Numerous considerations factor into the home buying process, ranging from curb appeal to the quality of nearby schools, but few are quite as important as mortgage rates. Unless you’re buying outright with cash, a mortgage is essential, and the interest rate tied to it can determine your finances for decades to come.

Rates can be either fixed or adjustable, and 40-year mortgages fall under the umbrella of fixed-rate loans. According to the Consumer Financial Protection Bureau, these mortgages have historically represented approximately 70-75 percent of all U.S. home loans.

Table of Contents

Choosing to apply for this type of mortgage is likely best suited to prospective homebuyers who aim to live in their new house for the long haul.

40-Year Mortgage

Fixed-rate mortgages are available in a variety of term lengths—depending on the lending institution offering them—with 10 or 15 years being the typical minimum, 40 years the most common maximum, and 30 years representing the in-between option (as well as the one most commonly chosen by American homebuyers).

The 40-year mortgage typically comes with a fixed interest rate, which might be best for buyers who have a desire to put down long-term roots but are also on a tight budget. That said, adjustable-rate 40-year mortgages are not unheard of and can be found by determined borrowers.

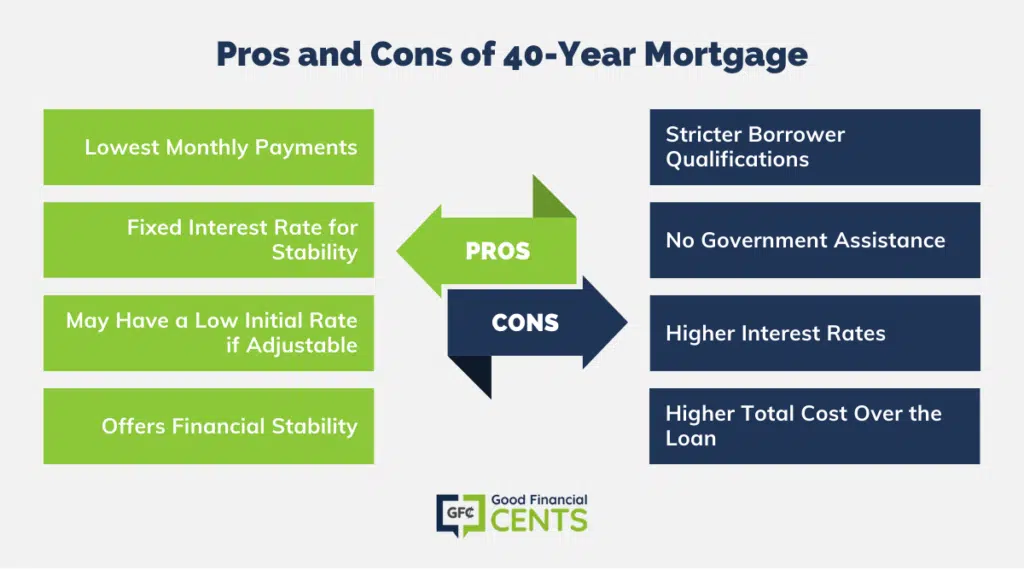

Pros of 40-Year Mortgage:

- The loan’s lengthy term makes for the lowest possible monthly payments, which benefits first-time buyers with lower incomes

- Any interest rate locked in at the time of purchase will not change, regardless of the housing market

- activity or other macroeconomic factors (unless they’ve chosen a 40-year ARM loan or the borrower chooses to refinance with their original lender or another institution)

- It offers a certain degree of stability for individuals seeking to simplify their financial obligations

- In its ARM form, the 40-year mortgage may have a fairly low initial interest rate

Cons of 40-Year Mortgage:

- Lenders are more reluctant to offer the 40-year mortgage as an option than any other type of fixed-rate or ARM loan, in large part because the federally mandated underwriting factors for borrower qualification can be much more strict

- These cannot be obtained with government assistance that is typically available to certain borrowers from the Department of Veterans Affairs, Federal Housing Authority, or other federal agencies, nor can government-sponsored enterprises like Fannie Mae or Freddie Mac offer such a mortgage

- Of all fixed-rate mortgages, interest rates will be the highest for 40-year loans, while ARM loans can be quite unpredictable

- Borrowers pay more altogether over the life of the loan than with any other kind of home financing

Get the Best 40-Year Mortgage Rate

Buyers who have their hearts and minds set on securing a 40-year mortgage will need to keep certain considerations in mind—factors that those who are seeking other loans don’t necessarily have to worry about. Some of the most notable of these include:

1. Borrowers might need to specifically request this type of mortgage from their loan officer, as lenders may not broadly advertise that they offer 40-year mortgages, for any or all of the reasons detailed above.

2. Lenders must be willing to offer non-qualified mortgages and, as such, be willing to meet the strict underwriting standards involved. (Under CFPB guidelines, a qualified mortgage cannot have a term length greater than 30 years.)

3. Regardless of the limitations noted here, borrowers must still visit as many different lenders willing to issue 40-year mortgages as possible, just like they would when searching for any other type of loan. Settling for the first financial institution that offers 40-year financing is simply too risky.

4. Vet lenders thoroughly by looking up their records with agencies such as the Better Business Bureau and TrustPilot. (Consumer reviews are worth looking at, but shouldn’t be taken as seriously as reports from the BBB and similarly well-established business evaluation organizations.)

5. It’ll be in borrowers’ best interest to make as large a down payment as they possibly can, as this will slightly reduce the burden of the monthly interest installments that will be due alongside the principal in the months and years to come.

6. Borrowers who apply for and receive approval on a 40-year fixed rate or ARM mortgage may become dissatisfied with their interest payments after a time and wish to refinance the loan. As such, they must find out in advance if the lender that they work with will be amenable to arranging a refinancing agreement in the future.

40-Year Mortgage: Two Alternatives

While this type of mortgage certainly has its advantages, borrowers should never feel as if they are limited to one financing option when looking to mortgage the home that they have worked toward owning for so long. Buying a house, especially for first-timers, is too significant a decision for such reductive thinking. Consider these choices as alternatives:

30-Year Fixed-Rate Mortgage

There’s a reason why this home loan option has been the most popular mortgage type in the U.S. for much of the last several decades—at times comprising up to 90 percent of home loans—even when its interest rates were much higher than they have been in recent years.

Also, 30-year fixed-rate mortgages can be CFPB-qualified, so certain eligible buyers will be able to receive government assistance to help them secure these loans.

10/1 ARM

This type of home loan isn’t quite as stable in its term length or interest rates as the 15-year or longer fixed-rate financing options. However, it does lock in a fixed rate for 10 years that will be lower than what is typically seen with long-term fixed-rate options.

Afterward, the interest changes annually; such fluctuations are often based on the London Interbank Offered Rate interest benchmark, but lenders aren’t bound to LIBOR and can use any other benchmark interest rate allowed by law. Although rates can change considerably each year after the first 10 years, borrowers will be notified of the rate adjustment in advance, so you have time to consider refinancing.

Also, legally mandated caps prevent interest from increasing beyond a certain point at the beginning of the adjustment period and throughout the life of the loan, so this particular ARM may still be viable for people settling down for more than a decade.

Recommended Companies for a 40-Year Mortgage

As noted earlier, 40-year mortgages won’t be as heavily promoted by their lenders as the other financing options they offer. Even some of the biggest lenders, like Wells Fargo, don’t offer 40-year mortgages.

Yet the following institutions do offer home loans with terms of up to 40 years, subject to certain caveats:

- NewFi: This California-based lender offers a 40-year option that is interest-only for the first 10 years and then converts to a standard 30-year fixed-rate mortgage. This will make it more difficult to build equity, however.

- Bank of America: This globally known bank offers a 40-year option structured as a 30-year loan that begins after a 10-year interest-only period – but only for jumbo home loans, which aren’t ideal for all buyers.

- New American Funding: Through this lender’s interest-only mortgage option, a fixed-rate mortgage can go up to 40 years. A higher-than-average down payment is required.

Guaranteed Rate: This lender offers interest-only mortgages with terms of up to 40 years and is available to homebuyers in all 50 states.

Bottom Line: Understanding 40-Year Mortgages

A 40-year mortgage is a fixed-rate home loan with an extended term, offering lower monthly payments but resulting in higher overall interest costs. While it suits long-term homebuyers on a tight budget, lenders may have stricter qualification criteria. Borrowers should explore multiple lenders, conduct thorough due diligence, and consider alternatives like the 30-year fixed-rate mortgage or the 10/1 ARM.

Notably, some institutions, such as NewFi, Bank of America, New American Funding, and Guaranteed Rate, offer 40-year mortgage options, albeit with varying terms and conditions. Ultimately, choosing the right mortgage requires careful consideration of one’s financial goals and circumstances.

We are interested in a interest only first ten years 40 year term on $320,000 20% down pmt. Middle score 647. In West Columbia, S.C., Lexington county