Associated Bank is a bank offering lending and other banking and personal finance services in the Midwest, particularly in Minnesota, Wisconsin, and Illinois.

The bank headquarters are located in Green Bay, Wisconsin, and the oldest branch that became a part of Associated Bank was founded in 1861 in Neenah, Wisconsin. It has a grade of A+ from the Better Business Bureau.

Table of Contents

Background of Associated Bank

Associated Bank was formed in 1970 through an alliance of three Wisconsin-based banks and is headquartered in Green Bay, Wisconsin, with branches in Illinois and Minnesota.

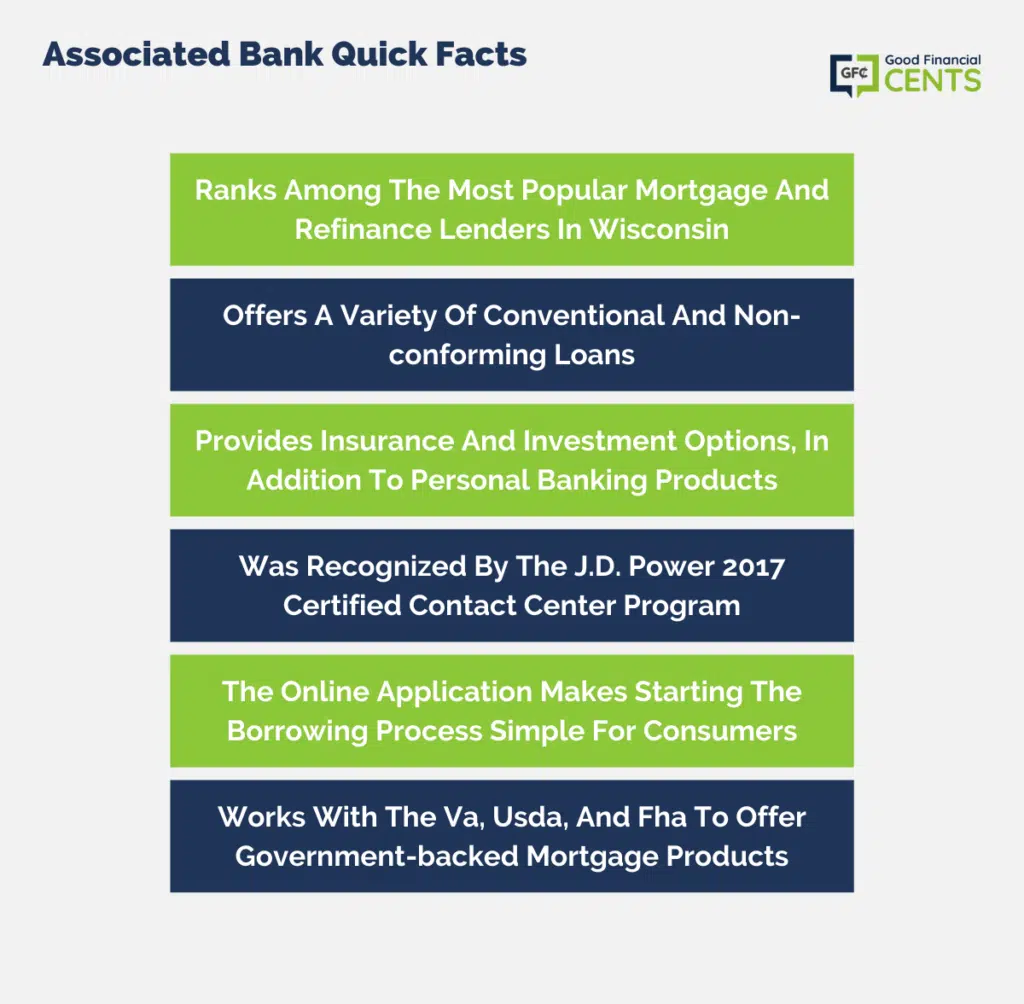

This bank is not listed in the top lenders in the U.S. mortgage industry, nor is it among the top originators on the Consumer Finance Protection Bureau’s list.

It’s among the leading lenders in the Midwest, particularly Wisconsin.

The loan options available through Associated Bank are varied and appeal to a host of borrower needs. The bank offers conforming loans as well as jumbo mortgages and government-sponsored programs.

Associated Bank has a good reputation, with an A+ rating from the BBB and no history of actions against the company by the Consumer Finance Protection Bureau.

The bank has fairly strict mortgage qualification requirements. It typically won’t work with consumers who have credit scores below 620 and requires a minimum 5 percent down payment from homebuyers who aren’t first-timers.

Consumers who have generally good credit and are looking for a standard mortgage will likely have a positive experience working with Associated Bank.

Associated Bank Loan Specifics

Associated Bank provides numerous loan types to accommodate buyers with varying needs. Conventional mortgages, for example, can feature fixed or adjustable rates, making them ideal for many homebuyers.

Some, on the other hand, will be eligible for government-backed loan programs such as FHA, VA, or USDA loans, which feature lower down payment requirements.

Associated Bank also offers jumbo mortgages for those who have their eyes set on a higher-priced home.

Fixed Rate Loans

Fixed-rate mortgages are available in flexible loan terms. Customers who opt for these types of loans also have access to preferred rates and discounts on checking accounts, certificates of deposit, and other Associated Bank products.

Fixed-rate mortgages provide long-term predictability, so this option might be best for homebuyers who plan to stay in their home for many years or those who prefer to stick to a predictable budget.

Adjustable Rate Loans

Adjustable-rate mortgages have rate protection for up to 10 years. Consumers who choose this option will likely see low upfront rates.

This is well-suited for people who plan to sell their home in a few years or who expect to increase their income in the 5-10 years after the home purchase.

Jumbo Loans

Nonconforming or jumbo loans offered through Associated Bank allow buyers to take out loan amounts beyond the maximum borrowing limits set by governmental entities Freddie Mac and Fannie Mae. In most counties, the limit has been raised to $766,550 in 2025.

Associated Bank offers jumbo loans with both fixed and variable rates and the chance to combine a jumbo mortgage with a second mortgage to help consumers control costs.

FHA Loans

FHA loans are insured by the Federal Housing Administration and offer low-cost mortgage insurance and flexible credit requirements. Unlike typical conforming loans, FHA loans have lower down payment requirements and often include closing costs and fees.

VA Loans

VA mortgages don’t require a down payment or mortgage insurance and allow buyers to finance 100 percent of their home.

Rates and fees are generally lower for VA loans, and credit requirements are usually more flexible. These loans can also help borrowers unable to cover closing costs.

VA loans are provided through the Department of Veterans Affairs, which works with qualified lenders such as Associated Bank.

Refinance Loans

Refinancing a mortgage gives consumers access to their home equity in the form of cash and can potentially lower interest rates.

Those who have adjustable-rate mortgages, for example, can refinance to a fixed-rate loan and benefit from fixed monthly payments. Another option is to refinance to a shorter loan term, which can help build equity faster.

Rural Housing Loans

The U.S. Department of Agriculture offers rural housing loans through the Guaranteed Rural Housing program. Consumers who meet the income requirements and are purchasing a home in a rural area, as defined by the USDA, are eligible for these loans.

Consumers can finance up to 100 percent of their home. Some closing costs may be included in the loan as well.

Associated Bank Mortgage Customer Experience

Customers can apply for an Associated Bank mortgage online. The bank notes that the application will take about 15-20 minutes to fill out, though users can also save the application to finish later.

After the application is submitted, a mortgage professional will reach out to the applicant by phone within the next business day.

The application page offers checklists of necessary items to apply for a purchase or refinance loan, a second mortgage, or a VA mortgage. Associated Bank has a first-time homebuyer guide on its site to help people understand the mortgage process.

Customers can check up-to-date mortgage rates in the Daily Rate Sheet, though there doesn’t appear to be a way for users to sign up for email alerts for rate changes.

The bank’s resource center provides articles about mortgages, home buying, and other personal finance topics. There’s a long list of personal finance calculators and tools in the resource center, with 21 of the 47 listed pertaining to home financing.

Though the bank has received generally positive scores from the Better Business Bureau and Bankrate, some consumers have expressed issues with Associated Bank, particularly due to their strict credit requirements.

Associated Bank Lender Reputation

Associated Bank is a bank active in the Midwestern states. It was founded in 1970 with the alliance of Kellogg Citizens Bank of Green Bay, Manitowoc Savings Bank, and First National Bank of Neenah. First National Bank was the oldest of the three, dating back to 1861.

Associated Bank’s contact centers were certified by the J.D. Power Certified Contact Center Program in 2016 and 2017, highlighting excellence in customer service.

To achieve this distinction, an institution must rank in the top 20 percent of customer service scores, and its representatives must have detailed knowledge about the services customers ask about and be able to resolve issues promptly.

Associated Bank has an A+ from the Better Business Bureau and has been accredited since 1945. For the last three years, there have been 77 customer complaints against the company on the BBB website.

- Information Collected on October 15, 2023

Associated Bank Mortgage Qualifications

Associated Bank accepts gifted funds for homebuyers’ down payments. The gift money can total up to 100 percent of the down payment if the buyer wishes. They will also work with down payment assistance programs.

The minimum down payment required for first-time homebuyers is 3 percent, while FHA borrowers must put down 3.5 percent. Non-first-time homebuyers need to put 5 percent down.

The bank also requires borrowers to have a debt-to-income ratio of no more than 50 percent.

Associated Bank checks the credit scores of each loan applicant on Experian, Equifax, and Transunion. Two of the three must be 620 or above; if this isn’t the case, the applicant will most likely be turned away.

That said, it is possible in some cases for applicants who have non-traditional credit histories to be considered for a loan.

| Credit score | Ranking | Difficulty to get an Associated Bank mortgage |

|---|---|---|

| 800-850 | Exceptional | Easy |

| 740-799 | Very good | Easy |

| 670-739 | Good | Fairly easy |

| 580-669 | Fair | Difficult |

| 300-579 | Very poor | Very difficult |

Associated Bank Phone Number & Additional Details

- Homepage URL: https://www.associatedbank.com

- Company Phone: 800-236-8866; Mortgages: 800-236-3617

- Headquarters Address: 200 North Adams Street, Green Bay, WI 54305

- States serviced: Services in the greater Midwest, particularly in Minnesota, Wisconsin, and Illinois.

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability.

Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation.

Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Associated Bank Review

Product Name: Associated Bank

Product Description: Associated Bank is a leading Midwest banking institution, offering a comprehensive suite of financial services ranging from personal and business banking to wealth management. With over a century of operations, it has built a reputation for its commitment to community engagement and customer-centric services. The bank serves individual clients, businesses, and institutions across its expansive branch and ATM network.

Summary of Associated Bank

Founded in 1861, Associated Bank has grown significantly, now standing as one of the top 50 publicly traded U.S. bank holding companies. With its headquarters in Green Bay, Wisconsin, the bank has managed to intertwine its vast financial expertise with local understanding, offering solutions tailored to the diverse needs of the Midwest community. Whether it’s everyday personal banking needs, specialized business services, or sophisticated wealth management offerings, Associated Bank positions itself as a trusted financial partner. Their digital banking platform, coupled with a broad physical network, ensures convenience and accessibility for clients. The bank’s long-standing legacy in the Midwest has cemented its position as a reliable financial institution committed to fostering economic growth and community well-being.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Community Engagement: With deep roots in the Midwest, the bank is actively involved in local initiatives and philanthropy.

- Comprehensive Services: Offers a wide spectrum of financial services, catering to diverse needs.

- Robust Digital Platform: Modern online and mobile banking tools enhance user experience and convenience.

- Stable Reputation: Over a century of operations indicates reliability and trustworthiness in the banking sector.

Cons

- Regional Limitations: Predominantly serves the Midwest, which might limit those outside this geographical area.

- Fees and Rates: Some users have noted that the bank’s fees and rates are not as competitive as those of online or larger national banks.

- Customer Service Variability: Given its size, there can be inconsistencies in customer service experiences across different branches.

- Branch and ATM Limitations: While they have a notable presence in the Midwest, national accessibility might be limited compared to larger banks.