The average car insurance premium in Pennsylvania is $1,522 per year, which is roughly in the middle of the U.S. average.

Many people believe the best car insurance in Pennsylvania will be the cheapest, but you’ll probably realize how true that isn’t after reading this guide. It’s more about getting the best car insurance at the best price, which may not be the cheapest.

Which company offers the best car insurance in Pennsylvania? Premiums certainly figure into the mix. But equally important are policy options, discounts, and the willingness of an insurance company to pay claims. We reflect that in analyzing what we believe to be the best car insurance in Pennsylvania.

As a matter of full disclosure, I’m with Progressive, which I’ve had an excellent experience with. But Progressive is only #5 on our list, and they may or may not be the right choice for you.

The only way to find the best car insurance for you is by getting quotes from several of the best providers.

Use the quote tool below from our car insurance partner:

The Most Important Factors When Comparing Car Insurance in Pennsylvania

Start with the state’s minimum car insurance requirements. From there, customize your policy to include any options necessary for your situation. And you’ll have to do it all in a way that will make it the most affordable.

Here are some criteria to consider that will help you in an effort:

- Shop between carriers. Even if a company appears at or near the top of a dozen “best for” lists, it may not be the right one for you. Shop until you find the right one for you.

- Match available policy options with your personal needs. Every company offers multiple options. The one with the options that best match your needs is likely to be the carrier for you.

- Discounts = lower premiums. Like options, every company offers discounts. The company with the most discounts that fit your driving profile, the lower the premium is likely to be.

The 7 Best Car Insurance Companies in Pennsylvania

As much as we’d like to categorically state there’s one best car insurance company for most drivers, what it really comes down to is the niche each specializes in.

Based on our analysis, the following companies are the best in one or more categories:

- Best Overall — Erie Insurance

- Cheapest Overall — Travelers

- Highest Customer Satisfaction — Erie Insurance

- Teen Drivers — GEICO

- Good Drivers — State Farm

- High coverage limits (100/300/100) — Nationwide

- Ridesharing — State Farm, GEICO, Progressive

- Drivers with a Single Moving Violation — State Farm

- Drivers with a DUI/DWI — GEICO

- Best for Drivers over 50 — GEICO

- Best for Members of the US Military — USAA

Author’s Pick:

Below is our list of what we believe to be the seven best car insurance providers in Pennsylvania. Our ranking is based on objective factors, and not on personal opinion.

We’ve also indicated why each company made our list and included a section under What Holds It Back to list any apparent weaknesses in their product offering.

Special Mention: USAA – Best for Members of the Military

With an average premium of $371, USAA has one of the lowest in Pennsylvania. The company gets an A++ rating on financial strength from A.M. Best, and they had the second-highest J.D. Power Customer Service rating of all carriers in the state, at 874 out of 1,000 points.

But USAA makes car insurance available only to active members and veterans of the US military and their families. Since their coverage isn’t available to the general public, we’ve excluded it from the list below.

But if you’re a current or former member of the US military and you’re looking for car insurance, USAA should be your first choice.

1. Erie Insurance

The Basics

| Policy Options | Pet coverage Personal items coverage – up to $350 Auto glass repair Roadside and rental bundle Locksmith services ERIE Auto Plus – comes with a diminishing deductible, a $10,000 death benefit, additional days of transportation expense coverage, waiver of deductible in certain situations, and increased limits for specific coverages ERIE Rate Lock – your rates will only change if you add or remove a vehicle or driver, or change the address where you keep your car parked |

| Discounts | Safe driving Car safety equipment Multi-car Multi-policy (bundling) Reduced usage Young drivers Annual payment plan |

Premiums: $390

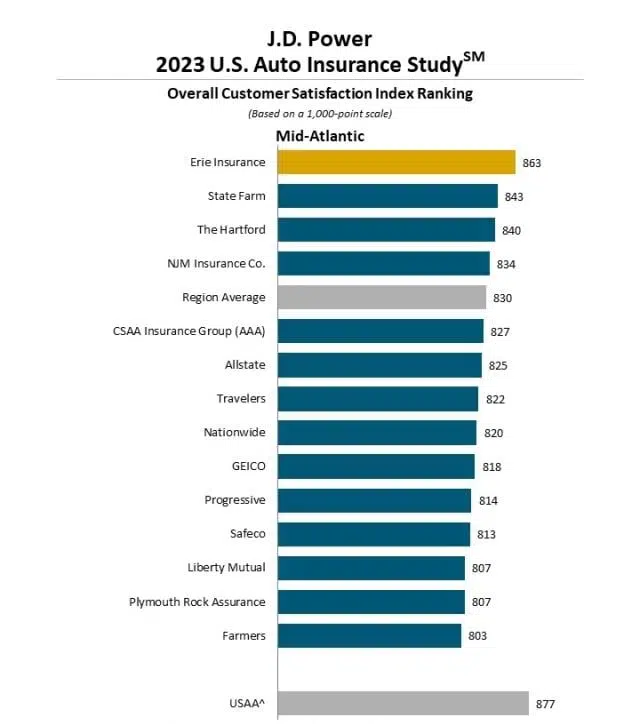

Customer satisfaction rating: 912 (#1 on the J.D. Power Survey)

Financial strength rating: A+

Why It Made the List

Erie Insurance tops our list with the second lowest average premiums in Pennsylvania, though they are only slightly higher than Travelers, the lowest-cost provider on our list. The company also rates #1 in customer satisfaction, which includes the all-important category of paying claims.

We also like the ERIE Auto Plus plan, which is a package of options, including a diminishing deductible, a death benefit, a deductible waiver in certain situations, and increased coverage limits, all at only a small increase in your premium.

What Holds It Back

Erie has an interesting rate lock option (the Erie Rate Lock) that may sound attractive to many consumers. They’ll honor the rate lock – unless you have a significant policy change. If you do, the rate will be recalculated and may go higher. It doesn’t look quite like the guarantee it promises to be.

2. Travelers

The Basics

| Policy Options | Gap coverage Rental coverage Roadside assistance Medical payments Ridesharing New car replacement Accident forgiveness (one accident and one minor violation every 36 months) Decreasing deductible ($50 every six months up to $500 you’re accident- or violation-free), New car replacement (replace your new vehicle with a brand-new vehicle of the same make and model if yours is totaled within the first five years of ownership) |

| Discounts | Multi-policy (bundling) Multi-car Homeownership Safe driver (10% for no accidents in three years, 23% for five years) Continuous insurance (up to 15%) Hybrid/electric vehicle New car Pay in full Good payer discounts Early quote Good student Student away at school Driver training IntelliDrive Program (uses a smart app to capture and score driver behavior, and could result in a 20% premium reduction). |

Premiums: $205

Customer satisfaction rating: 822

Financial strength rating: A++ (highest)

Why It Made the List

Travelers took the #2 position on the strength of having the lowest average premiums in Pennsylvania. The company also has the highest financial strength rating issued by A.M. Best, at A++.

But we also like that the company has plenty of valuable policy options, like ridesharing coverage and decreasing deductible, as well as accident forgiveness. They also have plenty of unique discounts, including one for hybrid and electric vehicles.

What Holds It Back

Travelers would have finished at the top of our list were it not for the fact that it ranks only #9 in customer satisfaction. That low rating may indicate issues with paying claims.

3. GEICO

The Basics

| Policy Options | Safety equipment New Vehicle Good driver (five years accident-free) Drivers over 50 Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

| Discounts | Safety equipment New vehicle Good driver (five years accident-free) Drivers over 50 Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

Premiums: $586

Customer satisfaction rating: 822

Financial strength rating: A++

Why It Made the List

GEICO made #3 on our list on the combination of having the third-lowest average premiums in Pennsylvania and placing a respectable #5 in customer satisfaction.

But the company also rates the top of our list for coverage for drivers over 50 and provides discounts for federal employees, members of the military, and certain memberships and employee affinity groups.

We also like that GEICO provides very specific details of their many discounts, giving the percentage range you can expect to save on your premium.

What Holds It Back

GEICO doesn’t offer gap coverage, which will be a problem for anyone who owes more on their loan or lease than their vehicle is worth. It can result in a big out-of-pocket hit if your vehicle is totaled.

4. State Farm

The Basics

| Policy Options | Car rental Travel expenses for an accident more than 50 miles from home Medical payments Emergency roadside assistance Rideshare Sports cars Antique classic cars Small business vehicle |

| Discounts | Anti-theft equipment Defensive driving course Drive Safe & Save – driving monitoring app Good driving Good student Multi-car Multi-policy Vehicle safety equipment Student away at school Steer Clear Safe Driver (complete education requirements and no at-fault accidents or moving violations in the previous three years – both met before turning 25) Accident-Free (after three years of continuous coverage without a chargeable accident) |

Premiums: $123

Customer satisfaction rating: 856

Financial strength rating: A++

Why It Made the List

State Farm ranks #4 on both average premiums in Pennsylvania and customer satisfaction, which has helped to secure it a #4 position on our list overall. But State Farm also tops our list for good drivers and offers valuable policy options, like ridesharing coverage and small business vehicle insurance.

We like the many discounts State Farm offers, but especially their Accident-Free discount. It’s available after just three years without a chargeable accident, which is a lot less than the normal five years required by other companies.

But the discount can even increase if you go beyond three years without an at-fault accident.

What Holds It Back

There’s no indication State Farm provides gap coverage. This is a critical missing part since many drivers owe more to their vehicles than those vehicles are worth.

5. Progressive

The Basics

| Policy Options | Gap coverage Medical payments Rental car reimbursement Roadside assistance Custom parts and equipment value Rideshare coverage Mexico auto |

| Discounts | Snapshot app ($145 average discount) Bundle auto and property Name Your Price Tool (enter your desired premium, and Progressive will design a policy) Multi-policy (5% average discount) Multi-car (12% average discount) Continuous coverage Good student Distant students (more than 100 miles from home) Homeowner (average discount nearly 10%) Online quote (4% average discount) Sign online (8.5% average discount) Paperless Pay in full Automatic payment Deductible savings bank (the deductible on your collision and comprehensive is reduced by $50 for every claim-free policy period, which is six months) Small accident forgiveness – premium won’t be increased for a claim of less than $500 Large accident forgiveness – no rate increase in an accident if you have been a customer for a least 5 years, and no accidents for the past 3 years |

Premiums: $57

Customer satisfaction rating: 822

Financial strength rating: A+

Why It Made the List

Progressive probably has more discounts available than any other car insurance company in America. The most interesting is the Name Your Price Tool, which enables you to build a policy around the amount you’re willing to pay for your premium.

That gives you greater control over your premium than what you’ll get with most competitors.

What Holds It Back

Progressive advertises you can save $796 per year. But that’s a bit difficult to swallow considering they rank only fifth in statewide car insurance premiums in Pennsylvania. With a discount that deep, you’d expect them to have the lowest premiums of all.

6. Nationwide

The Basics

| Policy Options | Medical payments Towing and labor Rental car expense (loss of use) Personal injury protection (PIP) Gap coverage Roadside assistance Vanishing Deductible (earn $100 off your deductible for each year of safe driving, up to $500) Total loss deductible waiver (deductible is waived in the event of a total loss) |

| Discounts | Multi-policy Multi-vehicle SmartRide monitoring app Accident-free Automatic payment Paperless documents Good student Defensive driving (complete a state-approved course for drivers 55 and over) Anti-theft Safe Driver (free of major violations or at-fault accidents for at least five years) Affinity member (extends to hundreds of alumni associations, professional groups, sports groups, and special interest groups) Accident Forgiveness – your rate won’t increase due to a first at-fault accident or minor violation |

Premiums: $19

Customer satisfaction rating: 883

Financial strength rating: A+

Why It Made the List

We like Nationwide because of its Accident Forgiveness provision, which will not increase your premium due to a first-at-fault accident or minor violation.

But we also like the Vanishing Deductible, which reduces your deductible for collision and comprehensive by $100 per year for each year of safe driving. If you start with a $500 deductible, you’ll have no deductible after five years.

What Holds It Back

Nationwide ranks #8 in the J.D. Power Survey for customer satisfaction in Pennsylvania, which could indicate problems on the claim side, with both customer service and payments.

7. Liberty Mutual

The Basics

| Policy Options | Lower or eliminate your collision deductible Lifetime repair guarantee New car replacement Better car replacement Rental car reimbursement Roadside assistance Gap coverage Original replacement parts for your car Coverage for teachers (protection for your car on school grounds) Driving in Mexico |

| Discounts | Accident forgiveness Multi-policy Multi-car Online purchase Automatic payment Pay in full Paperless policy RightTrack (save up to 30% for good driving behavior) Homeowner Active, reserve or retired military Early shopper Good student Student away at school Alternative energy vehicle Safety equipment Accident- and violation-free |

Premiums: $110

Customer satisfaction rating: 861

Financial strength rating: A

Why It Made the List

Liberty Mutual has some of the more interesting policy options, particularly when it comes to the maintenance of your vehicle.

Of special interest are the lifetime repair guarantee (you must use an approved facility), new car replacement assistance, and the option to replace your car with a better car that’s one model year newer and has 15,000 fewer miles.

We also like that it offers the ability to lower or eliminate your deductible, accident forgiveness, and accident- and violation-free discounts.

What Holds It Back

Liberty Mutual has the highest average auto insurance premiums of the seven companies on our list. In fact, it’s the only company on our list that has an average premium higher than the Pennsylvania statewide average.

It also ranks a disappointing #11 in customer satisfaction, and is on the low end of the financial strength rating, gathering only an “A” rating from A.M. Best.

How We Found the Best Car Insurance in Pennsylvania

To come up with our list of the best car insurance in Pennsylvania, we’ve used five independent criteria to make that determination.

Policy Options

Policy options are what an insurance company provides over and above the minimum requirements in a state. But other coverages commonly available – and strongly recommended – include collision, comprehensive, medical payments, gap coverage, and personal injury protection.

Over and above these, however, you may be particularly interested in a company that provides more specialized options, like ridesharing protection or auto insurance while driving in Mexico.

Discounts

Despite the average premiums charged by each company, we also gave considerable weight to discounts.

Though not all discounts will apply to all drivers, there may be one or more offered by a company that provides a significant premium reduction in your situation. Companies with a better discount menu have been given stronger consideration.

Premiums

It’s often tempting to come up with a list of the best car insurance companies based mainly on premium levels. That’s certainly the primary consideration for most consumers.

But while we did give heavy consideration to each company’s average premium, we didn’t want to rely too heavily on premium averages.

The problem with premium averages is that they’re just that, averages. The exact premium you will pay will depend on your own driver profile.

That will include your specific geographic location (living in a big city will come with higher premiums than a rural area), the type of vehicle you drive, your driving history, your credit score, and many other criteria.

We used average premiums only as a starting point. These were derived from The Zebra, which is determined to be a reliable source of pricing information.

Customer Satisfaction Rating

Customer satisfaction includes the all-important category of driver experience with filing claims. After all, paying claims for auto accidents is the whole reason for having car insurance in the first place.

If an insurance company is slow or uncooperative – or it has a history of declining too many claims – it won’t be worth having a policy through them, no matter how low their premium is.

To make a reasonable assessment of this all-important category, we’ve used the J.D. Power U.S. Auto Insurance Study, released in June 2023. More specifically, we’ve relied on the Overall Customer Satisfaction Index Ranking – Mid-Atlantic Region, which includes Pennsylvania.

Insurance Company Financial Strength

Financial strength indicates an insurance company’s ability to meet its financial obligations, which includes its ability to pay claims. Cheap car insurance will do little more than satisfy the minimum legal requirements in Pennsylvania but could leave you with unpaid claims.

For that reason, we’ve included only companies rated either “Superior” or “Excellent” for financial strength by the insurance industry rating service, A.M. Best.

Their ratings for companies with financial strength of “Good” or better are as follows:

- Superior: A+, A++

- Excellent: A, A-

- Good: B, B+

We have not included any companies rated lower than “A”.

What You Need to Know About Car Insurance Laws in Pennsylvania

Car insurance laws and requirements vary from one state to another. Regulations in Pennsylvania are as follows:

State Minimum Insurance Requirements

The minimum Pennsylvania car insurance requirement is “15/30/5”, broken down as follows:

- Bodily Injury: $15,000 for injury or death to one person as a result of an auto accident.

- Bodily Injury: $30,000 for injury or death to more than one person as a result of an auto accident.

- Property Damage: $5,000 per accident.

- Medical Benefits: This provision is optional in most states but required in Pennsylvania. It pays medical bills for you and others who are covered by your policy, regardless of fault. The minimum coverage is $5,000, but higher limits are available at your option.

Some insurance companies in Pennsylvania offer a single limit of $35,000, meaning both the bodily injury liability and property damage liability minimum requirements.

Pennsylvania also offers “Limited or Full Tort” coverage. Limited tort coverage lowers your premium, and you are still able to recover out-of-pocket medical and other expenses.

But you are not able to recover for pain and suffering unless the injuries meet one of the exceptions to limited for as described under Pennsylvania law. But if you go with full tort coverage, you’ll have unrestricted rights to bring a suit against a negligent party.

Penalties for Not Having Car Insurance in Pennsylvania

If you are found to be driving without at least minimum car insurance coverage, you’ll be subject to the following penalties:

- Minimum fine of $300

- Three-month suspension of your vehicle registration

- Three-month suspension of your driver’s license

- Restoration fees to restore your vehicle registration

- Restoration fees to restore your driver’s license

- Vehicle impoundment

Conclusion

Navigating the world of car insurance in Pennsylvania requires careful consideration of multiple factors, from the unique offerings of different providers to state-specific regulations.

While there isn’t a one-size-fits-all “best” insurer, certain companies excel in specific categories, from cost to customer satisfaction. Erie Insurance and GEICO, for example, emerge as dominant figures in overall satisfaction and niche provisions respectively.

However, the choice of insurance should also be influenced by individual needs, such as policy options, available discounts, premium costs, and the insurer’s financial strength.

Moreover, it’s imperative for Pennsylvania residents to be well-versed with the state’s car insurance laws, ensuring compliance to avoid severe penalties. Ultimately, selecting the right car insurance entails a balance between personal requirements and the strengths of the insurance provider.

Pennsylvania State Car Insurance FAQs

Is Pennsylvania a “no-fault” state?

Pennsylvania is considered neither an at-fault or no-fault state. It’s up to the driver to decide whether to purchase at-fault or no-fault coverage.

In an-fault insurance environment, you can seek damages from the at-fault party’s insurance company. Under a no-fault system, you must file claims against your own insurance carrier, and your rights to sue for damages are limited

In Pennsylvania, you can choose no-fault coverage and collect benefits from your own insurance company, regardless of who is at fault. But you also can also opt out of no-fault, and preserve the right to pursue remuneration from the at-fault party’s insurance company. This is determined at the time you purchase your policy, and cannot be changed as a result of an accident.

The requirement of full tort insurance means you are choosing at-fault coverage, preserving the right to pursue the insurance company of the at-fault driver. If you choose limited tort, you’re opting for no-fault coverage. You will then have limited ability to file a lawsuit for most accidents, except under those situations permitted by state law.

What do I do if I can’t get car insurance through traditional insurance companies?

If you’re unable to obtain proper car insurance through traditional insurance carriers, you can obtain coverage through the Pennsylvania Assigned Risk Plan. The program offers coverage to those who are unable to get it elsewhere. All insurance companies offering auto coverage in the state are required to participate in the plan. However, you will be assigned to a participating company, which will be determined by the proportion of the amount of business each company does in Pennsylvania. For more information, you can call (800)477–6146.

Summary: Best Car Insurance in Pennsylvania