Annuities are typically purchased for retirement purposes. While they are not for everyone, they can be the perfect pension substitute or a supplement to a pension that might not be sufficient to provide for your living expenses.

But one of the big worries that most people have when it comes to retirement is inflation. No matter how much income you have at the time that you retire, inflation raises the cost of living and makes it possible that the income that you have at age 65 will be inadequate in just a few years.

But when it comes to annuities, insurance companies have come up with a workaround to fix the inflation problem. They can add a cost-of-living rider to your annuity.

By doing that, the amount of your income payments can be adjusted each and every year, to make sure that they keep pace with the rising cost of living.

How a Cost of Living Rider Works

If you want to add a cost-of-living rider to your annuity, you can first choose what type of method will be used to calculate higher price levels in the future (see the next two sections). Once you do, the income payment that you will receive from your annuity will be adjusted higher each year.

Sounds simple enough, right?

But actually, it’s not quite that simple, and that’s why not everyone who has an annuity adds a cost-of-living rider.

Should you decide to add the rider, the insurance company will lower the base amount of the annual income payment that you will receive from the annuity. This will be done in order to lower the cost of the rider.

For example, the insurance company may lower the initial payment from the annuity from say, $10,000 per month down to $6,000. That’s roughly what it will be if you decide on a 5% annual increase. T

he initial payment will be higher if the annual increase is lower, and lower if the increase is higher. That might be a painful hit when you initially retire, but the benefits come later – when you might really need them.

If you select an annual increase of, say, 5%, then the $6,000 payment that you begin receiving at age 65, will grow to $15,919 in 20 years, when you’re 85.

If you select 5% as the annual payment increase, it will take about 10 years to reach the income payment level that you would have had if you had not added the rider.

That means that if you retire and begin taking income payments at 65, you will reach the break-even point on the rider at about age 75. After that, the rider will begin working to your advantage.

Naturally, you will have to weigh whether the loss of income in the early years will justify the higher payout later.

Most typically, you will want to consider a cost of living rider if you expect to live many years, certainly more than 10 years. But if you only expect an annuity to pay out for 10 years or so, the rider may not be worth taking.

How COLA Adjustments Are Calculated

The most common method for determining COLA adjustments is the Consumer Price Index or CPI.

This is a widely accepted measure of inflation that’s put out by the U.S. Government’s Bureau of Labor Statistics (BLS).

It is commonly used in calculating annual changes in payments, such as Social Security, pensions, pay raises, and even inflation adjustments with the tax code, such as tax brackets, personal exemptions, and standard deductions.

The CPI measures annual changes in prices of common goods and services that are widely consumed throughout the economy.

These include price changes in food and beverages, housing, apparel, transportation, healthcare, recreation, education, communication services, and a bunch of other prices.

For the most part, it measures general price changes across the entire country. However, since certain price changes can be more significant in one region than another, the CPI isn’t a perfect measure of price changes.

Still, it’s the most commonly used inflation statistic, and could – but not necessarily – be used to calculate annual COLA adjustments for your annuity.

Two Types of Cost of Living Calculations for Annuities

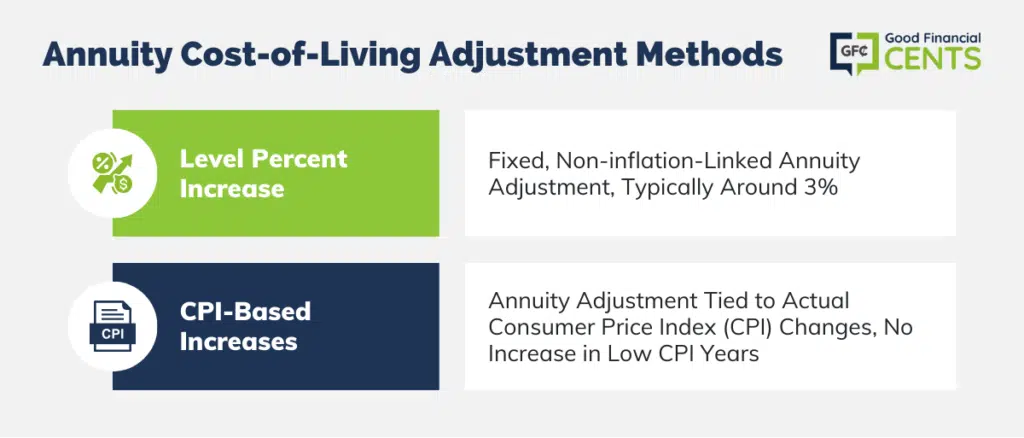

Life insurance companies typically offer one of two types of cost-of-living adjustments. The first is a level percent increase, and the second, CPI-based increases, is actually based on changes in the CPI, as described above.

Level Percent Increase

This calculation method is not based on the CPI, but rather on a predetermined percentage. Since the historic rate of inflation, based on the CPI, has run about 3% for the past several decades (but closer to 2% in recent years), 3% is the most common percentage used in a level percent increase.

However, the actual percentage change can run from a low of 1% to a high of 6%.

What this means is that the value of your annuity income payment will increase by 3% per year (or whatever percentage that you select) regardless of what happens with the actual rate of inflation as determined by the CPI.

Depending upon the insurance company, the annual increase will be calculated on a simple or compound basis. If it is calculated on a simple basis, then the amount of the annual increase is based on the original value of the annuity.

If it is calculated on a compound basis, then each annual calculation is based on the value in the most recent year. The compound method is the most common, and the one that will result in the highest income payment going forward.

The level percent increase tends to work best in low-inflation periods, similar to what we have been in for the past couple of decades. It could also be the better choice in the event that you believe that the CPI doesn’t adequately measure the true rate of inflation.

You can choose a percentage that you believe more adequately reflects increases in general price levels.

CPI-Based Increases

This is actually a true COLA adjustment because it is based on the actual changes in price levels, as measured by the CPI. The annual CPI change is calculated as of January 1 of each year. Once the change comes out, your annuity income will be adjusted accordingly.

One of the downsides of a CPI-based increase is that there may be years in which there is little or no increase in the index. That being the case, your annuity payment will not increase for that year. However, the CPI-based increase method works better during times of higher inflation.

For example, during the 1970s and early 1980s, the annual rate of inflation was in the high single digits and sometimes went into double digits. In that kind of environment, CPI-based increases will allow you to better keep up with rising price levels.

Why You Might Want to Add a Cost of Living Rider to Your Annuity

If you believe that inflation will continue to be a problem in the future, you might want to consider adding a cost-of-living rider to your plan.

Even though inflation is currently tame, you can use a level percentage increase method to steadily build up the payment level while inflation continues low.

Alternatively, you may want to consider using the CPI-based increase method, which will actually track annual increases in price levels.

Your expected longevity should also be a factor here. If you expect your annuity to pay you an income for the next 20 or 30 years, a cost-of-living rider is more important, since a payment determined today may not be sufficient well into the future.

But one factor you have to consider is cost. Since the cost-of-living rider will reduce the initial income stream from the annuity, you have to weigh that out against the benefit that you will receive in terms of higher future payments. An alternative might be to avoid the cost-of-living rider, and instead apply the extra premium cost to investing in a larger base annuity.

As is always the case with any add-ons to your annuity, make sure that you thoroughly discuss both the benefits and the cost of the rider. The decision to add or exclude any particular rider is never automatic.

Bottom Line: Annuity’s Cost-of-Living Rider

Inflation can erode the purchasing power of annuity payments over time. To combat this, insurance companies offer cost-of-living riders that adjust annuity payments based on inflation metrics. These riders can be tied to a fixed percentage increase or the Consumer Price Index (CPI), a government measure of inflation.

While the rider ensures increased payments over time, it often starts with a reduced initial payout. It’s vital to consider your longevity expectations, beliefs about future inflation, and the trade-off between initial and future payments.

Evaluating the benefits and costs thoroughly with a financial advisor is essential before deciding on adding such riders.