The 401k plan is a key part of saving for retirement for many people, but it’s easy to make mistakes with it. To make your 401k grow and work best for you, it’s important to understand what not to do. Like a garden, your retirement savings need regular care and the right moves to thrive.

The tips ahead are your tools for tending to your 401k, helping you grow a healthy fund for your future without getting tripped up along the way.

Table of Contents

- Not Diversifying Investments

- Ignoring Fees and Expenses

- Borrowing Against Your 401k

- Cashing Out When Changing Jobs

- Being Too Conservative or Too Aggressive

- Neglecting Beneficiary Designations

- Overlooking Catch-up Contributions

- Forgetting to Rebalance

- Falling for 401k Myths

- Not Monitoring Your 401k Regularly

- Final Thoughts on 401k Tips

Not Diversifying Investments

Risks of Putting All Eggs in One Basket

There’s a saying that you shouldn’t put all your eggs in one basket. This is really important advice for your 401k retirement savings. If you put all your money into just one company’s stock or just one type of investment, it’s a lot riskier. If that one investment doesn’t do well, you could lose a lot of money from your retirement fund.

Importance of Asset Allocation

Asset allocation is essential in mitigating risk while aiming for growth. It involves spreading investments across various asset classes such as stocks, bonds, and cash equivalents. A mix that includes domestic and international assets can act as a bulwark against volatility in any single market.

How to Diversify Within a 401k

Diversification within a 401k could mean selecting a mix of that represent different asset classes and market sectors. Target-date funds, which automatically adjust their asset allocation based on the investor’s age and proximity to retirement, can also be a straightforward diversification tool.

Ignoring Fees and Expenses

Understanding Fee Structures in 401k Plans

401k plans come with a variety of fees for administration, fund management, and other services. These can include plan administration fees, investment fees, service charges, and more.

Long-Term Impact of High Fees on Savings

Over time, high fees can significantly erode the value of your retirement savings. Even a 1% higher fee can mean a substantial difference in your account balance over a few decades.

Tips for Minimizing Fees

To minimize fees, investors should review the fee disclosures for their 401k plan, comparing the costs of different investment options and considering lower-cost index funds or exchange-traded funds (ETFs) when appropriate.

Borrowing Against Your 401k

Consequences of Taking Out a 401k Loan

Taking a loan from your 401k can seem like an easy source of funds, but it comes with drawbacks. It may reduce the amount of money that is invested and growing, and if not repaid, it can lead to taxes and penalties.

Alternative Options for Accessing Cash

Before borrowing from a 401k, consider alternatives such as a personal loan or home equity line of credit, which do not compromise your retirement savings.

How Borrowing Affects Retirement Savings Growth

A loan from your 401k interrupts the compounding growth of those funds. The lost opportunity for investment gains often outweighs the benefit of the loan.

Cashing Out When Changing Jobs

Tax Implications and Penalties

Cashing out a 401k when changing jobs can trigger taxes and early withdrawal penalties, reducing the amount you receive by a significant margin.

Options for Rolling Over Your 401k

Instead of cashing out, consider rolling over your 401k into an individual retirement account (IRA) or a new employer’s 401k plan to continue the tax-deferred growth.

The Power of Compound Interest

Leaving your investment to grow in a rollover IRA or another 401k takes advantage of compound interest. This can substantially increase your retirement savings over the long term.

Being Too Conservative or Too Aggressive

Finding the Right Balance Based on Age and Retirement Goals

Your investment strategy should balance between conservative and aggressive, tailored to your age and retirement horizon. Younger investors may have a more aggressive portfolio, while those nearing retirement often shift towards conservative investments.

Consequences of an Overly Conservative Approach

An overly conservative strategy, particularly for younger investors, can lead to insufficient growth, failing to outpace inflation and not accumulating enough for retirement.

Risks of an Overly Aggressive Strategy

Conversely, an overly aggressive strategy can expose you to unnecessary market volatility, potentially leading to large losses that could derail retirement plans.

Neglecting Beneficiary Designations

Importance of Keeping Beneficiary Information Up-To-Date

Beneficiary designations dictate who receives your 401k assets upon your death. It’s essential to keep this information current to ensure your wishes are fulfilled.

How Failing to Update Can Affect Estate Planning

Neglecting to update beneficiary designations can lead to unintended consequences, potentially causing your 401k assets to be distributed in a manner inconsistent with your overall estate plan.

Steps to Properly Assign Beneficiaries

Regularly review and update your beneficiary designations, especially after major life events such as marriage, divorce, or the birth of a child. Make sure your 401k plan’s designations align with your will and other estate documents.

Overlooking Catch-up Contributions

Opportunities for Those Over 50

If you’re over 50, you can make additional catch-up contributions to your 401k, allowing you to save more as you near retirement.

Impact of Catch-up Contributions on Retirement Readiness

How to Make Catch-up Contributions

To take advantage of catch-up contributions, you must elect to contribute beyond the standard limit through your plan’s enrollment process.

Forgetting to Rebalance

The Need for Periodic Portfolio Rebalancing

Over time, market movements can shift your asset allocation away from your target. Rebalancing is necessary to maintain your desired risk level.

How Rebalancing Aligns With Investment Goals

Periodic rebalancing ensures that your investment strategy stays aligned with your retirement goals and risk tolerance.

When and How to Rebalance Effectively

Many experts recommend rebalancing at regular intervals, such as annually, or when your asset allocation shifts beyond a certain percentage from your target.

Falling for 401k Myths

Debunking Common 401k Misconceptions

Misconceptions about 401k plans can lead to poor decision-making. For instance, some may mistakenly believe that they should not invest in a 401k if they cannot contribute the maximum amount.

How Misconceptions Can Lead to Poor Financial Decisions

Acting on myths can result in missed opportunities, such as failing to take advantage of employer matching contributions.

Resources for Accurate 401k Information

Seek information from reliable sources like the U.S. Department of Labor, financial advisors, or your 401k plan administrator to ensure you’re getting accurate guidance.

Not Monitoring Your 401k Regularly

Importance of Staying Informed About Your Investments

Regular monitoring of your 401k allows you to make informed decisions about your investment choices and overall strategy.

How Regular Check-Ins Can Lead to Better Decision-Making

By regularly reviewing your 401k, you can adjust contributions, rebalance your portfolio, and stay on track with your retirement goals.

Tools and Strategies for Monitoring Your 401k

Many 401k plans offer online tools for monitoring investments. Additionally, setting calendar reminders for periodic reviews can help maintain oversight.

Final Thoughts on 401k Tips

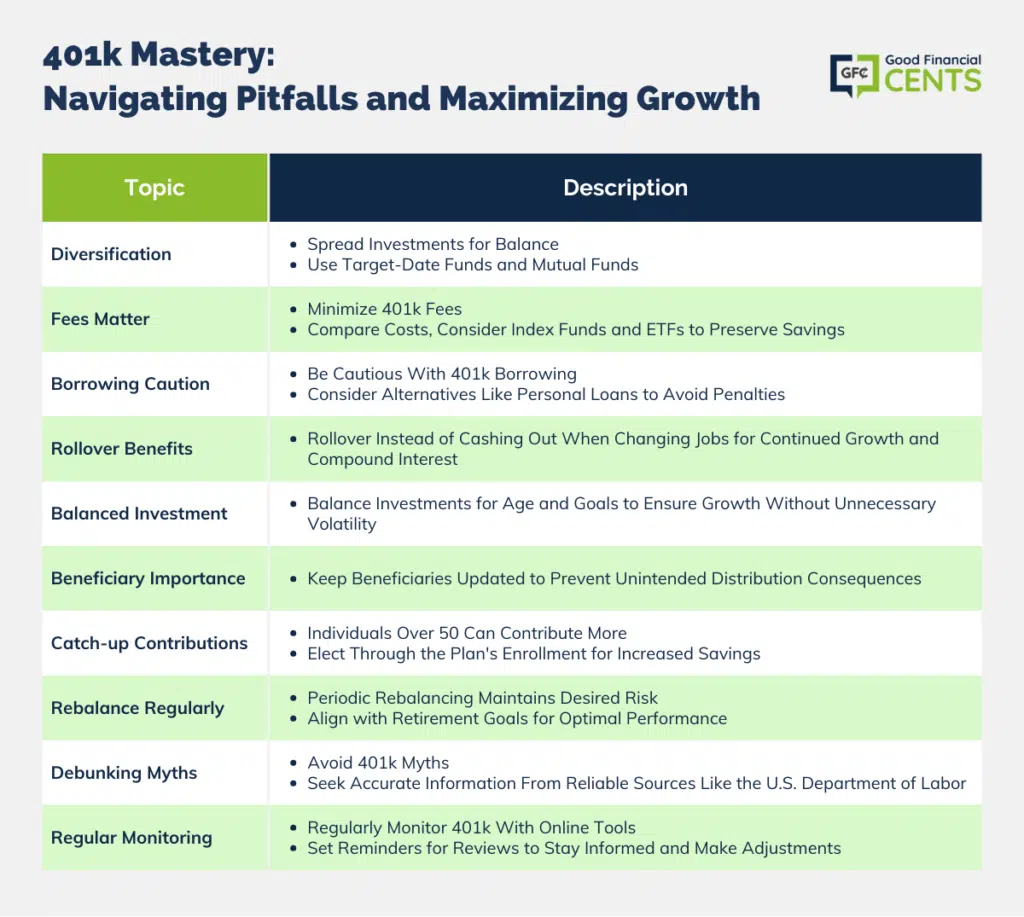

Smart 401k management involves diversifying investments, being mindful of fees, avoiding loans and early cash-outs, maintaining appropriate risk levels, updating beneficiary designations, making catch-up contributions if eligible, rebalancing periodically, debunking myths, and monitoring your account regularly.

401k management is an ongoing process that requires attention and adjustments as your financial situation and goals evolve. Given the complexity of investment choices and retirement planning, seeking the advice of a professional financial advisor can be a prudent step in ensuring the health and growth of your 401k savings.