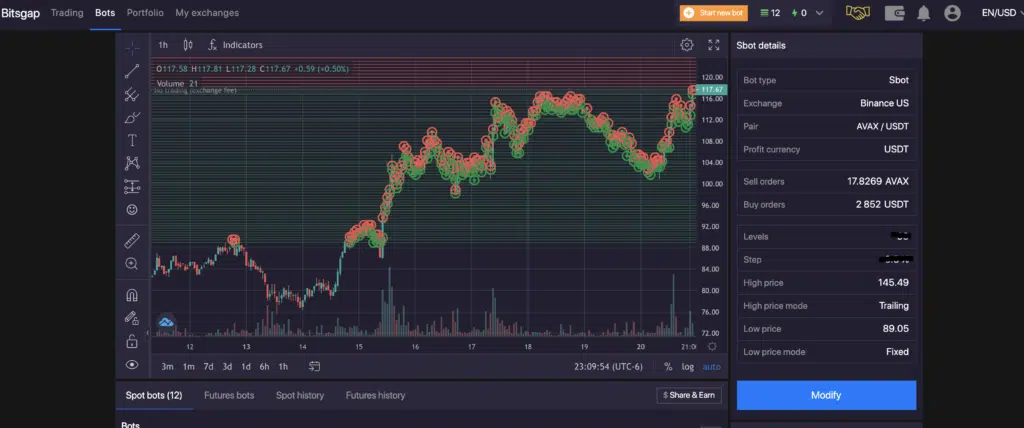

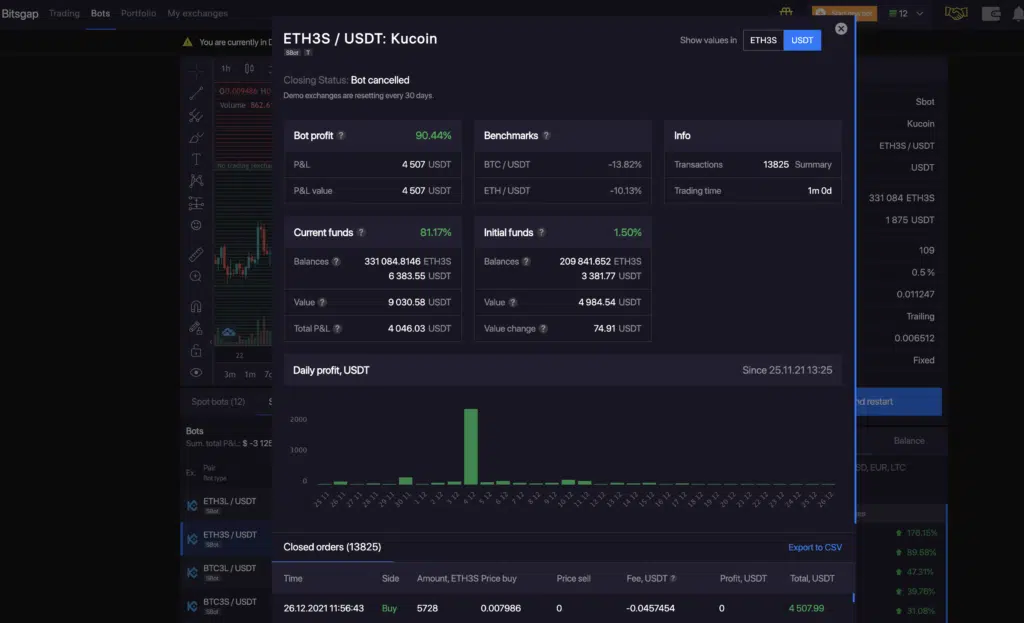

Here’s what it looks like in the software program:

Basically the key here is the more that the coin fluctuates, the more transactions are taking place, hence, more profit-generating.

So, in this case, when you’re setting up these, these trading bots don’t have to be Bitcoin, you can choose almost any coin that you want.

The software program I’m using is called Bitsgap. With Bitsgap, you connect your cryptocurrency exchanges (think investing brokerages) and then set up the grid bots through their program.

I know it sounds uber complicated. If it wasn’t for the training I went through, I’m not sure I could have figured it out on my own.

I created two new crypto accounts, Binance.US and KuCoin, for the sole purpose of setting up these grid bots.

I initially invested $5,000 in one bot and shortly after created another one with $5,000. The training program I went through suggested at least $3,000 per bot strategy but I decided to use $5,000.

I’m approaching $100,000 invested into several altcoin bots. And I can see myself adding more as.

Always Be Testing

Another cool feature of the Bitsgap software is that you can set up demo bots and test how they would have performed.

Here’s an example of a bot I tested before I actually invested real money:

I’ve tested several and continue to test new pairings. I set one demo up, and nine days later, I was up 7.12% on $5,000. Now, unfortunately, that’s not real money. But now I feel comfortable putting some real money into it.

I wish I could take credit for all of this, but this was completely over my head until I went through an amazing training program created by Dan Hollings, which he calls The Plan.

There is a significant investment into his training program, but you can sign up for his webinar and learn more about his grid bot trading success. I learned a ton just watching this, and I highly suggest anyone interested in crypto check it out.

As I continue to dive more into this, I’ll share more on the podcast, the YouTube channel (where you can see some tutorials), and possibly more here on the blog.

More updates come!

Leave a Reply