The life insurance industry offers some of the country’s top careers and highest-paying jobs. From agents to underwriters, plenty of career paths can lead you to a lucrative position in the life insurance field.

With more than 2.86 million people currently employed in life insurance roles across the United States in 5,954 insurance companies, it’s clear that this is a great place to start your search for a high-paying job.

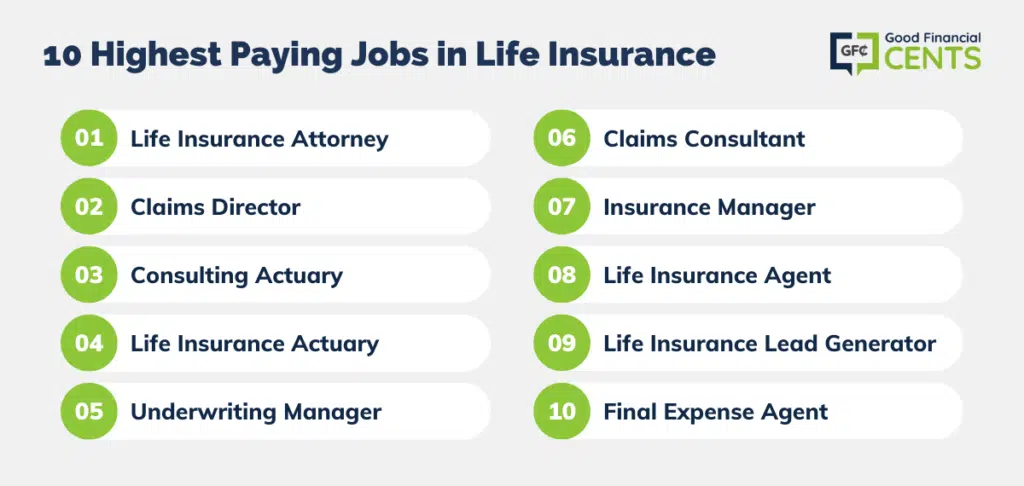

If you’re interested in a career in life insurance, here are 10 of the highest-paying life insurance jobs and some tips on finding positions in this field.

Table of Contents

- 10 Highest Paying Jobs in Life Insurance

- 1. Life Insurance Attorney

- 2. Claims Director

- 3. Consulting Actuary

- 4. Life Insurance Actuary

- 5. Underwriting Manager

- 6. Claims Consultant

- 7. Insurance Manager

- 8. Life Insurance Agent

- 9. Life Insurance Lead Generator

- 10. Final Expense Agent

- Skills Required in the Life Insurance Industry

- What to Consider Before Choosing a Life Insurance Job

- Resources

- The Bottom Line – 10 Best Paying Jobs in Life Insurance in 2025

- Final Thoughts on a Life Insurance Career

10 Highest Paying Jobs in Life Insurance

1. Life Insurance Attorney

Average Salary:

Becoming a life insurance attorney is not for the faint of heart. It requires an immense amount of dedication, knowledge, and hard work.

Not only must attorneys have a bachelor’s degree and law school experience, but they must also pass the bar exam in the relevant state and have familiarity with contract law.

However, the payoff can be great if you can meet the qualifications.

Life insurance attorneys hold important responsibilities, such as representing companies in lawsuits or handling insurance claims. To fulfill their duties, they must stay current on all regulations and terms of service.

Lawyers who work directly for an insurance company can have varying tasks, such as reviewing legal documents, offering advice on complex issues, and ensuring the marketing department complies with laws and regulations.

Some lawyers may be hired on a retainer basis to assist with a specific lawsuit or provide counsel to either an insured party or their employer.

2. Claims Director

Average Salary:

Claims Directors connect people, process crucial information, and make high-stakes decisions. It’s a career that demands experience, intellectual agility, and razor-sharp problem-solving skills if you want to stay at the top.

Claims Directors are responsible for developing and implementing policies that ensure customers receive fair compensation in the event of a life insurance claim.

They are also tasked with managing disputes between life insurers and their customers and overseeing teams of agents who handle life insurance claims.

They must use integrity and ensure everything is done according to the law to protect their companies from liability and keep customers satisfied.

3. Consulting Actuary

Average Salary:

With an average salary of $116,861 per year, Actuarial Consultants stand to make a significant amount from their profession.

Not only are they well-compensated for their work, but they also play an integral role in providing financial security through analysis and calculations of different kinds of life insurance policies.

But it’s not just the money that makes this a desirable career path; those who pursue consulting actuary roles can benefit from their work’s challenging yet rewarding nature.

The job requires specialized skills, but they are helping thousands of customers achieve peace of mind about their financial future.

4. Life Insurance Actuary

Average Salary:

Life Insurance Actuaries are charged with minimizing costs and risks to insurance companies. They carry out risk assessments, perform financial analyses, and generate reports for sales and management teams.

To be successful in the role, you must possess strong analytical and communication skills.

Being able to understand complex data and make sound decisions is paramount when it comes to the typical duties of a life insurance actuary.

By identifying key customer trends and patterns, these professionals can develop accurate figures that help insurers save money while providing valuable coverage.

To be effective in their role, actuaries must also possess knowledge of the human psychology behind decision-making.

5. Underwriting Manager

Average Salary:

Underwriting managers have their hands full. As a manager, they oversee the entire underwriting department, ensuring that all operations and administrative tasks are running smoothly.

This includes helping underwriters review insurance applications, claims, and proposals – a challenging task.

But if you’re up for some tough decisions and take pride in your organizational skills, this might be one of the best paths for growth in the life insurance industry.

The money is there, too – as an underwriting manager, you’ll make quite a bit more than the average employee while working on some of the most challenging claims.

6. Claims Consultant

Average Salary:

Claims consultants work to process life insurance claims and investigate complex cases as required. They review claim submissions, collect pertinent information, and make payments while ensuring accuracy.

In addition, they are responsible for updating claim files, creating reports and forms, and working with other professionals to guarantee successful outcomes.

Life insurance claims consultants must possess excellent analytical skills and industry knowledge to make correct decisions upon review of the insurance policies at hand.

It’s a dynamic job that requires dedication, attention to detail, and great time management capabilities – all qualities vital to success when it comes to one of the highest-paying jobs in life insurance.

7. Insurance Manager

Average Salary:

Insurance Managers are responsible for ensuring that policies are followed, and productivity is achieved. This role also involves mentoring sales agents to help them generate more sales.

In addition, they must utilize actuarial data accurately to set premium payments that best reflect the risk assessment of potential clients. It’s no wonder that insurance managers are amongst some of the highest-paid professionals in the world.

8. Life Insurance Agent

Average Salary:

Life insurance agents are among the most lucrative professions in life insurance. The base salary might not stand out, but they also earn sales commissions, which is where their real income potential lies.

Life insurance agents’ salaries vary depending on the type of life insurance policies they sell and other factors such as experience and education.

From being able to provide rate estimates to prospective clients to responding to inquiries and even pitching life insurance policies, agents have a knack for understanding the ins and outs of life insurance.

Aside from providing advice on insurance plans, life insurance agents also need to be well-informed about the different types of coverage available. Knowing how much protection clients qualify for is a critical part of their job.

Thanks to their knowledge and expertise, agents can help customers make balanced decisions about their financial security for years down the line.

9. Life Insurance Lead Generator

Average Salary: $42,688 per year

Average Salary:

Lead generators are responsible for seeking out potential leads for life insurance agents, using various sources, including online marketing efforts, email campaigns, and more traditional methods like direct mail.

They attract leads based on their quality and exclusivity and then sell them to agents at a cost, earning themselves significant paydays from each successful lead they generate.

The best part? You don’t even need formal qualifications to get started as a lead generator – just experience in lead generation and a solid understanding of the life insurance market.

If you’ve got a knack for marketing, this could be the perfect job for you.

10. Final Expense Agent

Average Salary:

Final Expense Agents help families cope with the financial burden of their loved one’s passing. They must have strong interpersonal and organizational skills to be successful in their role.

They are tasked with providing families with death benefits to cover the legal dues, funeral expenses, burial costs, and other immediate needs of a deceased loved one.

While their primary function is to market and research for sales leads, agents can expect a decent salary and additional commissions.

They must juggle multiple tasks accurately and efficiently, from market research to pursuing leads.

By offering life insurance policies that help protect people from financial difficulty, the rewards of their job extend beyond the financial.

Skills Required in the Life Insurance Industry

Now that you have an understanding of the best-paying life insurance jobs, here are the critical skills and personal qualities you need to succeed in this field:

Communication Skills

As an insurance professional, you are a subject matter expert and must be able to communicate key information in a way that’s easy to understand.

Successful insurance professionals can explain complex topics in a manner that is easy for customers to understand.

Of course, familiarity with the insurance industry is essential. Knowing what life insurance policies are available, how they can benefit customers, and the industry’s legal requirements is crucial.

Knowledge of the insurance industry lets you effectively advise clients on what products and services best suit their needs.

Analytical Skills

Analytics is more than crunching numbers but also about making sense of a situation. You must be able to look at the facts and figures, understand how they interact, and make sound decisions.

This involves forecasting outcomes, assessing probabilities, and predicting market trends. Analytical skills are essential for many roles within the life insurance industry, as you must be able to interpret and analyze customer data to make informed decisions.

For example, an underwriter needs to be able to take into account multiple factors (such as age, medical history, and lifestyle) and decide on the best policy for a customer. A broker needs to be able to assess the financial markets and make sound recommendations for their clients.

Management and Leadership Skills

For C-level and senior executives, the life insurance industry requires good management and leadership skills to succeed.

You need to motivate your staff, delegate effectively, and manage the financial side of your business. Also, since life insurance companies are typically large organizations, negotiation skills are essential for dealing with other firms and organizations.

Numeracy Skills

While some insurance roles require a higher degree of numerical expertise than others, actuaries must be well-versed in statistics and computer modeling to do their jobs effectively. In contrast, claims handlers need only have a general understanding of mathematics.

Regardless of the role you aspire to, having a good grasp on fundamental numeracy concepts, such as fractions and percentages, will put you at an advantage.

What to Consider Before Choosing a Life Insurance Job

Before you leap into the life insurance industry, here are some key points to consider:

Job satisfaction is more than just a salary. You need to consider your working environment and how it fits your lifestyle.

Hours and Work Environment

Working in the life insurance industry can be time-consuming and stressful, so you must be prepared for this. It may require you to work long hours or take on the occasional weekend shift.

You also need to ensure you are comfortable with the work environment. Some roles may require you to work in a physical office, while others may allow for more flexible working arrangements, like work-from-home roles or part-time positions.

Job satisfaction is more than just a salary. You need to consider your working environment and how it fits your lifestyle.

Education Requirements

Do you understand the education requirements of your preferred career in life insurance? Depending on the role you are considering, you may need a degree in a relevant field such as finance, mathematics, or economics.

Alternatively, you may need to undertake additional training or professional development courses.

Regardless of your role, you should understand life insurance products and regulations well to provide your customers with the best advice and service.

Job Location and Salary

No matter which life insurance career you choose, it won’t be a long-term career move if the job isn’t in a desirable location. Location is also important when it comes to salary and career progression.

Here’s how location impacts your life insurance career:

- Certain states may offer higher salaries than others due to their cost of living

- If you are looking for career progression, then certain cities may be better suited to your needs

- Smaller towns often mean fewer job opportunities and lower salaries.

It pays to research and understand the local job market before you make a final decision.

Career Growth Potential

Some companies are very small and may not offer much in the way of career growth. However, if you join a more prominent life insurance firm, there will be more potential for advancement.

Before joining an organization, ask questions about its structure and potential for career growth. By doing this, you can get a better feel for the job and how you may be able to progress within the company in the future.

Some big companies invest in their employees by offering fantastic career progression opportunities. This could include internal promotions, salary increases, and leadership roles.

If you’re pursuing a life insurance career, consider the points discussed above and find out as much information as possible about potential jobs before making any decisions.

Insurance Company Reputation

Always research a company before you start working for them. Consider their reputation as an employer and their customer satisfaction ratings.

These days, it’s easy to find information on companies online. You should also check what other life insurance agents have said about the company. Doing so can provide valuable insight into what it could be like working for them.

Resources

To help you identify the best-paying life insurance jobs, here are several resources you can use:

The Bottom Line – 10 Best Paying Jobs in Life Insurance in 2025

The life insurance sector continues to present promising opportunities for professionals seeking well-remunerated positions.

From attorneys to agents, the industry caters to a diverse range of skill sets and offers roles that are not only financially rewarding but also crucial in ensuring clients’ peace of mind.

With over 2.86 million individuals working in this domain, the competitive landscape highlights the importance of unique skills such as communication, analytics, leadership, and numeracy.

However, it’s imperative for potential candidates to evaluate factors beyond remuneration, like job satisfaction, location, company reputation, and growth opportunities, to ensure a fulfilling career in life insurance.

Final Thoughts on a Life Insurance Career

You can prepare for a life insurance career using the information that’s available online. Find out what life insurance jobs are available in your area or online, and begin applying.

Remember, life insurance sales jobs offer tremendous potential for growth and an excellent salary.

You can also become an independent agent, performing financial analysis and selling life insurance products to clients. Once you get started in the industry, you can take the necessary steps to advance your career and earn a lucrative salary. So, don’t wait – start mapping out your life insurance career today.

If you’re interested in other high-paying jobs in similar fields, check out our guides to the highest-paying jobs in real estate, major banks, and the best-paying jobs in finance.