There are a lot of companies offering car insurance in Illinois. But too many options can sometimes be confusing, and that’s why we’ve produced this best car insurance in Illinois guide. This guide narrows the field of potential quotes from more than 30 down to just eight. We believe these are the best car insurance companies in Illinois based on a combination of factors, including premium rate, customer satisfaction, financial strength, and policy options and discounts.

Start the process by comparing coverage and rates among several companies. Use the quote tool below from our car insurance partner:

The Most Important Factors When Comparing Car Insurance in Illinois

Table of Contents

Shopping for car insurance in Illinois is particularly involved, due to the very large number of companies operating in the state. To help you in your search, we recommend you do the following to find the right company for you:

Compare your premium with the statewide average. Fortunately, Illinois isn’t one of the more expensive states when it comes to car insurance. In fact, at $1,296 per year, car insurance is fairly reasonably priced in the state. Virtually every car insurance company on our list has a statewide average premium that’s below this figure, which will give you a good starting point for getting the best deal.

Look for discounts. Virtually all car insurance companies offer discounts. And from a consumer standpoint, this is critically important. It’s not always the company with the lowest average premium that will offer the best plan for you. Instead, it’s more likely to be the company with the most discounts you can qualify for.

Bundle and save. Most companies will give you a substantial discount if you have other types of policies with them. The most common is a type of home-related policy, like homeowner’s, renter’s, or condo insurance. But there may be other policy types that will qualify you for the bundling discount.

If you’re having difficulty finding affordable car insurance, raise your deductible. The reduction in your premium can be substantial by raising your deductible from the usual $500 to, say, $1,000. If you choose that option, just make sure you have enough funds in your emergency fund to cover the extra out-of-pocket costs you’ll need to pay with an at-fault accident.

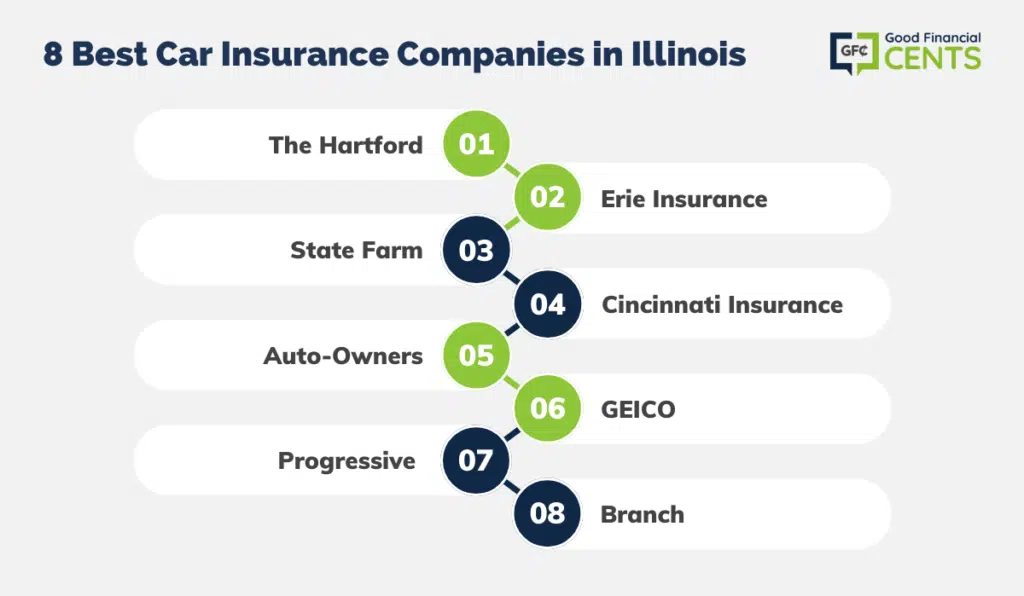

The 8 Best Car Insurance Companies in Illinois

There’s no one-size-fits-all when it comes to car insurance. While most companies have coverage in all driver categories, each has its own specialization, so be sure to check out the policy options. You may find you’ll get a more affordable policy with a company that specializes in your personal category than you will from the company that’s cheapest overall.

Based on our analysis, the following companies are the best options in Illinois

1. The Hartford

2. Erie Insurance

3. State Farm

4. Cincinnati Insurance

5. Auto-Owners

6. GEICO

7. Progressive

8. Branch

Author’s Pick: I personally have Progressive, and have found the company to be between good and excellent in all categories. However, I don’t live in Illinois, so the situation with Progressive may not be the same for you. However, I’ve not only found them to consistently have the lowest premiums but also outstanding customer service and fast payment of claims.

Below is our list of what we believe to be the best car insurance providers in Illinois. Our ranking is based on objective factors, and not on personal opinion. We’ve also indicated why each company made our list and included a section under What Holds It Back to list any apparent weaknesses in their product offering.

Note on Policy Options: We’re not going to include minimum required coverages in Illinois, nor collision and comprehensive, since all three are typical options offered by all insurance companies.

Special Mention: USAA — Best for Members of the Military

USAA would be included as one of the best car insurance providers in nearly every state in the country, based on objective factors. For example, its average premium of $2,261 is one of the lowest in Illinois. The company gets an A++ rating on financial strength from A.M. Best, and they had the highest J.D. Power Customer Service rating of all carriers in the state, at 890.

But USAA makes car insurance available only to active members and veterans of the US military and their families. Since their coverage isn’t available to the general public, we’ve excluded it from the list below. But if you’re a current or former member of the US military and you’re looking for car insurance, USAA should be your first choice.

1. The Hartford

The Basics

| Policy Options | Lifetime Renewability 12-month rate protection (rather than the standard six months) RecoverCare – assistance after an accident New car replacement coverage Lifetime car repair assurance First accident forgiveness Legal representation for accidents Disappearing deductible Bundle auto and home insurance Roadside assistance |

| Discounts | Special discounts for AARP members Auto safety equipment Driver training Good student discount Defensive driver course Paid-in-full discount |

Premiums: $862

Customer satisfaction rating: 886

Financial strength rating: A+

Why It Made the List

The Hartford scores well in every category, but the primary advantage – and why they’re at the top of our list – is that they also have the lowest statewide average premium at just $72 per month. But the company is also our choice for the top auto insurer for drivers over 50, especially given that they’ve been a provider of policies to AARP members for the past 34 years.

One other feature about The Hartford we really like is that it offers lifetime renewability. As long as you maintain a valid driver’s license and pay your monthly premiums, your coverage will never be dropped.

What Holds It Back

If The Hartford has a weakness it’s that it’s a bit light on discounts. However, with a low average premium within the state of Illinois, discounts may not be as necessary as they might be with other carriers.

2. Erie Insurance

The Basics:

| Policy Options | Pet coverage Personal items coverage – up to $350 Auto glass repair Roadside and rental bundle Locksmith services ERIE Auto Plus – comes with a diminishing deductible, a $10,000 death benefit, additional days of transportation expense coverage, waiver of deductible in certain situations, and increased limits for specific coverages ERIE Rate Lock – your rates will only change if you add or remove a vehicle or driver, or change the address where you keep your car parked |

| Discounts | Safe driving Car safety equipment Multi-car Multi-policy (bundling) Reduced usage Young drivers Annual payment plan |

Premiums: $1,458

Customer satisfaction rating: 912

Financial strength rating: A+

Why It Made the List

Erie Insurance has the second-lowest statewide average premiums in Illinois and ranks #3 in customer satisfaction. The company also offers a number of unique coverage options, like pet coverage – in case your pet is injured in an accident in your vehicle – and personal item coverage, covering up to $350 and personal possessions in your vehicle.

But maybe the star of the show from this company is the ERIE Rate Lock policy. Once you lock in your premium, it can only change if you make major changes in your plan. It’ll protect you from rising premiums due to moving violations and at-fault accidents.

What Holds It Back

The Erie Rate Lock option may not be as generous as it sounds. While your rates won’t increase unless you make a change to your policy, like adding or removing a vehicle or driver, or changing your address, accident-related increases can take effect when you update your policy for any of those changes. The rate lock policy will work best for those who either maintain a perpetually clean driving record or don’t make any significant changes to their policy.

3. State Farm

The Basics:

| Policy Options | Car rental Travel expenses for an accident more than 50 miles from home Medical payments Emergency roadside assistance Rideshare Sports cars Antique classic cars Small business vehicle |

| Discounts | Anti-theft equipment Defensive driving course Drive Safe & Save – driving monitoring app Good driving Good student Multi-car Multi-policy Vehicle safety equipment Student away at school Steer Clear Safe Driver (complete education requirements and no at-fault accidents or moving violations in the previous three years – both met before turning 25) |

Premiums: $1,481

Customer satisfaction rating: 835

Financial strength rating: A++ (highest)

Why It Made the List

State Farm is a well-respected insurance company on the national scene, but it’s strong across the board in Illinois as well. With an average annual premium of $1,481, it offers the fourth-lowest premium on our list. In addition, the company has the highest financial strength rating and ranks #5 in customer satisfaction.

State Farm offers coverage for ridesharing drivers, which is important because that type of driving activity isn’t covered under a typical personal car insurance policy. Otherwise, State Farm offers a generous list of both policy options and discounts.

What Holds It Back

There’s no indication State Farm provides gap coverage. This is a critical missing part since many drivers owe more to their vehicles than those vehicles are worth. Gap coverage is designed specifically to pay off excess debt. If it’s not offered, you’ll be on the hook to pay the difference.

4. Cincinnati Insurance

The Basics

| Policy Options | Rental car coverage Gap coverage Capstone Auto – covers all vehicles, including antique or collector vehicles and recreational vehicles under a single policy Personal Auto Plus – provides enhanced rental car benefits, airbag replacement, roadside assistance, deductible waiver, trip interruption, lock replacement, and glass deductible waiver Replacement Cost Plus – if your car is totaled, get covered for either a new replacement car or the payoff of the balance of the loan on your previous car Antique or collector car coverage |

| Discounts | Safe driver Bundle home and auto Good student Multi-car |

Premiums: $1,278

Customer satisfaction rating: 870

Financial strength rating: A+

Why It Made the List

Cincinnati Insurance makes our list based on having the third lowest average premium, and some value-packed auto insurance plans that combine numerous options and benefits.

For example, the Capstone Auto plan enables you to cover multiple vehicles under a single policy, with additional benefits like new car replacement, rental car coverage with no daily expense limit, no deductible, and a cash settlement option where you can accept cash if your vehicle sustains damage equal to 50% or more of the agreed-upon value.

What Holds It Back

Cincinnati Insurance ranks only 10th on the J.D. Power customer service survey. It’s still above the statewide average, but only by two points. In a world where consumers are accustomed to purchasing products and services online, you’ll be required to contact a live agent to get a policy. The company also has fewer discounts available than its competitors.

5. Auto-Owners Insurance

The Basics

| Policy Options | Classic cars Converted for modified vehicles Road trouble service New car replacement Rental car coverage Additional expense – to cover cost of your stranded away from home Diminished value – protects your vehicle value if it declines even after repair Loan/lease gap coverage Personal Automobile Plus – create a package of 10 optional coverages for one competitive rate; includes identity theft, rekeying locks, replacing your cell phone and more |

| Discounts | Multi-policy On-time payments (36 months or more) Paperless billing Multi-car Good student Student away at school Teen Driver Monitoring Paid-in-full premium Advance quote Vehicle safety features Favorable loss history |

Premiums: $1,049

Customer satisfaction rating: 822

Financial strength rating: A++

Why It Made the List

Auto-Owners Insurance has only the fifth lowest average premium on our list, at $1,049 per year. But this is still almost $300 below the Illinois statewide average car insurance premium. Meanwhile, the company has a decent customer satisfaction rating, at 822 points, and is at the top of the financial strength food chain, with a rating of A++.

The company also offers a solid number of policy options and discounts. The Personal Automobile Plus Package enables you to build a policy with as many as 10 coverages, all at a very competitive rate.

What Holds It Back

Auto-Owners Insurance is only available in about half the states in the US. If you have coverage with this company in Illinois, there’s about a 50% chance you’ll need a new carrier if you move to a different state.

6. Geico

The Basics

| Policy Options | Safety equipment New Vehicle Good driver (five years accident-free) Drivers over 50 Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

| Discounts | Safety equipment New vehicle Good driver (five years accident-free) Drivers over 50 Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

Premiums: $1,353 (6th lowest average premium on our list)

Customer satisfaction rating: 824

Financial strength rating: A++

Why It Made the List

GEICO doesn’t have the lowest premiums in the state – though they’re still well below the statewide average for Illinois. But they are one of the lower-cost providers and also have both above-average financial strength and customer service ratings. They should be on your short list of car insurance options in Illinois.

GEICO is also strong when it comes to certain types of drivers. This includes those who participate in ridesharing, drivers with a moving violation, and younger drivers.

What Holds It Back

GEICO is another provider that doesn’t offer gap insurance. They also offer certain types of coverage through partner service providers, rather than directly from the company itself.

7. Progressive

The Basics

| Policy Options | Gap coverage Medical payments Rental car reimbursement Roadside assistance Custom parts and equipment value Rideshare coverage |

| Discounts | Snapshot app ($145 average discount) Bundle auto and property Name Your Price Tool (enter your desired premium, and Progressive will design a policy), Multi-policy (5% average discount) Multi-car (12% average discount) Continuous coverage Good student Distant students (more than 100 miles from home) Homeowner (average discount nearly 10%) Online quote (4% average discount) Sign online (8.5% average discount) Paperless Pay in full Automatic payment Small accident forgiveness – premium won’t be increased for a claim of less than $500 Large accident forgiveness – no rate increase in an accident if you have been a customer for a least 5 years, and no accidents for the past 3 years |

Premiums: $687

Customer satisfaction rating: 822

Financial strength rating: A+

Why It Made the List

Progressive has more discounts on their car insurance policies than just about any company operating in Illinois. They assign at least a small discount to nearly every aspect of your existence, including your payment arrangements, document signings, document receipts, as well as large and small accident forgiveness.

Perhaps what Progressive is best known for is the Name Your Price tool. It enables you to choose a premium amount and build your policy around it. That will give you more control over the cost of your policy than the competition typically provides.

What Holds it Back

Progressive only ranks #12 in customer satisfaction in Illinois, and with 822 out of 1,000 points, it’s the only company on our list that’s below the average Illinois rating for insurance companies of 830.

8. Branch

The Basics:

| Policy Options | Liability coverageUninsured/Underinsured motorist protection Personal injury protection (PIP)Coverage for physical damage Comprehensive auto insurance coverage Coverage if you drive for Uber or Lyft |

| Discounts | Refer-a-friend program Community Pledge discount |

Premiums: Premiums not available

Customer satisfaction rating: 5-star rating with the Better Business Bureau (BBB)

Financial strength rating: A+

Why It Made the List

Branch promises to help Illinois residents save money on auto insurance thanks to their hassle-free, direct sales approach. This provider offers liability coverage, coverage for physical damage, personal injury protection (PIP), and special coverage you can purchase if you drive for Uber or Lyft. You can also access the lowest pricing without having to bundle policies, or you can get a quote from Branch and use it to bundle your auto insurance with homeowners insurance or renters insurance.

Branch lets you get a quote in as little as 30 seconds, and you can file claims seamlessly over the phone or using the Branch website or mobile app.

What Holds It Back

Branch doesn’t list many of the same discounts as other auto insurance companies, which is a shame since other providers give discounts for paperless billing, being a good student, paying your premium in advance, and more.

How We Found the Best Car Insurance in Illinois

We used the following criteria to determine our ranking. In each case, the car insurance company was rated based on the combination of these factors.

Policy Options

Every car insurance company will provide the minimum legally required coverage in Illinois. But they’ll also provide standard optional coverage, like collision, comprehensive.

In our evaluation, we listed additional coverage options, beyond the standard ones offered by virtually all companies. You should be able to find the company with the best combination of options for your driver profile.

Discounts

If you find a car insurance company with low premiums, chances are that discounts are a major reason. The more discounts the company offers – and the more substantial they are – the lower your final premium will be.

In our evaluation of each company, we listed all discounts published by each, unless those discounts were specifically unavailable in Illinois.

Premiums

Undoubtedly, premium cost is the criteria every consumer is most interested in, and that’s perfectly understandable. To accommodate that interest, we’ve used the average premium rates in Illinois for each company as a barometer. The premium information is based on data provided by The Zebra, which is determined to be a reliable source of pricing information.

But please use this only as a starting point for premiums. Because of the many different factors that affect premium level, it’s impossible to generalize which company is likely to be the least expensive. It will depend on a multitude of factors, including your driving history, the type of vehicle you own, how many miles you drive, your age, and the number of policy options and discounts you either want or are qualified for.

Short of getting a quote – which we recommend you do using the quote tool at the beginning of this guide – there’s no reliable way to estimate what your final premium will be.

Customer Satisfaction Rating

The real “product” of car insurance is paying a claim following an accident or other damage to your vehicle. The willingness – and the ease – with which an insurance company handles and pays a claim is a critical factor in determining the overall reliability of that company.

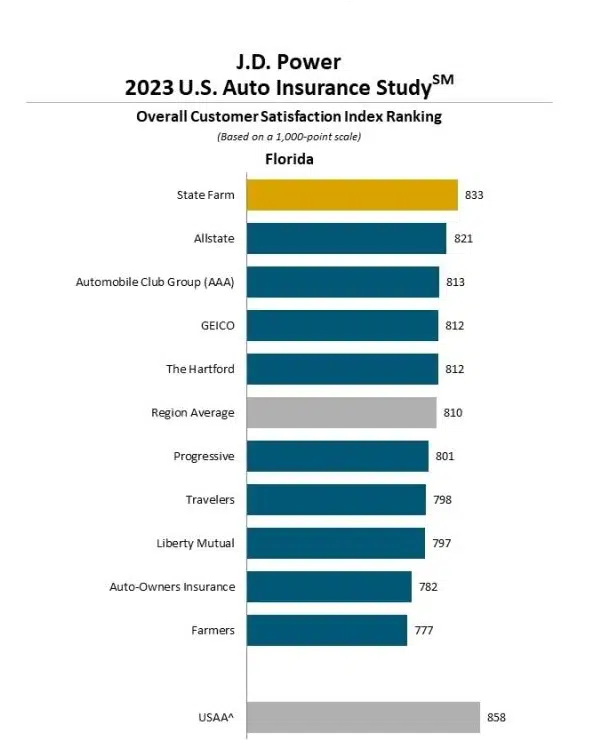

We’re using the J.D. Power U.S. Auto Insurance Study, released in June 2023. More specifically, we’ve relied on the Overall Customer Satisfaction Index Ranking – North Central Region, which includes Illinois. We included only the car insurance companies that were above or at least near the region-wide average score of 830.

Insurance Company Financial Strength

Financial strength indicates an insurance company’s ability to meet its financial obligations, which includes its ability to pay claims. Cheap car insurance will do little more than satisfy the minimum legal requirements in Illinois but could leave you with unpaid claims.

For that reason, we’ve included only companies rated either “Superior” or “Excellent” for financial strength by the insurance industry rating service, A.M. Best.

Their ratings for companies with financial strength of “Good” or better are as follows:

Superior: A+, A++

Excellent, A, A-

Good, B, B+

We have not included any companies rated lower than “A”.

What You Need to Know About Car Insurance Laws in Illinois

Car insurance laws and requirements vary from one state to another. Regulations in Illinois are as follows:

State Minimum Insurance Requirements

The minimum Illinois car insurance requirement is “25/50/20”, broken down as follows:

- Bodily Injury: $25,000 for injury or death to one person as a result of an auto accident.

- Bodily Injury: $50,000 for injury or death to more than one person as a result of an auto accident.

- Property Damage: $20,000 per accident.

Bodily injury, more commonly known as liability coverage, pays for both injury and loss of wages to another driver or their passengers, as a result of an accident caused by you. The same is true of property damage. It will cover damage to another driver’s vehicle in an accident where you are determined to be at fault. It’s important to understand that property damage does not extend to repairing your own vehicle in an at-fault accident. (Collision coverage pays for damage to your own vehicle when you are at fault in an accident.)

Illinois also requires the following coverage types:

- Uninsured Motorist Bodily Injury (UM): $25,000 for injury or death to one person as a result of an auto accident.

- Uninsured Motorist Bodily Injury (UM): $50,000 for injury or death to more than one person as a result of an auto accident.

- Under-insured Motorist Bodily Injury (UIM): Pays the difference between your UIM limits and the liability limits of the at-fault driver, if it is lower than your UIM limits.

Optional car insurance coverage under Illinois law includes:

- Collision

- Comprehensive

- Accidental Death

- Custom/non-factory equipment

- Gap coverage

- Medical payments

- Physical damage/repair/replacement coverage

- Rental reimbursement

- Towing

- Uninsured motorist property damage (UMPD) – covers damage to your vehicle caused by an identified, at-fault, uninsured driver

If you have a loan or lease on your vehicle, the lender will require you to have both collision and comprehensive coverage, and possibly Gap coverage.

Summary: Best Car Insurance in Illinois