While the best car insurance companies make it easy to get a free quote for coverage from the comfort of your home, there are additional factors to compare outside of the premiums they charge.

Not only should you compare the best auto insurance companies based on their customer service scores and ratings, but you should also look at the coverage options they offer and their record of paying out claims.

In order to choose the best car insurance company for you, you’ll also want to consider your unique needs and preferences and weigh factors like financial strength and availability in your state.

With all this in mind, we took the time to compare more than 20 of the best car insurance providers based on the factors that matter most. As you search for a new policy, consider getting a free quote from some of our top picks below.

Table of Contents

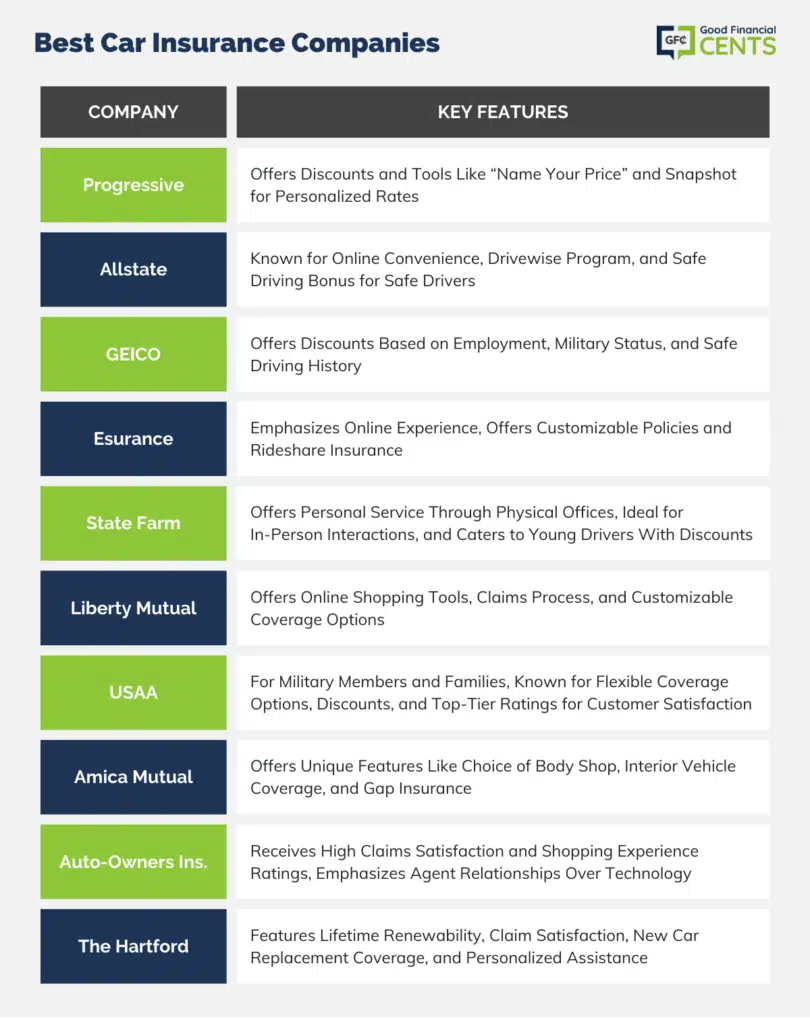

Our Top Picks for the Best Car Insurance of February 2025

- Progressive: Best for Discounts

- Allstate: Best Overall User Experience

- GEICO: Best Mobile App

- Esurance: Best for Ridesharing

- State Farm: Best for Teen Drivers

- Liberty Mutual: Best for Customization

- USAA: Best for Military

- Amica Mutual: Best for Gap Insurance

- Auto-Owners Insurance: Best Agent Experience

- The Hartford: Best for Claims Satisfaction

Best Car Insurance – Company Reviews

While the table above shows how the best car insurance companies compare based on some popular metrics, you should know more about each of these providers and how they work.

The car insurance reviews below explain the pros and cons of each auto insurance company as well as some basic information about their coverage options.

Progressive Insurance

Originally founded in 1937, Progressive Insurance has been offering an array of insurance options for nearly 100 years. This company is also listed as the third-largest in terms of auto insurance premiums written in 2020, with a total market share of 13.3% that year.

When it comes to Progressive auto insurance coverage, the company claims that customers who switch save an average of $700 right off the bat.

This is due to its affordable premiums, but it’s also due to the variety of discounts it offers for being a good student, bundling your renters, home insurance, or life insurance policies, paying your premiums in full, and more.

Progressive also offers “Name Your Price” and Snapshot tools (which help Progressive base your rate on your actual driving habits), which means almost everyone will qualify for at least one discount.

Need motorcycle coverage? Progressive tops our list for that, too!

Allstate

Allstate has been in operation since 1931, so this provider also has a long and storied history. This company is also listed as the fourth largest in auto insurance premiums written in 2022, per the Insurance Information Institute (III), with a total market share of 10.4% that year.

Allstate makes it incredibly easy for potential customers to get a free quote online, and its seamless online claims process makes it popular with customers.

It also offers many different discounts, including a DriveWise program that lets users qualify for lower premiums based on their driving history.

Finally, Allstate rewards safe drivers with a Safe Driving Bonus every six months that they remain accident-free.

GEICO

GEICO is one of the most popular car insurance companies out there today, and it’s partly due to its robust online presence. The GEICO website has a range of useful tools and features, including the ability to start a claim and monitor policies and payments online.

The company’s mobile app also boasts some of the best ratings out there, including 4.7 out of 5 stars on Google Play and 4.8 out of 5 stars in the App Store.

In addition to its online features, GEICO is also known for the many discounts it offers. For example, GEICO lets customers save on premiums based on their employment, whether they’re military members, their safe driving history, good student status, and more.

GEICO also says that new customers save an average of $500 when they switch.

Esurance

Esurance was one of the first companies to start selling directly to customers instead of going through an agent. While Esurance is now part of the Allstate Insurance family, it still focuses on its online presence without using local agents to sell or service their policies.

That said, the company does offer a smooth digital experience that makes it easy to customize a plan, receive quotes, manage your policy, and file claims.

One of the primary advantages of buying auto insurance through Esurance is that you have the control and flexibility to build a personalized policy specific to your unique needs.

Esurance also offers rideshare insurance for individuals who drive for Uber or Lyft to earn some cash on the side. This coverage can help fill in the gaps when someone uses their personal vehicle for their side hustle.

State Farm Insurance

Founded in 1922, State Farm Insurance has a history of financial stability and customer service satisfaction.

According to the Insurance Information Institute, State Farm is the largest provider of private passenger auto insurance, with its total premiums written earning a 16.9% market share at last count.

Although State Farm offers online quotes and a mobile app, it’s differentiated by its ability to offer individual, personal service through its robust network of physical offices and insurance agents.

So, unlike Geico and Esurance, which target the technology-savvy, hands-off type of consumer, State Farm is perfect for those who would rather drive to a local office and have their questions answered and their hands held through the process without having to navigate an app or website.

This could be part of the reason State Farm earned the fourth-highest rating in J.D. Power’s 2023 U.S. Insurance Shopping Study.

State Farm also offers the best car insurance for young adults and teenagers by far. While most companies charge notoriously high rates for this riskier demographic, State Farm offers both a good student discount and its Steer Clear feature.

Steer Clear is an app-based program for drivers under 25 that tracks driving behavior and offers mini-safety courses. After “graduating” from the program, drivers earn a substantial discount that lasts until they’re 25.

Liberty Mutual

Founded in 1912, Liberty Mutual is currently the sixth-largest insurer based on market share. Due to their robust online shopping tools and easy quote system, the company earned the highest rating in J.D.Power’s 2022 U.S. Insurance Shopping Study.

The company claims that new customers can save 12% off their car insurance premiums by shopping for a policy online. Liberty Mutual also offers a seamless online claims process that lets customers submit and monitor their claims from the comfort of their homes.

Most importantly, Liberty Mutual lets customers choose the coverage options they want and skip the rest. This can lead to more customized car insurance coverage and premium savings to boot.

USAA

If you’re fortunate enough to be a USAA member (members or former members of the United States military and their close family members), then USAA should be your first stop for auto insurance. This is partly due to their flexible coverage options and myriad discounts available, but it’s also due to the fact that USAA is known for offering affordable premiums.

This insurance provider also earned the highest rating in J.D. Power’s 2022 U.S. Insurance Shopping Study.

As if that wasn’t enough, USAA has the highest possible rating for financial strength from A.M. Best, as well as top-tier ratings from J.D. Power for claims satisfaction and overall customer satisfaction. USAA also makes it easy for car insurance shoppers to get a free quote and compare coverage options online.

Amica Mutual

Amica Mutual is consistently rated as one of the best auto insurance companies in industry awards and by its customers. In fact, it was near the top of this year’s J.D.

Power Claims Satisfaction Survey, and the company earned the second-highest ranking among mid-size insurance companies in J.D. Power’s 2021 U.S. Insurance Shopping Study.

While the insurer’s basic coverage insurance products include personal injury protection, underinsured or uninsured motorists, property damage, and bodily injury liability, its policies include features that most competitors do not, such as no restrictions on your body shop choice as well as interior vehicle coverage.

Amica Mutual also offers the chance to purchase gap insurance, which is a type of insurance coverage many of the best car insurance companies do not offer. Other options include roadside assistance, rental reimbursement, comprehensive coverage, and collision coverage.

Finally, young drivers who complete a training program, have good grades, or are full-time students away at school can also gain access to additional discounts.

Auto-Owners Insurance

While Auto-Owners Insurance keeps a fairly low profile, they receive extremely high marks across the board. In fact, J.D. Power gave this car insurance company excellent ratings for claims satisfaction as well as shopping experience in 2021.

The fact that Auto-Owners Insurance has been around since 1916 should also put your mind at ease. During that time, it has consistently exhibited financial stability, with the highest possible A++ rating from A.M. Best this year.

Auto-Owners Insurance operates on an agent-only model, favoring relationships and local businesses over faceless technology. In fact, it has 6,300 agents, despite only being available in 26 states. So if you’re in one of those states, there are likely multiple offices for you to choose from in your city alone.

Founded in 1810, this insurance company has built an excellent reputation in the insurance space for more than 200 years. Its car insurance coverage caters specifically to AARP members, offering several features that uniquely accommodate this group.

The Hartford

For example, car insurance from The Hartford comes with a lifetime renewability feature, 12-month auto insurance rate protection, and personalized assistance after an accident.

The Hartford has also received the highest possible ratings for claim satisfaction, which is a crucial factor for shoppers to consider. This provider also offers optional new car replacement coverage that will replace your new car with one of the same make, model, and equipment in the event of a total loss.

Car Insurance Guide

As you shop for a new insurance policy, it’s crucial to understand the inner workings of the auto insurance industry. Read on to learn more about factors that influence car insurance rates, the different types of car insurance available, how to save money on car insurance premiums, and more.

What Does Car Insurance Cover?

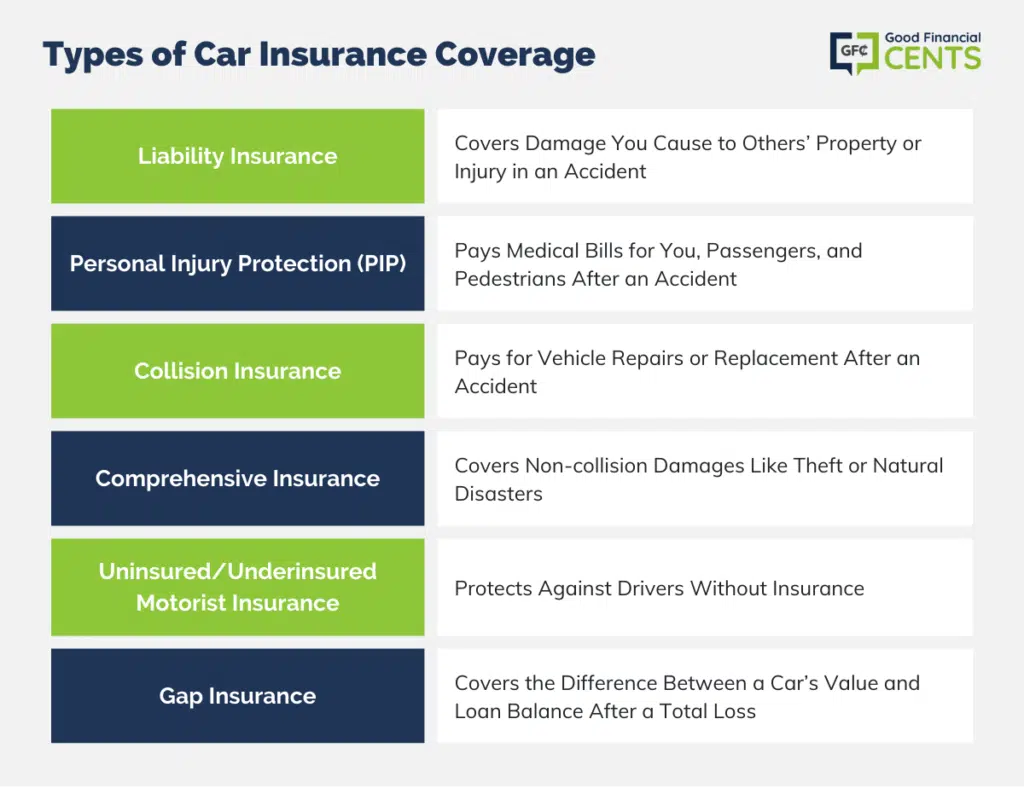

Auto insurance companies provide three main types of coverage to their customers:

- Property coverage that protects in the event of damage to your property (e.g., damage to or theft of your car)

- Liability coverage that can protect you financially based on your legal responsibility to others for bodily injury or property damage

- Medical coverage that can kick in to cover the cost of treating injuries, rehabilitation, lost wages, and funeral expenses

While some types of car insurance are mandatory, others are optional. Different states set their own minimum coverage options, yet the majority require a combination of bodily injury liability coverage and property damage liability coverage.

Some states also require drivers to have a minimum level of uninsured or underinsured motorist coverage within their auto insurance policy.

Types of Car Insurance

If you’re curious about the types of auto insurance out there, here’s a quick rundown of the most common coverage levels:

- Liability Insurance: This type of auto insurance protection covers the other person’s expenses if you cause a car accident. There are two types of liability coverage: bodily injury and property damage.

- Personal Injury Protection (PIP): Personal injury protection pays the medical bills for you and your passengers after an accident. It also extends to times when you’re a passenger in someone else’s car or if you’re hit by a car while walking or biking.

- Collision Insurance: Collision insurance helps pay to repair or replace your vehicle after an accident. This can be damage caused by another car or an object, like a tree or fence.

- Comprehensive Insurance: Comprehensive insurance coverage reimburses for the repair or replacement of your vehicle after an incident that doesn’t involve another car.

- Uninsured/Underinsured Motorist Insurance: This type of protection covers you in instances where the driver who caused the accident doesn’t have car insurance, or at least doesn’t have enough of it.

- Gap Insurance: This optional insurance covers the difference between the amount your car is worth and the amount you still owe after a total loss.

How Much Car Insurance Do I Need?

Whether you already own a car or you’re still trying to decide how much car you can afford, it’s equally important to know how much car insurance you need.

You’re legally required to purchase coverage that meets your state’s minimum insurance requirements, yet you will likely want to purchase more insurance than your state requires.

After all, you may have sufficient assets to protect, and you will want to make sure your policy limits are enough to handle any accident or situation that comes your way.

You’ll also want to make sure you have sufficient coverage if you purchase a new vehicle, including gap insurance that can make you whole if you owe more than your car is worth.

Only you can decide how many car insurance coverages to purchase (and how many add-ons to include), but you should think long and hard about the consequences of having insufficient coverage.

After all, many states require bodily injury liability limits as low as $25,000, and we all know that bodily injury resulting from a car accident can cost many times that much.

If you’re a high-net-worth individual who wants additional protection, you can also look into purchasing an umbrella insurance policy. This type of insurance can protect you against liability claims after you exhaust the limits on your other insurance policies.

How to Find Cheaper Car Insurance Rates

The average car insurance policy costs over $2,542 a year in 2024. While there are many ways to secure the best cheap car insurance out there today, the most important step involves shopping around for a policy.

By comparing car insurance rates across multiple providers, you can see which company charges lower premiums for a similar amount of coverage.

Other steps you can take to lower the average cost of car insurance include:

- Check for Car Insurance Discounts: Some of the best car insurance companies offer driver discounts on anything from bundled policies to good credit, zero claims, theft protection devices, pay-in-full, a clean driving record, and more.

- Drive Less: The less your vehicle is on the road, the less likely you are to have an accident. Car insurance companies recognize this, and many offer discounts or overall cheaper rates for low-mileage drivers as a result. Some companies also offer policyholders discounts for being a good driver or have the option of choosing pay-how-you-drive insurance.

- Raise Your Deductible: Choosing a car insurance policy with a higher deductible can help you pay lower premiums throughout the year.

- Reduce Coverage on Older Cars: Where full coverage is smart for newer cars, liability insurance coverage may be a smarter move for older, paid-off models.

- Increase Your Credit Score: If you have poor credit (or even average credit), increasing your credit score can help you secure lower car insurance rates. Good credit can also help you avoid having to choose from the best bad credit car loans.

- Keep Insurance Costs in Mind as You Shop: While now may not be the best time to buy a car, you should keep car insurance premiums in mind as you look for a new vehicle.

Factors That Influence Car Insurance Premiums

If you’re hoping to save on car insurance, you should find out which areas you have some control over. With that in mind, here are some of the major factors that can lead to higher or lower average rates overall.

- Driving Habits and Record: Your driving history will impact your car insurance rates more than almost anything else. You can take some proactive steps here, such as a defensive driving course.

- The Car You Drive: As we all know, some cars (and especially new cars) cost a lot more to insure. Whether you decide to lease or buy a car, the automobile you select can impact your premiums substantially.

- Age and Gender: Car insurance companies also formulate their rates based on the age and gender of covered drivers. Teens, for instance, are usually considered high-risk drivers.

- Credit History: Generally speaking, car insurance premiums are lower for drivers with good or excellent credit.

- Where You Live: Some states have higher car insurance premiums overall, and factors like the neighborhood you live in can also impact your rates.

- Mileage Driven: Many car insurance companies offer discounts for low-mileage drivers. Meanwhile, high-mileage drivers often have to pay more for coverage.

- Marital Status: Drivers who are married typically qualify for lower car insurance rates than single drivers.

How We Found the Best Car Insurance Companies

For the purpose of this ranking, we only selected car insurance companies with an ‘A’ or better for financial strength rating from A.M. Best. We also looked at providers who scored the best with J.D. Power for customer satisfaction, claims satisfaction, and their overall shopping experience. Other factors we considered include mobile app access, online quote processes, full coverage options, and insurance discounts offered.

Summary of the Best Car Insurance Companies February 2025

- Progressive: Best for Discounts

- Allstate: Best Overall User Experience

- GEICO: Best Mobile App

- Esurance: Best for Ridesharing

- State Farm: Best for Teen Drivers

- Liberty Mutual: Best for Customization

- USAA: Best for Military

- Amica Mutual: Best for Gap Insurance

- Auto-Owners Insurance: Best Agent Experience

- The Hartford: Best for Claims Satisfaction

Final Thoughts – 10 Best Car Insurance Companies of 2025

Selecting the right car insurance company involves careful consideration of multiple factors beyond just premiums. The top auto insurance providers of 2025 offer not only competitive pricing but also exceptional customer service, coverage options, and claims handling.

While evaluating companies like Progressive, Allstate, GEICO, Esurance, State Farm, Liberty Mutual, USAA, Amica Mutual, Auto-Owners Insurance, and The Hartford, it’s essential to align their offerings with your unique needs and preferences.

Factors like financial strength, discounts, coverage customization, and technology integration should guide your decision-making process as you aim to secure reliable and comprehensive car insurance.

Very helpful info on car insurance companies.

Do I have to call each Insurance Company separately for quotes/rates or is there a one stop shop/place where I can get quotes from all of the companies at once. Your article did not mention this valuable piece of information.

Hi Charnetta – You can call each individually, or you can use Quote Wizard, which can connect you with them all. We’ve included a link to Quote Wizard in the article.

Your site does me no good at all because it refused to accept my zip code as valid. We have lived in the home for 50 years and I know my zip code. It is 48322 yet you site keeps telling me to enter a valid zip code. 48322 is a valid zip code.

Patricia Low

I know from experience some of these insurance companies are only out to steal your money like Geico and State Farm.

Please send your quotes via email. I will send a copy of the current insurance coverage I have for auto and home. I would like to bundle my policies and add a 1 ml umbrella policy.

Hi Dwayne – We don’t offer auto insurance, but you can contact any of the companies on this list.

Looking for an affordable car insurance with full coverage

Hi Lisa – Check with some of the ones on the this list. Rates differ between states with the same company so do plenty of shopping.

Well, since I can hardly see any negative reviews on Progressive, and after all I’ve been hearing about it, I guess I’ll go for it then. 😉

Hi Titus – If you dig deep enough you’ll find some. But that doens’t mean they’re a bad company. Every business has complaints against it, and unfortunately, people are more likely to complain than to praise. But yes, Progressive is an excellent company.

I was with Liberty Mutual for about 15 years and was very satisfied with their prices and service, although I never filed a claim. When I retired and moved from California to Florida, my auto rate went up a ridiculous amount, to almost $10,000 a year even though I had no accidents and one minor moving violation in the last ten years. On top of that, Liberty Mutual screwed up my umbrella policy and told me it was “unenforceable,” whatever that means, but I had to pay for the policy anyway up to the time I canceled and switched to Progressive, which cost about one third the cost of Liberty Mutual for an identical policy. Even good companies change over time.

Hi Eric – What you’ve seen is not an unusual situation. A company that’s good in one state isn’t in another. Liberty Mutual worked for you in California, but not in Florida. This is why it’s not possible to say one company is the best. That will vary by state and by your own personal profile. That’s why we produce these “10 Best” lists, to give you companies to investigate.

I can’t Believe you have GEICO last I just recently got in a Car accident on 3/16/18 and the claim process has been going really smooth and what people have told me my full coverage for two vehicles is the best they have seen.

Being in the business for a very long time, I have found that most people are clueless about insurance, even most agents who sell them. I will agree that their rates are cheap. But I wouldn’t recommend them. Inexperienced adjusters. They do not fully investigate. The policy does not cover like, kind, and quality which is bad if you have a new vehicle.

STATEFARM worse company on the planet….dishonest, and does not do the right thing for there policyholders….

Screwing there policyholders is common practice for this insurance co.

Liberty Mutual has raised my premium every year over the last 4 years, it went up 48 a month from last years to this year; I’ve had 0 accidents, tickets or claims.

They said it has gone up because live in Pennsylvania, really I’m paying for other bad drivers.

Switching to another insurance carrier.

Well this is a good article on best auto insurance companies this has helped me out to choose the one..

Cheers

Biraj pokhrel

Liberty Mutual just dropped my family because of two claims that were made on my daughters car. She had her car at school freshmen year and It was parked and hit on the rear corner closest to the road. It wasn’t her fault and no one came forward to admit to the accident. She no longer has a car at school, and drives rarely when she’s home. The second accident was when she was pulling out of the carport and her front bumper caught a wooden railing when she was backing out. That was her fault, but an accident. Isn’t that why we have insurance????? Before I got this letter from Liberty mutual, I sang their praises. I will loudly have bad things to say from now on. Don’t count on Liberty Mutual

I think this is a fair list, but I would have liked to see a few more insurance companies listed. I believe there are several more comparable insurance companies out there that could have made the list. We have partnered with several A+ rating carriers in Kansas and Missouri.

BY far the worst and most expensive Insurance company is Intact Insurance. Worst experience ever trying to get payment after paying Insurance for 35 years and never having a claim! A disaster.

Comment on AARP Hartford ins. Under your rating for Hartford you state “•Only available to U.S. military members, veterans, or their close family members”

This is INCORRECT, that comment should be for USAA.

Now as to Hartford, I have had them for years and claims for uninured motorist on my car ins and for storm damage on my roof due to large hail. Both claims settled satisfactorily. Cost to the company will never be recovered thru cost of my policies. Also policy cost is in line with other large companies but defiantly not cheap. I just received a quote from Liberty Mutual on my car insurance $400 less that Hartford. However the agent seemed reluctant to send me the quote via email. I thought this strange since I wanted to verify the coverage was he same as I have, he said I just reviewed the coverage (via phone call) to which I replied I didn’t record the conversation so please send me an email detailing the cost and coverage, He stated he would but that was a couple hours age and still haven’ heard back. Go figure.

HY,

Its my first visit to your blog and i have found it so useful and informative. I am also looking to get my car insurance and searching top companies that provides best services.Amazing list you have provided, i like USAA.

USAA is great, but only for military families. For us “common folk”, it’s best to look around and see what is cheap in your area. Look at every website you find and get all the quotes you can. Eventually you’ll find some good rates that won’t break the back. I found 25/month (thru Insurance Panda) and I’m always looking for cheaper.

Also – I think there is no such thing as “customer loyalty” when it comes to auto insurance. If you’ve been with a company too long, chances are you are being screwed!

I am glad to see USAA at the bottom; but it should not be on the list at all. I am currently going through a claim with them (total loss, I got rear ended, pushed into the car in front of me and they hit the car in front of them; not at fault). I have all correspondence recorded and proof of them lying to me, and using made up regulations to justify it. When asked for the reference for said regulations, I am ignored. I have been throwing WAC at them, quote after quote as to how they are being unruly. This was in December, it is now April and they have YET to give me a valuation report in compliance with WAC. I will be more than happy to provide a copy of our correspondence (with PII edited, obviously), proving how bad USAA is at customer service and how willing they are to break the rules if it benefits them. Email me if you want to see it. I finally had enough and contacted the Washington State Insurance Commissioner; USAA has until the middle of this month to respond to them… We will see what happens next.

I have been a USAA client for over 10yrs; I had never had issues with them before last year. This is just the breaking point, I’m transferring all of my accounts to other places. Do not use USAA… They are not the same as they once were.

Matthew thanks for posting this. You’re absolutely right. USAA has gone down the tubes, I dont get it, a simple claim recently for auto, turned into a nightmare. bouncing my calls all over the country with a bunch of idiots for claim reps answering the phones, and forcing my car into total loss when it should not have been, and paying only a portion of the damage even though I have collision.

Only thing I’m not sure of, is USAA used to be the cheapest, and they usually don’t penalize you too bad if you have claims, other companies, when I was younger, would hit me with heavy penalities or kick me off policy.

Maybe its time for me to shop around. not sure. I think since Hurricane Sandy, hit the east coast, all the insurance companies have probably put on their nasty hats. IMHO , their attitude at USAA started to change towards the end of my (very small minor damage), Sandy claims.

I can’t even figure out how to make a formal complaint up the corporate ladder at USAA. Still working on it.m

I beg to differ on USAA. I had been a loyal customer for over 15 years. My first claim on property went okay. It took them 4 months to pay out on lightening & they low balled me. (August will make a year on lightening)

Now flash forward present day. Last month I had a wreck. It was not my fault. I called USAA to get my rental covered because the cop wouldn’t give me the @ fault driver’s info said I had to wait for the police report. USAA informs me that I don’t have rental. Excuse me 3 months ago when I added collision I told you add rental & you said you would. USAA claims I did not tell them that, but I know I did because Roadside made it but not rental? Now mind you my Escalade is totalled. The frame is warped among many other things. I’m not @ fault & USAA (my own insurance company) tries to screw me? (The @ fault driver’s insurance company is someone I’ve never heard of but it’s not USAA) The adjustor says not totalled we’ll settle for 10Gs…. no I’m not settling for 10Gs on 50G+ truck especially with a warped frame NO WAY!! I’ve lost major retail value & nobody will buy it with the carfax that’s attached to it now.

My advice to everybody is this… if you’re in a wreck & you’re NOT @ fault GO GET A LAWYER. If you get the best one around to your local area – stats show you’ll get @ least 3x more than if you don’t have a competent lawyer or you Pro Se it. I’m not sue happy, but I’m not getting taken advantage of either.

USAA’s adjustor knew he messed up big time. He told me that & I said no I don’t agree & I’m not accepting that, so, I guess you need to finish this conversation with my lawyer. He promptly snarkily replied we can’t talk if you have a lawyer… I said I guess we can’t talk then here’s his number & hung up. I think he had enough time to Google my lawyer & he called me back to back 3x. The 3rd one I said you said we can’t talk so we’re not talking. You are finishing it with my lawyer… click. I’m done messing around @ this point. I hurt. I can’t get to my follow-up doctors appointments & they’re trying to screw me out of fair market value for my truck. Just no way.

BTW regarding the wreck- do NOT talk to the other insurance company- the @ fault driver’s insurance company. You’re not required if you have a lawyer. Get a lawyer!! Call them from the hospital if you have to they’ll come to you @ the hospital if you call them there. They’ll even come out to your house. Please don’t let the insurance company screw you. You just want what’s fair & your property covered fairly.

Molly, im curious how you get a lawyer to help on an auto damage-only claim, do you have to pay the lawyer by the hour, i mean if there’s no injuries, wish you could elaborate on this one.

I LOVE USAA! I am surprised it’s not higher on that list. I had Allstate and they never fought for me or my family even though we were paying more than we are paying now. Over where we are at, the speed limit for the highway is 70. There was hardly anyone on the road so my husband drive on the far left since there is a lot of exits in the far right lane. This woman pulled out in the far left lane doing 20. My husband didn’t have time to break because she pulled out right in from God us with no turn signal. But Always was already assuming it was his fault even though they can review the car to see how fast he was going and who was in the wrong. I am glad we dropped them and moved to USAA. They are the best!

Sorry there is a few typing errors. My phone didn’t show the bottom of where I was typing and my phone must have auto corrected a couple of these words.

I have had Progressive for years and have never had any trouble. My car got plowed into by a deer, and Progressive was reasonable to deal with. Their rates are also about the best I can find. We bundle in our home insurance (through some licensed third party) and save even more! Our rates just actually went down this past 6-month period which was a pleasant surprise.

I know I’m going to have to start looking at my auto-insurance options some time in the near future, so I am definitely going to have to do my research and, like you said, see what each company’s customer base says about their experience. Thanks providing this list and your advice!

I’m pretty surprised that GEICO didn’t make the list. I’ve been really pleased with them ever since becoming a customer. That said, I’ve never had to file a claim, but my limited interaction with their non claim related customer service has been really good

I have been a GEICO customer for about least 15 years. Claims and customer service are not the issue with them. After said years of faithfully paying my insurance on time and renewing each year I accidently back into a car in my driveway. The cars were repaired without incident. However, GEICO penalized me by taking away my good driver discount and increase my monthly insurance rate by nearly $100.00 ; leving a hefty penalty for making a claim. I can’t imagine the money they made off of me during the 15 years I’ve faithfully paid auto insurance. I am hunting for a new auto insurance carrier since GEICO obviously thinks driving is perfect and accidents never happen.

Watch out for GEICO especially when changing coverages. I have learned the hard way that you can’t trust them to get your changes correct. I was just hit in the rear while stopped at a stop sign. I am trying to go through the collision coverage I am supposed to have only to have GEICO tell me that I removed this coverage a few months ago. The fact of the matter is I did not remove this coverage and never would have done that or agreed to that. Trying to reason with them has been an exercise in futility so far with a supervisor trying to put the onus on me for the problem. I am currently awaiting their final position on their review of this matter, but whatever the outcome I now know I cannot relie on them to get things right and I will always have to check on them. The mistakes they make hurt you, not them.

I have been with Geico for 10 years, what kept me with them is that my daughter had just graduated high school and started college she asked to borrow the car because she was late for school, I said yes she got into a fender bender. Geico paid the claim and they even asked its my choice to add my daughter to my policy or not. Insurance only went up by $30 dollars a month.

I have 1 Full coverage, and 2 Liability vehicles with them and I pay $170 a month.

Hi Stephen – I think you’re doing the right thing – as long as the premium continues to be reasonable compared to the competition. Even though we obsess on low rates, quality of service matters. It does little good if you get the cheapest policy, then they stick you when you have a claim. With must auto claims there’s going to be a human error factor (especially with new drivers), and you can’t be with companies that will hold that against you to such a degree that it seems like they no longer want your business.

I have had GEICO for over 15 years, about 8 years in my rates skyrocketed never made a claim. An hour and fifteen minute call and GEICO found about $550 worth of discounts. 8 year later my daughter had an accident my rates went up 102%. A 102% increase does not fit my budget.