Welcome to another Ask GFC! If you have a question that you want answered you can ask it here.If your questions get featured on GFC TV or the GFC Podcast, you are the lucky recipient of a copy of my best selling book, Soldier of Finance, and a $50 Amazon gift card.So what are you waiting for? Ask your question now!

This is a question that’s on the minds of most people, but it came specifically from Ask GFC reader Erica W. —

Erica, you haven’t given me any specifics, such as your age, your retirement horizon, or how much you earn, so my answer to your question is going to be very general. That’s good too, because a lot of people have the same question, so hopefully my response will help a lot of readers.

You do have a twist in there, with your $4,000 credit card debt. Since you mentioned it, you must consider paying it off to be a priority. I agree. But it’s a fairly manageable amount that you should hopefully be able to pay in addition to funding your retirement. You might consider a part-time job and dedicate the income to paying off the debt, or delaying your retirement contributions by a year or so to enable you to first payoff the cards.

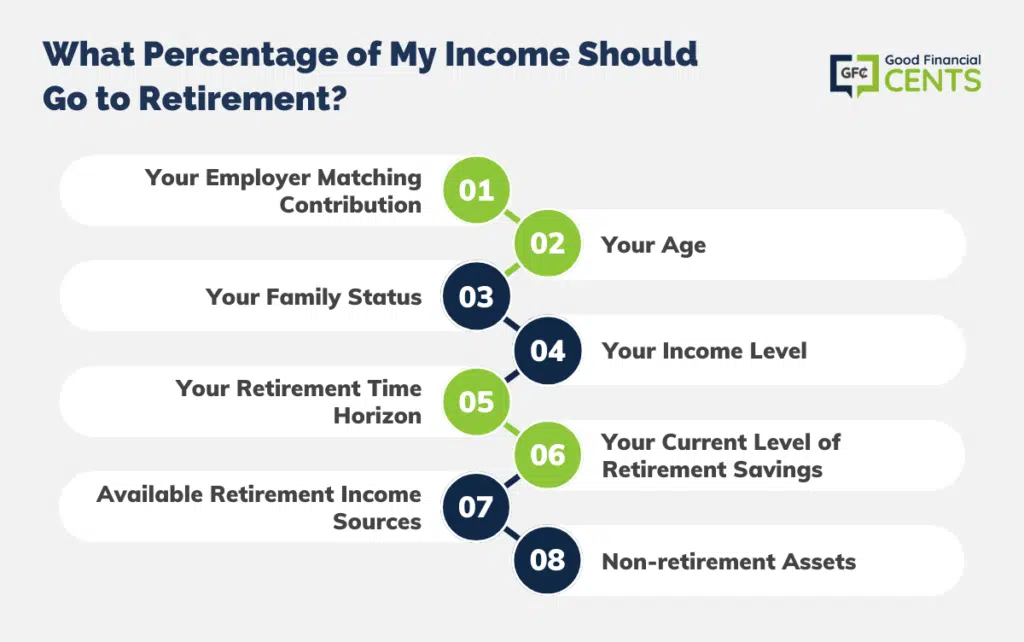

There is no flat answer to the main question about how much to contribute. That’s because there are several factors – eight at least – that go into deciding what percentage of your income should go to retirement. Let’s take a look at each, one at the time, and hopefully, you will find the answer to your own question in your answers.

Table of Contents

1. Your Employer Matching Contribution

Does your employer provide a matching contribution to your retirement plan? If so, you’ll want to contribute at least the minimum that you need to in order to get the maximum employer match.

For example, let’s say your employer will provide a matching contribution of up to 50% of your contribution, up to 5% of your income. You can get the full 5% match by contributing 10% of your pay to your plan. The combination of the two will mean that 15% of your income will be contributed to your plan each year.

The employer match is like getting free money, and that’s why you will want to get the biggest one that you can.

2. Your Age

As a rule, the younger that you are the less that you need to contribute. Conversely, your contributions might have to get larger as you get older. If you’re in your 20s, it might be enough to simply make the minimum contribution required to get the maximum employer matching contribution. Since you will have 40 or so years to save for retirement, this may be enough to build the kind of retirement portfolio you need.

You’ll probably want to contribute a higher percentage as you get older and closer to retirement, but that will also depend upon how much you have saved for your retirement up to this point.

3. Your Family Status

If you have young children, you’ll need more of your income in order to provide for living expenses. That will, of course, leave less to contribute to a retirement plan. You may even find that you can make only a very minimal contribution, and that will have to be enough until your expenses begin to settle down, and your income increases.

At the opposite end of the spectrum, if you are an empty-nester or you don’t have children, you should have more income available to put towards your retirement. You may even want to contemplate early retirement, which is easier to accomplish when you don’t have dependent children.

4. Your Income Level

The higher your income level is, the more you should be contributing to your retirement plan. While percentages are fixed regardless of income levels, it is admittedly harder to make ends meet on a smaller income than it is on a larger one. Some expenses rise and fall with income level, but others, like gasoline, bread, and even health insurance, are the same regardless of how much you make.

But this shouldn’t enable you to ignore the fact that saving for retirement does involve a healthy amount of sacrifice. No matter what income level you are at, you will have to make room in your budget to make your retirement contributions. The more you are able to carve out of your budget, the more that you will have available to put into your plan.

Also, keep in mind that your contributions to your retirement plan are tax-deductible. That means that at least part of your contributions will be funded by the income tax you have to pay as a result of making them. But once again, this favors higher incomes because they have higher income tax rates.

A person who is in the 33% tax bracket is getting a whole lot more help with contributions from the government then someone who is in the 15% bracket.

5. Your Retirement Time Horizon

The sooner that you hope to retire, the more you will need to contribute your retirement plan. Contributing 10% per year may be plenty if you’re 30 years old and expect to retire at 65. But if you are 40 years old and want to retire at 55, you may have to contribute 20% or even more.

6. Your Current Level of Retirement Savings

The more that you have in retirement savings – relative to the amount of money you will need for retirement – the less you will need to contribute. For example, if you’re 35 years old and you expect to retire at 65, and you already have $250,000 in your retirement plan, you can save a lower percentage of your income than someone in a similar position who has only $50,000.

Let’s say that both people are earning an average return on investment of 10% per year. The person who has $50,000 in retirement savings is earning $5,000 per year. But the one with $250,000 is earning $25,000 per year. Each is earning 10% on their money, but the one with the larger retirement portfolio is earning a lot more in dollars. Higher contributions can at least partially offset this difference.

7. Available Retirement Income Sources

Virtually everyone who has earned income, and pays FICA taxes on it, is entitled to collect Social Security retirement benefits. But if you also have some sort of employer provided pension plan – which is more typical of government employees – then you will not need to save as much in your retirement plan.

If however you don’t have an employer pension – which is most people now – you’ll have to save a much higher percentage of your income. The income that will be provided by a retirement portfolio will be necessary in order to supplement your Social Security income. In a way, your retirement savings will become your pension, which is really the whole point of 401(k) and other plans.

8. Non-retirement Assets

Whenever you are contemplating retirement, you have to look at your entire financial picture. That includes retirement savings, but it also goes beyond. How much money you have saved – or expect to have saved – in non-retirement assets should impact your retirement plan contribution level.

Examples of non-retirement assets include:

- Your primary residence (if you own one) and/or a second home

- Business equity

- Non-tax-sheltered investments, like stocks, mutual funds, brokerage accounts, etc.

- Cash value of life insurance policies or annuities

If you have any of these assets, and expect to liquidate them by the time you retire, you will not need to save as much for retirement. However, if you don’t have these assets, or you do and you don’t plan to sell them, your retirement contributions should be higher.

Final Thoughts

Erica – and anyone else who has this same question – I realize that this list doesn’t exactly provide you with a calculator to precisely determine what your retirement contributions should be. But there really is no way to do that. Your contribution level will vary, depending upon your personal situation in regard to each of these factors.

If you’re unsure, the best strategy is to set your contribution level a little bit higher than you think it should be.

Time, Time, Time is key! The more you save when you are young, the greater your retirement savings will be. I also think the debt question is of primary importance, especially to millennials who have a lot of student loans. Thanks for this article.