Have you ever thought about doing a cash-out refinance on your home for investment?

A lot of people have.

I received exactly this question from a reader.

Reader Question

Hi Jeff,

Thanks for your videos and educational websites!

I know you are very busy and this may be a simple answer so thank you if you can take the time to answer!

Would you ever consider approving someone to take a cash-out refi on the equity in their house to invest?

I have been approved for a VA 100% LTV cash-out refi at 4% and would give me 100k to play with.

With average ROI on peer to peer, Betterment, Fundrise, and S&P 500 index funds being 6-8%, it seems like this type of leveraging would work.

However, this is my primary residence and there is an obvious risk. I could also use the 100k to help buy another property here in Las Vegas, using some of the 100k for a down and rent out the property.

BTW, I would be debt free other than the mortgage, have 50k available from a 401k loan if needed for an emergency, but with no savings.

I have been told this is crazy, but some articles on leveraging seem otherwise as mortgages at low rates are good at fighting inflation, so I guess I am not sure how crazy this really is.

I would greatly appreciate a response and maybe an article or video covering this topic as I am sure there are others out there who may have the same questions.

Table of Contents

My Thoughts

But rather than answering the question directly, I’m going to present the pros and cons of the strategy.

At the end, I’ll give my opinion.

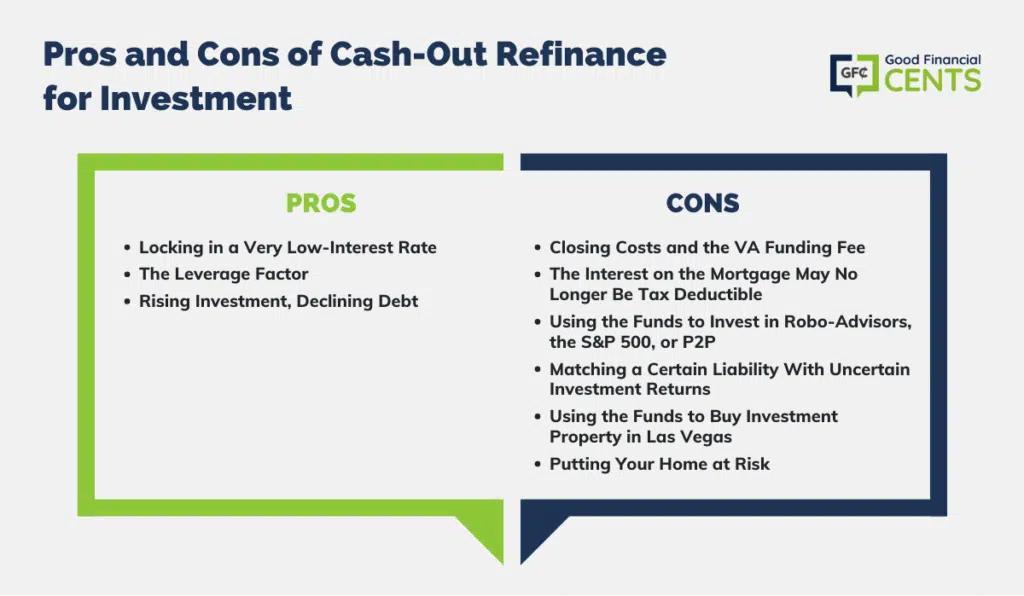

The Pros of a Cash-Out Refinance on Your Home For Investment Purposes

The reader reports he’s been told the idea is crazy.

But it’s not without a few definite advantages.

Locking in a Very Low-Interest Rate

The 4% interest rate is certainly attractive.

It will be very difficult for the reader to borrow money at such a low rate from virtually any other source. And with rate inching up, he may be locking into the best rates for a very long time.

Even better, a home mortgage is very stable debt. He can lock in both the rate and the monthly payment for the length of the loan – presumably 30 years.

A $100,000 loan at 4% would produce a payment of just $477 per month. That’s little more than a car payment. And it would give him access to $100,000 investment capital.

As long as he has both the income and job stability needed to carry the payment, the loan itself will be fairly low risk.

As long as he has both the income and job stability needed to carry the payment, the loan itself will be fairly low risk.

So far, so good!

The Leverage Factor

Let’s use an S&P 500 index fund as an example here.

The average annual rate of return on the index has been right around 10%.

Now that’s not the return year in, year out. But it is the average based on nearly 100 years.

If the reader can borrow $100,000 at 4%, and invest it at an average rate of return of 10%, he’ll have a net annual return of 6%.

(Actually, the spread is better than that, because as the loan amortizes, the interest being paid on it disappears.)

If the reader invests $100,000 in an S&P 500 index fund averaging 10% per year for the next 30 years, he’ll have $1,744,937. That gives the reader a better than 17 to 1 return on his borrowed investment.

If everything goes as planned, he’ll be a millionaire using the cash-out equity strategy.

That’s hard to argue against.

Rising Investment, Declining Debt

This adds an entire dimension to the strategy. Not only can the reader invest his way into millionaire status by doing a cash-out refinance for investment purposes, but at the end of 30 years, his mortgage is paid in full, and he’s once again in a debt-free home.

Not only does his investment grow to over $1 million, but over the 30 year term of the mortgage, the loan self-amortizes down to zero.

What could possibly go wrong?

That’s what we’re going to talk about next.

The Cons of a Cash-Out Refinance on Your Home

This is where the prospect of doing a cash-out refinance on your home for investment purposes gets interesting.

Or more to the point, where it gets downright risky.

There are several risk factors the strategy creates.

Closing Costs and the VA Funding Fee

One of the major disadvantages with taking a new first mortgage are the closing costs involved.

Whenever you do a refinance, you’ll typically pay anywhere from 2% to 4% of the loan amount in closing costs.

This will include:

- origination fees

- application fee

- attorney fee

- appraisal

- title search

- title insurance

- mortgage taxes

and about a dozen other expenses.

If the reader were to do a refinance for $100,000, he would only receive between $96,000 and $98,000 in cash.

Then there’s the VA Funding Fee.

This is a mortgage insurance premium charged on most VA loans at the time of closing. It’s usually added on top of the new loan amount.

The VA funding fee is between 2.15% to 3.30% of the new mortgage amount.

Were the reader to take a $100,000 mortgage, and the VA funding fee set at 2.5%, he’d owe $102,500.

Now… let’s combine the effects of both the closing costs in the VA funding fee. Let’s assume the closing costs are 3%.

The borrower will receive a net of $97,000 in cash. But he will owe $102,500. That is, he will pay $102,500 for the privilege of borrowing $97,000. That’s $5,500, which is nearly 5.7% of the cash proceeds!

Even if the reader gets a very low-interest rate on the new mortgage, he’s still paid a steep price for the loan.

From an investment standpoint, he’s starting out with a nearly 6% loss on his money!

I can’t recommend taking a guaranteed loss – upfront – for the purpose of pursuing uncertain returns.

It means you’re in a losing position from the very beginning.

The Interest on the Mortgage May No Longer be Tax Deductible

The Tax Cuts and Jobs Act was passed in December 2017, and applies to all activity from January 1, 2018, forward.

There are some changes in the tax law which were not favorable to real estate lending.

Under the previous tax law, a homeowner could deduct the interest paid on a mortgage of up to $1 million, if that money was used to build, acquire or renovate the home. They can also deduct interest on up to $100,000 of cash-out proceeds used for purposes unrelated to the home.

That could include paying off high interest credit card debts, paying for a child’s college education, investing, or even buying a new car.

But it looks like that’s changed under the new tax law.

Borrowing up $100,000 for purposes unrelated to your home, and deducting the interest looks to have been specifically eliminated by the new law.

It’s now widely assumed that cash-out equity on a new first mortgage is also no longer deductible.

Now the law is still brand-new and subject to both interpretation and even revision. But that’s where it stands right now.

There may be an even bigger obstacle that makes the cash-out interest deduction meaningless, anyway.

Under the new tax law, the standard deduction increases to $12,000 (from $6,350 under the previous law) for single taxpayers, and to $24,000 (up from $12,700 under the previous law) for married couples filing jointly.

(Don’t get too excited – personal exemptions are eliminated, and combined with the standard deduction to create a higher limit.)

The long and short of it is with the higher standard deduction levels, it’s much less likely mortgage interest will be deductible anyway. Especially on the loan amount as low as $100,000, and no more than $4,000 in interest paid.

Using the Funds to Invest in Robo-advisors, the S&P 500 or Peer-to-Peer Investments (P2P)

The reader is correct that these investments have been providing steady returns, well in excess of the 4% he’ll be paying on a cash-out refinance.

In theory at least, if he can borrow at 4%, and invest at say, 10%, it’s a no-brainer. He’ll be getting a 6% annual return for doing virtually nothing. It sounds absolutely perfect.

But as the saying goes, if it looks too good to be true, it probably is.

I often recommend all of these investments, but not when debt is used to acquire them.

That changes the whole game.

Whenever you’re thinking about investing, you always must consider the risks involved.

The last nine years have somewhat distorted the traditional view of risk.

For example, the stock market has been up nine years in a row, without so much as a correction of greater than 10%. It’s easy to see why people might think the returns are automatic.

But they’re not.

Yes, it may have been, for the past nine years. But if you look back further, that certainly hasn’t been the case.

The market has gone up and down, and while it’s true that you come out ahead as long as you hold out for the long term, the debt situation changes the picture.

Matching a Certain Liability With Uncertain Investment Returns

Since he’ll be investing in the market with 100% borrowed funds, any losses will be magnified.

Something on the order of a 50% crash in stock prices, like what happened during the Dot.com Bust and the Financial Meltdown, could see the reader lose $50,000 in a similar crash.

But he’ll still owe $100,000 on his home.

This is where human emotion comes into the picture. Since he’s playing with borrowed money, there’s a good chance he’ll panic-sell his investments after taking that kind of loss.

If he does, his loss becomes permanent – and so does his debt.

The same will be true if he invests with a robo-advisor, or in P2P loans.

Robo-advisor returns are every bit as tied to the stock market as an S&P 500 index fund is. And P2P loan investments are not risk-free.

In fact, since most P2P investing and lending has taken place only since the Financial Meltdown, it’s not certain how they’ll perform should a similar crisis take place.

None of this is nearly as much a problem with straight-up investing based on saved capital.

But if your investment capital is coming from debt – especially 100% – it can’t be ignored.

It doesn’t make sense to match a certain liability with uncertain investment gains.

Using the Funds to Buy Investment Property in Las Vegas

In a lot of ways, this looks like the most risky investment play offered by the reader.

On the surface, it sounds almost logical – the reader will be borrowing against real estate, to buy more real estate. That seems to make a lot of sense.

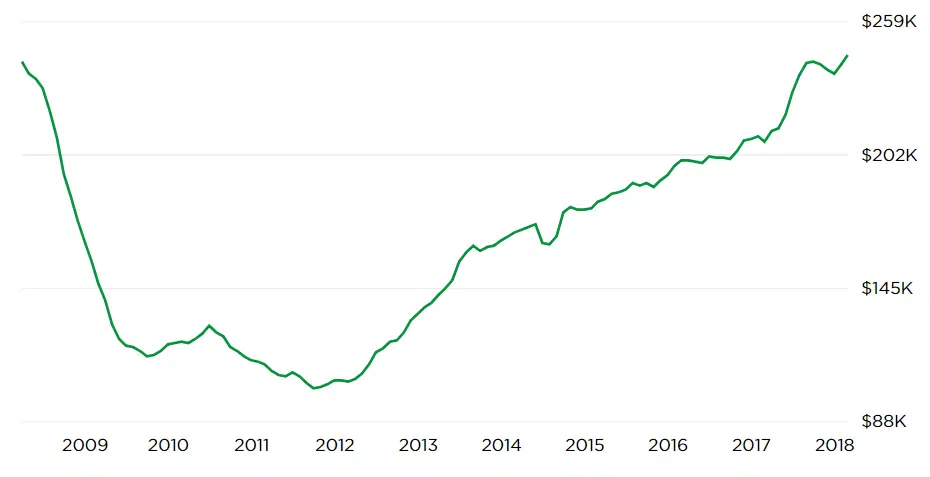

But if we dig a little deeper, the Las Vegas market in particular was one of the worst hit in the last recession.

Peak-to-trough, property values fell on the order of 50%, between 2008 in 2012. Las Vegas was often referred to as the “foreclosure capital of America”.

I’m not implying the Las Vegas market is doomed to see this outcome again.

But the chart below from Zillow.com shows a potentially scary development:

The upside down U formation of the chart shows that current property values have once again reached peak levels.

That brings the question – which we cannot answer – what’s different this time? If prices collapsed after the last peak, there’s no guarantee it can’t happen again.

Once again, I’m not predicting that outcome.

But if you’re planning to invest in the Las Vegas market with 100% debt, it can’t be ignored either. In the last market crash, property values didn’t just decline – a lot of properties became downright unsalable at any price.

The nightmare scenario here would be a repeat of the 2009-2012 downturn, with the reader losing 100% of his investment. At the same time, he’ll still have the 100% loan on his home. Which at that point, might be more than the house is worth, creating a double jeopardy trap.

Once again, the idea sounds good in theory, and certainly makes sense against the recent run-up in prices.

But the “doomsday scenario” has to be considered, especially when you’re investing with that much leverage.

Putting Your Home at Risk

While I generally recommend against using debt for investment purposes, I have an even bigger problem when the source of the debt is the family homestead.

Borrowing money for investment purposes is always risky.

But when your home is the collateral for the loan, the risk is double. You not only have the risk that the investments you’re making may go sour, but also that you’ll put your home at risk in a losing venture.

Let’s say he invests the full $100,000. But due to leverage, the net value of that investment has declined to $25,000 in five years. That’s bad enough. But he’ll still owe $100,000 on his home.

And since it’s a 100% loan, his home is 100% at risk. The investment strategy didn’t pan out, but he’s still stuck with the liability.

It’ll be a double whammy if the money is used for the purchase of an investment property in your home market.

For example, should the Las Vegas market take a hit similar to what it did during the Financial Meltdown, he’ll not only lose equity in the investment property, but also in his home.

He could end up in a situation where he has negative equity in both the investment property and his home. That’s not just a bad investment – that’s a certified nightmare!

It could even lead him into bankruptcy court, or foreclosures on two properties – the primary residence and the investment property. The reader’s credit would pretty much be toast for the next 10 years.

Right now, he has zero risk on his home.

But if he does the 100% cash out, he’ll convert that zero risk to 100% risk. Given that the house is needed as a place to live, this is not a risk worth taking.

Final Thoughts

Can you tell that I don’t have a warm, fuzzy feeling about the strategy? I think you figure it out by the greater emphasis on Cons than on Pros where I come down on this question.

I think it’s an excellent idea in theory, but there’s just too much that can go wrong with it.

There are three other factors that lead me to believe this is probably not a good idea:

1. The Lack of Other Savings

The reader reports that he has “…50k available from a 401k loan if needed for emergency, but with no savings.” For me, that’s an instant red flag. Kudos to him for having no other debt, but the absence of savings – other than what he can borrow against his 401(k) plan – is setting off alarm bells.

To take on this kind of high risk investment scheme without a source of ready cash, exaggerates all of the risks.

Sure, he may be able to take a loan against his 401(k), but that creates yet another liability.

That that will need to be repaid, and it will become a lien against his only remaining unencumbered asset (the 401k).

If he has to borrow money to stay liquid during a crisis, it’s just a question of time before the strategy collapses.

2. The Reader’s Risk Tolerance

We have no idea what the reader’s risk tolerance is.

That’s important, especially when you’re constructing a complex investment strategy.

While it might seem the very fact he’s contemplating this is an indication he has a high risk tolerance, we can’t be certain. He’s basing his projections on optimistic outcomes – that the investments he makes with the borrowed money will produce positive returns.

What we don’t know, and what I ask the reader to consider, is how he would handle a big reversal.

For example, if he goes ahead with the loan, invests the money, and finds himself down 20% or 30% within the first couple of years, will he be able to sleep at night? Or will he instead contemplate an early exit strategy, that will leave him in a permanent weakened financial state?

These are real risks that investors face in the real world. At times, you will lose money. And how you react to that outcome can determine the success or failure of the strategy.

This is definitely a high risk/high reward plan. Unless he has the risk tolerance to handle it, it’s best not to even start.

On the flip side, just because you have the risk tolerance, doesn’t guarantee success.

3. Buying at a Market Peak

I don’t know who said it, but when asked where the market would go, his response was “The market will go up. And the market will go down”.

That’s a fact, and one that every investor has to accept.

This isn’t about market timing strategies, but about recognizing reality.

Here’s The Problem:

Sooner or later, all markets reverse. These markets will too.

I’m worried that the reader might be borrowing money to leverage investing at what could turn out to be the absolute worst time.

Ironically, a borrow-to-invest strategy is a lot less risky after market crashes.

But at that point, everyone’s too scared, and no one wants to do it. It’s only at market peaks, when people believe there’s no risk in the investment markets, that they think seriously about things like 100% home loans for investments.

In the end, the reader’s strategy could be a very good idea, but with very bad timing.

Worst Case Scenario: The Reader Loses His Home in Foreclosure

This is the one that seals the deal against for me. Doing a cash out refinance on your home for investment is definitely a high-risk strategy.

Heads you’re a millionaire, tails you’re homeless.

That’s not just risk, it’s serious risk. We don’t know if the reader also has a family.

I couldn’t recommend anyone with a family putting themselves in that position, even if the payoff were that high.

Based on the facts supplied by the reader, we’re looking at 100+% leverage – the 100% loan on his house, then additional (401k) debt if he runs into cash flow problems. That’s the kind of debt that will either make you rich, or lead you to the poor house.

Given that the reader has a debt-free home, no non-housing debt, and we can guess at least $100,000 in his 401(k), he’s in a pretty solid situation right now. Taking a 100% loan against his house, and relying on a 401(k) loan for emergencies, could change that situation in no more than a year or two.

I’d recommend against the cash-out refinance.

What’s your opinion?

Jeff,

Thank you for the article. I have a slight twist on this possibility. My husband and I are both 50. We owe less than $340k on our home (with approximately 20yrs left on the mortgage with 5.25% rate) that has recently been appraised for $2M- 2.5M. Our taxes on the home are approximately $6K per year. Our household makes approximately $200K/yr and we would like to retire in 5 years or so.

My husband is of the opinion that we sell the house, invest the $2M and pay any new mortgage and retirement expenses out of the interest as necessary. The new house would cost somewhere in the $800K-1M range (secured by a new mortgage) and taxes would likely be triple or more than our current home. However, since the market historically pays approximately 10%, he believes it will still make more sense than staying in our current home and would give us stability in our retirement.

Although I am open to the above idea, I would prefer to stay in our current home and possibly do a cash-out for some home improvements (approximately $15K), and invest the rest since the 10% should out perform the mortgage interest. Should we opt for cash-out, the lender we have charges .5-1% in fees (no other fees such as appraisal, closing fees, etc).

My husband grew up very poor and is anxious about having enough to cover all of the bases and provide a pleasant retirement for the 2 of us. Which of these 2 ideas makes the most sense? Perhaps, there are other options we have not considered. Any advice is welcome.

Angela

Thanks for the sound advice. I was on the fence about doing a cash out refinance and this convinced to hold off and save up for a down payment on a second rental property instead.

Good idea Thomas. If you take equity from your home, you’ll be putting it at risk for the rental property. Let the rental property stand completely on it’s own.