With the average debt burden for indebted graduates surging over $37,718 in 2023, desperate students are exploring all their options when it comes to loan forgiveness and creative payment options.

The Pay As You Earn repayment plan, also known as PAYE, is one option that can help make your student loan payments more doable. It could also mean some of your loans could be forgiven after a certain time period.

Table of Contents

How PAYE Works

Like any other loan forgiveness program, PAYE has a myriad of benefits – and a few drawbacks. Let’s start with the positive.

Benefits of PAYE

For borrowers who qualify, PAYE caps monthly federal student loan payments at 10 percent of their discretionary income.

This detail alone sets PAYE apart from Income-Based Repayment (IBR), another repayment program that caps monthly loan payments at 15 percent of discretionary income.

Just like IBR, however, loans involved in the PAYE program will be forgiven in full by the federal government after 20 years.

Drawbacks of PAYE

The biggest drawback you’ll find with PAYE is that you’ll have to make student loan payments for 20 full years. No matter how you look at it, that’s a long time.

Further, the elongated timeline may mean you’re mostly paying interest on your loans for the duration of the pay period.

This may not matter to you since your loans will be forgiven after 20 years, but it’s something to consider nonetheless.

How to Decide If You Need PAYE

Here’s the big question everyone is asking: Will paying on your student loans for a full 20 years really benefit you?

The truth is, it depends. Here are a few considerations.

Income

For students who expect to earn a modest salary for the duration of their careers, PAYE and even IBR can transform crushing student loan payments into something a whole lot more tolerable.

The less money you make, the more beneficial an IBR plan or PAYE can be.

Take an honest look at your income. If your payments are a sizeable amount of the money you bring home, you may want to look at your income-driven repayment options.

Loan Amount

Further, students who wound up borrowing far more than they planned might find that PAYE or IBR are some of the best options they have if they hope to live a normal life.

An income-driven repayment plan is well worth your while if you’re struggling to keep up with a massive student loan bill each month and could save your credit score by making your payments more manageable.

Cosigning

One other thing to consider is whether or not you took out federal student loans without cosigner parents.

An Example

Let’s say Steven borrows $50,000 at 8 percent APR to pursue a Bachelor’s degree in Psychology and then earns close to the national annual mean wage as a Community Health worker- $38,180.

After taxes, Steven is left with $28,635 per year or $2,386.25 per month. On the standard ten-year timeline, his monthly payment would average $606.64, more than 25 percent of his take-home pay.

With PAYE, Steven’s payments would be limited to 10 percent of his discretionary income. Better yet, his entire balance would be forgiven after twenty years of timely payments. That goes even more for someone who had 100k in student loan debt.

How to Qualify for PAYE

A complex set of requirements obfuscates what it actually takes to qualify for any type of student loan forgiveness, especially PAYE. Here are some basic guidelines that can help you decide if you qualify:

Guidelines

- The monthly payment you would make under the PAYE or IBR plan (based on your income and family size) is less than what you would pay under the Standard Repayment Plan with a 10-year repayment period

- Your federal student loan debt is higher than your discretionary income or represents a significant portion of your annual income

- You’re a new borrower as of October 1, 2007, and you have received a disbursement of a Direct Loan on or after October 1, 2011

- You borrowed money in the form of federal student loans

Applicable Loans

Pay As You Earn is eligible for the vast majority of federal loans. In fact, the only types of federal loans not eligible for PAYE are Direct PLUS Loans made to parents and Direct Consolidation Loans that repaid PLUS Loans made to parents.

You can also apply PAYE to consolidated loans, as long as they weren’t turned over to a private lender.

Please note that only federal student loans can be repaid under the income-driven plans. Private student loans are not eligible for any type of loan forgiveness, and you may need to look at how to get a loan from a bank to refinance these private loans.

To qualify, your loan must also be in good standing and not in default.

Who Can Benefit From PAYE?

The following checklist can help you determine if PAYE is something you, yourself, should look into:

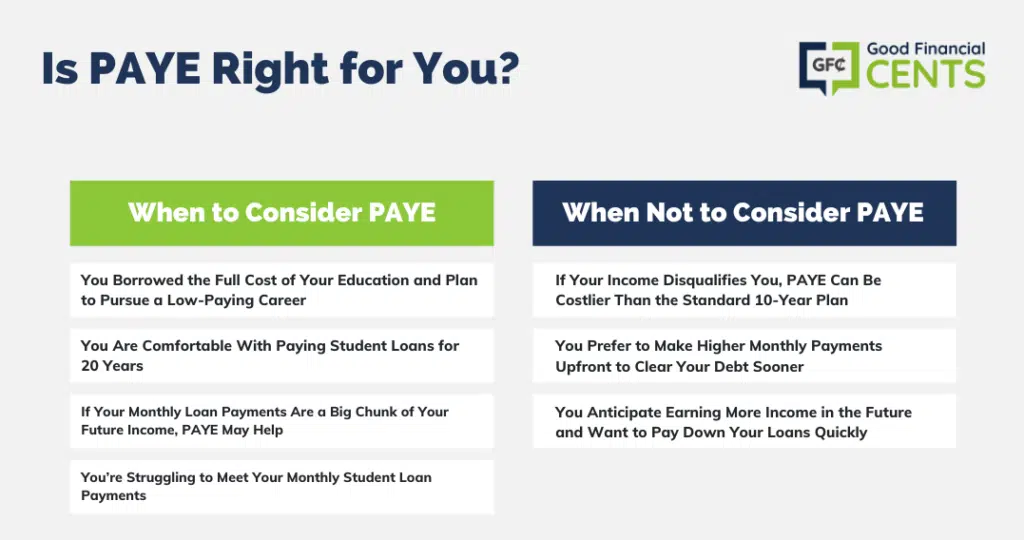

When to Consider PAYE

- You Borrowed the Full Amount: If you borrowed the full freight of the cost of your education and plan to pursue a low-paying career

- 20 Years Makes Sense: If you don’t mind paying monthly payments on your student loans for 20 years.

- Payments Are Too High: If your normal monthly payment (without using PAYE) represents a large portion of your future take-home pay

- You Need It to Stay Afloat: If you’re struggling to make student loan payments each month

When Not to Consider PAYE

- Your Monthly Income Disqualifies You: If the amount you would pay with PAYE is more than the standard ten-year repayment plan

- You Don’t Want to Pay Student Loans for 20 Years: If you would rather suffer up front to get out of debt sooner

- You Hope to Earn More Money in the Future: If you would rather pay down your loans as much as possible now and enjoy the benefits later.

The Bottom Line

While over 40 million Americans now deal with some level of student loan debt, the PAYE program – and other income-driven loan forgiveness programs – were created to ease the burden for individuals who meet certain income guidelines.

If you want to learn more about how you can qualify, compare your financial situation to the guidelines created by StudentAid.gov.

And if your income disqualifies you, you can also consider refinancing your federal and private student loans with a lender that offers better terms and a lower interest rate.

Student loans cannot be discharged in bankruptcy, but they can be forgiven if you opt for a government-sponsored loan forgiveness program and follow the prompts. It’s up to you to decide if it’s worth it.

The student loan debacle makes my blood boil. I’m not sure if I’m more pissed at the students who make uncalculated decisions on how much they’re borrowing or the lenders that seem to prey on people who don’t have much experience. Either way, it’s a mess! I know it’s up for debate, but why not work your way through college and pay as you go?