Breathe in.

Smell that?

It’s the stench of a variable annuity.

If you just threw up a little bit in your mouth, I don’t blame you.

If you didn’t, you probably don’t know enough about variable annuities.

What’s a variable annuity?

It’s a contract between an owner and an issuer whereby the owner agrees to give the issuer principal, and in return, the issuer guarantees the owner variable payments over time.

Sounds innocent enough, but are they?

Variable annuities are one of those products of which I can pretty much make a blanket statement and say they’re horrible.

“Why are they horrible, Jeff?”

I thought you’d never ask. Let me count the ways!

Table of Contents

1. You’ll Pay High Fees

Variable annuities have extremely high fees. Picture a Tasmanian devil gobbling up your money. Picture throwing cash into a bonfire. Picture . . . well, you get the idea.

The national average for variable annuity fees is 3.61%. Ouch! Remember, that’s just the average. Fees can go above 5% and you may not even realize it when it happens to you.

And by the way, I’m not the only one speaking out against these outrageous fees.

Here’s what Michael Gauthier, CERTIFIED FINANCIAL PLANNER™ from Strategic Income Group says about variable annuities:

Variable annuities are one of the most oversold products in the financial services industry.

Especially for people that are in the Accumulating Wealth Phase of their lives, these investment vehicles tend to slow down the process of actually accumulating wealth due to the high fees that are associated with these products.

Most investors would be better off owning lower cost options in ETFs and/or appropriate mutual funds.

Thank you, Michael. I agree.

High fees can make a huge dent in your potential earnings. Even if you are expecting to make a 7% return with an annuity, those fees will make that number look much less attractive.

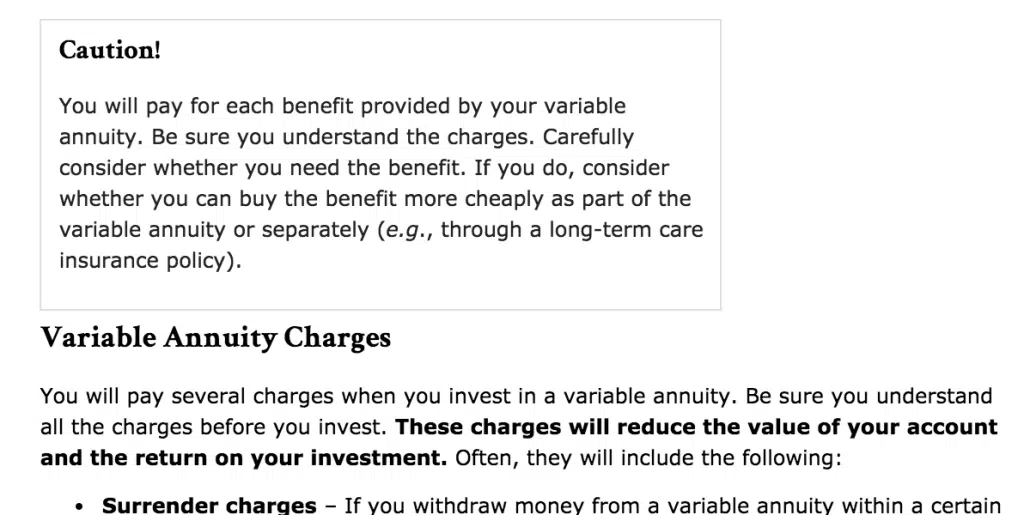

Variable Annuity Fees

Curious about what types of fees you can expect to pay? Here’s a breakdown of what could potentially be eating away at your returns (quotes via the SEC):

| Mortality and Expense Risk Charge: | “This charge is equal to a certain percentage of your account value, typically in the range of 1.25% per year. This charge compensates the insurance company for the insurance risks it assumes under the annuity contract. Profit from the mortality and expense risk charge is sometimes used to pay the insurer’s costs of selling the variable annuity, such as a commission paid to your financial professional for selling the variable annuity to you.” |

| Administrative Fees: | “The insurer may deduct charges to cover record-keeping and other administrative expenses. This may be charged as a flat account maintenance fee (perhaps $25 or $30 per year) or as a percentage of your account value (typically in the range of 0.15% per year).” |

| Underlying Fund Expenses (Sub-Accounts): | “You will also indirectly pay the fees and expenses imposed by the mutual funds that are the underlying investment options for your variable annuity.” |

| Additional Riders: | “Special features offered by some variable annuities, such as a stepped-up death benefit, a guaranteed minimum income benefit, or long-term care insurance, often carry additional fees and charges.” |

| Surrender Charges: | “If you withdraw money from a variable annuity within a certain period after a purchase payment (typically within six to eight years, but sometimes as long as ten years), the insurance company usually will assess a “surrender” charge, which is a type of sales charge. This charge is used to pay your financial professional a commission for selling the variable annuity to you. Generally, the surrender charge is a percentage of the amount withdrawn, and declines gradually over a period of several years, known as the “surrender period.” |

Even the SEC warns against the high fees that variable annuities have:

What makes variable annuities so sneaky is the fees are hidden. Literally.

You’ll hardly ever see the fees on your statement. If you really want to find out how much you’re paying you’ll have to read the prospectus. Do you know that 47-page booklet that looks like something only a 3rd-year law student would be interested in reading?

I often joke with my clients suggesting they put an annuity prospectus on their nightstand if they are suffering from insomnia. Reading the prospectus will cure anyone’s insomnia in minutes! 🙂

And by the way, that’s not the only factor that can hurt you . . . .

2. You’ll Have Limited Investment Options

Variable annuities have something called sub-accounts, which are basically clones of various mutual funds.

Now, when you sit down with an insurance salesperson – and even some investment advisors – and they tell you that you can choose from a variety of investment options within your variable annuity, they’re telling the truth.

But what they aren’t telling you is that you can’t choose from any mutual fund – you must choose from their predetermined list of sub-accounts.

I don’t know about you, but I love to have choices. Choices are a good thing, especially when it comes to investing.

What’s even more frustrating is trying to do research on the sub-accounts within variable annuities. While there are some that are modeled directly after open-ended mutual funds, there are 1,000’s that are extremely difficult to find any data on whatsoever.

I’ve personally spent hours trying to do research on several variable annuity sub-accounts using both Morningstar and Thomson Reuters research tools only to find myself beating my head against my desk after hitting dead end after dead end.

If it’s difficult for me to do research on sub-accounts, think how difficult it must be for the investor who isn’t privy to all the paid research tools that I and other advisors have.

So while companies that sell variable annuities may boast about how many options you have inside of a variable annuity (say, around 80 to 300 mutual funds), you have many more options if you just open a TD Ameritrade account, and it will be MUCH less of a headache trying to do research on them.

3. Guaranteed Death Benefit and Income Accounts Aren’t Always Here to Stay

You read that right.

Companies do not have to be in financial trouble to take away the death benefit or income riders for new policies, and sometimes they try to change existing policies when possible. One company offered a lump sum to tempt people to get rid of guarantees.

Another required certain changes to be made or the riders would be eliminated. Here’s a sample of what that company was requiring their shareholders to do:

That’s why it’s important to understand that changes in a company’s policy may affect your ability or willingness to maintain those benefits.

In summary, guaranteed death benefits and income accounts may have a lot of fine print you should understand before you sign on the dotted line.

4. Your Variable Annuity Might Be a Time Bomb

Cut the red wire! No wait, the blue wire! Yes, the blue wire!

Bang.

Oh well, you just lost your money. And guess what? You really didn’t have a choice anyway.

This can happen to you. Mike Lester at Fortune.com explains how, and I’ll break it down for you here.

Lester shows how there are certain restrictions that come with some variable annuities because of a correlation between some income and death benefit riders that have been sold with variable annuities in recent history, and restrictions that accompany those riders.

What are those restrictions? Well, we already covered how death benefits and income accounts aren’t really guaranteed. But sometimes there are more restrictions.

This particular “time bomb” restriction has to do with income or death benefit riders that are restricting the investment options to portfolios that require a minimum percentage of bonds held at all times in the account.

Why is this a problem? Well, many times these insurance companies who offer variable annuities don’t offer a fixed interest option or money market option in the account. This creates a situation where your money must be 100% invested in the market all the time.

Now, the idea of using equities and bonds to create a balanced portfolio isn’t new, and it’s certainly not bad practice.

But if you’re forced to stay in the market because of the restrictions of your variable annuity, you may be also forced to watch your account lose money while interest rates are going up and quit markets are correcting.

Because the funds invested in a variable annuity are in the market, you can potentially lose your money. Oh, and just because you read the word, “guaranteed,” that doesn’t mean you’ll necessarily get a guaranteed return. Read the prospectus!

If you’re wanting a way to save your money and make a little interest, try a high-yield savings account.

5. You’ll Pay High Fees

Yes, I know I’m repeating myself. But I’m doing so for a very good reason.

Listen, the last thing you want to do is pay outrageous fees. Too many variable annuity policies have these unreasonable fees, and they will eat away at your money.

Here’s what Todd Tressider at FinancialMentor.com says about variable annuities:

. . . consumer advocates argue some variable annuity fees are so steep it can take more than a decade to outperform more straightforward investments, the benefits are misrepresented, and the restrictive features and penalties aren’t adequately understood.

Now, you might be asking, “Okay Jeff, so how do I invest without paying those high fees?”

One great option is investing in the stock market with AssetLock™. AssetLock™ is proprietary software that is only available through a select group of advisors. The software is designed to monitor your stock market accounts every single day.

I am an AssetLock™ approved advisor. I’d be happy to show you how AssetLock™ works and explain why it’s a great alternative to variable annuities. Take me up on this offer!

Oh, and remember what Todd said about variable annuities – that the benefits are often misrepresented? Even if you think the fees are worth the benefits, you could find out later that the benefits weren’t quite what you originally thought.

Let’s Summarize! – Why You Shouldn’t Buy a Variable Annuity

The bottom line is that variable annuities stink. I mean, really.

But let’s summarize our key points here!

First, you have the outrageous fees. Then, these variable annuity companies are going to limit your investment options. You also can’t be too sure that these companies are going to want to keep your death benefit and income account benefits around.

And scariest of all, you could lose all your money because you’re investing in the stock market without some kind of monitoring like AssetLock™ provides.

And remember, the benefits can be really confusing. Here’s what Alan Moore, CERTIFIED FINANCIAL PLANNER™ at Serenity Financial Consulting says about benefits:

Variable annuities are incredibly complex and are difficult for most financial advisors to understand, so I don’t expect the vast majority of consumers to really understand how they work.

He also went on to say:

There are plenty of advisors that don’t earn commissions, so consumers should be sure their advisor is working in their best interest.

I agree. Learn how the fees and commissions work, and hopefully you’ll understand why it’s important to say no to variable annuities!

Hi Jeff – Love your website and perspective!

I agree and disagree with your article here respectfully. Variable Annuities can definitely be the wrong investment for many investors, however, I often find it is the advisor placing them to be the main issue.

I have seen these products do a lot of good over the years; you just need to be well researched in the product offerings which a solid advisor should do.

Like anything else, they have a place for the right person at the right time for the right reasons. Just because I don’t believe in drinking milk, doesn’t that you shouldn’t either, right?

Thanks for reading. I look forward to seeing your email correspondence …and I will be peeking into your book as well 🙂

-Rob