There are many different types of riders that can be added to annuities. One of the most popular is the lifetime income benefit rider (LIB). This rider guarantees that you will receive regular income payments from your annuity for your entire lifetime. In fact, you will receive those income payments even if your annuity is fully depleted!

A rider like the lifetime income benefit rider is one of the more compelling reasons why people like to add annuities to their investment mix when planning for retirement.

Table of Contents

How the Lifetime Income Benefit Works

If you are concerned that you will outlive your money, you can add a lifetime income benefit rider to your annuity. It will represent a guarantee by the insurance company that you will continue to receive income payments from your annuity no matter what happens, even if your full investment in the annuity has been used up and has gone negative.

In exchange for a relatively small annual cost, the rider can provide you with payments on an annual, quarterly, or monthly basis for the rest of your life. For example, if you take out a $200,000 annuity that begins paying $10,000 per year at age 60, and you live to be 100 – and your annuity has long since been used up – you will continue receiving $10,000 per year until the day you die.

There are very few investment choices you can make that can offer that kind of guarantee, and it certainly strengthens the case for using annuities to fund your retirement.

Lifetime Income Benefit Features

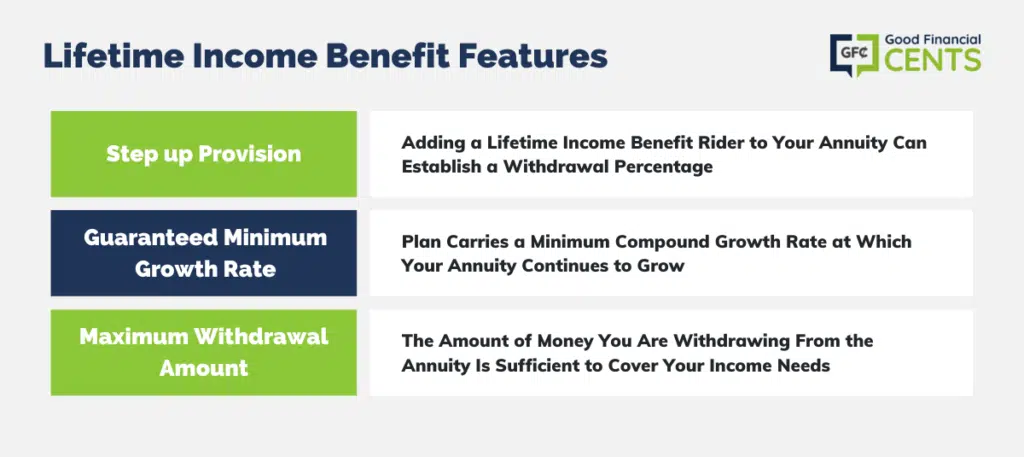

Some of the features that are, or can, be included with a lifetime income benefit rider are:

Step up Provision. When you add a lifetime income benefit rider to your annuity, you establish a withdrawal percentage. However, many LIB riders also have a “step up provision.” That means that if the value of your annuity increases due to rising investments, the withdrawal percentage will be applied to the higher balance, resulting in higher income payments going forward.

Guaranteed Minimum Growth Rate. Once you open an annuity with a lifetime income benefit rider, the plan carries a minimum compound growth rate at which your annuity continues to grow. 5% per year is not unusual, though the actual percentage rate will vary. Your withdrawal percentage will also be loosely based on this percentage.

Maximum Withdrawal Amount. This feature makes sure that the amount of money you are withdrawing from the annuity is sufficient to cover your income needs. A typical range is between 5% and 7%, but some plans may allow 10% or even more.

Lifetime Income Benefit Examples

Any type of financial instrument is always best explained and demonstrated by case examples. Let’s take a look at three different scenarios and see how the lifetime income benefit rider performs under each set of circumstances.

Scenario #1 – The Financial Markets Decline After You Start Your Annuity.

This is an example of the guaranteed minimum growth rate described above. Let’s say that you take an annuity for $200,000 with the intention that you will retire in 10 years after the account has had an opportunity to grow significantly. But instead of increasing in value, a prolonged bear market drops the value of the account to $150,000. If your income payment percentage is 5%, you might be limited to $7,500 per year in income.

But if you have taken a lifetime income benefit rider with a guaranteed minimum growth rate of 5%, the value of the annuity will instead be $326,000 after 10 years at that rate. If you’re income payment percentage is also 5%, you will be able to receive income payments of $16,300 per year instead.

Scenario #2 – The Financial Markets Perform Very Well Between the Time You Open Your Annuity and You Begin Taking Income Payments.

This scenario is an example of a step up provision. Continuing with the same facts as in Scenario #1, except that, due to a very strong investment market in the 10 years between when you started the annuity and you began taking income payments, the annuity is worth $500,000. If your income payment percentage is 5%, then your annual income payments will be $25,000 per year ($500,000 X 5%).

Without the step up provision in the rider, your annual income payments would be just 5% of $326,000, or $16,300 per year.

Scenario #3 – The Financial Markets Decline After You Begin Taking Income From Your Annuity.

This scenario is an example of a lifetime income benefit rider with a step up provision in which the insurance company allows you to base your income payments on the highest value of the account over a ten-year period.

Continuing with the same facts from Scenario #1, except that at some point during the 10 year period after you began your annuity, the value of the account was as high as $400,000, sometime before it crashed down to $150,000. If your set up provision allows for the income percentage to be based on the highest value, then your payments will be based on the high value of $400,000 and not the current level of $150,000.

What a Lifetime Income Benefit Rider Costs

There is a fee charged to your annuity for adding a lifetime income benefit rider. The actual amount varies depending on the insurance company, as well as the type of annuity, but it generally falls between 0.5% and 1.5% per year.

It’s also likely that the specific amount that will be charged will be based on the features included in the rider. For example, while a company may charge you 0.35% per year for the rider, they may charge 0.60% if the rider includes a step up provision.

The fee is charged as a reduction in your income payment percentage. For example, if the cost of the lifetime income benefit rider is 0.75%, and the income payment percentage is 6.00%, then you will receive a net income payment percentage of 5.25% per year for the life of the annuity.

Final Thoughts – Why You Might Want to Add a Lifetime Income Benefit Rider to Your Annuity

A lifetime income benefit rider is an excellent add-on if you are concerned about the possibility of outliving your money. This is especially true for a person who begins retirement fairly early. For example, you are allowed to begin taking penalty-free withdrawals from tax-sheltered retirement plans as early as age 59 1/2. If you start your retirement at this age, you’ll need to have an income that will last for at least 30 years.

The lifetime income benefit rider will ensure that your annuity continues to pay you an annual income for virtually the rest of your life. Even if the actual value of your annuity is fully depleted after 20 years or so – which is typical of annuities – your plan will continue to pay you income payments each year.

You probably don’t want to add a lifetime income benefit rider to your annuity if you don’t plan to begin taking income payments from the plan until you are, say, 70 or older. Since your life expectancy at that age will be lower, the rider may not be worth the cost for you to have it included with your annuity.