When you’re living on a fixed income and short on cash to live the life you want, it can be tempting to tap into what is probably your largest source of wealth — your home equity.

While it’s possible to access home equity by refinancing your home loan or taking out a home equity line of credit (HELOC), you can also consider a reverse mortgage.

A reverse mortgage will allow you to stay in your home until you pass away or move for other reasons, yet you can access your home’s equity in one lump sum upfront or through a line of credit.

However, this type of loan is only available to consumers over 62 and has considerable home equity, so a reverse mortgage won’t work for everyone.

To help you in your search, we compared the top companies that offer reverse mortgages to senior citizens today.

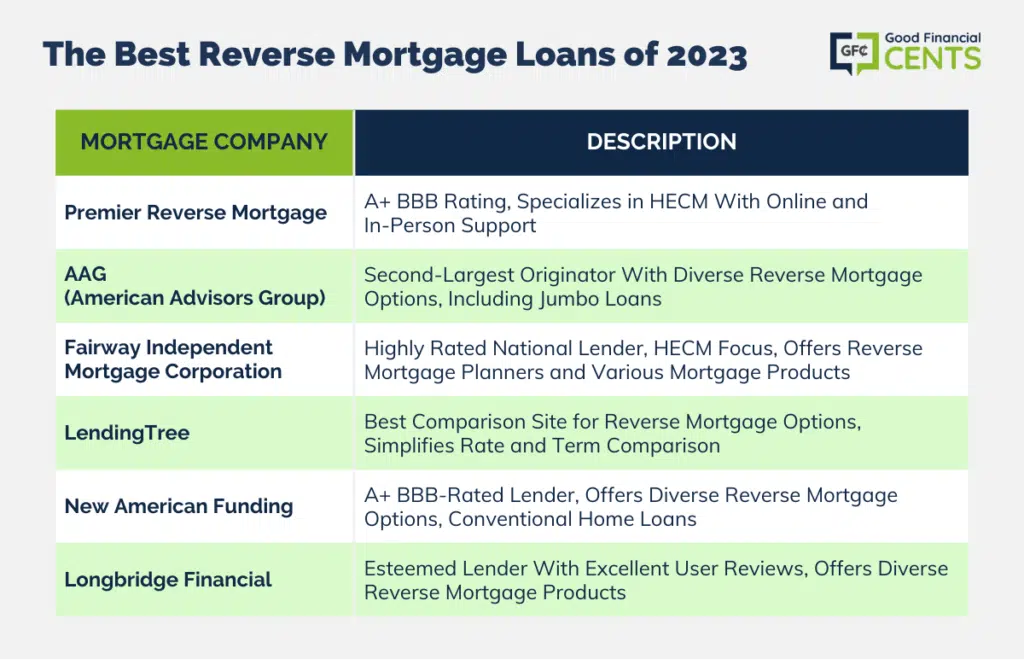

Premier Reverse Mortgage came out ahead in our study due to its rankings from third-party agencies like the Better Business Bureau (BBB) as well as its diverse customer service offerings.

Table of Contents

The Most Important Factors When Applying for a Reverse Mortgage

- Which Lenders Offer an HECM? The most common type of reverse mortgage, the Home Equity Conversion Mortgage (HECM), is insured by the federal government and only available through approved FHA lenders.

- Can You Complete the Loan Process Online? Many reverse mortgage companies let you complete the bulk of the loan process online. Some even let you close on your reverse mortgage anywhere you want, and even at your home.

- Do You Want a Fixed Rate or a Variable Rate? Even though the reverse mortgage company makes a payment (or multiple payments) to you, interest is still charged on borrowed amounts. Generally speaking, you can choose options with a fixed rate or a variable rate, depending on your needs.

- Lump Sum or Line of Credit? Some reverse mortgages, including HECMs, offer your funds in a lump sum, a line of credit, or a combination. Make sure to figure out which options each lender offers and what you prefer.

The Best Reverse Mortgage Loans of 2025

Reverse Mortgage Company Reviews

Finding a company for your reverse mortgage can seem intimidating, but it helps if you have a general overview of what each provider has to offer.

The following reviews explain the highlights of each of the companies we selected for our ranking, as well as why you might want to consider choosing them for your reverse mortgage needs.

Premier Reverse Mortgage — Excellent Customer Support

Premier Reverse Mortgage is another company that is rated A+ with the BBB, and they also focus their business on the government-insured HECM product.

This company offers free reverse mortgage quotes and a ton of information and reverse mortgage resources online, but you can also book an appointment with a mortgage professional who can look over your unique situation and make recommendations for your loan needs.

For that reason, we believe Premier Reverse Mortgage offers a smart combination of online support and in-person help.

You should also note that Premier Reverse Mortgage offers special resources and options for condo owners who might want to tap into their home equity with a reverse mortgage.

While reverse mortgages for condos come with unique rules that don’t apply to single-family homes, they may be available to those who qualify.

Why This Lender Made the List: Premier Reverse Mortgage offers several ways for potential customers to reach out. They offer a helpful online chat feature, a direct email address, and a contact form on their website.

You can also call their 1-800 number and reach a mortgage professional over the phone.

What Holds It Back: Premier Reverse Mortgage is only available in nine states — Arkansas, California, Colorado, Florida, Georgia, Michigan, New Jersey, Virginia, and Washington.

AAG (American Advisors Group) — Best Jumbo Loan Option

AAG is the second largest originator of reverse mortgages in the US, trailing only Wells Fargo. The company was named the Best Overall Reverse Mortgage Company of 2022 by Investopedia and has an “A+” rating from the Better Business Bureau, the highest rating they assign.

The company provides reverse mortgages in 48 states.

AAG offers five types of reverse mortgages: a lump sum payment of up to 60% of the proceeds in the first year, a growing line of credit, term or tenure loans (payments made to you for a fixed number of years or for as long as you live in your home), and a reverse mortgage for purchases to help you downsize into a more appropriate home.

But the most unique reverse mortgage product is their jumbo loan. Known as the AAG Advantage, it allows you to withdraw up to $4 million in equity on higher-priced homes.

By completing a brief online application, you’ll be able to receive a reverse mortgage information kit. Alternatively, you can also chat with an AAG home equity specialist by phone.

Why This Lender Made the List: AAG offers a wider variety of reverse mortgages than other lenders. That includes their proprietary jumbo reverse loan program, which will unlock millions of dollars in home equity for owners of high-value properties.

What Holds It Back: Since the company specializes in reverse mortgages, they don’t offer other loan types or related financial services.

Fairway Independent Mortgage Corporation — Personal Support From a Reverse Mortgage Planner

Fairway Independent is another mortgage company that is highly rated on a national level. In fact, this firm was ranked #2 in J.D. Power’s 2019 U.S. Primary Mortgage Origination Satisfaction Study, right behind Quicken Loans.

Generally speaking, Fairway Independent focuses their reverse mortgage business on HECMs. This company also offers a range of reverse mortgage information on its website, as well as a tool that helps you find reverse mortgage planners in your area.

Also note that Fairway Independent offers a wide range of additional mortgage products, so they may be a good option if you’re considering a reverse mortgage but want to consider all the alternatives that are available to you.

Why This Lender Made the List: Unlike national lenders that operate online, Fairway Independent connects consumers with a local reverse mortgage planner who can walk them through the process.

What Holds iI Back: If you want personal help planning your reverse mortgage, you may need to travel. In some states, only one or two Fairway reverse mortgage planners are available.

LendingTree — Best Comparison Site

If you want to compare several reverse mortgage options in one place, consider using LendingTree. This loan comparison site lets you fill out your information once and receive multiple loan offers as a result.

Since shopping around for a loan is typically the best way to secure the most affordable rates and terms, LendingTree can help you save money and time by taking care of most of the grunt work for you.

Why This Lender Made the List: LendingTree offers an array of reverse mortgage information as well as valuable mortgage tools that can help you estimate the financial impact of your loan.

What Holds It Back: While LendingTree makes it easy to compare loan options, they don’t actually facilitate your reverse mortgage loan.

With that in mind, you’ll have to do additional research on the companies they suggest to make sure they offer the loan products and customer service options you need the most.

New American Funding — Broad Availability Nationwide

New American Funding is another mortgage lender that made our list due to exceptional reverse mortgage options and high ratings. This company has an A+ rating from the BBB, for starters, and they also have an average of 4.9 stars out of 5 across more than 90,000 customer reviews.

While New American Funding offers reverse mortgage loans, they also offer conventional home loans, cash-out refinance loans, and more. You can also get a free quote online or by calling their toll-free number to speak with a qualified loan professional.

Why This Lender Made the List: Where some reverse mortgage lenders only offer loans in certain states, New American Funding offers their loan products in every state but New York.

What Holds It Back: New American Funding doesn’t offer any information on the specific types of reverse mortgage loans they offer, so you’ll need to call or get a free quote to find out.

Longbridge Financial — Excellent User Reviews

Longbridge Financial is another esteemed lender in the reverse mortgage space based on its excellent reputation and reviews.

This company offers three different reverse mortgage products — a HECM reverse mortgage, a HECM for purchase, and a Longbridge Platinum Loan, which is a reverse mortgage with an option for a line of credit.

Longbridge offers an array of important resources and guides on reverse mortgages on their website, as well as a free quote calculator that can help you predict your reverse mortgage costs as well as the amount of cash you may be able to access.

They also make it easy to contact them via email, phone, or online chat when they have a representative online.

Why This Lender Made the List: Longbridge Financial has mostly excellent reviews from users on a variety of platforms, including TrustPilot.

What Holds It Back: While their Longbridge Platinum product is intended to help homeowners access more cash than a traditional HECM, it’s important to note this loan is only for homeowners whose homes are valued at $400,000 or more.

How We Found the Best Reverse Mortgage Companies

To come up with the lenders for our ranking, we looked for reverse mortgage companies that are highly rated in terms of the loan products they offer.

Since HECM loans that are insured by the government are the most popular and safe reverse mortgage products available today, we also looked for reverse mortgage lenders that proudly advertise HECM loans on their website.

While many consumers prefer to shop around for their financial products online, we are well aware that some people don’t want to take care of all of their financial matters via the web.

With that in mind, we gave preference to lenders that offer the option for in-person help, whether that help is offered on the phone, in person, or through digital tools like online chat.

What You Need to Know About the Reverse Mortgage

There’s a lot of misinformation about the reverse mortgage loan product, and it’s easy to see why. This type of loan works opposite of the traditional home loan, where the homeowner makes payments until their loan is paid off.

With a reverse mortgage, the lender makes a payment (or multiple payments) to the homeowner in exchange for a share of the equity of their home.

While having a lender give you money for part of your home equity probably sounds like a dream, keep in mind that plenty of eligibility requirements apply. Here are the main requirements you need to know about:

- You have to be at least 62 or older to qualify, and you have to own your home outright or have significant equity in your home.

- You also have to live in your residence in order to take out a reverse mortgage, which means this type of loan doesn’t work for vacation homes or rental properties.

- To qualify for an HECM, you also have to have a single-family home, a 2 to 4-unit dwelling, or an FHA-approved condo.

- Very minimal credit and property requirements also apply, although reverse mortgages are easier to qualify for with a relatively low credit score and no real income requirement.

- Also, note that HECMs require the homeowner to attend reverse mortgage counseling from a HUD-approved counseling agency before the process can move forward.

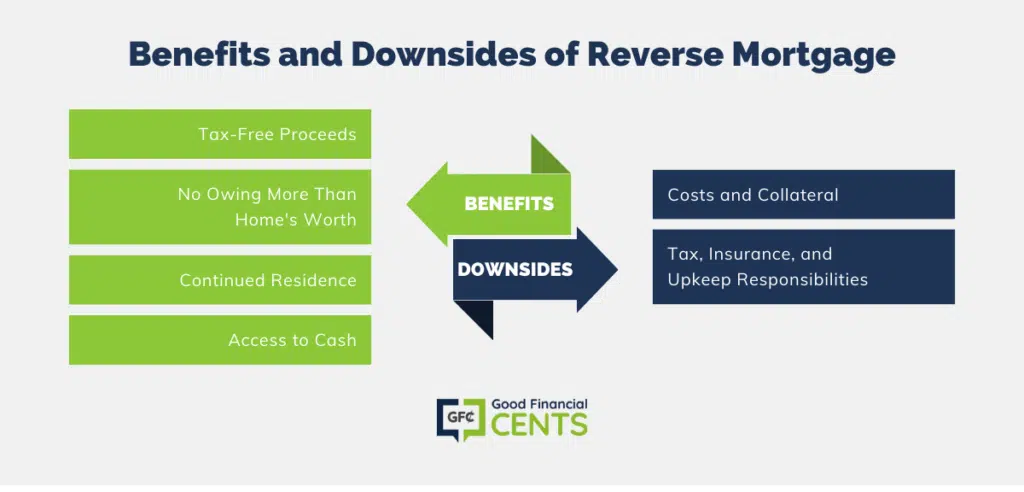

While all of this might sound like a lot, there are a ton of benefits to look forward to with this loan. For example:

- The proceeds of your reverse mortgage are usually tax-free

- You’ll never owe more than your home is worth, no matter how long you live there

- You can stay in your home until you pass away or permanently move out

- Get your hands on cash you can use to cover living expenses, consolidate debt, or simply live out your golden years your own way

The biggest downside of a reverse mortgage is the fact that there are costs involved, including closing costs to close on your reverse mortgage loan.

And since you’re putting up your home as collateral for the loan, you’re ultimately pledging your property to the reverse mortgage lender once you can no longer live there, although your heirs will have the right to purchase the property if they prefer.

Finally, note that you have to have the resources to pay for taxes, insurance, and upkeep on your home after you take out a reverse mortgage. If you don’t pay taxes and insurance and keep up on home maintenance, you risk losing your property to your lender.

Final Thoughts – The Best Reverse Mortgage Lenders for 2025

When considering the best reverse mortgage lenders for 2025, it’s crucial to understand the potential benefits and drawbacks of tapping into your home equity.

Premier Reverse Mortgage shines with its comprehensive customer support and varied service offerings, while AAG stands out for its diverse range of reverse mortgage options, including a jumbo loan program.

Fairway Independent Mortgage provides personalized guidance through local reverse mortgage planners, and LendingTree offers a convenient platform for comparing various loan options. New American Funding’s nationwide availability and Longbridge Financial’s positive user reviews further enrich the choices.

Remember, thorough research and understanding of eligibility requirements are essential before pursuing a reverse mortgage.