Do you have a passion for helping people with their money, but you just don’t know how to go about it?

Maybe you already have a career, and you’re not ready to do it full-time. Can you be a part-time money coach?

A listener to the GFC podcast who is interested in helping people with their money asked my opinion on whether it makes sense to pursue his passion.

I just love answering these types of questions from people who are determined to follow their passion to serve others.

Side note: Feel free to ask your question here.

“I’m currently in the software industry and looking to move into financial planning. I’ve started taking the CFP courses, and my thought is to start part-time as a financial coach, helping individuals and families get their finances in order and then eventually, hopefully, move into full-time financial planning.

I was wondering if you could offer any advice to me in regards to this. Do you think that this is a viable option? What was the most important thing that you did in building your own business? Thanks in advance for your help, Chris.“

Before I’ve finished this question, I mean, dude, Chris, let me say the fact that you’ve already purchased the CFP courses and you’re already going through them – that’s awesome!

That is a testament to your dedication to this. And that is something that I don’t want you to discount, especially if you really want to get into financial coaching (money coaching) and help people with their finances.

That says a lot about you. The fact that you’ve already committed the finances and the time.

Make sure that you mention that whenever you are talking with people who might end up becoming eventual clients of yours.

Table of Contents

- Can You Be a Part-Time Financial Coach?

- Financial Coach vs Financial Planner – What’s the Difference?

- Does a Financial Coach Need a Special Certification?

- How Do You Find Clients for Financial Coach Business?

- What Is Your Money Story?

- Who Are You Going to Help? – Identifying Your Niche

- People Buy Because of Benefits

- What Is Your Fee?

- What Was the Most Important Thing That I Did in Building My Own Business?

- Connecting With Other Financial Coaches

- Bottom Line – Part-Time Financial Coach

Can You Be a Part-Time Financial Coach?

First and foremost, do I think this is a viable option? Without a doubt – absolutely!

I don’t know what the time restrictions are with your job. Do you have time to do this on the side?

Obviously, I don’t know your family situation. Do you have young kids? Are you married? If this is something that you’re passionate about, it may require you to sacrifice some of that family time that you have been accustomed to.

Or maybe not because you are just super efficient at what you do. And you can pull this off where you’re not being pulled in too many directions. If that is the case, man, I give you props and encourage you to go for it!

Financial Coach vs Financial Planner – What’s the Difference?

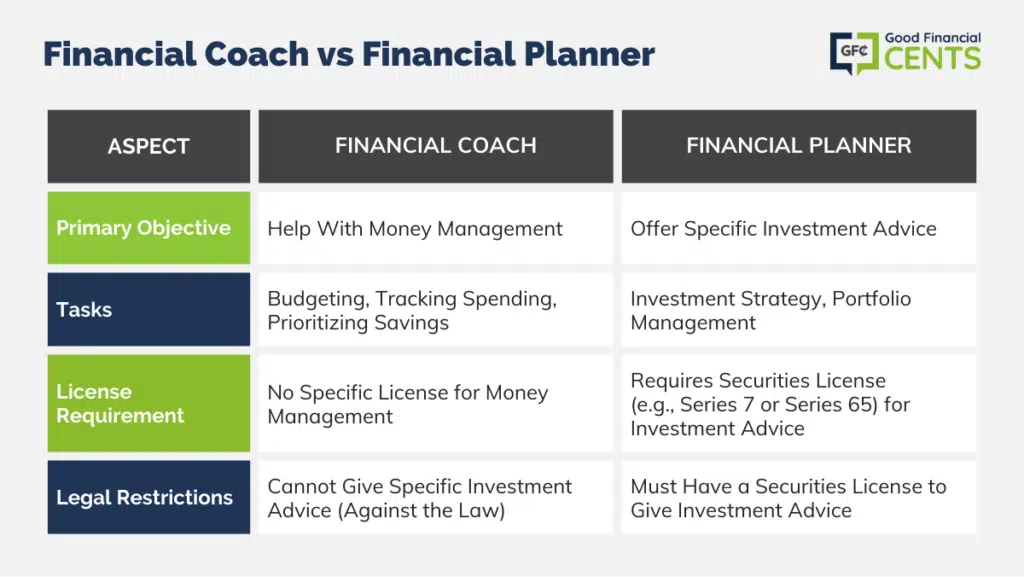

Before I dive in and answer your question with a little bit more detail, I think it’s important to discuss the difference between a financial coach, a financial planner, and a financial advisor.

There really isn’t a lot of difference. Both a financial coach and a financial advisor are going to help people with their finances, typically more like money management. That could be budgeting, tracking their spending, or prioritizing their savings.

In fact, they can’t because it is against the law. You have to have a securities license (like a Series 7 or Series 65) if you plan on giving specific investment advice.

That is the key because you don’t want to get into trouble. If you have an eventual goal of becoming a financial planner, and you’re already giving financial advice as far as specific investment advice, that could get you in hot water with the SEC or FINRA.

Does a Financial Coach Need a Special Certification?

It’s also important to note as a financial coach that there’s no specific requirement that you have a certification or a financial coaching degree. Now, that being said, there are financial coaching certifications you can obtain.

Okay, if I don’t have to have one, then why do they have them?

That is a great question. I’m just gonna say, I assume that’s because why not? Because if we can offer a financial coaching certification, people will pay for it. I think, in some cases, people want to look professional. They want to look like they are legit. If you don’t have any of these credentials to back you up, it may be harder to gain trust.

Here is just one of the certifications that you can get from the AFCPE (Accredited Financial Counseling and Planning Education):

The Accredited Financial Counselor gold standard includes:

- Comprehensive life cycle

- Financial education

- Provide the knowledge and skills to assist clients in complex financial decision-making

- An accredited financial counselor that can address your immediate money challenges

- Create a plan to achieve your unique goals and dreams

- Build a sustainable foundation for long-term financial well-being

These are all the services an accredited financial counselor can do for their clients.

But do you have to have this certification? You don’t. If you want to be a financial coach or money coach and have a passion for helping others to achieve that same type of success, you have the ability to be a money coach.

How Do You Find Clients for Financial Coach Business?

Now that you’ve established that you have a passion for helping people with their money, you’ll then have to figure out how to find people who are willing to pay you for your coaching services.

I think the first crucial item you need to do first is to identify your “money story”.

What Is Your Money Story?

If you are interested in becoming a financial coach like Chris, I think the thing that I would want to say at the very beginning is knowing exactly what your money story is.

What is the success that you’ve had with managing money? This is very important. It’s important as a marketing tool, but also it’s very important to earn the trust of the people that you are trying to help out.

You have to have a story that they can resonate with.

For me, I started off as a financial advisor. I already had my securities license whenever I was trying to find new clients. I shared my story time and time again because I was younger. I didn’t have any certifications other than my Series 7 and Series 66 securities licenses.

At the time, I was not a Certified Financial Planner, but I did have a finance degree. So, I had some of those “credentials” but didn’t have any certifications. I didn’t have an MBA and didn’t have any ‘alphabet soup’ at the end of my name on my business card.

For me, it really was about: what is my money story? It was important because the people who wanted to work with me wanted to be able to trust me and wanted to know, like, why am I doing this? Am I doing it because I’m trying to rip them off or try to sell them something?

Maybe I will make a big commission or fund my life goals and my financial goals (cars and houses). Or is this something that I am truly passionate about?

I don’t know if I did it intentionally, like did I think I needed to have a money story? I guess I realized the more that I started meeting new people, especially potential new client prospects, that question came up a lot.

They wanted to know what my money story was. They didn’t ask me like that. They usually asked what made me get into finance or become a financial planner.

Most of my story involved both my parents filing bankruptcy, my dad dying with a negative net worth, me making some of those same financial mistakes, and realizing who I didn’t want to become.

Then, I made a huge change in the way that I approached my finances by making savings, living within my means a priority, and just sharing that, and not in a sales-y way, just in a straightforward and honest way.

Lo and behold, I did not realize I would end up selling the practice and doing more on the online side, but I still have a passion for money and finance. That is why I record this Podcast, have the YouTube channel, and still keep up with this Good Financial Cents blog.

It is part of how I’m wired. I just love it, and that is why I do it. That is my money story.

If this is a way to brag about yourself, then so be it. Have it be a humble brag, ‘Oh man, I was $100,000 in debt, then I went on an extreme debt payoff plan where I sold all my stuff, and I was working two jobs, and I paid off all that debt in like two years.

That could be your money story. It doesn’t really matter what it is. It’s just a matter of knowing what you’re passionate about and building it.

People want to hear that excitement. They want to hear what you’re passionate about. They want to know that they can achieve whatever it is that you’ve achieved. That’s how you’re trying to find like-minded individuals that you can help coach through this process.

Once you get your money story established, the next thing that you want to know and be very clear on is what your specialty is.

Who Are You Going to Help? – Identifying Your Niche

In Chris’s case, he mentioned that he was in the software industry. He says he’s like a financial coach helping individuals and families get their finances in order and then eventually, hopefully, move into full-time financial planning. So, individuals, families, I think you want to be a little bit more specific or more niche.

What is your niche? Is it families, and let’s think about families, right, is that new families, maybe with young kids, maybe it’s families that have older kids that are getting ready to start college.

Or maybe it’s helping individuals who are trying to pay off student loans. It could be freelancers, it could be men, it could be women. If you try to figure out the type of community that you want to help. The more that you focus on a specialty and a niche, the easier it is for you to articulate. Also, for people to refer other people to you.

Chris, you’re in the software industry, so maybe you want to target software industry professionals. Maybe they struggle with budgeting, and that’s what you did, or maybe just with your upbringing with your family history, there might be something there.

Maybe you’re into running marathons, or you’re into fishing, or maybe you’re into music, you know, that could be another way to focus on like that type of subgroup. Eventually, you can broaden who you want to help.

My Niche

I initially started helping retirees, but then, because I had young children, I was friends with younger people, and they would gravitate towards me. Then, I started the blog and started doing more things online.

I had entrepreneur types that were that gravitated towards me, probably for the same reasons why you found me on social media and why you’ve been following me. You gravitated towards either my style, the content I was producing, or just the things that I shared about my personal experiences. Either way, there’s something that led you to continue to follow me.

I would encourage you to figure out what that is for you so that others will just naturally gravitate to your story and what you have to share.

- What is your specialty?

- What is your specific solution for them?

- What are you going to do for these people?

- Do you want them to have a clearly specified budget within 30-90 days or to have a specific debt payoff plan?

- What is your specific solution that you can offer?

People Buy Because of Benefits

They might hire you because they like you. But if people really don’t know you that well, and for the most part, the reason they’re going to pay you money is that there is something specific that they want to achieve.

For whatever reason, through your story or your specialty, you’ll be able to help them achieve that specifically. And that’s, that’s a big deal. So, what is your solution that you’ll be able to offer? Another thing to consider is what you are going to charge.

What Is Your Fee?

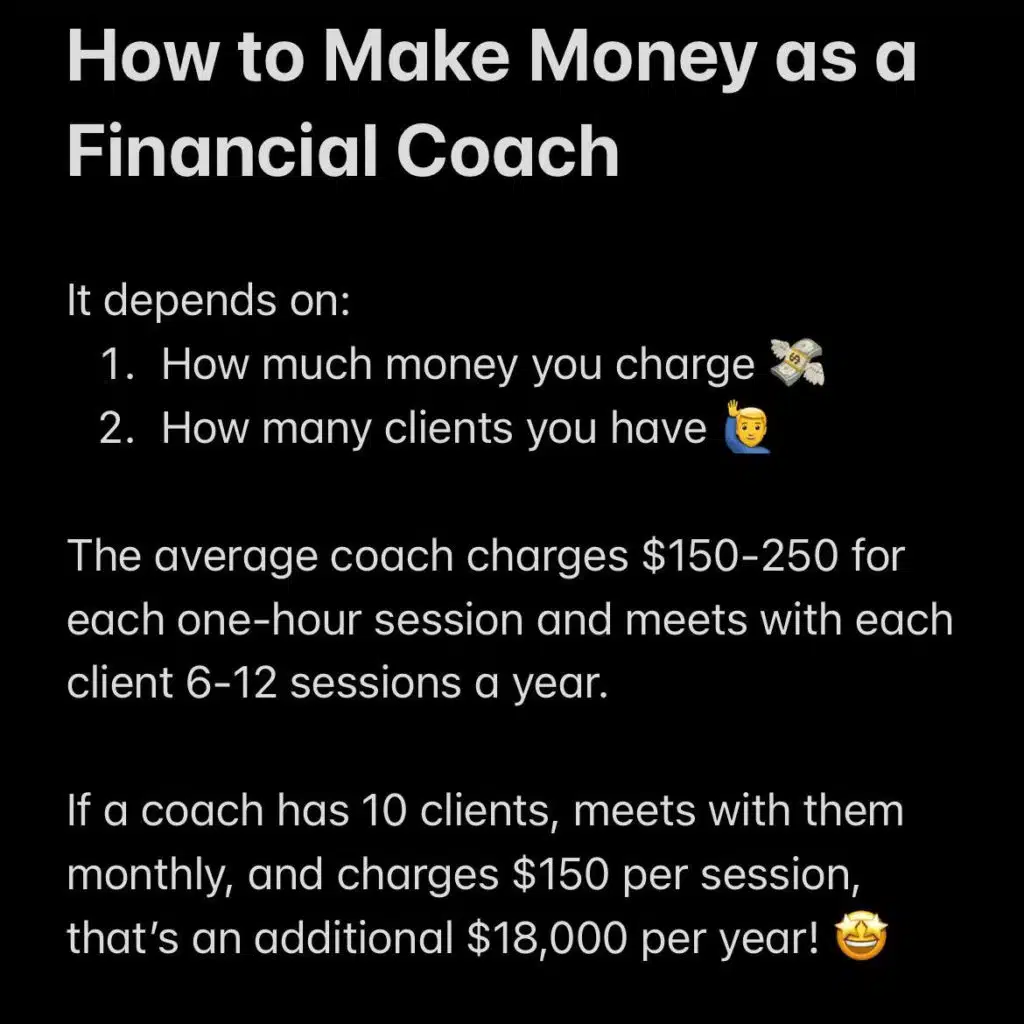

I can’t give a lot of good advice here because I never had to charge, I’ve done consulting. I know you could do the hourly thing, or you could do some sort of package. There are a variety of different ways that you can do this.

Having some knowledge and experience with the FinCon community, I know that there are quite a few Finn Connors that are also financial coaches.

There’s one I’ve never actually met, but I’ve seen her at fin con and fin con is the financial blogging conference. Her name is Whitney Hansen, and she is a financial coach.

She also offers different programs to become a financial coach. She offers a course on everything that you need to know to become a financial coach. This is something she’s been doing for 10 years.

You might be able to learn something from her story and apply that to yours as well. This way, you can understand the types of clients that you’re trying to find and also how much you want to charge.

Outline everything that you want to offer. There are so many different ways that you can slice and dice it. The key is that you definitely want to have your offers and charge you’re worth.

Don’t be afraid to ask people to pay for your time and for your expertise and your services.

You can also check out financial coach Kelsa Dickey from FinancialCoachAcademy.com. She shares her journey from going from part-time to full-time financial coaching so you get a good understanding of how challenging it can be.

What Was the Most Important Thing That I Did in Building My Own Business?

For me, I go a few different ways, but in growing the financial planning practice, one of the key things for me was trying to find as many people as I could tell my story to. Then, understanding their pain points with their money situation or investing?

What were the things that they were trying to do that they didn’t have a good understanding of where I could offer help?

Things like Roth IRs,A college savings plan 401(k)s, and the more that I was able to share, the more I was able to learn what other people were going through.

Finding anybody that was willing to meet me for lunch or for coffee, to tell my money story, also, connect with other professionals. Now, this may not apply so much in your situation. But for me, it was like I wanted to connect with other attorneys, CPAs, etc., and really connect with those types of professionals just so I could get to know them.

They could find out about me and what my beliefs were, and that just increased the likelihood that they would refer other people to me. That’s one thing that you could look into.

Connecting With Other Financial Coaches

You may find other money coaches in your area or financial coaches and see what their specialty is. You may decide that you want to focus on student loans, young families, or something else that you are passionate about. You may be able to nail this: “This is what I’m passionate about, this is what I do, and here’s the type of people I’m looking for.”

Now, they have a good understanding of the services that you offer and what you’re passionate about. If they have anybody that doesn’t fit their program or their services, they’ll be more apt to refer them to you. This is just another way to connect and meet people and find out what they’re doing, find out their money story, and just continue to make those connections.

There’s something for me, not so much a financial coach. His name is Damon Day. Whenever I got really big into this, helping people pay off debt, I had this thing called The Debt Movement. This was years ago. I had a lot of people reaching out to me who wanted help with paying off debt.

Some really insane amounts of debt. Some of them had looked into debt consolidation. This wasn’t the type of client that I was looking for. For me, it was looking for some people who are more interested in investing. So, I was able to connect with Damon Day, who is a money coach. I’m not sure actually what he calls himself, maybe a debt coach.

Basically, he really helped people who had a lot of debt. Maybe they tried some other debt-elimination schemes and just got burned. He wanted to help these people out, and I was able to refer several people his way.

But it made a ton of sense for him. And just because we made that connection, I was able to refer people to him. So don’t discount reaching out to people making these connections. You never know who you’re going to meet and how it may help you down the line.

Bottom Line – Part-Time Financial Coach

That’s what I have to say about becoming a part-time financial coach. Is it viable? If you truly want to grow this thing, why not also share a lot of your expertise on social media? Whether that be on Facebook, or if you’re good at doing TikToks, maybe a YouTube channel, maybe starting a podcast, something where you’re sharing your story, sharing your money story, and also just sharing what you’ve learned by talking with others about their finances. This is actually a good thing.

If you really want to do this and grow this thing. It’s a good way to build that base, especially as a financial coach, since you don’t have a securities license. So, you don’t have the compliance restrictions that licensed financial planners have.

You don’t have to worry about that right now. It’s something you have to deal with later on when you become a licensed financial planner.

Either way, Chris, I really appreciate the question. I hope some of this advice and some of my experience is helpful to you or anybody else who is interested in becoming a part-time financial coach.