There are at least two dozen companies providing car insurance in California, but we’ve narrowed the list down to seven which we believe are the very best. This will eliminate the need for you to investigate every car insurance company in California so you can focus on the handful that provide the best value for the money. We’ve analyzed coverage offered, available discounts, customer service rating, average premium, and financial strength ratings to come up with our list. We’ve done it all, so you won’t have to.

But before we dive in, we need to make an important point about our top pick – USAA. We can’t say enough good things about USAA, since it tops the list in nearly every category. And it’s certainly our recommendation for anyone with a military affiliation. But unfortunately, it isn’t available for the majority of drivers, who aren’t either active duty military or eligible veterans.

My own personal favorite – and the car insurance I use – is Progressive. But to show you that this review of the best California car insurance companies is unbiased, we’ve only ranked Progressive at #3. Progressive may not be the right choice for you. The best way to get the right coverage at the most affordable premium is to compare quotes between several companies. For that, you can use the quote tool below from our car insurance partner:

Table of Contents

- The Most Important Factors When Deciding on Car Insurance in California

- Best Car Insurance Companies in California

- How We Found the Best Car Insurance in California

- What You Need to Know About Car Insurance Laws in California

- Summary: Best Car Insurance in California

- California State Car Insurance FAQs

The Most Important Factors When Deciding on Car Insurance in California

No one really likes shopping for car insurance. Not only is it a complicated process, but it can be difficult to evaluate the combination of costs and benefits provided by each company. We recommend considering the following when you’re looking for coverage:

Car insurance in California is much more expensive than the rest of the country. It has a statewide average premium of $2,291. To minimize that high cost, the single best strategy is to shop for policies between several different companies. While you might expect all companies to have roughly the same premiums, they actually don’t, and you can save yourself hundreds of premium dollars each year by doing this.

Look for discounts. Many insurance companies offer dozens of them, and you should take advantage of everything that applies to you. There are discounts for safe driving, specialized equipment in your car, driving habits, and much more. Ask the insurance company for a list of all discounts they offer and see which apply to you.

Bundling is one of the most common ways to save money on car insurance. If you include other policies with your car insurance, especially homeowner’s, renter’s, business, or life insurance, you may get a large discount on your car insurance. Just be sure you aren’t giving back the savings on your car insurance to higher premiums on the other policies in the bundle.

Don’t skimp on coverage! While cost is definitely important, never forget the whole purpose of car insurance – which is to protect you and your family in the event of an accident. Make sure the coverage will apply to most common accidents and events and that it’s consistent with your overall net worth (if you have large assets, you shouldn’t have minimum coverage).

And if you use your vehicle for business, you’ll need coverage to accommodate that use. Most insurance companies won’t pay a claim on a personal policy when the vehicle covered has been used for business purposes.

Best Car Insurance Companies in California

One of the disadvantages – and strengths – in an industry as diverse as car insurance is that different companies are especially strong in certain categories. Put another way, there’s no one best car insurance company for all drivers. While they certainly compete with one another, each carves out its own niche where it’s stronger than the rest. So you’ll need to do your research to determine what is best for you and your specific situation.

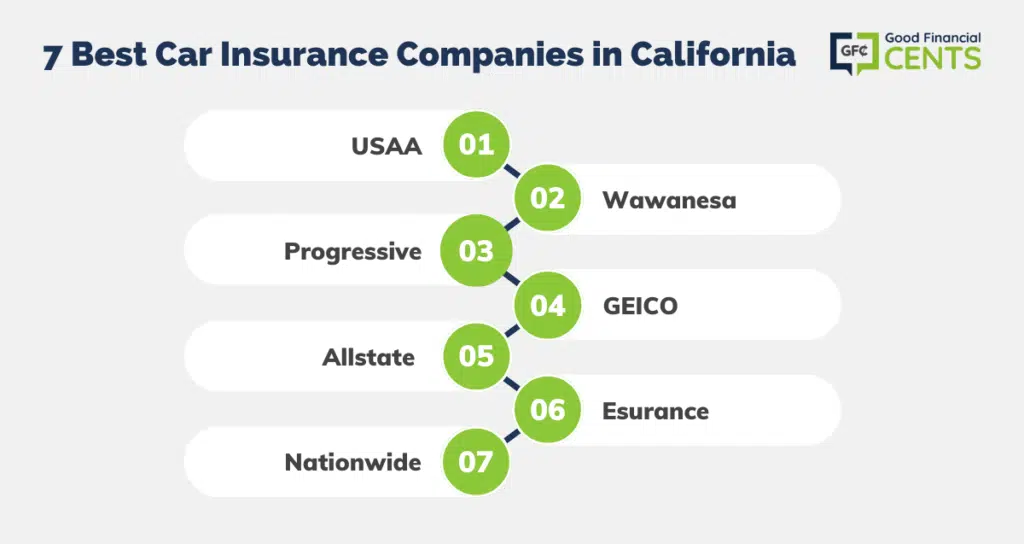

Based on our analysis, the following are the best car insurance companies in California:

Author’s Pick: I don’t live in California, but I’ve had progress for many years while living in two different states. Throughout the years, Progressive has not only had the lowest premiums but also outstanding customer service and fast claim payment. We’ve also found adjusting our policy over the years to be incredibly easy and convenient. For those reasons, Progressive is my own personal top pick.

My own preference aside, below are what we believe to be the best car insurance companies in California. Each description includes basic information for each company, why it made our list, and what holds it back.

Note on Policy Options: We’re not going to include minimum required coverages in California, nor collision and comprehensive, since all three are typical options offered by all insurance companies.

1. USAA

The Basics

| Policy Options | Rental Reimbursement Roadside Assistance Rideshare Coverage |

| Discounts | Safe Driver (min. 5 years) Defensive Driving Course Driver Training (for drivers under 21) Good Student New Vehicle (under 3 years) Multi-vehicle Multi-policy (bundle) Annual Mileage (the fewer, the bigger the discount) Vehicle Storage (discount up to 60%) Family Discount (multiple drivers) Length of Membership Military Installation (save up to 15% when vehicle is garaged on base) No Payment Plan Fees |

Premiums: $1,022

Customer satisfaction rating: 874

Financial strength rating: A++ (highest rating issued by A.M. Best)

Why It Made the List

USAA isn’t just strong in a single category – it’s a list topper in most of them. For example, not only does it offer the lowest premiums in California, but it also ranked #1 in customer satisfaction in the J.D. Power Survey and has the highest financial strength rating of all insurance companies at A++. But it also offers plenty of discounts to bring your premium down to the lowest rates available in California.

What Holds It Back

USAA offers auto insurance only to active duty US military personnel, veterans, and their families. Unfortunately, despite all the benefits it provides, its coverage is not available to the general public. In addition, policy options are more limited than they are with other providers, and the Accident Forgiveness provision is not available in California.

2. Progressive

The Basics

| Policy Options | Gap coverage Medical payments Rental car reimbursement Roadside assistance Custom parts and equipment value Rideshare coverage |

| Discounts | Snapshot app ($145 average discount) Bundle auto and property Name Your Price Tool (enter your desired premium, and Progressive will design a policy), Multi-policy (5% average discount) Multi-car (12% average discount) Continuous coverage Good student Distant students (more than 100 miles from home) Homeowner (average discount nearly 10%) Online quote (4% average discount) Sign online (8.5% average discount) Paperless Pay in full Automatic payment Also offers large accident forgiveness if you have been a customer for at least five years, with no accidents in the last three years. |

Premiums: $1,642

Customer satisfaction rating: 853

Financial strength rating: A+

Why It Made the List

Progressive doesn’t offer the lowest premiums in the state, but it does come in at a very respectable #4 on average premium amount. This may be the result of the large number of discounts offered, and the high-percentage cost reductions they provide. Progressive offers so many discounts it can feel as if you’re getting a break just for signing up – which is actually true!

The company offers accident forgiveness, and the Name Your Price tool, which allows you to choose a premium amount and build your policy around it. That will give you more control over the cost of your policy than the competition typically provides.

What Holds It Back

Progressive has a customer satisfaction of 853 out of 1,000 points, it’s just a hair above the California statewide average of 817.

3. Geico

The Basics

| Policy Options | Emergency roadside assistance Rental reimbursement Mechanical breakdown Motorcycles ATVs Recreational vehicles Boats Collector autos Ridesharing |

| Discounts | Safety equipment New vehicle Good driver (five years accident-free) Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

Premiums: $1,544 (6th lowest average premium on our list)

Customer satisfaction rating: 857

Financial strength rating: A++

Why It Made the List

GEICO’s average premium is only the 6th lowest on our list, but it’s still more than $300 below the California statewide average premium. Not only does GEICO have a very extensive list of discounts, but they publish the percentage savings for each on their website (they can run as high as 40 % for a single discount).

They also offer optional coverage for mechanical breakdown. It can take the place of the car manufacturer’s extended warranty and cover your vehicle for up to seven years or 100,000 miles. It’s a way of combining savings on car maintenance with auto insurance.

What Holds It Back

GEICO ranks #6 in customer satisfaction among the companies listed in the J.D. Power survey. It also would’ve placed higher if its premiums were a little bit lower. Even though they’re well below the statewide average, they’re several hundred dollars higher than USAA, Wawanesa, and Nationwide.

4. Allstate

The Basics

| Policy Options | Rideshare coverage New car replacement Accident forgiveness Sound systems Roadside assistance Personal umbrella Rental reimbursement Classic cars Car insurance for travel to Mexico |

| Discounts | New car Multi-policy Smart student Vehicle safety equipment Early signing Responsible payer New car Paperless Pay by automatic withdrawal and/or full payment Drivewise monitoring app |

Premiums: $1,850

Customer satisfaction rating: 822

Financial strength rating: A+

Why It Made the List

Allstate has the built-in advantage of being one of the most well-established and respected insurance companies in America. But they also offer plenty of valuable policy options, and enough discounts to keep the premium levels well below the statewide average.

What Holds It Back

Allstate is below average in customer satisfaction, coming in at #12 on the J.D. Power Survey. It could indicate some issues with payment of claims in the Golden State.

5. Esurance

The Basics

| Policy Options | Car rental Travel expenses for an accident more than 50 miles from home Medical payments Emergency roadside assistance Rideshare Sports cars Antique classic cars Small business vehicle |

| Discounts | Multi-car Anti-Theft Mature Driver Multi-policy (bundle) Paid in Full Claim-Free (at least five years with no claim or DUI/DWI) DriveSense monitoring app Good student Vehicle safety equipment |

Premiums: $1,473

Customer satisfaction rating: 836

Financial strength rating: A+

Why It Made the List

It’s not a coincidence that Allstate and Esurance placed five and six on our list since Esurance is part of the Allstate family. Even still, Esurance has a much stronger customer service rating, ranking #2 on the J.D. Power Survey. It’s hard to say why one part of the same company would have a much more favorable claim experience but we’re not going to question it.

What Holds It Back

The average premium at $1,473 is the highest on our list, and only slightly below the statewide average. Esurance also has fewer policy options than other insurance companies on this list.

6. Nationwide

The Basics

| Policy Options | Medical payments Towing and labor Rental car expense Gap coverage Roadside assistance Vanishing Deductible (earn $100 off your deductible for each year of safe driving, up to $500) Total loss deductible waiver (deductible is waived in the event of a total loss) |

| Discounts | Multi-policy Multi-vehicle SmartRide monitoring app Accident forgiveness Automatic payment Good student Defensive driving (complete a state approved course for drivers 55 and over) Anti-theft Safe Driver (free of major violations or at-fault accidents for at least five years) Affinity member (extends to hundreds of alumni associations, professional groups, sports groups, and special interest groups) |

Premiums: $1,238 (3rd lowest average premium on our list)

Customer satisfaction rating: 883

Financial strength rating: A+

Why It Made the List

Nationwide has one of the lowest average premium rates in California, typically charging a full one-third below the statewide average. That certainly warrants consideration of their car insurance, especially when you consider Nationwide is one of the most respected insurance companies in the country. Nationwide is a bit light on policy options, but their Vanishing Deductible allows you to reduce your deductible by $100 for each year of safe driving, up to $500. It may be possible to completely eliminate your deductible with this provision.

What Holds It Back

Nationwide ranks #16 in the J.D. Power Survey, placing it just one step above last among 17 companies included in the survey. This can be an indication there are problems with claims, though the company’s A+ financial rating would suggest they certainly have the financial resources to cover those payments.

How We Found the Best Car Insurance in California

In compiling our list of what we believe to be the best car insurance companies in California, we’ve used the following five criteria to make that determination:

Policy Options

Every insurance company in California provides legally required coverages, like liability and property damage. But what differentiates one company from another in this category is the number of options they offer above the legal minimum.

We’ve evaluated options such as ridesharing coverage, gap insurance, rental car reimbursement, and other provisions to determine which companies offer the most complete set of policies.

Discounts

A major reason why some car insurance companies in California have significantly lower premiums than others has to do with discounts. They may have similar base premiums, but a large number of discounts bring the policy cost down to a much more affordable level.

In determining our list of the best car insurance companies in California we looked not only at the number of discounts offered by each company but also at the percentage of those discounts offered. For example, a company that provides a 30% discount for bundling is stronger in this category than one offering only 15%.

Discounts are a complicated category because there are so many and some are unique to each provider. As we have already advised, you should request a full list of discounts from any company you are considering getting car insurance from so you can take advantage of any that apply to you.

Premiums

If anyone trying to present car insurance premiums in any state is completely honest, it’s virtually impossible to come up with hard numbers. The reason is that premiums vary based on more than a dozen factors. Factors include your driving history, age, gender, credit history, occupation, the type of vehicle you drive, the number of miles you drive, and as we’ll discuss in a few moments, your geographic location within the state. And that’s not a complete list.

The most that can be done is to make reasonable estimates based on averages. In preparing this guide, we’ve presented premium information based on data provided by The Zebra, which is determined to be a reliable source of pricing information.

It would be convenient to say that the company offering the lowest statewide average premium is likely to be the lowest for most people under the “all things being equal” doctrine. But when it comes to car insurance, all things are never equal. That’s why it’s critically important to get quotes from several companies. It doesn’t matter which company is reputed to be the cheapest, the premium you’ll pay will depend entirely on your personal circumstances.

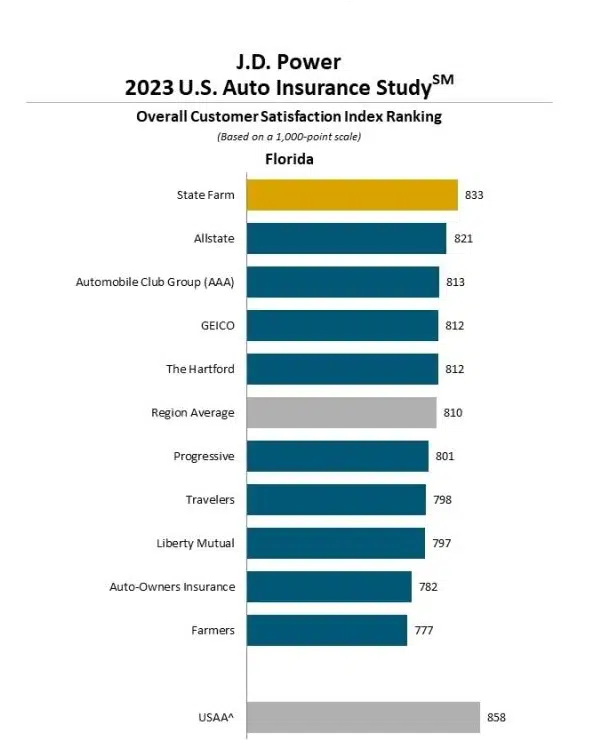

Customer Satisfaction Rating

Paying a low premium is obviously important. But what’s equally important is the primary purpose car insurance serves, and that’s the payment of claims in the event of an accident. Fortunately, there’s an industry survey that ranks companies’ claims performance in each state or region.

We’re using the J.D. Power U.S. Auto Insurance Study, released in June 2023. More specifically, we’ve relied on the Overall Customer Satisfaction Index Ranking – California Region.

Insurance Company Financial Strength

The financial strength of an insurance company is often totally ignored by consumers, who are more concerned with getting the lowest premium. However, financial strength indicates an insurance company’s all-important ability to meet its financial obligations. That includes the payment of claims. It will do you little good to pay the cheapest premium if the insurance company you have your coverage with can’t afford to pay a claim.

In our evaluation, we’ve included only companies rated either “Superior” or “Excellent” for financial strength by the insurance industry rating service, A.M. Best.

Their ratings for companies with financial strength of “Good” or better are as follows:

- Superior: A+, A++

- Excellent, A, A-

- Good, B, B+

We have not included any companies rated lower than “A”.

What You Need to Know About Car Insurance Laws in California

Car insurance laws and requirements vary from one state to another. Regulations in California are as follows:

State Minimum Insurance Requirements

The minimum California car insurance requirement is “15/30/5”, broken down as follows:

- Bodily Injury: $15,000 for injury or death to one person as a result of an auto accident.

- Bodily Injury: $30,000 for injury or death to more than one person as a result of an auto accident.

- Property Damage: $5,000 per accident.

Bodily injury, more commonly known as liability coverage, pays for both injury and loss of wages to another driver or their passengers, as a result of an accident caused by you. The same is true of property damage. It will cover damage to another driver’s vehicle in an accident where you are determined to be at fault. It’s important to understand that property damage does not extend to repairing your own vehicle in an at-fault accident. (Collision coverage pays for damage to your own vehicle when you are at fault in an accident.)

Also be aware that, unlike many other states, California does not require drivers to maintain coverage for uninsured or under-insured motorists, or personal injury protection (PIP). Those are optional coverages in California, but very valuable additions nonetheless.

California’s Financial Responsibility Provision

Though maintaining car insurance is a legal requirement in California, state law does provide for alternatives. In fact, there are three – though only a small percentage of the state’s population chooses to go that route:

- You can make a cash deposit of $35,000 with the Department of Motor Vehicles.

- You can obtain a self-insurance certificate from the DMV.

- Obtain a surety bond in the amount of at least $35,000 from an issuer licensed to do business in the state.

It’s easy to see why so few take advantage of the Financial Responsibility provision. If you do, you’ll essentially be transferring your liability from an insurance company to yourself personally. It may be a good option and have for some people under very limited circumstances, but it certainly isn’t applicable to the typical driver.

California Mandates a Good Driver Discount

Under Proposition 103, California guarantees you a discount – of 20% – if you meet the following criteria:

- You’ve had your driver’s license for at least three years,

- You have no more than one point on your driving record in the past three years, and

- You haven’t been determined to be at fault in a fatal car accident or one that’s caused at least $1,000 in property damage in the past three years.

A 20% discount in a state that has some of the highest car insurance premiums in the country is a goal worth working toward.

Geography Has a Major Effect on Car Insurance Premiums in California

Throughout this guide, we’ve presented premium numbers. But it’s important to understand those are just averages. The actual premium you’ll pay will depend on factors such as your driving history, age, gender, occupation, vehicle type, and safety equipment, credit rating, and many other factors.

For example, while there are densely populated metropolitan areas, like Los Angeles, San Diego, and the Bay Area, there is also extensive farm country and rural areas. If you live in an urban area, premiums will be much higher than they will be for those living in rural regions. This has to do with much greater population density, and the likelihood of more frequent accidents it causes.

While someone in a rural community may pay $1,500 per year for car insurance, another with an otherwise identical driving profile may pay two or three times more just for living in a major urban area. For this reason, it’s very difficult to generalize premium rates in California.

Summary: Best Car Insurance in California

California State Car Insurance FAQs

Is California a “no-fault” state?

No. Generally speaking, no-fault laws – which apply in about a dozen states – require that you file a claim against your own insurance company in the event of an accident, regardless of who is at fault. And varying on the state, it may also limit your ability to sue an at-fault party for damages, like pain and suffering.

California is not one of those states. If you are determined to be at fault in an accident you will be required to cover the liability and property damage caused to the injured party. You may also be subject to litigation if your insurance is insufficient to cover the damages claimed.

With California having among the highest car insurance premiums in the country, what can I do if I can’t afford coverage?

If you can’t afford coverage, you can take advantage of California’s Low-Cost Auto Insurance (CLCA). It’s a state-sponsored program designed to make auto insurance more affordable. However, the website doesn’t provide potential premium ranges, probably because they’re subject to all the variables that affect any auto insurance policy.

To qualify for the program, you’ll need to meet the following eligibility requirements:

- Have a valid California driver’s license.

- Meet income eligibility guidelines (see below).

- Own a vehicle valued at $25,000 or less.

- Be at least 16 years old.

- Have a good driving record.

Current yearly income eligibility is as follows:

- Single person household, $31,900.

- 2-person household, $43,100.

- 3-person household, $54,300.

- 4-person household, $65,500.

- 5-person household, $76,700.

- 6-person household, $87,900.

There are additional income limits for larger households, but you can refer to the website for that information.

Should I get uninsured or under-insured motorist coverage, even though it’s not required by state law?

If you can afford the additional cost, you absolutely should. Despite laws requiring all drivers to have coverage and stiff penalties if they don’t, many thousands continue to go without it. If you are involved in an accident where the at-fault party either has insufficient coverage or none at all, you’ll need to collect from your own insurance company. That raises the possibility of your premiums being increased for a claim.

Since you could very well end up paying a higher premium for not having uninsured/under-insured motorist coverage, it might make more sense to pay for the provision upfront and avoid taking a bigger hit later.

Why does it seem that there are fewer policy options and discounts in California than in other states?

It likely has to do with Proposition 103. Since state law mandates that driver history must be the primary criterion in determining car insurance premiums, some of the policy options and discounts offered in other states may not be available or necessary in California. Since insurance companies are required to provide an across-the-board discount to a good driver automatically, an itemization of provisions and discounts is less needed.