When facing the loss of a loved one, the last thing someone wants to think about is the expense related to the funeral. Often the cost comes as a shock to the family. When I lost my father in 2006, it was up to my step-mom and me to go about planning his funeral arrangements. I guess I always knew that the cost of a funeral could get pricey, I just never realized how much

Table of Contents

Average Funeral Costs

The cost of the average funeral has dramatically increased in the last 25 years. However, it’s an expense that we can’t avoid. Being prepared and understanding the costs involved can help the process of planning for a funeral a little bit easier and help people decide whether getting a burial insurance policy is the right choice to support their loved ones.

Breaking Down the Costs of a Funeral

From death to burial, and all the steps in between, today’s average funeral can cost upwards of $15,000. There are a few areas where the expense can be cut, such as in choosing the style and extravagance of the casket. But some basic services, such as the cost of the funeral director services cannot be avoided.

There are two areas that need to be looked at in terms of expense: the funeral service/funeral home fees, and the burial/cemetery fees. This is where a burial insurance policy can be very helpful.

Costs of Funeral Services

According to the National Funeral Directors Association, the average funeral cost is around $6,500. This does not include the burial fees, including plot and headstone.

Here’s a look at some of the fees broken down and what they cover:

- Non-declinable Basic Services Fee: $1800 – this fee can include the cost of the funeral directors services in securing permits, overhead, arranging the funeral plans, and coordinating services

- Removal/Transfer of Remains to the Funeral Home: $250 – while your loved one may pass at home, in a hospital, or someplace else, their body has to get moved to the funeral home for the services

- Embalming: $625

- Other Preparation of the Body: $200 – this may include dressing the body, grooming, or applying make-up

- Use of Facilities/Staff for Viewing: $395 – average cost, but can change based on the duration of viewing hours and space needed

- Use of Facilities/Staff for a Funeral Ceremony: $450 – let’s face it, those folks who drive the hearse, open the doors for visitors, fetch more tissues, etc… need to get paid

- Use of a Hearse: $275 – includes a driver and their services as well

- Use of a Service Car/Van: $125 – this is usually a limousine used to transport the family from the funeral home to the church and/or cemetery

- Memorial Printed Package: $125 – can include programs and mass cards

The Cemetery Costs

Costs related to the burial are separate than those of the funeral. The burial costs include:

- The Cemetery Plot: $1000 – this is the area of land purchased in the cemetery for the burial of the body

- The Vault: $700 – an airtight container is required to hold the casket, the cost can vary based on the material used

- Headstone: hundreds to thousands of dollars – this cost varies greatly based on the size, material chosen, engraving and details.

Regarding the headstone, I have to emphasize “cost varies greatly”. I was unaware of all the subtle differences that can go into selecting a headstone and how much the cost can escalate. For example, having smooth sides or edges really jumped the price up considerably.

Breaking Down Funeral Costs

| Expense Component | Typical Cost |

|---|---|

| Basic Services Fee | $1,800 |

| Body Transfer | $250 |

| Embalming | $625 |

| Facility Usage | $395 |

| Hearse | $275 |

| Service Car/Van | $125 |

| Memorial Printed Package | $125 |

| Cemetery Plot | $1,000 |

| Vault | $700 |

| Headstone | Hundreds to Thousands |

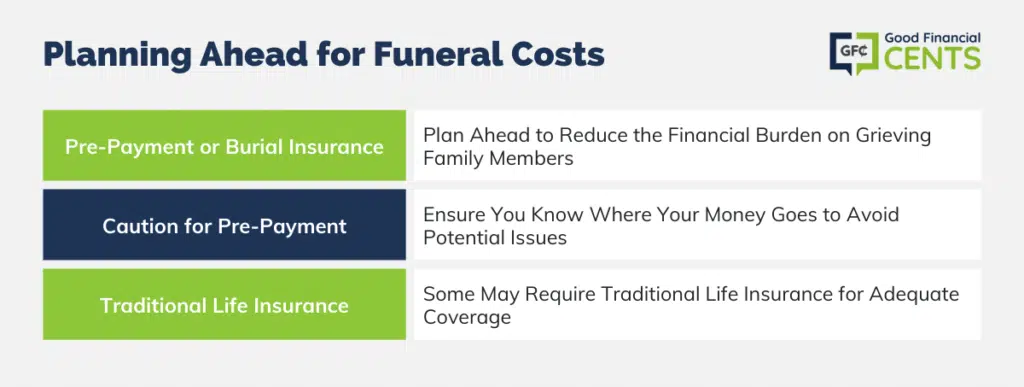

Planning Ahead for Funeral Costs

It is common now for people to plan ahead for their funeral services and even pre-pay or purchase a burial insurance policy. Arrangements and payments can be made over time with the funeral home to help family members not be burdened with the costs and details of funeral arrangements in their time of grief.

Even if your loved one hasn’t paid ahead, taking the time to consider what costs are really necessary and where you might be able to save is a good idea.

Word of caution on pre-paying funerals: make sure you know where the money is going. An estate attorney that I work with shared a story of a funeral home that was selling pre-paid funeral plans. Those plans became obsolete when the funeral home went bankrupt.

For some people, burial insurance isn’t enough – they need a traditional life insurance policy.

Did you have to bury a loved one and get shocked at how much it cost?

The Bottom Line – Average Funeral Costs and Expenses

The burden of funeral costs can be overwhelming during the already challenging time of losing a loved one. Over the past 25 years, funeral expenses have soared, with today’s average funeral exceeding $15,000. While some costs, like extravagant caskets, can be trimmed, basic services from funeral directors remain unavoidable. Two critical areas to assess are funeral service/home fees and burial/cemetery expenses, where burial insurance can provide vital assistance. The National Funeral Directors Association reports an average funeral cost of around $6,500, excluding burial fees.

Understanding the breakdown of these costs can help individuals make informed decisions, ensuring their loved ones are not financially burdened during a difficult period. Planning ahead and considering options like pre-payment or burial insurance can ease the financial strain, offering solace during grief.

This is very useful information! I won’t need burial insurance though, as my bank requires me to keep $10,000 in my interest-bearing checking account to avoid monthly fees. With that amount of money (or more) easily accessible, I think that my family will be fine. I also signed a POD form (payable on death) so that my bank account won’t need to go through probate for my heirs to access it. Advance planning is smart, no matter what your age or state of health!

Having $10,000.00 in the bank, even in a POD account, your funds won’t likely survive a stay in the nursing home ($7,500.00) per month and a final illness with a hospital stay can exceed most peoples’ liquid assets. Having a dedicated life insurance product that will increase in value over time (as most final expense products do) is a smart investment and the best protection of your assets.

What’s an average cost in Ohio, cremation rite away and no services

plase be kind to guide me for burial insurance funeral cost plaese