Fortunately for residents of the Tar Heel State, North Carolina has some of the lowest car insurance premiums in the country. They’re more than $185 lower than the U.S. national average of $1,553.

Even so, no one wants to pay more for car insurance than they need to, even in low-premium states like North Carolina. For that reason, we’ve identified seven companies we believe qualify as providing the best car insurance in North Carolina.

That doesn’t mean all the companies on our list are the cheapest – though some definitely are. But our list also reflects companies that blend plenty of policy options and discounts, with a strong financial rating and a demonstrated willingness to pay claims when necessary.

Coincidentally, I have my own car insurance through Progressive, which sits at the top of our list (though I don’t live in North Carolina). While Progressive is a strong competitor in North Carolina, we absolutely recommend you shop between carriers. The only way to know which company is the right car insurance provider for you is to get quotes from several.

To make it easy for you, you can use the quote tool below from our insurance partner to check rates from several companies:

Table of Contents

- The Most Important Factors When Deciding on Car Insurance in North Carolina

- The 7 Best Car Insurance Companies in North Carolina

- How We Found the Best Car Insurance in North Carolina

- What You Need to Know About Car Insurance Laws in North Carolina

- The Bottom Line – Find the Best Car Insurance Company in North Carolina

- North Carolina State Car Insurance FAQs

- Summary: Best Car Insurance in North Carolina

The Most Important Factors When Deciding on Car Insurance in North Carolina

We strongly suggest against the practice of choosing a car insurance company based primarily on premiums. One of the main reasons is that one company may be the lowest only because they’re excluding certain types of coverage you should have.

For that reason, we recommend using the following strategies when shopping for the best car insurance in North Carolina:

Get Quotes for Identical Coverage From Each Company. The only real way to know if one policy is cheaper than another is by comparing the coverage they provide. One company is only cheaper than another if they provide identical coverage at a lower premium.

The State-Required Minimum Coverage Is Probably Not Right for You. Minimum coverage is just what the name implies, and it should generally be considered only by young drivers and those who have no assets. If you have the minimum coverage, another driver can pursue legal action against you for additional funds under North Carolina law. Higher coverage limits will be your best defense against that outcome.

Get Quotes From Several Companies. Yes, shopping for car insurance is not one of life’s more pleasurable experiences. But you owe it to yourself to investigate at least a few different companies. Once again, use the quote tool above to get multiple quotes before making your choice.

Increase Your Deductible to Reduce Your Premium. This is a better strategy than lowering your coverage limits. Increasing your deductible from $500 to $2,000 can drastically lower your premium while giving you the benefit of high coverage. You can cover the higher deductible by adding additional funds to your emergency savings in case you’re involved in an at-fault accident.

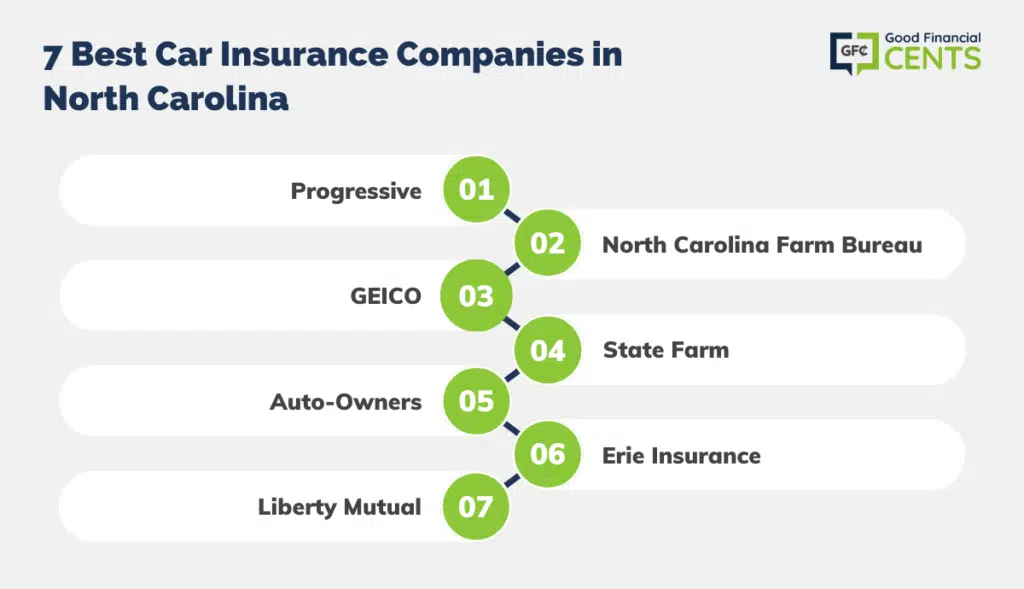

The 7 Best Car Insurance Companies in North Carolina

There is no one best car insurance company for all drivers or even for most. Many companies specialize in certain niches that will make them the best choice for you. To help you in that effort, below is a list of the companies in North Carolina we believe to be the best in specific niches:

Author’s Pick:

Special Mention: USAA — Best for Members of the Military (But Not Available to the General Public)

USAA would rank in the top two or three companies in North Carolina. But we had to exclude them because they provide coverage only for current and previous members of the U.S. military and their families. As great as it is, their car insurance is not available to the general public.

However, if you’re a current or former member of the U.S. military – and North Carolina has many – USAA will almost certainly be the top choice. They offer some of the lowest premiums in North Carolina and have one of the highest customer satisfaction ratings in the Southeastern US. All this is in addition to the fact that they offer a wide range of other financial services to military members.

1. Progressive

The Basics:

| Policy Options |

|

| Discounts |

|

Premiums: $645 (THE lowest average premium on our list)

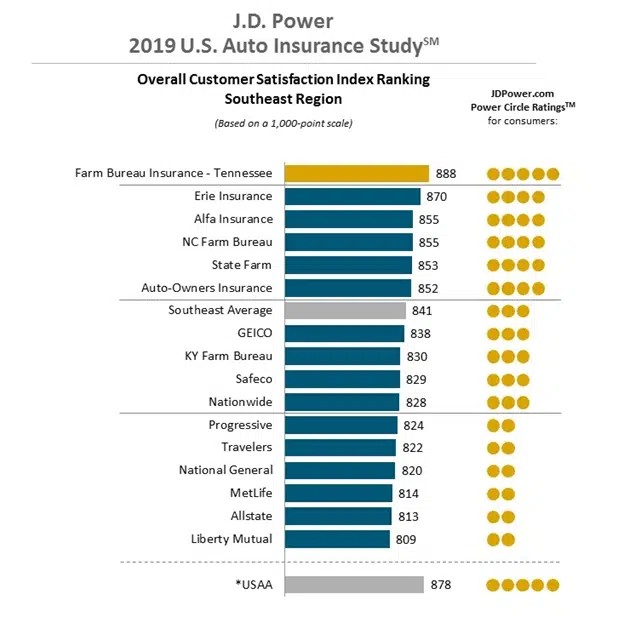

Customer Satisfaction Rating: 824 (#11 on the J.D. Power Survey)

Financial Strength Rating: A+

Why It Made the List

Progressive has the lowest statewide average premium in North Carolina, which by itself might be enough to put it in the top position overall. But a big part of the low premium undoubtedly has to do with the many discounts the company offers, which is probably more than any other insurance company!

But Progressive also has some solid policy options, including ridesharing and custom parts and equipment replacement. It also occupies a number of “best for” categories, including best overall, cheapest overall, best for senior drivers, and one of three companies offering coverage for rideshare drivers.

What Holds It Back

Progressive places only #12 in customer satisfaction, in a tie with Grange Mutual. That’s only slightly below the average customer satisfaction rating for the North Central States. But we’d feel better if it ranked at least in the top 10.

2. North Carolina Farm Bureau

The Basics:

| Policy Options |

|

| Discounts |

|

Premiums: $723 (3rd Lowest Average Premium on Our List)

Customer Satisfaction Rating: 854 (#4 on the J.D. Power Survey)

Financial Strength Rating: A

Why It Made the List

North Carolina Farm Bureau offers a strong combination of having the third-lowest statewide average premium in North Carolina, as well as ranking #4 in customer satisfaction. Much like Progressive, it appears in many of our “best for” categories, including best for minimum coverage, drivers with a DUI or DWI, and drivers with one at-fault accident. This is clearly a company with strong niches.

What Holds It Back

North Carolina Farm Bureau lists a limited number of discounts. But more significantly, the company does not disclose what policy options it offers. This may have to do with the company’s emphasis on local agents and a desire to have customers call in for additional information. That in itself is a bit of a negative factor in an economy where just about every business operates primarily or entirely online.

3. GEICO

The Basics:

| Policy Options |

|

| Discounts |

|

Premiums: $734 (4th lowest average premium on our list)

Customer Satisfaction Rating: 838 (#7 on the J.D. Power Survey)

Financial Strength Rating: A+

Why It Made the List

GEICO made #3 on our list on the strength of having the fourth lowest average premium in North Carolina, a very respectable #7 rating in customer satisfaction, and a financial strength rating of A+. The company also fills some “best for” categories, including best-for-good drivers, drivers with poor credit, and ridesharing drivers. The company is also an excellent second choice behind USAA as an auto insurance provider for members of the U.S. military.

GEICO also has a long list of discounts, and they provide the percentages of those discounts on their website. If you qualify for some of those discounts, GEICO may be your preferred choice.

What Holds It Back

GEICO doesn’t offer gap coverage, which will be a problem for anyone who owes more on their loan or lease than their vehicle is worth. It can result in a big out-of-pocket hit if your vehicle is totaled.

4. State Farm

The Basics:

| Policy Options |

|

| Discounts |

|

Premiums: $764 (5th Lowest Premium on Our List)

Customer Satisfaction Rating: 853 (#5 on the J.D. Power Survey)

Financial Strength Rating: A++ (Highest)

Why It Made the List

State Farm has the fifth lowest statewide average premiums on our list and ranks #5 in customer satisfaction. The company also has the highest financial strength rating possible, at A++. But the company also got our nod for the best carrier for a less-than-perfect driving record and best for students. It’s also one of three companies that offers ridesharing coverage. Much like GEICO and Progressive, State Farm offers an extensive list of discounts to help you minimize your premium.

What Holds It Back

There’s no indication State Farm provides gap coverage. This is a critical missing part since many drivers owe more to their vehicles than those vehicles are worth. Gap coverage is designed specifically to pay off excess debt. If it’s not offered, you’ll be on the hook to pay the difference.

5. Auto-Owners Insurance

The Basics:

| Policy Options |

|

| Discounts |

|

Premiums: $861 (6th Lowest Average Premium on Our List)

Customer satisfaction rating: 852 (#6 on the J.D. Power Survey)

Financial strength rating: A++

Why It Made the List

Auto-Owners Insurance has both the sixth lowest statewide average premium level and ranks #6 in customer satisfaction. It also has a top-of-the-line A++ rating from A.M. Best, the highest financial strength rating possible in the insurance industry. We also believe Auto-Owners is the best company for young drivers. Additionally, they have a more than adequate list of both policy options and discounts to help you customize your policy.

Auto-Owners also has a long list of policy options and discounts. The Personal Automobile Plus Package enables you to build a policy with as many as 10 coverages, all at a very competitive rate.

What Holds It Back

Auto-Owners Insurance makes car insurance available in about half the states in the US. If you have coverage with this company in Georgia, there’s about a 50% chance you’ll need a new carrier if you move to a different state.

6. Erie Insurance

The Basics:

| Policy Options |

|

| Discounts |

|

Premiums: $913 (7th Lowest Average Premium on Our List)

Customer Satisfaction Rating: 870 (#2 on the J.D. Power Survey)

Financial Strength Rating: A+

Why It Made the List

Erie Insurance isn’t one of the best-known car insurance companies in America, but it appears on our lists of the best car insurance in multiple states. The company is seventh out of seven companies on our list for statewide average premiums. But at $913, they’re still more than $180 below the North Carolina statewide average. But even more important, the company ranks #2 in the all-important category of customer satisfaction. This is an excellent indication Erie Insurance pays claims reliably.

What Holds It Back

Erie has an interesting rate lock option (the Erie Rate Lock) that may sound attractive to many consumers. They’ll honor the rate lock – unless you have a significant policy change. If you do, the rate will be recalculated and may go higher. It doesn’t look quite like the guarantee it promises to be.

7. Liberty Mutual

The Basics:

| Policy Options |

|

| Discounts |

|

Premiums: $714 (2nd Lowest Average Premium on Our List)

Customer Satisfaction Rating: 809 (#16 on the J.D. Power Survey)

Financial Strength Rating: A

Why It Made the List

Liberty Mutual has the second-lowest statewide average premium of the companies on our list. At $714 per year, it’s more than $380 below the North Carolina statewide average. That factor alone guarantees it a place on any list of the best car insurance in North Carolina. But the company also offers more policy options and discounts than most of its competitors. They’ll give you a better opportunity to customize your policy, with the assurance that Liberty Mutual is one of the lowest-cost providers in the state to begin with.

What Holds It Back

Liberty Mutual ranks a disappointing #16 in customer satisfaction. This could be an indication they’re not as good at paying claims as the other companies on this list. Also, the company didn’t place in any of the “best for” categories on our list. But that wouldn’t necessarily stop it from being the right car insurance company for you.

How We Found the Best Car Insurance in North Carolina

To show that the evaluation of our list is objective, we used the following criteria to determine our rankings. In each case, the car insurance company was rated based on the combination of these factors.

Policy Options

The best car insurance policy is one that is customized to your own personal needs and driver profile. The best way to make that happen is with a company that offers a large number of policy options. For that reason, the number of policy options offered by a car insurance company is a significant factor in our ranking.

Discounts

Discounts are still another way to customize your policy. But just as important, they also provide an opportunity for you to get a lower premium based on specific factors that may offer significant reductions in your premium. Discounts are another major factor in our list of the best car insurance in North Carolina.

Premiums

Just like everyone else, we understand the central role premiums play in determining car insurance selection. Premiums are one of the major contributing factors to our list of what we believe to be the best car insurance providers in North Carolina. But at the same time, we’ve been careful not to overemphasize it. It has to be balanced against a company’s demonstrated willingness and ability to pay claims (which is the last criterion below).

We obtained those averages from The Zebra, which is determined to be a reliable source of pricing information. But please understand these are only a starting point. In the insurance universe, a company with the lowest average premium may not necessarily end up being the lowest-cost policy for you. Once again, get quotes from multiple companies!

Customer Satisfaction Rating

We’ve given customer satisfaction equal weight with premiums in determining our list. That’s because it includes the consumer’s experience with the claims-paying side of each company on the list. It does little good to pay a rock-bottom premium only to have the company fail to pay a claim in an accident. After all, paying claims is the main reason for car insurance in the first place.

We’re using the J.D. Power U.S. Auto Insurance Study, released in June 2019. More specifically, we’ve relied on the Overall Customer Satisfaction Index Ranking – Southeast Region, which includes North Carolina.

Insurance Company Financial Strength

Financial strength indicates an insurance company’s ability to meet its financial obligations, which includes its ability to pay claims. Cheap car insurance will do little more than satisfy the minimum legal requirements in North Carolina but could leave you with unpaid claims.

For that reason, we’ve included only companies rated either “Superior” or “Excellent” for financial strength by the insurance industry rating service, A.M. Best.

Their ratings for companies with financial strength of “Good” or better are as follows:

- Superior: A+, A++

- Excellent: A, A-

- Good: B, B+

We have not included any companies rated lower than “A”.

What You Need to Know About Car Insurance Laws in North Carolina

Car insurance laws and requirements vary from one state to another. Regulations in North Carolina are as follows:

State Minimum Insurance Requirements

The minimum North Carolina car insurance requirement is “30/60/25”, broken down as follows:

- Bodily Injury: $30,000 for injury or death to one person as a result of an auto accident

- Bodily Injury: $60,000 for injury or death to more than one person as a result of an auto accident.

- Property Damage: Covering all necessary and reasonable medical expenses up to $25,000 for a covered injury, regardless of who is at fault.

- Uninsured motorist bodily injury: $30,000 for injury or death to one person as a result of an auto accident and $60,000 for two or more. This coverage is usually bundled with your regular liability coverage and not carried as a separate provision.

- Uninsured motorist property damage: $25,000

Optional car insurance coverage under North Carolina law includes:

- Collision

- Comprehensive

- Gap coverage

- Rental cars (up to 22 days)

- Towing and labor

If you have a loan or lease on your vehicle, the lender will require you to have both collision and comprehensive coverage and possibly Gap coverage.

The Bottom Line – Find the Best Car Insurance Company in North Carolina

North Carolina’s favorable car insurance premiums, being significantly lower than the national average, presents a boon for its residents.

Among the array of insurance providers, seven companies stand out for their blend of competitive pricing, policy flexibility, and strong financial standing, offering a fine balance between cost and coverage.

Progressive, notably mentioned by the author, leads the pack, yet a thorough exploration across carriers is encouraged to unearth the one most attuned to individual needs.

Alongside the hunt for lower premiums, obtaining quotes for identical coverage from various companies and considering an increase in deductible are savvy steps toward landing a cost-effective yet robust car insurance policy.

Moreover, the special mention of USAA underscores an excellent option for military members, epitomizing the diverse offerings in the North Carolina car insurance landscape.

North Carolina State Car Insurance FAQs

Is North Carolina a “no-fault” state?

No. Under North Carolina driving regulations, drivers can pursue claims against the at-fault party in an accident. And if that other person has insufficient coverage, you can legally pursue payment from the at-fault party personally.

Under a no-fault system, you would file a claim against your own insurance company regardless of who is at fault. In addition, the ability to pursue legal remedies is typically limited.

What will happen if I don’t have car insurance in North Carolina?

Insurance companies operating in North Carolina are required to notify the North Carolina Division of Motor Vehicles anytime liability insurance is canceled or coverage lapses. The DMV will send a liability insurance termination notification, and you will then have 10 days to respond. If you don’t, you’ll be subject to the following penalties:

- First insurance lapse: $50

- Second insurance lapse: $100

- Subsequent insurance lapses: $150

- Restoration fee: $50

Will my North Carolina car insurance cover me if I’m driving in another state?

Under what’s known as a broadening clause, your North Carolina policy will automatically extend to driving in other states. This includes states that operate under a no-fault system. It’s typically included in the policies of most car insurance companies.

What type of factors will affect the premium I’ll pay for my car insurance in North Carolina?

Though there can be a number of factors based on the individual insurance company issuing your policy, there are four primary determining factors:

Your driving record. This will include both moving violations and claims for-at fault accidents. Fortunately, there is typically a time limit after which these infractions are dropped from your record for insurance purposes.

Where you live. If you live in a highly-populated metropolitan area or city, you’ll pay a higher premium due to the greater likelihood of an accident. Premiums will generally be lower in small towns and rural areas.

The type of vehicle you drive. Generally speaking, the more expensive a vehicle is the more it will cost to insure. But certain types of vehicles have higher premiums, including sports cars, SUVs, and luxury vehicles.

The number of miles you drive. Someone who drives 30 miles in each direction, each day to and from work will be charged a higher premium than another whose commute is just 10 miles in each direction.