Ask any financial advisor about 72t and I’ll bet you’ll see them cringe.

It’s not a popular planning method, mostly because it comes with lengthy restrictions that, if violated, can lead to severe penalties.

Clients don’t like paying penalties. Advisors don’t like when their clients pay penalties. 72(t) has the potential if done wrong, for the clients to pay a huge chunk of penalties. See why we cringe about 72(t)?

Some of you may have no clue what 72(t) is. If you are not planning on retiring early (before the age of 60), then skip this post and come back another day. 🙂

If you are in the financial position to retire early and have a bulk of your assets in retirement accounts, then 72(t) may be of help to you. Let’s take a look at the 72(t) early distribution rules.

Table of Contents

What in the Heck Is 72(t)?

Most often when you take money from your retirement account before you turn 59 ½, you are assessed a 10% penalty on top of ordinary income tax. One exception (others include: first-time home purchase, college tuition payments, disability) to that is a 72(t) distribution that is a “substantially equal periodic payments”.

Clear as mud? I thought so. Moving on……

Read more on How to Withdraw From Your IRA Penalty Free

How Does the IRS Consider 72(t)?

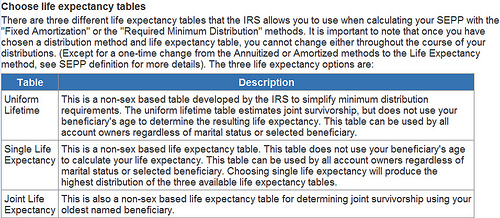

The IRS calculates your “substantially equal periodic payments” by using one of the three methods that the IRS has determined and then takes your payment on a set schedule for a specific time period.

It is required that you take those payments for either 5 years or when you turn 59 1/2, whichever comes later.

For example, if you start taking your payments at the age of 52, then you must do so for 8 years. Someone who starts at 57, must do so till the age of 62.

72(t) Real Life Example

In the 10 years I’ve been a financial planner, I’ve only executed 72(t) a handful of times. The concern is having to lock in your withdrawal rate for a minimum of 5 years is longer than most advisors are comfortable with- myself included.

Recently, I had a potential new client who was getting an early buyout from his job and was considering using 72(t) for a portion of his IRA. Here are some of the details (name and some of the data have been changed for privacy concerns).

Paul was born on 8/21/55 and $720,000 he will receive in a lump sum distribution from his employer. He would like to do a 72(t) from age 57.3-62.3. He needs about $2,000 a month until 63.5 where he will have the remainder in an IRA. Paul also had $140k in his 401k.

How 72(t) Distributions Work

The 72(t) plan must not be modified until 5 years have passed from the date of the first distribution for those who will reach 59.5 before the 5-year period is completed. However, it is not clear whether Paul plans to take the 72t distributions from the employer plan or from a rollover IRA.

If the 72(t) plan is needed, the best approach is to do a direct rollover from the plan to a rollover IRA, determine what IRA balance is needed to generate 24k per year using the amortization plan, and then transfer that amount to a second IRA and start the plan.

The original rollover IRA can be used for emergency needs to prevent the 72t plan from being broken if he needs more money. Employer plans do not provide 72(t) support and may not offer flexible distributions. They also will not allow funds to be rolled back in the event too much is taken out due to an administrative error.

Note:

But for that to be practical the plan must allow flexible distributions until the 5 year period ends. If the plan required a lump sum distribution, even though the penalty would not apply, a distribution of 120,000 in a single year would inflate his marginal tax rate and that might well cost more than the 10% penalty.

If a lump sum is required, then a direct rollover to an IRA should be done before starting a 72(t) plan.

Some of you may be considering initiating 72(t) distributions. 72(t) distributions take careful planning and consideration.

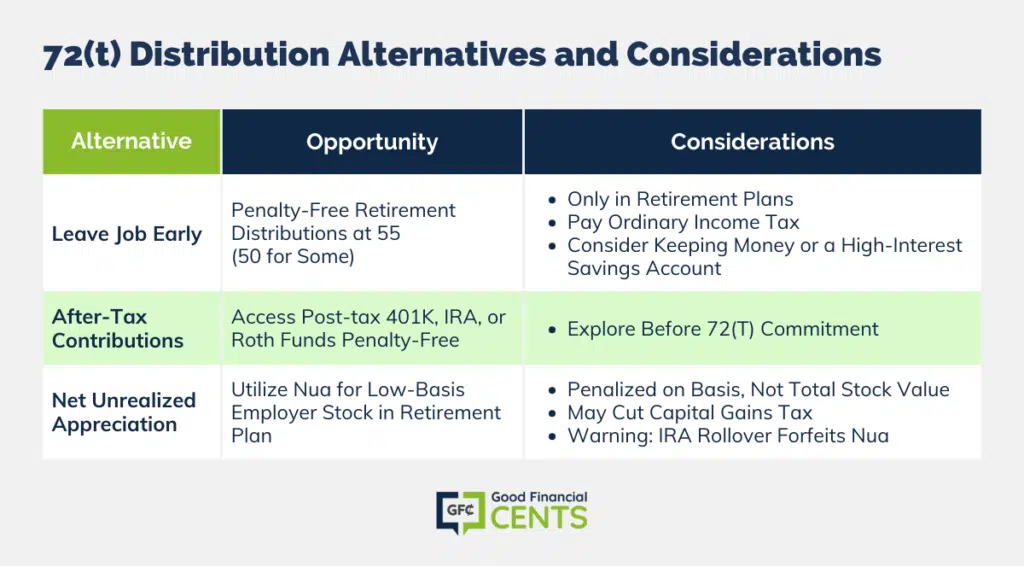

Before you lock in those payments, there are some alternatives that you may want to explore:

72(t) Distribution Alternatives

Just because you can, doesn’t mean you should. Definitely look to see if there are other things you can (should) do first.

Here are a few examples.

Leave Your Job Early

If you leave your job on January 1st of the year you turn 55 (50 for certain government agencies), you are allowed to pull out lump sum distributions out of your company retirement plan penalty-free.

Notice I said retirement plan and not IRA. Once you roll over into an IRA, you lose out on that opportunity.

Consider leaving a portion of money in the retirement plan as a precautionary. Or you can just take a lump sum distribution out of the plan pay the tax and park it in a high-interest savings account for emergency purposes. Do remember that you will pay ordinary income tax on that distribution.

Don’t Forget About After-Tax Contributions

You can also tap into after-tax contributions to your 401k, non-deductible IRA contributions, or after-tax contributions to your Roth IRA. Consider these penalty-free options first prior to locking in your payments.

Net Unrealized Appreciation

Even a bigger secret than 72(t) is NUA. What is Noo-uhh you ask? Well, it is the acronym for Net Unrealized Appreciation. Get it yet? Didn’t think so. NUA pertains to employer stock that you have in your retirement plan that may have an extremely low-cost basis.

You may be one of the lucky ones who started working for the company prior to them going public and you’ve seen your company stock double and split more times than you can count.

If you utilize the NUA on your stock you will just be penalized on the basis, not the total value of the stock.

For example, if you have company stock that is valued at $100,000 but your basis in the stock is only $20,000, you would be only penalized on the $20,000 if you took it early if you are under 59 ½.

The remaining gain ($80,000) would be taxed as a long-term capital gain when you decided to liquidate it, not ordinary income. That could be the difference between 15% and 35% in taxes, depending on your tax bracket.

Warning! Once you roll over your employer stock into the IRA, you forfeit your NUA.

These are just a few of the alternatives that one can explore before committing to the 72(t) distribution rule.

The Final Call – Early Retirement? Remember 72(t)!

The verdict is still out on whether the client and I are going to do 72(t). Since he has a good amount in his 401k and his wife has a nominal 401k, as well (not mentioned above); I suggested using that money first.

Since he’s retiring early, he can avoid the 10% early withdrawal penalty so as long as the money is distributed from his 401k. Once you do a 401k rollover to an IRA, you lose that option.

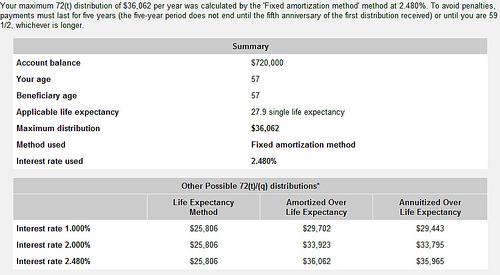

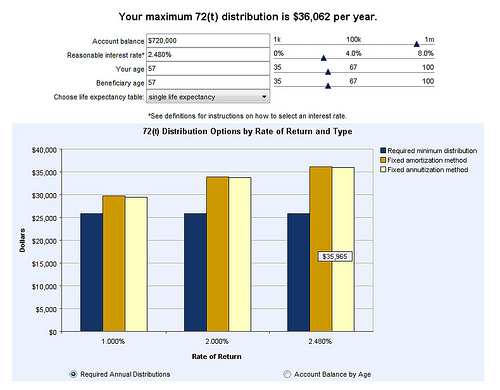

Out of curiosity, I went to Bankrate.com and used their 72t calculator to see how much we could get with his retirement account. Below are some of those results.

Here’s a sample amount that one could withdraw from your IRA using 72(t). Note the interest rate of 2.48%. That amount was already entered into Bankrate’s calculator.

You have the ability to choose your own interest rate but be careful. You want to choose a rate that is normal and sustainable based on current market and economic conditions.

Have you retired early? Would you be comfortable executing 72(t) distributions for 5 years?

This must be old news. They have the 55 rule now also

One of the best explanations of 72t I’ve read.

48 with an old 401K from an old job with approx. 111,000 in it. I want to take 85,000 out and roll into a single premium immediate annuity to fund a asset based Long term care product for 20 years. Would the 72t rule apply here. The SPIA would provide approximately 5400 per year to cover the annual cost of the LTC

Hi Bob – Since you’re 48 I’d talk to a CPA about that. Also, you’ll have to get that cleared by your current plan trustee. This is one of those “measure twice, cut once” moments.

My company is closing, I have 401k and 2 pensions. One of the pensions is 40k cash out. I’m 54 n will probably be on disability soon. I was thinking I would try to just retire now. Question is, could I put that 40k pension in my 401k and apply the 72t plan to that total amount? Also if I become disabled would I still be bound to the 72t plan?

Hi Teresa – You’ve got a lot going on there, so I’d spend some time discussing it with a CPA. You should be able to transfer the pension into the 401k as long as the plan allows it. I don’t think that disability would affect your 72t distribution, but again, that’s a good question for a CPA.

What does this mean? Note: that if Paul separated from service from the employer sponsoring the qualified plan in the year he would reach 55 or later, distributions taken directly from the plan are not subject to penalty, and a 72t plan could be avoided.

I lost my job in the same year I turned 55, does this mean I can use my pension without the 10% penalty

Hi Rich – Yes, that’s exactly what it means. See the last item on this chart. Not only is the penalty waived at age 55 due to separation from service, but it can be as early as age 50 for public service workers.

Doesn’t the after 55 rule only count in the year in which you retired? ie, if you retire in January, you have an entire year to pull money out, but if you retire in December, you can pull out only until the end of the month. A large lump in December is no big deal, but it doesn’t allow for multiple year withdrawals from my understanding.

Jeff,

I am 58 and lefy my company a few years ago. I still have my 401K with them. If I opt to do the 72T, can I just do a portion of my 401K balance, and leave the rest in there, or because I no longer work for them, would I have to roll over the full amount to an IRA. If this company doesn’t do the 72T, would I have to roll over the entire amount to another company that does? I would like a portion of my investments to go towards a 72T, but not the full amount. Can you help?

Thanks,

@ Michael If the 401k is with your employer still, you can take distributions and avoid the 10% early withdraw penalty (since your 55).

I would avoid electing 72t if you don’t have to.

Michael is 58 at the time of writing this, and he said he left his company “a few years ago” (didn’t specify at what age). If he left at age 55 or older, he could indeed take penalty-free withdrawals. However, if his date of separation was age 54, for example, wouldn’t he have to wait until age 59 1/2 to take penalty-free withdrawals? I believe that’s the case, and your answer needed to clarify that.

Hi Christina – I try to avoid questions that aren’t specifically asked. In this case if Michael was a government worker, he could take the withdrawals anytime after age 50. He didn’t specify, so I didn’t speculate. There are too many X factors to address every possibility.

Can you work part time if you do a 72T?

@ William You sure can.

Can you work full time or part time and contribute to your new employer’s 401k while taking the 72t disbursement?

Hi Tammy – I believe you can, but I’d recommend asking a CPA or tax attorney for an opinion, as well as citations of the tax code that specifically permit it. My understanding is that you can do it as long as the new retirement plan is not the same one you are taking 72t distributions from.

If I already started at 72t arrangement, can I roll over a portion of that account into another qualified account, and if so, do I maintain the SEPP as originally calculated, or can it be lowered?

I had a 72t set up for me when I was about 38, now I am 46. Is there anyway to “undo” or reverse the 72t prior to the age of 59 1/2. For example, extenuating life circumstances such as divorce?

I’m 57.66 years old, and have been using rule 72t since I turned 50. What I’m trying to figure out is this: when, exactly, can I stop using it? I get my money monthly on the 25th of each month. On January 25, 2017 I will have just turned 59 1/2 years old. Can I then quit doing the 72t thing, or do I have to continue all through the calendar year that I turn 59 1/2 in? Thanks in advance for your insight.

I just turned 55, I’m considering trying to retire. My understanding if I take my 401k out I have to pay the 10 percent penalty. Is this correct?

@Melissa Incorrect. If you rolled it into an IRA and the took a distribution, that would be correct. If you leave it in your 401k, you’l be able to access it without penalty. I wrote about that exact situation here: https://www.goodfinancialcents.com/early-retirement-mistakes-avoid-this/

Jeff, I’m a little confused. In our case we have an employer 401k that only allows us a lump sum cash out, or roll-over (to IRA). My wife and I are 58. Are you saying that if we roll-over the 401 to an IRA, we can’t then exercise the 72T, because of the 10% penalty? By the way, we’re eligible for the “age 55” exception to the penalty, but don’t want to get zapped by the huge tax burden of taking the lump sum, 20%, etc.

@Neil You can exercise the 72t once you rollover to an IRA, but I probably wouldn’t suggest that in your case. I would leave a sum (depending on how much you think you’ll need from now until 59 1/2) in your 401k to avoid the 10% early withdrawal penalty.

Hi Jeff,

Can you open two IRAs put a large sum into one account and use that for the 72 T guidelines and then have a second account in case of an emergency that you would pay the 10% penalty on.

And, as long as you did not withdraw money out of the 72T IRA than no penalties would be incurred?

Or do you have to use your entire retirement balance to determine the annual withdraw for 72t regardless if you have two different IRAs?

Thank you,

Mary

Great article overall. I plan on using 72(t) from my company rollover when I’m 50.9.

Re: Note: that if Paul separated from service from the employer sponsoring the qualified plan in the year he would reach 55 or later, distributions taken directly from the plan are not subject to penalty, and a 72t plan could be avoided.

Warning — this varies from company to company. At some (like mine) as soon as you take ANY withdrawal then their rule is you have to take (rollover) the whole thing. ie. they don’t want to keep you on the books and manager your money. It probably cost the company per employing for the 401k management.

Hi Jeff,

I was reading about the 72t and I was wondering if it had to be started in the beginning of the year (January) or can you start it at any time?

@ Tara Nope. You can start 72t at any time.

You should go into the penalties some more. I throw everything into my Roth since I’m only 30. But if I get to the point where it’s feasible to retire, I’d like to with this.

Also, Is there a withdrawl amount you have to hit exactly, or can you be a bit less. Is it based on the price of your investments or fixed? How much are the penalties?

Obviously if you hit this point you want your debts low, and a cushion outside of your planned living for unexpected items, but presuming I can get both in 10-20 years, you know I’m going to take it.

Also, are there other restrictions on working if I just went to working 10 hours a week?