Purchasing a home can be an exciting experience, but real financial consequences that can arise if you don’t compare lenders before you apply for a mortgage. On top of costly closing costs and higher fees, some mortgage lenders cannot offer the lowest mortgage rates available today.

If you wind up with a subpar loan because you failed to shop around, you could easily spend thousands of extra dollars in interest for no reason at all.

Table of Contents

Since your mortgage will likely be around for at least 15 to 30 years, comparing mortgage rates and terms is essential. We compiled a list of the top mortgage lenders and rates for this reason — to help you figure out which lenders are reputable, and which offer the lowest mortgage rates available in your area.

Current Mortgage Rates

As we all now, mortgage rates fluctuate daily. The table below gives you the latest 15 and 30 year U.S. National Mortgage rate according to the Federal Reserve Bank of St. Louis (FRED):

| Term | Rate | Source |

| 15 Year | 6.43 | FRED 15 Year |

| 30 Year | 7.34 | FRED 30 Year |

By selecting your state below, you can browse current mortgage rates for your area. Keep in mind several factors affect the actual rate you will get including your downpayment and credit score.

Which Lenders Offer the Best Mortgage Rates in February 2025?

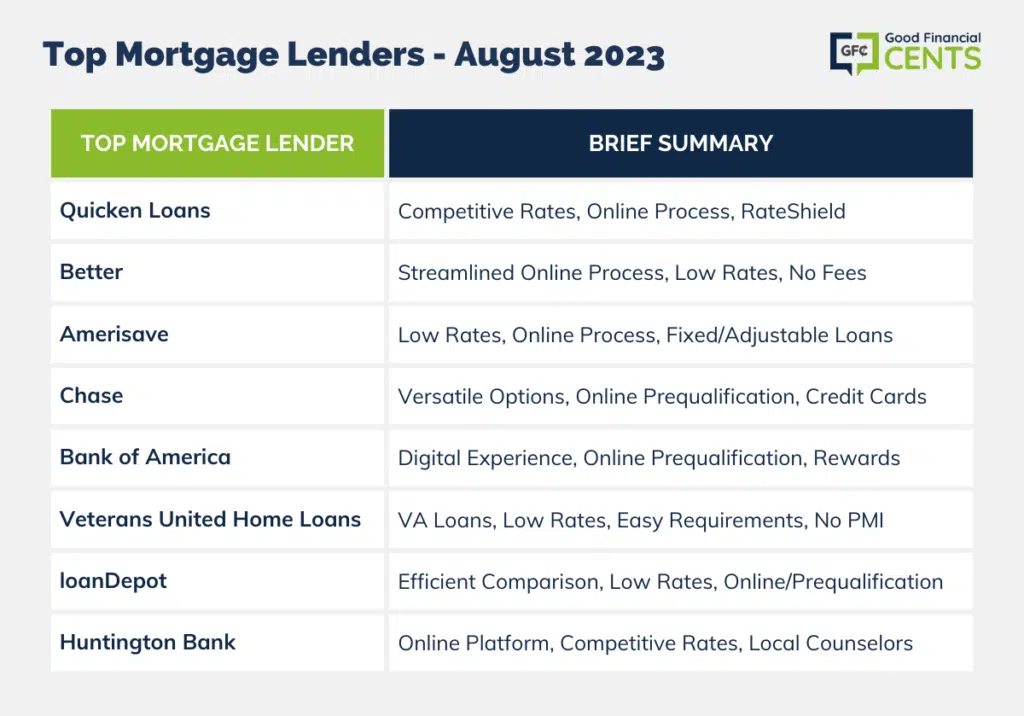

Before you move forward with a home loan, take the time to compare interest rates, fees, and customer service ratings among the top lenders in the market today. The following lenders made our list of top mortgage lenders based on the rates they offer, their reputation and ratings, and their online loan platforms and features.

- Quicken Loans

- Better

- Amerisave

- Chase

- Bank of America

- Veterans United Home Loans

- loanDepot

- Huntington Bank

#1: Quicken Loans

Quicken Loans is frequently considered one of the top mortgage lenders nationwide, and it’s easy to see why. Not only does Quicken Loans offer some of the most competitive interest rates borrowers can find today, but they also offer a fully online mortgage process that lets you avoid visiting a local branch to get your loan processed and underway.

Quicken Loans even offers a feature called RateShield, which locks in your mortgage rate for up to 90 days while you shop for a home or finalize your home loan. You can apply for your home loan online, but you can also call into their 1-800 number for help. Quicken Loans even offers a helpful online chat feature that lets you get all your questions answered before you apply.

Get Started with Quicken Loans

#2: Better

Better leverages today’s technology to bring the mortgage process into the modern world. What’s often a nerve-racking and complicated process is now streamlined. Thanks to its 100% online approach, Better applications result in faster closings. Notably, it doesn’t charge commissions or fees, which saves borrowers a significant amount of money.

Although Better doesn’t offer certain products, like a HELOC or VA loan, its mortgage rates are generally quite low (which it credits to its investor-matching technology). Applicants can get a quote in just minutes after answering a few questions.

#3: Amerisave

Amerisave is an online mortgage lender that promises amazingly low rates and a simple digital mortgage process. You can complete an application and upload all the documentation required for your mortgage online, and Amerisave will even send a representative to your home to complete the closing process at the time and date of your choosing.

Amerisave offers fixed-rate and adjustable-rate mortgage loans with every timeline you can imagine, and all with some of the most competitive rates available today.

#4: Chase

While Chase is known for its popular credit cards, checking accounts, and savings accounts, they also offer a competitive mortgage product.

Chase even lets you get prequalified online without a hard inquiry on your credit report, which makes it easy to see an estimate of the mortgage rates you’ll qualify for — and how much you may be able to borrow —before you move forward with a full application.

Like Quicken Loans, Chase offers a wide range of mortgage options consumers want including 30-year and 15-year fixed-rate mortgages as well as adjustable-rate mortgage options. Chase also offers valuable tools that can help you determine your new home loan payment, figure out how much you can afford to borrow, and more.

#5: Bank of America

Bank of America promises a “digital” mortgage experience that’s more convenient than working with a brick-and-mortar bank. You can get prequalified online without a hard inquiry on your credit report, and you an also access valuable tools that can help you figure out the right loan for your needs.

Bank of America offers fixed-rate and adjustable-rate mortgage options, so they’re bound to offer a home loan that suits your needs. They also offer closing cost discounts and other perks for existing Bank of America customers who belong in their Preferred Rewards program.

Get Started with Bank of America

#6: Veterans United Home Loans

Veterans United Home Loans connect veterans, active military, and qualifying spouses to VA loans with low rates and easy borrowing requirements. Since Veterans United focuses solely on VA loans, however, this lender isn’t an option for consumers who don’t meet eligibility requirements based on military activity.

VA loans can be very attractive for those who can qualify since they come with easy credit requirements and you don’t have to put any money down. You do have to pay an initial funding fee, but VA loans also come without burdensome private mortgage insurance or PMI.

Since Veterans United Home Loans focuses on VA loans, they’re one of the best lenders to consider if you plan to choose this option.

Get Started with Veterans United Home Loans

#7: loanDepot

Consider loanDepot if you want to compare loan products and get prequalified online in a matter of minutes. This mortgage lender offers access to mortgage loans for a new home purchase or a refinance, and you may be able to qualify for extremely low rates depending on your creditworthiness.

If you’re looking for a more personal experience, keep in mind that loanDepot will connect you with an individual loan counselor that can help you find the best loan for your needs.

#8: Huntington Bank

Huntington Bank also offers a robust online mortgage platform that makes it easy to compare loan options online. They offer fixed-rate and adjustable-rate mortgages to meet a variety of needs, and interest rates can be extremely competitive based on your creditworthiness and other factors.

Consider Huntington Bank if you want to purchase a new home or refinance an existing mortgage but you want the option to speak with a local mortgage counselor in your area.

Get Started with Huntington Bank

How to Get the Best Mortgage Rates

The best mortgage rates typically go to borrowers who have excellent credit, a stable income, a long history of employment, and the ability to put down a large down payment. This means that, if you want to qualify for the best mortgage rates available today, you may need to take some steps to improve your situation before you apply.

Here are some tips that can help you become a more attractive borrower or alter your home loan to secure the lowest rate possible:

Shop Around With Multiple Lenders

Shopping around with several different lenders is the best way to ensure you’re getting the lowest rate you can qualify for. You can do this by comparing several different lenders and their loan offerings, or by applying for a new mortgage with a loan aggregator like LendingTree so you can compare multiple loans and rates in one place.

We always suggest comparing mortgage rates with at least 2 to 4 lenders before you apply for a home loan. In addition to mortgage rates, make sure to ask about and compare closing costs and fees along with online account management options.

Consider Working With a Credit Union

In addition to traditional banks and online lenders, you can also compare mortgage rates and loans offered by credit unions in your area. While you typically need to be a member of a bank at a credit union, these institutions are not-for-profit, meaning they’re often able to offer lower interest rates than for-profit lenders and banks.

Also, remember that you may be able to join a credit union with ease if you aren’t a member already. Credit unions may charge up to $25 to join, but it’s possible you could be eligible for a membership-based on where you live, which communities you’re involved for, your job, your military service, and other factors.

Look at Government-Backed Mortgage Programs

Also check into government-backed mortgage programs like FHA loans, VA loans, and USDA loans. Since the federal government guarantees these loan programs, you may be able to qualify for lower mortgage rates and better terms even if your credit is less than perfect.

Just remember that there’s usually a tradeoff to be made with government loan programs — even if they let you secure a lower interest rate.

FHA loans, for example, let you get started with a down payment as low as 3.5% of your loan amount if your credit score is at least 580, but they also charge upfront mortgage insurance and ongoing mortgage insurance premiums that cannot be canceled during the life of your loan — even after you have more than 20% in equity built up.

Take Steps to Boost Your Credit Score

Another important factor that determines your mortgage rate is your credit score. While 680 or higher is typically considered a “good” FICO credit score, you may qualify for better rates with a traditional home loan if you can find a way to boost your credit score to greater heights.

While there are many factors that influence your individual FICO score, keep in mind that the two main factors that determine your score are your payment history and the amounts you owe in relation to your credit limits. As a result, paying all your bills early or on time and paying off debt can make a significant impact on your credit score in a hurry.

Save Up a Larger Down Payment

Another factor that can impact your mortgage rate is how much money you can afford to put down on your home. Most traditional lenders prefer borrowers to put down at least 20% of their home’s value when they buy, and they often extend the best rates to buyers who can reach this threshold.

If you don’t have a down payment or your down payment is minimal, you may also find your home loan options are limited. Many lenders require you put down 5% at a minimum and even FHA loans require 3.5%, so you should start saving until you have enough money to secure the loan you want with a rate and payment you can afford.

Get a Shorter Mortgage

The most popular type of mortgage is the fixed-rate home loan, mostly because the interest rate and mortgage payment (including principal and interest) will never change. However, you don’t have to go with the traditional 30-year home loan if you prefer to pay off our home faster. Many lenders offer 20-year loans, 15-year mortgages, and even 10-year home loans with a fixed rate.

Even better is the fact that most of the time, fixed-rate mortgages with a shorter repayment timeline come with lower mortgage rates. This means you’ll pay your home off faster and pay less in the interest all along.

Consider Alternative Mortgage Loan Products

In addition to fixed-rate mortgages, many lenders offer loans with an adjustable rate. Adjustable-rate mortgages, also called ARMs, typically let consumers pay a lower fixed rate for an introductory period before resetting to market rates once the introductory offer is up.

Where fixed-rate home loans are usually best for consumers who plan to stay in their home for a long time, adjustable-rate mortgages can be a good deal for people who want an initial low rate because they plan to move or refinance within a few years after buying their home.

Pay for Points

Mortgage points, which are also called mortgage discount points, let consumers pay a flat fee to secure a lower mortgage rate on their home loan. One point, which typically translates into a .25% discount off your rate, normally costs 1% of your mortgage amount or $1,000 for every $100,000 you borrow.

While paying for points may not make sense if you only plan to own your home for a short amount of time, the savings can be significant if you plan to remain in your home for the long haul.

Join a Bank-Based Loyalty Program

Finally, don’t forget that some mortgage lenders offer preferable rates and terms to consumers who use their own banking and loan products. This is the case with Citibank and Bank of America, for example, since both banks offer mortgage rate discounts or a reduction in closing costs for customers who bank with them and meet other criteria.

If you participate in the Bank of America Preferred Rewards program, for example, you can earn a higher rate of rewards with their rewards credit cards and get a reduced origination fee on your home loan.

What Are The Best Mortgage Rates

While mortgage rates may be somewhat out of your control, there are steps you can take to improve your chances of qualifying for superior mortgage rates and loan terms. You can shop around and compare lenders for starters, but you should also try to improve your credit and financial situation so you’re a more attractive borrower overall.

The lenders on this list offer some of the best mortgage rates and loan terms available today, so make sure to consider them first as you look for ways to get into the best loan possible.

Final Thoughts: What Are The Best Mortgage Rates Today?

When seeking the best mortgage rates today, thorough lender comparison is crucial to avoid unnecessary expenses. Suboptimal loans from inadequately researched lenders can result in thousands of extra interest costs.

Since mortgages persist for 15-30 years, evaluating rates and terms is paramount. This article lists top mortgage lenders like Quicken Loans, Better, Amerisave, Chase, Bank of America, Veterans United Home Loans, loanDepot, and Huntington Bank.

Strategies to secure optimal rates include shopping around, engaging with credit unions, exploring government-backed programs, enhancing credit scores, increasing down payments, considering shorter mortgages, leveraging adjustable-rate mortgages, paying for points, and capitalizing on bank loyalty programs.