Life insurance is a critical financial product that provides a safety net for individuals and their families in the event of an untimely death. It ensures that loved ones are not left with a financial burden and can maintain their standard of living.

However, the cost of life insurance, reflected in the premiums that policyholders pay, can vary significantly based on a variety of factors. In this article, we will delve into the reasons and causes of higher life insurance premiums, providing a comprehensive understanding of the elements that influence these costs.

Table of Contents

Age

One of the primary determinants of life insurance premiums is the age of the insured. Generally, the older an individual is, the higher the premiums will be. This is because as people age, they are statistically more likely to pass away, increasing the risk for the insurance company. Younger individuals are considered a lower risk, which results in lower premiums. Individuals should purchase life insurance at a younger age to lock in lower rates.

Health Status

An individual’s health plays a significant role in determining life insurance premiums. Insurance companies typically require medical exams or health questionnaires to assess the insured’s health status. Pre-existing conditions, chronic illnesses, or poor health can result in higher premiums as they increase the risk of mortality. On the other hand, individuals in good health are likely to receive lower premiums.

Gender

Statistically, women tend to live longer than men, which can result in lower life insurance premiums for females. The longer life expectancy reduces the likelihood of the insurance company having to pay out a death benefit in the near term, resulting in lower risk and, subsequently, lower premiums.

Smoking and Lifestyle Choices

Smoking is a major red flag for insurance companies as it is associated with numerous health risks and a shorter life expectancy. Smokers, therefore, face significantly higher life insurance premiums compared to non-smokers. Additionally, engaging in high-risk activities or having a hazardous occupation can also lead to higher premiums.

Policy Type and Coverage Amount

The type of life insurance policy and the amount of coverage selected play a crucial role in determining premiums. Whole life insurance policies, which offer lifelong coverage and a cash value component, typically have higher premiums than term life insurance policies, which provide coverage for a specified term. Additionally, the higher the coverage amount or death benefit, the higher the premiums will be.

Family Medical History

Insurance companies also take into consideration the medical history of an individual’s immediate family members. A history of hereditary conditions or diseases in the family can increase the risk of the insured developing similar issues, resulting in higher premiums.

Weight and BMI

Body Mass Index (BMI) is another factor that insurance companies consider when determining premiums. Individuals with a BMI in the overweight or obese range may face higher premiums due to the associated health risks, including heart disease, diabetes, and certain types of cancer.

Driving Record

A poor driving record with accidents, traffic violations, or DUI convictions can lead to higher life insurance premiums. Insurance companies view these individuals as high-risk, as they are more likely to be involved in a fatal accident.

Credit History

Some insurance companies consider an individual’s credit history when setting premiums. A poor credit history can be seen as a sign of financial instability, which may correlate with risky behavior, leading to higher premiums.

Payment Plan

The frequency of premium payments can also impact the total cost of life insurance. Opting for a monthly payment plan can result in higher total premiums compared to paying annually. This is because insurance companies often charge additional fees for the convenience of monthly payments.

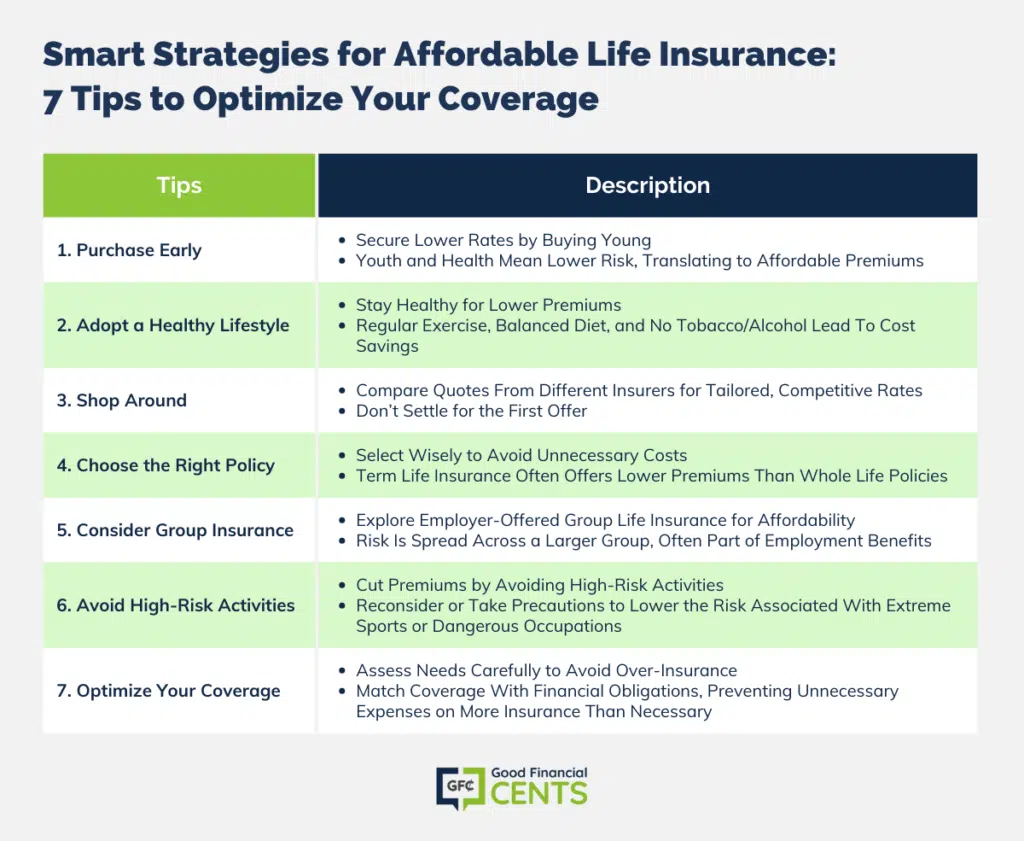

Tips on How to Avoid Higher Life Insurance Premiums

Purchase Early

Buying life insurance at a younger age can help lock in lower rates. The younger and healthier you are, the less of a risk you pose to the insurer, which translates to more affordable premiums.

Adopt a Healthy Lifestyle

Maintaining a healthy lifestyle can significantly impact your life insurance premiums. Regular exercise, a balanced diet, and avoiding tobacco and excessive alcohol can improve your health and lead to lower rates.

Shop Around

Don’t settle for the first quote you receive. Shopping around and comparing quotes from different insurance providers can help you find the most competitive rates tailored to your unique needs.

Choose the Right Policy Type

Understanding the different types of life insurance policies and choosing the one that best suits your needs can help avoid unnecessary costs. Term life insurance, for instance, generally offers lower premiums than whole life insurance.

Consider Group Life Insurance

Some employers offer group life insurance as a part of their benefits package. These policies can be more affordable than individual policies, as the risk is spread across a larger group of individuals.

Avoid High-Risk Activities

Engaging in high-risk activities such as extreme sports or having a dangerous occupation can lead to higher premiums. If possible, reconsidering such activities or taking additional safety precautions can help lower rates.

Optimize Your Coverage

Ensure that you’re not over-insured. Assess your coverage needs carefully, considering your financial obligations and the needs of your dependents, to avoid paying for more insurance than necessary.

Conclusion

Life insurance is a vital component of financial planning, providing peace of mind and security for individuals and their families. Understanding the factors that contribute to higher life insurance premiums enables consumers to make informed decisions and potentially lower their costs. By considering age, health status, lifestyle choices, and other factors mentioned above, individuals can work towards securing the most favorable life insurance rates possible.

Great article! I totally agree that insurance is not that expensive as it sounds and there are multiple plans to choose from depending on your need. I too used to believe that getting an insurance seems like a hassle and a complicated process but finding the right guidance can help you and make the process look like a breeze. Thankfully I found great service and consultancy at IFG Insurance services, where i was thoroughly briefed regarding all the choices I had and proposed a health insurance plan that worked just right for me. If you are living near Saint Petersburg, Florida or nearby areas, I would suggest you to visit their site!

Ryan is lying. He is an agent and IFG provides terrible coverage. Don’t listen to this guy