A lot of people make money investing in real estate.

But there’s the real version and the TV version.

I fell for the TV version.

Based on little more than a book from a self-proclaimed real estate superstar, I blazed forward and bought my first real estate investment property.

It was a complete failure.

I learned seven lessons from that failure, and now I’ll share them with you.

Table of Contents

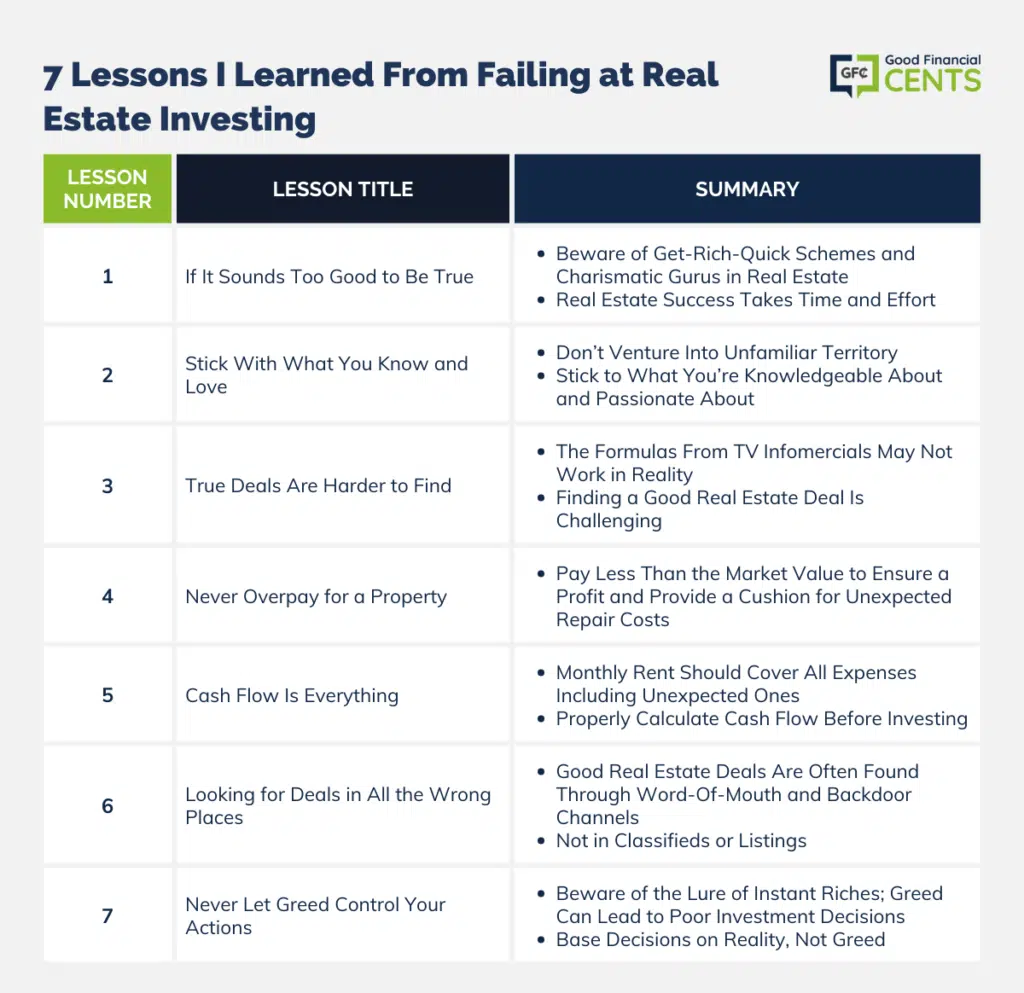

- 1. If It Sounds Too Good to Be True, It Probably Is – And It Was!

- 2. Stick With What You Know and Love

- 3. True Deals Are Harder to Find Than You Ever Imagine

- 4. Never Overpay for a Property

- 5. Cash Flow Is Everything – And You Better Calculate It Right the First Time

- 6. Looking for Deals in All the Wrong Places

- 7. Never Let Greed Control Your Actions

- Bottom Line: 7 Real Estate Investing Mistakes I Made

1. If It Sounds Too Good to Be True, It Probably Is – And It Was!

Have you ever heard of a guy named Carlton Sheets? He was one of those how-to-get-rich-in-real-estate-without-really-doing-anything gurus from back in the 1980s and 90s.

I wouldn’t be surprised if you don’t know anything about him – he hasn’t been around much lately. He had a series of convincing TV infomercials, as well as paid real estate investment courses and books, and was quite successful for a number of years.

My father-in-law bought me one of his books, and after reading it I was hooked. I was going to be a real estate millionaire. Look out Donald Trump, Jeff Rose is on your tail, and will be passing you in the fast lane in just a couple of years!

At least that’s what I convinced myself.

2. Stick With What You Know and Love

Other than the book by Carlton Sheets, the sum total of my accumulated real estate investment knowledge was zero. I had never actually invested in real estate, at least not apart from my own home.

But if you’ve ever seen one of those glitzy TV infomercials about how to get rich, you have to admit they’re pretty convincing. I’m a positive, high-energy guy, and I figured that if anyone could make this plan work, it would be me.

But there was one problem with my thinking: real estate investing is not exactly my thing. And that means everything!

Financial planning is, and I’m all over it. That may be the biggest lesson I learned from failing at real estate investing. Always stick with what you know and love, and leave the other stuff to other people.

3. True Deals Are Harder to Find Than You Ever Imagine

My father-in-law and I decided that we’d go into this real estate investment venture together. I was a seasoned money guy, and my father-in-law was an accomplished handyman. It was the perfect tandem for investing in real estate.

I studied Carlton’s book and knew the “formula” for buying a winning investment property – buy a property from which you can reasonably expect to receive a monthly rental income equal to at least 1% of the purchase price.

We found such a property. The asking price was $120,000, and market data indicated that it could be rented for $1,200 per month. Exactly 1%! We were on our way.

But TV infomercial formulas and reality don’t mix. We purchased the property with a $500 earnest money deposit. I then discussed the deal with my CPA, himself a real estate investor with more than a dozen properties. He quickly told me that we overpaid for the property.

That was a direct blow to the stomach – as well as to my ego. Since we just closed on the property, he recommended that we get out of it in anyway that we can. With the cooperation of our real estate agent, we were, in fact, able to void the deal.

But I learned something else from my CPA friend. Finding bargain real estate for investment is not at all easy. Since every other real estate investor is looking for bargains, you never find them in the usual places.

More on that in Lesson #6 below.

4. Never Overpay for a Property

This one is huge. You need to pay much less for the property than its true market value.

Not only will that provide the profit on the sale, but it will also afford you some protection in the event the property has costly and unexpected repairs.

5. Cash Flow Is Everything – And You Better Calculate It Right the First Time

Forget about the 1% rule, the monthly rental should actually be a lot higher. My CPA friend informed me of this after we closed on the property, which is when I bothered to actually ask him.

Cash flow is also critical to the success of any real estate investment.

The rent has to be sufficient not only to cover the monthly cost of financing, property taxes, insurance, and landlord-paid utilities but also to provide a profit, as well as an allowance for some of those unexpected expenses. Expenses like a new roof or furnace.

But whoodda thought? Definitely not me while I was still in my “expert phase”.

6. Looking for Deals in All the Wrong Places

When you are looking to purchase investment real estate you will not find truly good deals in the newspaper classifieds (where I found my “deal”) or even on the local multiple listing service. It’s more likely that you will find a winning property through word-of-mouth and other backdoor channels. It’s often a matter of locating distressed property sales before they hit the market.

The problem is that real estate investment is very competitive. You’re never the only person out there looking for the next big deal. For that reason, all of the usual places you might find property are quickly picked over, few that there are.

Successful real estate investing requires a lot of patience and investment of time. You have to do a lot of digging and get to know a lot of people in order to find the deals that will make it work.

7. Never Let Greed Control Your Actions

So many people have gotten wealthy by investing in real estate that is hard to ignore the opportunity, even if you know nothing about it. It’s called greed, and the combination of big profits and slick TV infomercials can make it too good to be ignored.

But that’s never a decision that’s based on financial reality, or even a reasonable evaluation of your own skill set. It’s based purely on greed. You see big money being made, and you want in. But wanting in and being able to make it happen are two very different things.

From now on, I’ll stick with what I know, and leave the promise of instant riches to the people who write books about it.

That’s my story. Have you ever fallen for what turned out to be a money-making scheme? Share and make me feel better about my own crash-and-burn.

Bottom Line: 7 Real Estate Investing Mistakes I Made

Embarking on a real estate investment journey can be both enticing and perilous, as I learned from my own misadventures. Guided by a TV infomercial and an alluring book, I dove into a world that promised wealth but delivered lessons instead.

Critical takeaways include being wary of deals that seem too good to be true, recognizing the importance of genuine market knowledge, understanding that true bargains are rare and need a deep search, ensuring the right calculations for genuine cash flow, and never letting greed drive decisions. Success in real estate, or any venture, requires patience, understanding, and sticking to one’s core strengths.

This post originally appeared on Forbes.com.

I am looking for a good mentor in real estate.. Kindly help me out. I am from India. I can invest only in small amount say ₹1000/- a month plz get me good options.

Yes, very good. What a lovely article and a great piece of advice. Do what you love. And love what you do. This is the only way to riches.

Hi Jeff, Really fantastic article. Personally, I really like two of your ideas, the first one is we should stick with our plans, what we know and we love. And the 2nd one is never ever overplayed for a property. I totally agree on due diligence. Thanks for sharing such information

I love learning lessons from failures. It’s kind of a way to turn failures into success.

I think learning to stay in your investing lane is a valuable lesson. There are some people in your real estate market that are highly specialized and invested in that as a profession or business. Dipping a toe in the water and expecting to win right away is a tough way to make it work.

It reminds me of Warren Buffet talking about tech stocks in the late 90s. He wouldn’t invest because he didn’t understand them. When pressed that this was the ‘next big thing.’ He pointed out how when he was younger the equivalent was air travel, but that there were only a handful of those stocks left.

That’s true. Part of the problem is that there are books, websites and infomercials that make real estate look easy. And of course, since it’s a physical thing, people assume they have greater knowledge of it than they do. It really is a business, and unless you’re willing to approach it that way, it’s best to avoid it entirely.

Like with any other investment, invest in what you know and understand.

Jumping into anything is never a good idea.

My sentiments exactly. There’s a saying, “Do what you do best and let others do the rest”. Works for me!

Your article is very interesting and it really highlights how much bad information there is out there and how easy it is to buy into it.

I’ve been a real estate investor since 2009 and have been very successful at it. Good information is really hard to find and it never looks as glamorous as the bad information is.

The best thing I did when I started investing in RE was to get a mentor — someone who knew the market, knew how to rent (he did it himself too), and could give great advice.

He helped me know what would work, what wouldn’t, what a good price was, what wasn’t, what my costs and income might be, etc. He was the only reason I could even think of investing.

He was also my real estate agent, so when I bought, he made a commission. That’s how he got compensated for his time and advice.

I would never have tried it otherwise.

Good lessons, though technically it sounds like you got out just in time before you actually failed. Actually purchasing the property and then uncovering these things would have been true failure. This was more…almost..failure 🙂