Homeowners insurance is an important investment that will help you recover if your property is damaged or destroyed — or even if someone sues you after getting hurt.

The best home insurance companies aren’t always the cheapest, but if you’re looking to save money, there are definitely ways you can cut down your insurance bill.

How much you’ll pay for homeowners’ insurance depends on a variety of factors ranging from where you live to the age of your home, the size of your home, and how often you’ve made a claim.

While some of these factors may be beyond your control, it’s also important to note that you can typically save money on homeowners insurance if you’re willing to shop around every few years.

If you’ve had the same homeowner’s insurance policy for a few years, you may be wondering if you could get a better deal elsewhere. We did the hard work to sort through all of your home insurance options to find the most comprehensive and best-value options for you.

The best companies are happy to give you a free, no-obligation quote so you can compare and make an informed decision.

Cheapest Homeowners Insurance in March 2025

Table of Contents

Getting a fair deal on homeowners insurance requires that you figure out how much coverage you need before you shop around. That way, you’re able to make an apples-to-apples comparison that helps you assess pricing with a few companies based on similar types of coverage. While you should consider a wide range of insurers when you shop for a cheap homeowners insurance policy, the following companies tend to offer some of the lowest rates around:

- Lemonade

- Amica Mutual

- Allstate

- Farmers

- State Farm

- Erie Insurance

- Liberty Mutual

#1: Lemonade

Lemonade is a newer online insurance company that offers low prices and “instant everything” via its easy-to-use online portal. They claim it only takes 90 seconds to qualify for a homeowners or renters insurance policy and that rates can be as low as $25 per month.

They also maintain that customers who switched from other insurers like Geico and Progressive saved between 10% and 31% on their policies right away.

Lemonade Insurance claims they’re “designed for social impact,” which mostly means they focus less on profits and more on people. The company takes a flat fee from its customers for overseeing the plans, which is why they can offer lower rates. Also note that although Lemonade is a newer insurance company, it still has an A+ rating with the BBB.

#2: Amica Mutual

Amica Mutual is consistently rated well by third-party agencies like J.D. Power. In fact, this company earned the #2 spot in J.D. Power’s 2023 Home Insurance Study, which considered factors like customer satisfaction, policy offerings, and price.

In addition to affordable homeowners policies, Amica Mutual offers a wide range of discounts that can help you save even more. Their customer service team is nationally recognized, and the company received an A+ rating for financial strength from A.M. Best.

Best of all, Amica Mutual lets you tailor your homeowners insurance policy so you get the exact amount of coverage you need.

#3: Allstate

Allstate is a well-known national insurer who is known for offering high-quality auto insurance, homeowners insurance, life insurance, and more. Their rates can be extremely competitive, although this is partly due to the many insurance discounts they offer.

Allstate makes it easy to get a free, no-obligation quote for homeowners insurance online, and they allow you to tweak your policy details so you wind up with the exact amount of coverage you want. Allstate was also rated highly in J.D. Power’s 2023 U.S. Home Insurance Study, claiming the #11 spot among more than 20 different companies.

#4: Farmers

Farmers Insurance is another highly rated company that receives praise from insurance rating companies. They were ranked 16th in J.D. Power’s 2023 U.S. Home Insurance Study, which puts them among the top national companies considered. Farmers Insurance Group also has an A+ rating with the Better Business Bureau (BBB).

Scoring an affordable homeowner’s insurance policy with Farmers is an easy feat, thanks to its online quote engine. You can choose between a standard plan, an enhanced plan, or a premier plan based on your coverage needs, and you can qualify for discounts and even claim forgiveness.

Farmers also assign you a local agent you can lean on for help making important financial decisions for your family, which is why many people move all their insurance policies to Farmers if the price is right.

#5: State Farm

State Farm offers home and property insurance that can be extremely affordable depending on where you live, the details of your home, and other factors. They make it easy to get a free quote online, and you can tailor your insurance policy so you receive the exact amount of coverage you need.

Discounts are available for State Farm customers who bundle multiple policies and have limited claims history. Best of all, State Farm was rated #5 in J.D. Power’s 2023 U.S. Home Insurance Study, meaning its customers give it high ratings for customer service, policy offerings, price, and more.

#6: Erie Insurance

Erie Insurance offers extremely transparent coverage options with no gray areas or confusing terms. They also offer 24/7 support for customer service or claims, as well as the ability to choose unique policy details that provide the exact amount of coverage you need.

One important feature Erie Insurance offers is “guaranteed replacement cost,” which means your homeowners insurance policy is guaranteed to cover the actual replacement cost of your home instead of just costs up to coverage limits. Erie Insurance notes that many homeowners don’t realize that actual cash value policies subtract for wear and tear and depreciation.

The promise of guaranteed replacement cost makes Erie Insurance homeowners insurance policies an even better deal.

This is probably part of the reason Erie Insurance is rated so highly by third-party rating agencies. The company received the #1 spot in J.D. Power’s 2023 U.S. Home Insurance Study, ahead of Amica Mutual.

#7: Liberty Mutual

Liberty Mutual offers affordable — and even “cheap” — homeowners insurance policies that come with standard coverage for your dwelling, personal possessions, liability, and additional living expenses. If you want a higher level of coverage, you can pay for higher coverage limits or add on additional protection for valuables you have, water backup and sump pump overflow, and even inflation protection.

Liberty Mutual also makes it easy to get an online quote for homeowners insurance and even to play with your policy details until you reach a price you’re comfortable with. Also note that Liberty Mutual offers generous discounts for having protective devices installed in your home, bundling multiple policies, having a history free of claims, and more.

Top Home Insurance Companies for 2023

| Company | Description | Notable Features |

|---|---|---|

| Lemonade | • Online Insurer With Quick, Low-Cost Policies • 10%-31% Savings for Switchers | • Focus on Social Impact • A+ BBB Rating |

| Amica Mutual | • #2 in 2023 Home Insurance Study • National Recognition for Service • Various Discounts Available | • Customizable, Affordable Policies • A+ Financial Strength Rating |

| Allstate | • Well-Known National Insurer • Highly Ranked in 2023 U.S. Home Insurance Study | • Competitive Rates and Multiple Options • Offers Numerous Discounts |

| Farmers | • 16th in 2023 U.S. Home Insurance Study • Easy Online Quotes and Local Agents | • A+ BBB Rating • Standard, Enhanced, or Premier Plans |

| State Farm | • Affordable Home and Property Insurance • Discounts for Bundling and Tailored Policies | High Customer Satisfaction Rating |

| Erie Insurance | • #1 in 2023 U.S. Home Insurance Study • 24/7 Customer Support and Transparent Policies | • Guaranteed Replacement Cost Coverage • Highly Rated by Third-Party Agencies |

| Liberty Mutual | • Affordable Homeowners Insurance | • Flexible Coverage Options and Discounts |

How Much Should You Pay For Homeowners Insurance?

According to a 2023 study from Bankrate, the national average cost for homeowners insurance worked out to $1,428 annually for someone with a $250,000 dwelling home, a $1,000 deductible, and $100,000 in liability coverage.

However, it’s hard to say what your actual homeowners insurance rates will be. That’s because the price of cheap homeowners insurance depends on a wide range of factors, including the size of your home, the coverage levels and deductibles you select, which discounts you qualify for, and more. Where you live is another factor that can impact your homeowners insurance rates.

*These estimates are based on a $200,000 dwelling, $1,000 deductible, and $1,000 in liability coverage

Most expensive homeowners insurance policies, by state:

- Florida: $3,575

- Louisiana: $2,979

- Oklahoma: $2,651

- Alabama: $2,314

- Mississippi: $2,290

- Arkansas: $2,063

- Texas: $1,945

- Kansas: $1,939

- Missouri: $1,722

- Nebraska: $1,583

Least expensive homeowners insurance policies, by state:

- Hawaii: $337

- Vermont: $589

- Idaho: $622

- Utah: $642

- Oregon: $643

- Washington: $653

- New Hampshire: $680

- Nevada: $703

- Washington D.C.: $706

- New Jersey: $711

As you can see, where you live can play a huge role in how much you’ll pay for homeowners insurance. Still, there are plenty of factors you have some control over, so make sure to conduct due diligence as you shop around for a new policy.

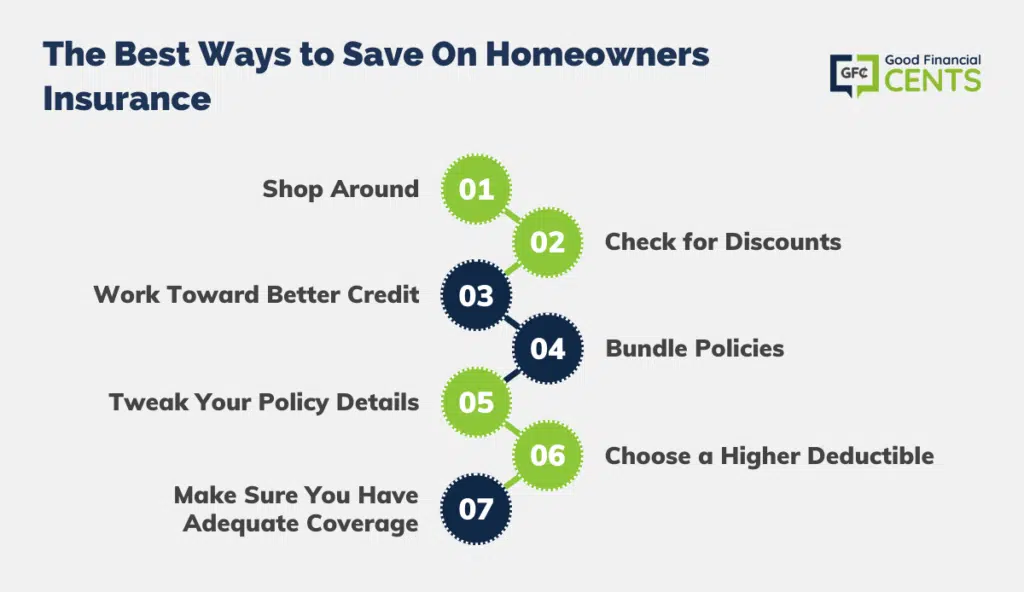

The Best Ways to Save On Homeowners Insurance

Table of Contents:

- Shop Around

- Get a Discount

- Build Better Credit

- Bundle Insurance Policies

- Choose Higher Deductibles

- Reevaluate Your Coverage

Getting a cheap rate on homeowners insurance isn’t rocket science by any means, but there are steps you can take to ensure you’re paying the lowest price you can. The following tips can help you secure a homeowners insurance policy without sacrificing quality or coverage.

Shop Around

The most important step you can take to save on homeowners insurance is shopping around and getting multiple quotes. This step is important since different companies weigh all the factors that impact your rates differently. Where one company may need to charge you higher rates based on your individual details, another may offer coverage for a whole lot less.

Fortunately, shopping around online for homeowners insurance is easier than ever. Most of the top companies let you get a free, no-obligation quote online without ever leaving your home or speaking to an agent.

Check for Discounts

When you’re shopping around for homeowners insurance quotes, make sure you check which discounts might be available to you. It’s possible you could qualify for a lower rate if you have a home security system or fire alarm, for example. You might also qualify for lower rates based on loyalty discounts, claims-free discounts, living in a gated community, paying your premiums online, being a non-smoker, and more.

Work Toward Better Credit

Like it or not, many homeowners insurance companies consider your credit rating before extending you a policy. Poor credit might leave you paying more for homeowners insurance. However, good or excellent credit can help you save money over time.

Expert Tip

Keep in mind that the most important factor that makes up your FICO score is your payment history.

For that reason, it’s crucial to pay all your bills early or on time each month.

Also, note that how much you owe in relation to your credit limits is the second most important factor that makes up your FICO score. This is a good reason to pay down debt if you have any, especially if you have unsecured debts like credit card debt.

Bundle Policies

You can also save money on homeowners insurance if you’re able to bundle several policies with a single insurer. This could mean moving your homeowners and auto insurance policies to a new company that offers a lower rate, but you can also bundle additional policies like life insurance, umbrella insurance, and more.

Tweak Your Policy Details

Also, remember that most homeowners insurance companies let you tailor your policy details to your needs. You can save money this way by selecting the exact coverage levels you need to feel protected and only paying for add-ons you actually want.

Many companies will even let you experiment with policy details online using their online quote engine.

Choose a Higher Deductible

One homeowners insurance factor you have a lot of control over is the deductible you choose for your policy. Choosing a higher deductible can help you pay lower homeowners insurance premiums, whereas a lower deductible means you’ll pay more for your policy.

If you have the emergency funds to go with a deductible of $2,000 or more instead of a $500 deductible, you’ll pay much lower homeowners insurance premiums overall.

Make Sure You Have Adequate Coverage

Saving money is important, but that doesn’t mean you should cut your insurance policy down so much that it doesn’t provide enough coverage. If you don’t purchase enough insurance coverage to repair or replace your home or protect yourself in the event of a lawsuit, you could easily suffer dire financial consequences.

The key to getting the best homeowners insurance rates is finding the best price on the amount of coverage you need without paying for any extras. That’s why we suggest thinking through the entire situation before you settle on a policy. If you skimp on homeowners insurance to save a few hundred bucks and your house burns down, you could live to regret it.

Bottom Line: Top Affordable Homeowners Insurance Providers

Finding the right balance between affordability and comprehensive coverage is essential. Numerous factors, such as your location, home size, and claims history, influence insurance costs.

To secure the best deal, it’s wise to periodically explore options from various insurers. Notably, companies like Lemonade, Amica Mutual, Allstate, Farmers, State Farm, Erie Insurance, and Liberty Mutual offer competitive rates.

Research reveals that strategic steps can lower expenses—shopping around, exploring discounts, improving credit, bundling policies, adjusting deductible levels, and ensuring adequate coverage.

Balancing cost and protection is pivotal, as skimping on coverage may lead to regrettable consequences. The path to economical homeowners insurance hinges on informed decisions and tailored policies.