- Key Takeaways:

- – Offers remote tax preparation

- – Helps clients with tax debt relief strategies

- – Provides bookkeeping services

Falling behind on your taxes can be overwhelming. It’s estimated that American tax debt, with federal and state taxes combined, is about $527 billion. The longer you go without filing or paying your taxes the more daunting getting back on track can feel.

Taxpayers who are struggling financially due to the COVID-19 pandemic can get help from tax relief services. These services offer support and products to help chart a way forward in the face of a financial crisis.

There are many tax services out there — some are truly helpful while others take advantage of people in desperate tax situations. It’s important to accurately research and compare the best tax services before choosing one.

Considering Anthem Tax Services for your tax preparation or debt relief? Here’s what you need to know.

Table of Contents

About Anthem

Anthem Tax Services has a team of tax professionals who are licensed in all 50 states and have a combined 30 years of experience. You’ll work with certified tax professionals who can provide remote tax preparation and debt relief.

They can also assist in creating an offer of compromise or installment agreement that makes your tax situation more manageable.

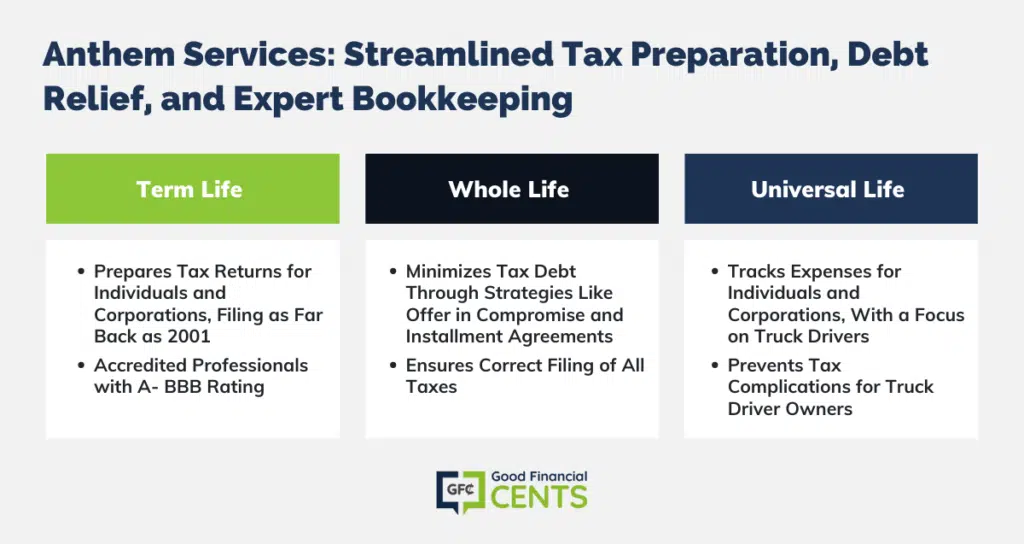

Anthem Services

Anthem Tax Services provides tax preparation and debt relief services remotely to both individual and corporate clients across the United States.

They specialize in helping clients minimize their tax debt through assistance with submitting an “Offer of Compromise”, fresh start forgiveness, or an installment agreement. Anthem also offers bookkeeping services for those who want help with their finances throughout the year.

Tax Preparation

Anthem offers tax preparation services for individuals or corporations at any time during the year. They’ll also help you catch up on filing any taxes you might have missed — they can file missed tax returns for as far back as 2001.

Anthem’s tax professionals are accredited by industry groups, like the National Association of Tax Professionals and the National Association of Enrolled Agents.

They currently have an A- rating with the Better Business Bureau.

To prepare your individual tax return you’ll need to have documented information about your income and expenses for each tax year that you’re filing.

For corporate tax returns, you’ll need to provide information such as your dividends, cost of goods sold, gross receipts, and expenses such as interest paid and rent.

Tax Relief

Carrying a tax burden can be a stressful experience, but it’s important to remember there are ways to pursue relief. The IRS has a number of strategies for taxpayers who are behind on their taxes and having difficulty getting current and Anthem Tax Services can walk you through your options.

For example, the IRS has a Fresh Start program that allows taxpayers to create an Offer in Compromise to settle their debt.

However, first, you must file any tax returns that you haven’t filed in the past. All your returns, past and current, must be filed correctly. If you’re not sure how to do this, Anthem Tax Services will review any outstanding issues and get your tax returns up to date.

The IRS also offers other forms of tax relief that Anthem helps clients navigate such as an installment agreement or penalty abatement.

Bookkeeping

In addition to tax preparation and debt relief, Anthem also offers bookkeeping services to corporations and individuals, with a particular focus on helping truck drivers.

As a bookkeeper, Anthem helps keep track of expenses such as union dues, mileage, insurance, and permits. This can help truck drivers who are owners and not considered employees. Detailed bookkeeping upfront can prevent tax headaches down the road.

Unique Features

What sets Anthem Tax Services apart and why would you choose them over all of the many tax preparation services out there?

Here’s what you need to know about Anthem’s unique features.

- Fully remote: Anthem has offices in Florida and California but operates on a fully remote basis. Anthem has team members licensed in all 50 states so they are prepared to help clients across the country.

- Focus on truck drivers: Anthem Tax Services is equipped to cater specifically to truck drivers. Having a tax professional who understands the nuances of your industry can be a major help when it comes to the practicalities of tax filing, such as knowing which expenses are tax deductible.

- A- Better Business Bureau (BBB) rating: There are many tax preparation services out there taking advantage of taxpayers who feel desperate. Anthem Tax Services has 4.5 out of 5 stars based on 231 customer reviews available from the Better Business Bureau.

When to Use Anthem

Who would benefit the most from using Anthem to file their taxes?

Here are some scenarios when Anthem could be a good fit:

- Social distancing. If you’re trying to avoid going into an office due to self-isolating or social distancing during COVID-19, Anthem’s fully remote capabilities could be what you’re looking for. They are able to complete all of their services online.

- Income in multiple states. Anthem Tax Services has tax professionals who are licensed in every state, so if you moved during the year or have income in multiple states, Anthem could be well-suited to help you file your taxes.

- Unfiled returns. If you need to catch up on filing your taxes before pursuing tax debt relief options, Anthem is equipped to help you do this and can walk you through any future options when it comes to approaching your tax debt.

Anthem vs. Other Tax Relief Competitors

There are a lot of tax relief companies out there, here’s how some of the top competitors look when compared against each other.

| Company | BBB rating | States served | Services |

|---|---|---|---|

| Anthem Tax Services | A- | 50 States | Tax preparation, tax resolution, bookkeeping |

| Community Tax | A+ | Not Specified | Tax preparation, tax resolution, bookkeeping, tax assurance |

| Larson Tax Relief | A+ | 50 States | Emergency and long-term tax relief |

What You Should Know About Tax Relief

Even though there are many success stories from people who have used tax relief companies to get out of negative situations, they’re not the right solution for everyone.

Not all tax relief services are legitimate. In fact, the IRS has issued several warnings about tax scams.

As more tax services go online an important scam to be wary of is what the IRS calls the “ghost” tax return preparer — this is where a tax preparer completes your return but doesn’t sign it or provide their Preparer Tax Identification Number (PTIN).

If anything goes wrong with your return, you’re left unable to track down your original preparer. Be sure to ask anyone who’s preparing your tax return for their PTIN, which they’re required to have by law.

Also, make sure to review your tax return and ask clarifying questions about anything you don’t understand.

Something else to consider is whether you need the help of a tax relief service to get out of tax debt. The IRS has many online resources to help you navigate tax relief by yourself, such as their Offer in Compromise Pre-Qualifier.

If you feel confident navigating the paperwork by yourself, you could save money with a DIY approach. You can also take advantage of free government-sponsored and nonprofit tax help.

The Bottom Line: Anthem Tax Services Review

Working with Anthem Tax Services has both pros and cons. On the one hand, it’s entirely remote and they’re qualified to help with tax preparation and tax relief in any state. Their A- BBB rating distinguishes them from some of the scam tax preparers out there.

Conversely, you might be confident enough to handle your tax preparation by yourself and could save the fee that Anthem Tax Services will charge you to complete the paperwork. If you’re already tight on money and owe a tax debt, this fee could make a big difference.

If you’re going to use a tax relief service, be sure to research the top competitors to make sure you’re going with a company that’s legitimate and has the right mix of services for your situation. Compare some of the best tax relief services to help you decide which is right for you.

Anthem FAQs

Anthem Tax Services has a BBB rating of A- with 45 complaints filed against them as of September 2020. You can review official complaints against Anthem Tax Services through the Better Business Bureau.

Anthem Tax Services provides no information about their costs online. To learn more about their service fees, contact them at (888) 548-0478.

You can reach Anthem Tax Services by phone at (888) 548-0478.

How We Review Tax Preparation Software:

Good Financial Cents reviews various tax preparation software options, emphasizing user experience, feature sets, and accuracy in calculations. We aim to provide users with a balanced perspective, assisting them during tax season. Our editorial process is transparent and thorough.

We source data from software providers, testing functionalities and evaluating user interfaces. This hands-on approach, combined with our research, ensures a comprehensive review.

Each software option is then rated based on its strengths and weaknesses, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate tax preparation software and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Anthem Tax Services Review:

Product Name: Anthem Tax Services

Product Description: Anthem Tax Services is a tax resolution firm specializing in helping clients with various tax-related challenges. They offer an array of services from tax preparation to handling complex issues like back taxes, liens, and wage garnishments. The firm employs a team of licensed tax professionals, CPAs, and attorneys to assist clients.

Summary of Anthem Tax Services

Anthem Tax Services stands out as a comprehensive solution for those facing tax-related concerns. With a blend of licensed professionals ranging from tax preparers to attorneys, the firm is equipped to handle a diverse range of tax situations, whether they are straightforward or complex. Their services encompass not only tax preparation and planning but also intricate resolutions such as tax settlements, penalty abatements, and audit representation. This robust offering is aimed at ensuring clients find solace from tax burdens and achieve financial peace of mind.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Diverse Team: The firm boasts a combination of tax professionals, CPAs, and attorneys, ensuring expert handling of various tax scenarios.

- Wide Range of Services: From basic tax preparations to intricate tax resolutions, they cover a broad spectrum of tax-related needs.

- Transparent Pricing: Anthem often provides transparent pricing, giving clients clarity on what they will be charged.

- Customer Service: Many clients appreciate their attentive and responsive customer support.

Cons

- Service Limitations: While they offer a wide range of services, some niche tax issues might be outside their purview.

- Cost: Depending on the complexity of the case, some users might find their fees to be on the higher side.

- Availability: Their physical presence might be limited to certain locations, although they serve clients nationwide.