BMO Harris Bank has a 200-year history. It was founded in 1882 as Harris Bank but later became BMO Harris when BMO Financial Group, an institution with a legacy dating back to 1817, purchased it. This long history brings vast experience as well as a desire for development and growth.

In keeping with that vision of progress, BMO Harris has gradually refined its service models in an effort to optimize their customer experience.

Table of Contents

BMO Harris Overview

Its competitive mortgage rates aren’t the only area where the bank stands out. BMO Harris is also a community-centric bank based in Chicago but with branches across Illinois, Indiana, Kansas, Wisconsin, Minnesota, Missouri, Arizona, and Florida.

The bank operates as part of the BMO Financial Group, a Montreal-based financial services firm that is among the oldest and largest in Canada. However, this scale of operations hasn’t distracted BMO Harris from its community values.

The bank was recently named one of the most ethical businesses in the world by the Ethisphere Institute.

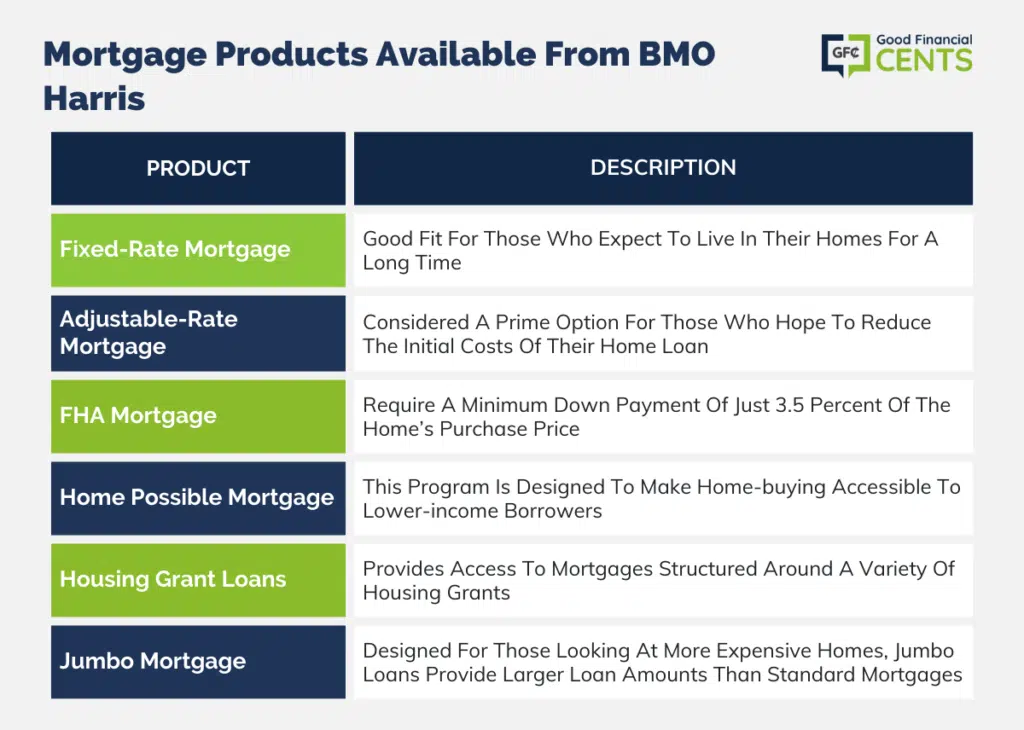

As a mortgage lender, BMO Harris offers solutions aimed specifically at low-income and first-time home buyers. However, it also provides typical fixed- and adjustable-rate mortgages and jumbo loan options.

BMO Harris Mortgage Rates

BMO Harris Loan Specifics

BMO Harris offers mortgage products tailored to two very particular borrower profiles. On one hand, the bank provides mortgage products that are aimed at affluent customers. On the other, it also provides access to specialized loans for low-income households or those who don’t have significant capital available for a down payment.

Here’s a look at the mortgage products available from BMO Harris:

Fixed-Rate Mortgage

BMO Harris advertises its fixed-rate mortgage as a good fit for those who expect to live in their homes for a long time. The cost predictability ensures borrowers can budget effectively and anticipate their costs. This is easier with fixed-rate loans because the interest rate won’t change throughout the loan term.

This mortgage is available for those purchasing or refinancing a primary residence, investment property, or second home.

Adjustable-Rate Mortgage

An adjustable-rate mortgage is often considered a prime option for those who hope to reduce the initial costs of their home loan. These loans often come with a lower initial interest rate that fluctuates after a pre-determined number of years, depending on market conditions.

This won’t always mean a higher price, but it does create the possibility of having higher monthly payments after the initial term. What’s more, the rate doesn’t just change after the first term; it actually becomes a variable rate that can shift each year.

FHA Mortgage

There is also an added degree of flexibility in terms of credit score requirements, closing costs, and the ability to use gift funds. FHA mortgages through BMO Harris require a minimum down payment of just 3.5 percent of the home’s purchase price.

Home Possible Mortgage

The Home Possible Mortgage program is designed to make home-buying accessible to lower-income borrowers. While a minimum down payment of 5 percent is required, borrowers may be able to access financial assistance for the down payment or closing costs.

Housing Grant Loans

BMO Bank also provides access to mortgages structured around a variety of housing grants. The bank can help customers connect with state or local grants and use those as financial assistance for closing costs or down payments.

Jumbo Mortgage

Designed for those looking at more expensive homes, jumbo loans provide larger loan amounts than standard mortgages. These loans are available as either fixed- or adjustable-rate mortgages and are intended for those seeking a loan above $766,550.

The wide variety of loans available from BMO Harris Bank makes the institution’s products suitable for a wide range of borrower profiles. This variety is only part of what makes the bank stand out from the competition.

BMO Harris also provides an integrated online banking experience that includes an auto-pay feature for those with a BMO Harris checking account. As of October 18, 2023, the bank offers a discount on closing costs for setting up automatic payments.

BMO Harris Mortgage Application

BMO Harris started as a community bank. The value of supporting the local communities remains central to how it operates today. This comes across in a web experience designed to easily guide users through the lending process.

Each loan page offers a simple five-step layout of the mortgage process, giving users key details about what to expect at each phase. These details clearly delineate what the borrower is responsible for and what the bank will take care of for them.

This simple five-step guide on each mortgage page can help to demystify the home-buying process and make the idea of applying for the loan less intimidating.

It’s also worth noting that BMO Harris does not directly advertise its mortgage rates on its website at this time (October 2023). While this may create some initial difficulties in comparison shopping, it’s because the bank is focused on more personal experiences.

Instead of showcasing the lowest possible rate you can get, the bank provides an easy-to-use online tool that lets you obtain a personal quote by providing just a few pieces of information.

You don’t have to provide your Social Security Number, but you should know how much the homes you’re considering cost and have an idea of what range your credit score falls into.

You can file a mortgage application and request prequalification online. You can also access a few mortgage cost calculators and informational resources with information on mortgages on the institution’s website.

Beyond these factors, the bank also stands out for its ethical processes. In March 2018, BMO Financial Group was recognized by the Ethisphere Institute as one of the World’s Most Ethical Companies of 2018. The award comes, to some degree, as a result of the bank’s focus on trying to support communities through its lending products and financial services.

BMO Harris Grades

With a legacy dating back more than 200 years, BMO Harris has had a long time to cement its reputation as a community-focused bank. The company appears to have done an excellent job in this area, as it has been recognized as a Better Business Bureau-accredited company with an A+ rating.

Furthermore, a 2018 study from the Reputation Institute recognized BMO Harris as one of the most reputable banks in the country. This distinction comes at a time when the reputation of the larger banking industry is improving in the public eye.

An American Banker analyzing past Reputation Institute studies in comparison to this year’s results highlighted this trend. Just two years ago, the banking industry was ranked as the worst sector in the U.S. during the Reputation Institute’s annual study. This year, banking has climbed to the 10th position out of 16 industries.

BMO Harris is an Equal Opportunity Lender operating under the NMLS number 401052.

- Information collected on December 19, 2018

BMO Harris Mortgage Qualifications

| Payment assistance available | Special access qualifications | Down payment required | |

|---|---|---|---|

| Fixed-rate loans | No | No | Yes |

| Adjustable-rate loans | No | No | Yes |

| FHA loans | Yes | Yes | Yes |

| Home Possible loans | Yes | Yes | Yes |

| Housing Grant loans | Yes | Yes | Yes |

| Jumbo loans | No | No | Yes |

Qualification details vary substantially from loan to loan and are often reliant on a variety of conditions monitored by third parties, such as community groups that manage grants.

BMO Harris Phone Number & Additional Details

- Homepage URL: https://www.bmoharris.com/main/personal

- Company Phone: 1-888-482-3781

- Headquarters Address: 111 W. Monroe St., Chicago, Illinois, 60603

The Bottom Line – BMO Harris Mortgage Review

BMO Harris Bank, with its deep-rooted legacy and commitment to community values, stands out as a trusted mortgage provider in today’s competitive landscape. Its range of mortgage products, designed to cater to various borrower profiles, ensures that both first-time and seasoned buyers can find a solution tailored to their needs.

The bank’s emphasis on a transparent and user-friendly online experience, combined with its unwavering ethical standards, reinforces its reputation as a leading financial institution. For those seeking a blend of tradition, trust, and innovation in mortgage solutions, BMO Harris emerges as a compelling choice.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: BMO Harris Mortgage Product Description: BMO Harris Mortgage, a segment of the longstanding BMO Harris Bank, offers a diverse range of mortgage products tailored to meet varied borrower needs. Rooted in community values, the institution couples its rich heritage with innovative financial solutions to guide homebuyers on their journey. Summary Founded on a legacy that spans over 200 years, BMO Harris Mortgage stands as a testament to financial resilience and adaptability. As a subsidiary of BMO Harris Bank, this mortgage entity extends an array of products, from fixed and adjustable-rate mortgages to specialized solutions for low-income and first-time buyers. Central to their ethos is a commitment to the community, evidenced by their tailored lending programs that prioritize inclusivity and accessibility. Operating under the larger umbrella of BMO Financial Group, BMO Harris Mortgage leverages vast financial expertise to deliver a blend of traditional and contemporary mortgage solutions. Pros Cons

BMO Harris Mortgage Review

Overall