Ohio is one of the most affordable states to buy car insurance in. And even if you pay a little bit more, you’re probably still paying less than the average American does for car insurance in other states. We prepared this guide to the best car insurance in Ohio and are happy to report that five of the eight companies we’ve included have statewide average premiums below the Ohio average.

But there’s a big difference between getting the cheapest car insurance in Ohio and getting the best car insurance for the money. And that’s precisely what we’ve emphasized in this guide. We’ve looked at a variety of criteria to determine the companies we believe offer the best car insurance in Ohio.

While premium level certainly figured into our rank, we also considered qualitative factors, including customer satisfaction and policy options, in determining which companies are likely to best serve the majority of drivers.

The only way to find the best car insurance for you is by getting quotes from several of the best providers. Use the quote tool below from our car insurance partner:

Table of Contents

The Most Important Factors When Deciding on Car Insurance in Ohio

Buying car insurance isn’t the simplest purchase the average person makes because it’s something of a matrix. Sure, you want to get the cheapest policy possible. But at the same time, you’ll want to make sure you have the right amount of coverage and the specific provisions that will best match your driver profile.

To help you find the best car insurance in Ohio, we recommend using the following strategies:

- The company with the lowest premium isn’t necessarily the best. Do some investigating to find out the company’s customer satisfaction rating, as well as its financial strength rating. We’ve done that with the companies on our list. Both are important because they indicate the company’s willingness and ability to pay claims. Since that’s the whole reason for having car insurance in the first place, it must be carefully considered.

- Shop, shop, shop! If it’s one thing we’ve learned from preparing these insurance guides it’s that there is no one best company for everyone. Be sure to get quotes from several different companies, then do a side-by-side comparison to decide which one stands above the others.

- Match available policy options with your personal needs. Every company offers multiple options. The one with the options that best match your needs is likely to be the carrier for you.

- Get the right amount of coverage. Before deciding on a car insurance policy, first do an evaluation of your financial situation. If you’re young and have few assets, you may be well covered by minimum policy amounts. But if you have a home and significant financial assets you’ll need a higher coverage level. Don’t skimp here! In most states, if you’re the at-fault party in an accident the other driver can pursue your personal assets if your insurance coverage is insufficient to settle the claim.

The Best Car Insurance Companies in Ohio

We would absolutely love to categorically declare one company has the best car insurance in Ohio, but that would be a complete exaggeration. What’s more important for most drivers is finding the company that will best fit your needs and preferences, which is why it’s important that you take a close look at the policy options offered by each company. With that in mind, below is a list of the companies we found to be the best in Ohio:

Author’s Pick:

Below are descriptions of what we believe to be the best car insurance providers in Ohio. Our ranking is based on objective factors, and not on personal opinion. We’ve also indicated why each company made our list and included a section under What Holds It Back to list any apparent weaknesses in their product offering.

Special Mention: USAA — Best for Members of the Military (Not Available to the General Public)

Before we get into our list of the best car insurance in Ohio, we want to start the discussion with USAA. It’s not included on our list only because it’s not available to the general driving public. It’s strictly for active and retired members of the US military and their families. For that reason, we had to leave it off our list.

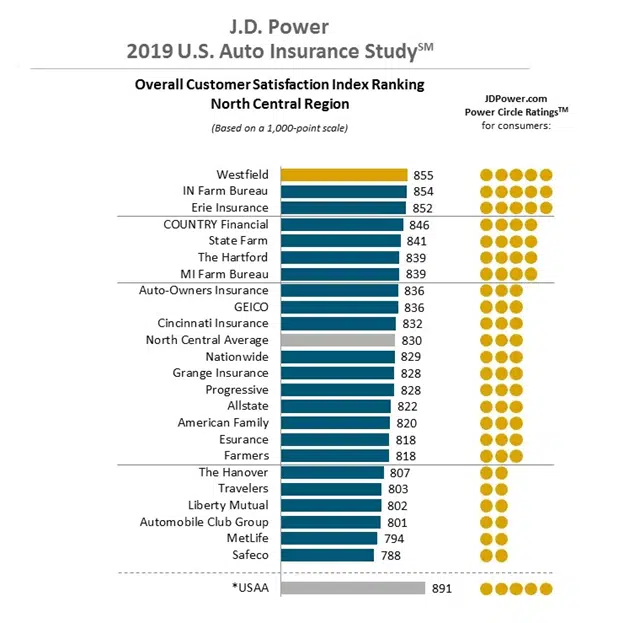

But if you’re a current or former member of the military, USAA will almost certainly be your best choice for car insurance. First, they have the highest customer satisfaction rating in Ohio on the J.D. Power Customer Satisfaction Survey of all carriers in the state, at 891 out of 1,000 points. They have an A++ rating on financial strength from A.M. Best. And they also have one of the lowest statewide average premiums in Ohio, at $409.

1. Erie Insurance

The Basics:

| Policy Options | Pet coverage Personal items coverage – up to $350 Auto glass repair Roadside and rental bundle Locksmith services ERIE Auto Plus – comes with a diminishing deductible, a $10,000 death benefit, additional days of transportation expense coverage, waiver of deductible in certain situations, and increased limits for specific coverages ERIE Rate Lock – your rates will only change if you add or remove a vehicle or driver, or change the address where you keep your car parked |

| Discounts | Safe driving Car safety equipment Multi-car Multi-policy (bundling) Reduced usage Young drivers Annual payment plan First Accident Forgiveness Diminishing deductible ($100 per year, up to $500) |

Premiums: $674 (THE lowest average premium on our list)

Customer satisfaction rating: 852 (#2 on the J.D. Power Survey)

Financial strength rating: A+

Why It Made the List

Erie made the top spot on our list with a combination of having the lowest average premium of the companies on our list, as well as the second-highest rating on the J.D. Power Customer Satisfaction Survey (see discussion under “Customer Satisfaction Rating” toward the end of this guide).

But we also like the policy options the company offers, especially the Erie Auto Plus Plan which provides a package of policy options for one low premium cost. They also offer some unique options, like coverage for your pet if it’s injured in an accident, as well as auto glass repair and locksmith service.

What Holds It Back

Erie has an interesting rate lock option (the Erie Rate Lock) that may sound attractive to many consumers. They’ll honor the rate lock – unless you have a significant policy change. If you do, the rate will be recalculated and may go higher. It doesn’t look quite like the guarantee it promises to be.

2. Cincinnati Insurance

The Basics:

| Policy Options | Rental car coverage Gap coverage Capstone Auto – covers all vehicles, including antique or collector vehicles and recreational vehicles under a single policy Personal Auto Plus – provides enhanced rental car benefits, airbag replacement, roadside assistance, deductible waiver, trip interruption, lock replacement, and glass deductible waiver Replacement Cost Plus – if your car is totaled, get covered for either a new replacement car or the payoff of the balance of the loan on your previous car Antique or collector car coverage Umbrella coverage |

| Discounts | Safe driver Bundle home and auto Good student Multi-car |

Premiums: $764 (2nd lowest average premium on our list)

Customer satisfaction rating: 832 (#10 on the J.D. Power Survey)

Financial strength rating: A+

Why It Made the List

Cincinnati Insurance has the second-lowest statewide average car insurance premiums on our list. We also like that they have some strong policy options, like Personal Auto Plus, and Replacement Cost Plus, and their Capstone Auto which covers all your vehicles under a single policy.

What Holds It Back

Cincinnati Insurance ranks only 10th on the J.D. Power customer satisfaction. That still leaves it slightly above the statewide average, but only by two points. In a world where consumers are accustomed to purchasing products and services online, you’ll be required to contact a live agent to get a policy. The company also has fewer discounts available than its competitors.

3. Westfield

The Basics:

| Policy Options | Loan/lease gap coverage Medical payments Personal injury protection (PIP) Roadside assistance Boat, RV, camper, and motorcycle insurance Loan/lease gap coverage Umbrella coverage |

| Discounts | Multi-policy (bundling) Multi-car Safety equipment Good credit Good student Student away at school Defensive driver Continuous coverage Loyalty discount |

Premiums: $927 (5th lowest average premium on our list)

Customer satisfaction rating: 855 (#1 on the J.D. Power Survey)

Financial strength rating: A

Why It Made the List

Ohio-based Westfield Insurance made a third place on our list as a result of having the top rating in the J.D. Power Customer Satisfaction Survey, and having the fifth-lowest average statewide premiums on our list.

What Holds It Back

One of the limitations with Westfield is that though they’re based in Ohio, they provide insurance in only 10 states. That means if you move out of state, there’s an excellent chance you’ll need to get a policy with an entirely new company. Also, the number of policy options and discounts offered by this company is limited compared to the competition.

4. State Farm

The Basics:

| Policy Options | Car rental Travel expenses for an accident more than 50 miles from home Medical payments Emergency roadside assistance Rideshare Sports cars Antique classic cars Small business vehicle |

| Discounts | Anti-theft equipment Defensive driving course Drive Safe & Save – driving monitoring app Good driving Good student Multi-car Multi-policy Vehicle safety equipment Student away at school Steer Clear Safe Driver (complete education requirements and no at-fault accidents or moving violations in the previous three years – both met before turning 25) Accident-Free (after three years of continuous coverage without a chargeable accident) |

Premiums: $876 (4th lowest premium on our list)

Customer satisfaction rating: 841 (#5 on the J.D. Power Survey)

Financial strength rating: A+

Why It Made the List

State Farm has the fourth-lowest statewide average premium on our list and ranks fifth in customer satisfaction, which has helped to secure it the #4 position on our list overall. But State Farm is also a well-recognized and widely respected company, offering important coverage options like ridesharing coverage and small business vehicle insurance.

We like the many discounts State Farm offers, but especially their Accident-Free discount. It’s available after just three years without a chargeable accident, which is a lot less than the normal five years required by other companies. But the discount can even increase if you go beyond three years without an at-fault accident.

What Holds It Back

There’s no indication State Farm provides gap coverage. This is a critical missing part since many drivers owe more to their vehicles than those vehicles are worth.

5. Grange Insurance

The Basics:

| Policy Options | Loan/lease gap coverage Full glass repair Rental car reimbursement Roadside assistance Pet injury and mobile device Original equipment manufacturer coverage Personal umbrella coverage |

| Discounts | Multi-policy Multi-vehicle Paid in full Advance quote Safe driver Good student Student away at school Legacy loyalty Accident forgiveness |

Premiums: $820 (3rd lowest average premium on our list)

Customer satisfaction rating: 828 (#12 on the J.D. Power Survey)

Financial strength rating: A-

Why It Made the List

Grange Insurance has the third-lowest statewide average auto insurance premiums on our list, but they also stack up as the leader in three important categories: good drivers, drivers with an at-fault accident, and drivers with a DUI/DWI.

What Holds It Back

Grange ranks only #12 in customer satisfaction, putting it just below the statewide average. Also, the company operates in only 13 states, which once again creates the likelihood you’ll need to change auto insurance providers if you move to one of the 37 states where they don’t offer coverage.

6. Auto-Owners Insurance

The Basics:

| Policy Options | Classic cars Converted for modified vehicles Road trouble service New car replacement Rental car coverage Additional expense – to cover cost of your stranded away from home Diminished value – protects your vehicle value if it declines even after repair Loan/lease gap coverage Personal Automobile Plus – create a package of 10 optional coverages for one competitive rate; includes identity theft, rekeying locks, replacing your cell phone and more |

| Discounts | Multi-policy On-time payments (36 months or more) Paperless billing Multi-car Good student Student away at school Teen Driver Monitoring Paid-in-full premium Advance quote Vehicle safety features Favorable loss history |

Premiums: $978 (6th lowest average premium on our list)

Customer satisfaction rating: 836 (#8 on the J.D. Power Survey, tied with GEICO)

Financial strength rating: A++

Why It Made the List

Auto-Owners Insurance has only the sixth-lowest average premium on our list, at $978 per year. Meanwhile, the company has a decent customer satisfaction rating, at 836 points, and is at the top of the financial strength food chain, with a rating of A++.

The company also offers a solid number of policy options and discounts. The Personal Automobile Plus Package enables you to build a policy with as many as 10 coverages, all at a very competitive rate.

What Holds It Back

Auto-Owners Insurance is only available in about half the states in the US. If you have coverage with this company in Ohio, there’s about a 50% chance you’ll need a new carrier if you move to a different state. The company also doesn’t seem to have quite as many discounts as its competitors.

7. GEICO

The Basics:

| Policy Options | Safety equipment New Vehicle Good driver (five years accident-free) Drivers over 50 Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

| Discounts | Safety equipment New vehicle Good driver (five years accident-free) Drivers over 50 Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

Premiums: $1,072 (7th lowest average premium on our list)

Customer satisfaction rating: 836 (#8 on the J.D. Power Survey, tied with Auto-Owners)

Financial strength rating: A+

Why It Made the List

GEICO isn’t the least expensive auto insurer in Ohio, but it has some excellent options and discount programs. Those include discounts for federal employees, members of the military, and certain memberships and employee affinity groups.

We also like that GEICO provides very specific details of their many discounts, giving the percentage range you can expect to save on your premium.

What Holds It Back

GEICO ranks seventh out of eight companies on our list for statewide average premium and about the middle of the pack for customer satisfaction. Also, they don’t seem to offer gap coverage, which will be a problem for anyone who owes more on their loan or lease than their vehicle is worth. It can result in a big out-of-pocket hit if your vehicle is totaled.

8. Branch

The Basics:

| Policy Options | Refer-a-friend program community Pledge discount |

| Discounts | Refer-a-friend programCommunity Pledge discount |

Premiums: Premiums Not Available

Customer satisfaction rating: BBB 5-star rating

Financial strength rating: A+

Why It Made the List

Branch is a newer insurer that offers several types of insurance coverage, including auto coverage, in five different states. Ohio is one of its major markets, and residents of this state have the potential to save big on coverage.

The branch promises to help customers save money on their premiums thanks to its direct sales approach. Branch makes it easy to get a free quote for auto insurance in 30 seconds. This means you can quickly and easily check and compare rates.

In terms of its insurance policies, Branch offers robust auto insurance coverage with liability, personal injury protection (PIP), coverage for physical damage, and more. You can even buy specific coverage that protects you while driving for Uber or Lyft.

Branch uses up-to-date technology, which is how it can offer a seamless online claims process. Branch also offers a mobile app that lets you stay on top of your insurance coverage no matter where you are.

What Holds It Back

Branch is so new that they’re not profiled by third-party ranking agencies, like J.D. Power. This means we don’t have complete data in terms of its customer service quality and claims process.

How We Found the Best Car Insurance in Ohio

To come up with our list of the best car insurance in Ohio, we’ve used five independent criteria to make that determination.

Policy Options

Every car insurance company offers at least the minimum coverage required by that state. To get a better idea of the quality of an insurance carrier we give careful consideration to the options offered above state-required mandated minimums.

Most provide common options, like collision, comprehensive, gap coverage, medical payments, towing, and roadside assistance. But we also gave heavier consideration to those that provide specialized options, like ridesharing coverage and new car replacement.

Discounts

Though some insurance companies offer low average premiums, that doesn’t necessarily mean they’ll be the cheapest for you. With the right combination of discounts matching your own driver profile, is often possible to get an even lower premium. For that reason, we gave consideration to the companies that offered the largest number of discounts, particularly those we felt would apply to a large number of drivers.

Premiums

We get that this is often the top priority among drivers looking for car insurance. We gave average premium rates strong representation in coming up with our list of the best car insurance in Ohio. At the same time, we never want to rely entirely or primarily on low premiums, since they may hide other issues (like rates quoted only for their best applicants).

For example, the company in Ohio with the lowest auto insurance premiums of all is Utica National. But since they weren’t included in the J.D. Power U.S. Auto Insurance Study, we did not include them on our list. Low premiums alone are not sufficient reason to choose an auto insurance company.

We used average premiums only as a starting point. These were derived from The Zebra, which is determined to be a reliable source of pricing information.

Customer Satisfaction Rating

We gave virtually equal weight with premiums to customer satisfaction ratings. That’s because customer satisfaction also reflects consumer’s experience with auto insurance companies in handling and paying claims. A lower rating in this all-important category did result in a lower overall ranking of the company on our list, even if they have very low average premiums.

To make a reasonable assessment of this all-important category, we’ve used the J.D. Power U.S. Auto Insurance Study, released in June 2019. More specifically, we’ve relied on the Overall Customer Satisfaction Index Ranking – North Central Region, which includes Ohio.

Insurance Company Financial Strength

Financial strength indicates an insurance company’s ability to meet its financial obligations, which includes its ability to pay claims. Cheap car insurance will do little more than satisfy the minimum legal requirements in Ohio but could leave you with unpaid claims.

For that reason, we’ve included only companies rated either “Superior” or “Excellent” for financial strength by the insurance industry rating service, A.M. Best.

Their ratings for companies with financial strength of “Good” or better are as follows:

Superior: A+, A++

Excellent, A, A-

Good, B, B+

We have not included any companies rated lower than “A”.

What You Need to Know About Car Insurance Laws in Ohio

Car insurance laws and requirements vary from one state to another. Regulations in Ohio are as follows:

State Minimum Insurance Requirements

The minimum Ohio car insurance requirement is “25/50/25”, broken down as follows:

- Bodily Injury: $25,000 for injury or death to one person as a result of an auto accident.

- Bodily Injury: $50,000 for injury or death to more than one person as a result of an auto accident.

- Property Damage: $25,000 per accident.

Optional car insurance coverage under Ohio law includes:

- Uninsured motorist (UM) – covers you, your family, and your passengers for bodily injury caused by an at-fault uninsured motorist.

- Underinsured motorist (UIM) – covers you, your family, and your passengers for bodily injury caused by an at-fault motorist who lacks sufficient coverage.

- Personal injury protection (PIP) – pays medical expenses and lost wages regardless of who is at fault in an accident.

- Collision – pays for damage to your vehicle if you are at fault in an accident.

- Comprehensive – pays for the damage to your vehicle from non-moving hazards, like falling trees, theft, or vandalism.

- Rental reimbursement – pays for a rental car while your vehicle is being repaired due to an accident.

- Roadside assistance.

- Gap coverage – pays the difference between reimbursement for a totaled vehicle and the balance owed on the loan or lease.

Note that collision, comprehensive, and gap coverage will generally be required on any vehicle on which you have a loan or a lease.

Penalties for Not Having Car Insurance in Ohio

If you are found to be driving without at least minimum car insurance coverage, you’ll be subject to the following penalties:

- Suspension of your driver’s license for up to 90 days on a first offense, and up to one year for subsequent offenses.

- A $75 reinstatement fee to get your driver’s license back on a first offense, and up to $500 on subsequent offenses.

- Your vehicle may be impounded.

Ohio State Car Insurance FAQs

No, Ohio is not a no-fault state. Under a no-fault system, each driver must recover compensation from his or her own insurance company. In addition, the ability to bring a lawsuit for additional damages is generally limited to extreme situations.

Ohio however is not a no-fault state, and therefore the at-fault party is responsible to pay for damages. This is usually handled through the at-fault driver’s auto insurance policy, but a lawsuit can still be instituted if policy coverage is insufficient.

We include averages in our guides only as a starting point. An average only means that a company generally tends to have lower premiums. But in diverse states like Ohio, averages can be deceiving.

For example, in large metropolitan areas, like Cleveland, Columbus, or Cincinnati, you should expect to see higher premium levels. This is because a higher population density leads to more traffic and more accidents. By contrast, if you live in a rural area, your premium may be lower than the average that’s presented here.

And of course, all premiums are also heavily influenced by your personal driving profile. If you have moving violations or at-fault accidents, you’ll pay a higher premium than someone who doesn’t.

Unfortunately, yes. There is a correlation between poor credit and driving behavior that isn’t lost on car insurance companies. That’s why you should do whatever you can to maintain good credit. While it may not have a major impact on your premium, every little bit helps when you’re looking to minimize the cost of car insurance.