What’s your legacy plan? This is a question that I often ask my clients. I ask this for many reasons, but the main reason is to get them thinking about what happens when they are not here. Have they taken care of their wills, life insurance policies, and, for this discussion, retirement plan beneficiaries?

I’ve already shared a few stories on the importance of your beneficiary designations, but I can’t stress this enough. This time, I want to focus on retirement plans- specifically, IRAs and 401k’s.

Since their introduction in the early 1970s, Individual Retirement Arrangements (IRAs) and qualified plan assets such as 401(k), 403(b), and 457 plans have become an important component of many investors’ retirement plans.

While the intent of these accounts is to supplement Social Security and provide income during retirement, many affluent investors may not need or be able to spend all of the money in their retirement accounts. This creates an opportunity to leave these accounts for the benefit of heirs.

Table of Contents

This post outlines the fundamentals of beneficiary designations, which are important not only in terms of leaving a legacy but also in ensuring that estate and income taxes don’t unintentionally consume retirement plan assets. It should be noted that a full discussion of the tax impact of such designations is beyond the scope of this post; investors should seek appropriate counsel prior to making any investment or tax decision.

Tax Considerations

Assets in qualified retirement accounts are considered “income in respect of a decedent.” As such, they are includable in a decedent’s estate on which taxes are due within nine months after death. In 2023, the maximum federal estate tax was 40%, and the exemption equivalent amount was $12.92 million.

In an estate where the qualified account is a sizable estate asset, depending on who is the account beneficiary (for example, a non-spouse who does not qualify for the marital deduction), without advance planning for payment of estate taxes, the account might have to be liquidated to pay them.

This distribution could, in turn, trigger an income tax liability to the beneficiaries. (Note that there is an income tax credit available to beneficiaries for estate tax paid.) With proper beneficiary planning, this can be minimized or avoided.

Definition of Beneficiary

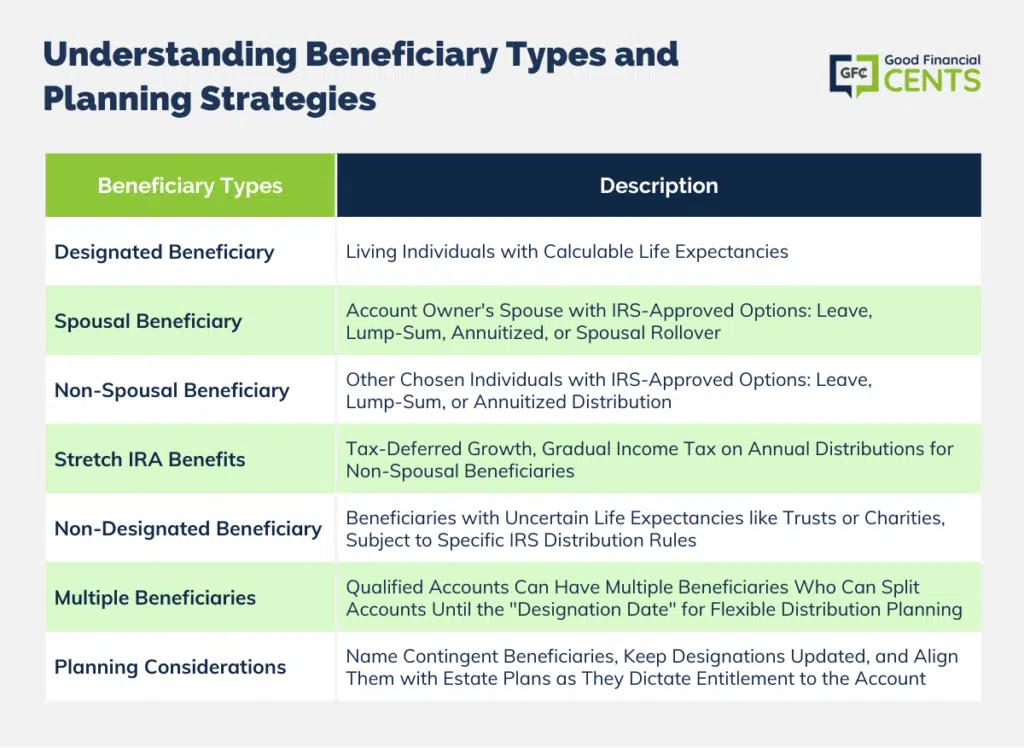

As illustrated below, beneficiaries of qualified accounts are considered to be either “designated” or not. A designated beneficiary is a living person for whom a life expectancy can be calculated.

A non-designated beneficiary (called simply a “beneficiary”) is anything else. This is a critical distinction in determining how the assets are paid out of the account.

Designated Beneficiary

A designated beneficiary can be further classified into two types — the spouse and everyone else (“non-spouse”). In some situations, trusts can be considered designated beneficiaries, assuming they are set up correctly.

Spousal Beneficiaries

The account owner’s spouse is usually listed as the beneficiary of the account upon the account owner’s death. In fact, in many cases, the spouse has to approve the designation of an alternative beneficiary. As a beneficiary, the spouse has four options allowed by the IRS:

- Leave the Money in the Account

- Take a Lump-Sum Distribution

- Take an Annuitized Distribution Based on Their Life Expectancy

- Roll the Assets Over Into Their Own IRA Account

This last option is only available to a spousal beneficiary and is often called a “Spousal Rollover.”

Non-Spousal Beneficiaries

A non-spousal beneficiary could be children, grandchildren, nieces, nephews, or any other living person the account owner chooses. These beneficiaries have three distribution options allowed by the IRS:

- Leave the Money in the Account

- Take a Lump-Sum Distribution

- Take an Annuitized Distribution Based on Their Life Expectancy

Non-spousal beneficiaries cannot roll the account into their own account as a spouse can. One very popular strategy for non-spousal beneficiaries is the third strategy – taking distributions based on life expectancy.

This is often called the “Stretch IRA,” and a child beneficiary can stretch the distributions into the future for as long as they are expected to live– 30, 40, or even 50 years — depending on their age when the account owner dies.

There are two primary benefits to this strategy:

- Most of the money remains in the account and grows on a tax-deferred basis,

- The beneficiary only pays income tax on the amount that comes out each year, stretching out their income tax liability over many years, instead of having to pay it all at once if a lump sum distribution is taken. (If estate tax has been paid due to income in respect of a decedent, a pro-rated income tax deduction is allowed for the beneficiary. Contact a tax advisor for more information.)

Non-Designated Beneficiaries

Non-designated beneficiaries include any beneficiaries for whom a life expectancy cannot be determined, such as non-qualified trusts, charities, and the decedent’s estate.

Multiple Beneficiaries

It is possible, and quite common, to have more than one beneficiary identified for a qualified account. IRS rules issued in 2002 have made planning for this situation much easier.

Beneficiaries now have a “Gap Period” between the date of death of the account owner and September 30th of the following year, called the “Designation Date,” in which to separate the account for each beneficiary. This provides beneficiaries more flexibility in their planning and the opportunity to take distributions as they wish.

Hypothetical Example of “Gap Period”

For example, if an account listed 3 beneficiaries, two children, and a charity, and the accounts were not split before death or during the Gap Period, the account would have to be completely distributed within 5 years of the owner’s death because the charity is a non-designated beneficiary. This would cause an income-taxable event for the beneficiaries more quickly than they may have wished.

However, if the account were split into three separate accounts, one for each beneficiary, the charity’s portion would go to the charity, and each child would be able to decide how they wanted to have the money distributed, including taking it out as a Stretch IRA, based on their individual life expectancy.

Other Planning Considerations

- Ensure that contingent beneficiaries are named. Beneficiaries cannot be named after the death of the owner/participant, and if the primary beneficiary is dead and no contingents are named, the estate becomes the beneficiary, and the account must be distributed within 5 years.

- Ensure that beneficiary designations are current on all retirement accounts, as changes may be necessary due to births, deaths, marriages, and divorces.

- Coordinate beneficiary designations on all qualified accounts with those listed in their will or in their estate planning documents. Beneficiary designation forms control over who legally is entitled to the account, not the will.

The Bottom Line – Understanding Beneficiary Options- What’s Your Legacy Plan?

Legacy planning, particularly concerning retirement accounts like IRAs and 401(k)s, plays a pivotal role in ensuring that one’s hard-earned assets benefit heirs and do not inadvertently result in large tax burdens. Since the 1970s, these accounts have grown in significance, offering a potential bequest to beneficiaries.

However, the intricate rules governing distributions based on the type of beneficiary (spousal, non-spousal, or non-designated) underscore the importance of proper planning.

Key considerations include understanding tax implications, ensuring updated beneficiary designations in alignment with life events, and coordinating these designations with other estate documents. Informed choices today can preserve assets, minimize taxes, and shape one’s legacy for generations to come.