For nearly two decades, I’ve counseled clients through financial uncertainties, witnessing firsthand their concerns about safeguarding the assets they’ve diligently amassed.

Market fluctuations and headline news often trigger fears of potential loss, highlighting the necessity of asset protection strategies for not only safeguarding wealth but also ensuring my clients’ peace of mind.

I’m pleased to present insights from Blake Harris, Managing Attorney at Mile High Estate Planning. With his primary focus on comprehensive client protection, he has graciously offered to share his expertise on our blog. Here are Blake’s detailed thoughts on securing your assets effectively.

For those who have assets, making sure they are safe is a top priority. There are various threats to your continued ownership of your property, including lawsuits, creditors, and even divorce.

In today’s litigious society, many different people can try to take what you have worked hard for from you. The good news is you are not entirely defenseless in this area. There are laws you can use to your advantage in order to protect what you have, and it is entirely legal.

In order to do so, you will need an asset protection attorney who has an understanding of the relevant areas of the law.

Table of Contents

- What Is Asset Protection?

- Who Can Help?

- What Happens?

- When Do You Need It Most?

- What Are Different Types of Asset Protection?

- What Are Different Types of Trusts You May Need?

- What Is the Extent It Covers?

- How to Pick an Attorney

- The Bottom Line – The Basics of Asset Protection Planning – The Rules You Need to Know

What Is Asset Protection?

Asset protection encompasses a broad range of legal strategies designed to shield one’s assets from creditors, legal judgments, and personal life events such as divorce. This field doesn’t offer a one-size-fits-all approach; it includes diverse financial and legal actions tailored to individual circumstances.

Essentially, asset protection strategies are proactive measures taken to ensure that, regardless of what life throws your way, your assets remain firmly within your grasp.

The variety in asset protection means that for some, it could involve complex financial planning, while for others, it may necessitate the establishment of legal entities or trusts. The core objective is to create a robust defense against any situation that might threaten one’s financial stability.

It’s about understanding the nuances of your financial landscape and utilizing legal tools to create a bulwark around your wealth.

Who Can Help?

The complexity of asset protection calls for expertise that lies beyond the purview of laypersons. It’s a multidisciplinary realm where trust and estate law intersect with family law, business entities, and sometimes even international law.

Given the intricacies involved, one needs a guide who is well-versed in the varied and complex laws that govern asset protection.

Estate planning attorneys are the torchbearers in this domain. Their specialized knowledge can be the difference between a secure financial future and a vulnerable one. They not only design and implement the asset protection plan but also ensure its resilience against legal challenges.

Any misstep can render the plan ineffective, exposing your wealth to the very threats you sought to avoid. Therefore, seeking the right legal counsel is crucial in constructing a fail-safe asset protection strategy.

What Happens?

Asset protection planning often leads to two primary outcomes; both focused on safeguarding your wealth from potential legal threats. The first outcome revolves around the concept of securing your assets from legal actions, which can include lawsuits and judgments.

Securing Assets From Legal Action

Asset protection planning is designed to fortify your assets against claims from creditors or legal judgments. When legal action is taken against you, properly structured asset protection measures work to make your assets inaccessible to the opposing party.

This structure is pivotal in scenarios where you may be facing a lawsuit. By moving assets into structures such as trusts or legal entities that are recognized as separate from your personal holdings, these assets often become untouchable, shielding them from judgments.

Maintaining Flexibility for Legitimate Claims

Not all creditor claims are unfounded, and asset protection planning also accounts for this reality. Certain strategies ensure that there is a reservoir of liquid assets that can be used to address legitimate creditor claims.

This careful planning prevents the dismantling of your entire wealth portfolio in the face of legal challenges. The objective is to establish a legal framework that protects your assets while still allowing you to meet valid financial obligations without exhaustive litigation or loss of control over your assets.

The Balance Between Protection and Control

Asset protection is not about hiding or locking away your assets but rather about smartly managing them within the legal boundaries to guard against potential threats.

A well-designed asset protection plan strikes a crucial balance, acting as a robust shield for your assets while still giving you the flexibility to manage and control them.

This balance is vital, especially if and when you face adverse judgments, ensuring that you are able to navigate the situation without losing your financial autonomy.

When Do You Need It Most?

The simple answer to this question is now, before it is too late. If your asset protection plan is not in place when trouble hits, you will have difficulty safeguarding your property. There are laws that prevent something called a fraudulent conveyance.

This occurs when someone tries to transfer money to another party in order to avoid a debt or a judgment. The key here is there has to be a debt or a judgment that one must be trying to circumvent.

This means any plan must be in place before the debt is incurred or the judgment is entered because anything executed after that may be considered null and void by a court.

The appropriate time to worry about this is before there is anything to worry about. If the asset protection plan is already in place, then it will be operative and provide the safety you need.

While most people would benefit from some type of asset protection, not everyone will ultimately need it. By definition, you will need to have assets you are trying to safeguard, so you will need to have a net worth.

People who would be ideal beneficiaries of this course of action would be those who may ultimately face frequent lawsuits or the threat of a financially crippling lawsuit.

For example, while doctors may have malpractice insurance, it does not always remove all elements of personal risk to them. Doctors live with the possibility they may have to surrender assets if there is a judgment against them.

While they do need to maintain control over some of their assets, it may behoove them to “take money off the table” by executing an asset protection plan.

In addition, spouses who enter into a marriage with significant assets of their own may also gain from an asset protection plan because prenuptial agreements may not always be foolproof.

Another important use of an asset protection trust is for someone who may eventually need nursing home care. Nursing homes will look at your assets first, and if you do not have them, then Medicaid will cover the costs of skilled nursing care.

Thus, it is imperative to move assets into a trust so that the cost of a nursing home does not eat up all of the assets that you plan on leaving to your loved ones.

What Are Different Types of Asset Protection?

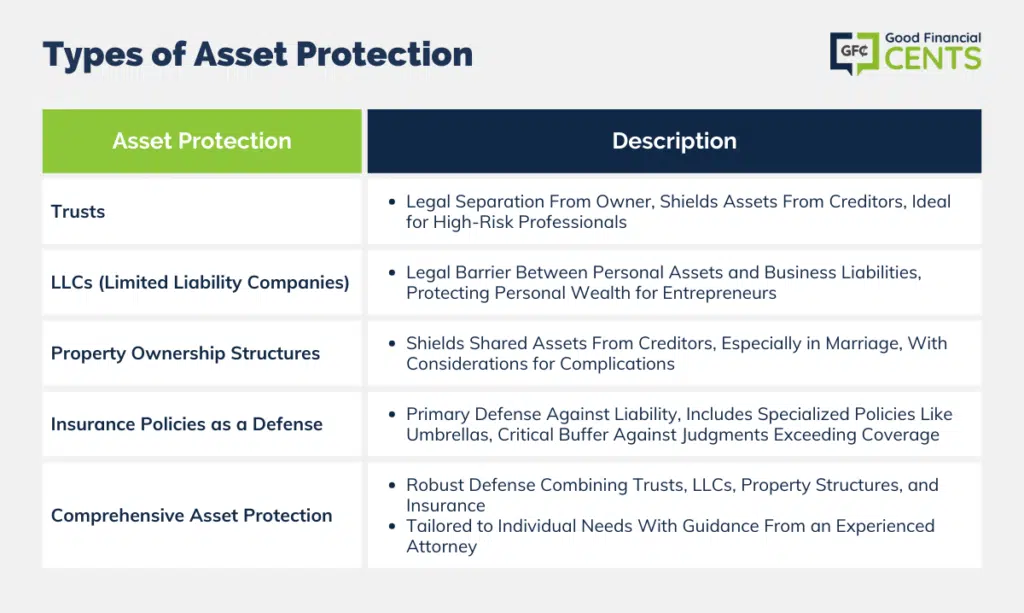

Asset protection is an essential aspect of financial planning that employs a variety of legal tools and strategies to safeguard an individual’s assets from potential creditors and legal judgments.

The different types of asset protection include the use of trusts, business entity formations, property ownership structures, and insurance policies. Each method has distinct characteristics tailored to different situations and risks.

Trusts as a Protective Measure

Creating trust is a common and robust method of asset protection. Trusts come in many forms, such as revocable, irrevocable, domestic, and offshore trusts. The primary purpose of setting up a trust is to create a legal separation between the trust’s grantor and the assets placed within it.

Once the assets are transferred into the trust, they are legally owned by the trust and managed by a trustee. This separation is key in protecting the assets from creditors, as the trust’s assets are typically not considered the personal assets of the beneficiaries or the grantor.

This can be particularly useful for high-risk professionals or those who want to preserve their wealth for future generations without exposure to personal financial volatility.

Limited Liability Companies (LLCs)

Forming a Limited Liability Company (LLC) is another effective form of asset protection, especially for business owners. An LLC creates a legal barrier between the member’s personal assets and the business’s liabilities.

This means that if the LLC faces a lawsuit or incurs debt, the personal assets of the owners are generally protected. The creditors can pursue only the assets within the LLC.

This type of asset protection is crucial for separating and minimizing risk in business operations, and it’s especially beneficial for entrepreneurs and small business owners who seek to prevent their personal wealth from being targeted due to business-related liabilities.

Property Ownership Structures

The manner in which property is titled can also serve as a form of asset protection. For instance, owning property as ‘tenants by the entirety’ with a spouse can provide a shield against claims made against one spouse.

In this arrangement, the property is jointly owned, and creditors pursuing a debt against one spouse cannot claim the property as it legally belongs to both. This type of ownership is valuable for married couples who want to protect their shared assets.

However, it is essential to consider the potential complications that could arise in the event of a divorce or the death of a spouse.

Insurance Policies

Insurance is often the first line of defense against liability. Specialized insurance policies, such as umbrella policies, can provide additional coverage beyond the limits of standard insurance policies.

This type of protection is particularly useful in situations where an individual might be exposed to lawsuits that could result in judgments exceeding the individual’s existing coverage.

While insurance alone may not be sufficient to protect all assets, it plays a critical role in an overall asset protection strategy, serving as a buffer to absorb financial shocks that might otherwise impact the owner’s wealth directly.

Combining these various types of asset protection strategies can provide a comprehensive shield for an individual’s assets.

However, the choice of which method or combination of methods to use should be based on a careful assessment of one’s assets, risk exposure, and overall financial goals, ideally under the guidance of an experienced asset protection attorney.

What Are Different Types of Trusts You May Need?

Trusts are a sophisticated and flexible tool in asset protection planning, each with its structure tailored to meet various protective and financial goals. Here is a discussion of the different types of trusts:

Domestic Asset Protection Trusts (DAPTs)

Domestic Asset Protection Trusts are a type of trust set up under the laws of a specific U.S. state, which allows for the creation of these entities. A DAPT is designed to protect the assets of the trust’s settlor (the individual who creates the trust) against potential creditors.

One of the key advantages of a DAPT is its geographical convenience and adherence to U.S. law, making it more straightforward for residents who may be wary of international jurisdictions.

However, since the regulations and protections offered by a DAPT vary significantly from state to state, and not all states allow them, they may not provide as robust protection as offshore trusts.

Only a subset of states has enacted legislation that permits the formation of DAPTs, and these states have varying degrees of protection against creditors.

In states where DAPTs are allowed, there may be specific requirements and limitations, such as a statute of limitations on transferring assets into the trust, which are essential to understand in the planning process.

Offshore Trusts

Offshore Trusts are established under the laws of a foreign country. The primary appeal of offshore trusts is the enhanced level of asset protection they often provide.

These trusts are typically located in jurisdictions with favorable laws that are more resistant to claims from foreign creditors, making it significantly more challenging for U.S.-based creditors to access the assets held in such trusts.

The level of protection stems from the fact that foreign jurisdictions may not recognize U.S. court judgments directly, thus requiring a creditor to litigate in the trust’s domicile, which can be a daunting and expensive process.

Furthermore, offshore jurisdictions often have legal frameworks that are intentionally designed to attract foreign investments by offering strong asset protection features.

However, the complexity of offshore trusts is considerable. They come with increased regulatory scrutiny, especially in light of global efforts to combat tax evasion and money laundering.

There is also a layer of complexity in terms of compliance with both the laws of the foreign jurisdiction and U.S. reporting requirements, such as the Foreign Account Tax Compliance Act (FATCA) and the Report of Foreign Bank and Financial Accounts (FBAR).

When considering the establishment of any trust for asset protection, individuals should carefully assess their needs, the legal environment, and the potential risks and benefits.

Consulting with legal experts specialized in asset protection and trust law is crucial to navigating the intricacies of both domestic and offshore trusts. This ensures that the trust structure chosen aligns with the individual’s financial landscape and provides the desired level of protection.

What Is the Extent It Covers?

Asset protection, while legal, has its boundaries. It’s not a mechanism for tax evasion or avoiding lawful debts. Plans must be structured to comply with tax laws and ethical standards. Transparency with the IRS and creditors is paramount to avoid the implications of fraudulent transfers.

Judges, especially in the U.S., can order the repatriation of assets from offshore trusts, and refusal to comply can lead to serious legal consequences, including contempt of court. The notion that offshore trusts are untouchable is a myth; they must be set up and maintained with care and legal guidance.

How to Pick an Attorney

The selection of an attorney for asset protection planning is pivotal. Look for someone who offers depth rather than breadth, a specialist who has dedicated their practice to understanding the intricacies of asset protection.

The right attorney not only possesses knowledge of trust and estate law but also understands the dynamics of family law, bankruptcy, and even international law if considering offshore trusts.

Interview potential attorneys, inquire about their experience, and ask for references. Ensure they have a proven track record in establishing asset protection structures. Remember, this individual will be responsible for the safety of your financial future.

The Bottom Line – The Basics of Asset Protection Planning – The Rules You Need to Know

Of course, this guide would be incomplete without a discussion of some of the drawbacks of an asset protection plan so you can make an informed decision about what to do with your property.

One of the main considerations is trusts cost money to set up and maintain and then require tax returns over the life of the trust. In addition, as mentioned above, trusts can have a certain degree of permanence that is inescapable.

Finally, when placing assets in a trust, you will lose some element of control over the asset, lest a court “pierces the veil” and finds you are essentially the same as your trust.

Of course, you should compare the costs of setting up the trust to what you may stand to lose if creditors or judgment holders have the ability to help themselves to your assets.