While most people are well aware you can earn cash back with rewards credit cards, few know banks offer yet another way to earn free cash. With bank bonuses, you can earn a few hundred bucks for opening a new account and meeting a few simple requirements.

Best of all, the money you earn is absolutely free – and with no strings attached. Since I love online bank accounts, it should be no surprise that a bonus offer from Chase recently caught my eye.

By signing up for a checking or savings account (or both), I could earn a few hundred dollars from Chase.

While I don’t have any Chase branches nearby, I still thought this was a stellar deal. I have most of the best Chase credit cards, after all, and I love to pay bills online. Since Chase is known for their user-friendly online interface and excellent bill-pay feature, I knew I would be in good shape.

Fortunately, the same Chase banking bonuses I could take advantage of are now available to everyone. Keep reading to figure out how you can sign up.

Table of Contents

Chase Signup Bonuses for Checking and Savings Accounts

There are three different promotions currently, each of which comes with its own bonus and stipulations. Read how to sign up for Chase Premier Plus CheckingSM, Chase Total Checking®, or Chase SavingsSM and earn a huge bonus below.

Chase Premier Plus CheckingSM

- Enjoy $300 as a new Chase checking customer when you open a Chase Premier Plus CheckingSM account and set up direct deposit.

- Get $300, more benefits, and earn interest on your new Chase checking account.

- The $25 Monthly Service Fee is waived when you keep an average beginning day balance of $15,000 or more in any combination of this account and linked qualifying Chase checking savings, and other balances.

- There is no Chase fee on the first four non-Chase ATM transactions per statement period.

- Earn interest on your checking account balance.

- Access to over 16,000 Chase ATMs and 5,100 branches.

- Apply online in minutes. Open your account online now.

Updated Ongoing APY: 0.01% effective as of 10/17/23. Interest rates are variable and subject to change.

Updated ATM Surcharge: $5 per withdrawal and $2.50 for any transfers or inquiries at ATMs outside the U.S., Puerto Rico, and the U.S. Virgin Islands. Fees from the ATM owner still apply

Chase Total Checking®

- Enjoy a $200 bonus when you open a new Chase Total Checking® account and set up direct deposit.

- Access to over 16,000 Chase ATMs and 5,100 branches.

- Mobile check deposit – It’s as easy as taking a selfie.

- Chase QuickPay® with Zelle® – Take the drama out of splitting a check.

- Real-time fraud monitoring – We watch your debit card to help your money stay your money.

- Apply online in minutes.

- Open your account online now.

Updated Ongoing APY: 0.01% effective as of 10/17/23. Interest rates are variable and subject to change.

Updated ATM Surcharge: $5 per withdrawal and $2.50 for any transfers or inquiries at ATMs outside the U.S., Puerto Rico, and the U.S. Virgin Islands. Fees from the ATM owner still apply.

Chase SavingsSM

- Enjoy a $150 bonus when you open a new Chase Savings(SM) account, deposit a total of $10,000 or more in new money within 20 business days, and maintain a $10,000 balance for 90 days.

- Access to over 16,000 Chase ATMs and 5,100 branches.

- Link this account to your Chase checking account for Overdraft Protection.

- Chase QuickPay® with Zelle® – Take the drama out of splitting a check.

- Real-time fraud monitoring – We watch your debit card to help your money stay your money.

- Apply online in minutes. Open your account online now.

Updated Ongoing APY: 0.01% effective as of 10/17/23. Interest rates are variable and subject to change.

Updated Surcharge: $5 per withdrawal and $2.50 for any transfers or inquiries at ATMs outside the U.S., Puerto Rico, and the U.S. Virgin Islands. Fees from the ATM owner still apply.

Chase Total Checking® + Chase SavingsSM

Updated Marketing Bullets:

- Enjoy up to $350 when you open a new Chase Total Checking® account with Direct Deposit and/or open a new Chase Savings(SM) account, deposit $10,000 or more in new money, and maintain a $10,000 balance for 90 days.

- Enjoy a $200 bonus when you open a new Chase Total Checking® account and set up direct deposit.

- Enjoy a $150 bonus when you open a new Chase Savings(SM) account, deposit a total of $10,000 or more in new money within 20 days, and maintain a $10,000 balance for 90 days.

- Access to over 16,000 Chase ATMs and 5,100 branches.

- Chase QuickPay® with Zelle® – Take the drama out of splitting a check.

- Real-time fraud monitoring – We watch your debit card to help your money stay your money.

- Apply online in minutes. Open your account online now.

Updated Ongoing APY: 0.01% effective as of 10/17/23. Interest rates are variable and subject to change.

Chase Signup Bonuses for Checking and Savings Accounts

| TYPE | DESCRIPTION |

|---|---|

| Premier Plus CheckingSM | New Customers Earn $300 With Direct Deposit and Enjoy Various Benefits |

| Total Checking® | New Customers Get a $200 Bonus With Direct Deposit and Added Conveniences |

| SavingsSM | Earn a $150 Bonus by Depositing $10,000 Within 20 Days and Maintaining Balance |

| Total Checking® + SavingsSM | Combined Accounts Offer Up to $350 Bonus Along With Various Benefits |

What You Need to Know About Chase Banking Bonuses

If you aren’t a Chase customer already, these bonuses might be enough to jolt you into changing that pretty fast.

With several hundred dollars of free cash on the table, each of these offers is enticing on its own. Still, it’s important to know how these offers work inside and out – and how to maximize them.

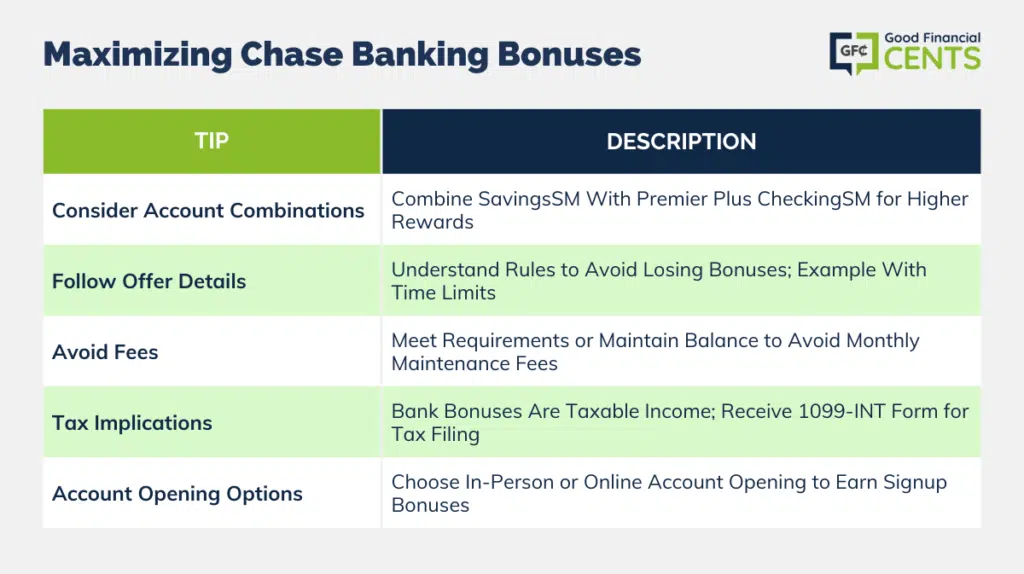

Here are some tips that can help:

Combine Offers for Even More Free Cash!

While Chase banking offers are usually only good for new customers, that doesn’t mean customers can’t earn more than one bonus. By opening both a Chase Total Checking® and Chase SavingsSM account, for example, you can earn $250 in bank bonuses with just one trip to your local branch.

You could also combine Chase SavingsSM with Chase Premier Plus CheckingSM to earn even more. Before you do, however, you should make sure you’re able to meet all requirements at the same time.

Know Your Offer Details, and Follow Through

Whenever you open a new checking or savings account in order to earn a signup bonus, there are certain rules you must follow. If you don’t, you risk losing out on your bank bonus altogether – or having it clawed back somewhere down the line.

Here’s a Good Example:

If you don’t read the fine print of your offer, little details like this can cost you.

Find Out How to Avoid Fees

As you start reading the fine print on these offers, you’ll probably notice that each account comes with monthly maintenance fees. The good news is you can avoid these fees by meeting certain requirements or keeping a minimum amount of money on deposit.

This is yet another reason it’s crucial to read the fine print!

With Chase Total Checking®, for example, your balance will incur a $12 monthly maintenance fee unless you do one of two things – have monthly direct deposits totaling $500 or more or maintain an average daily balance of at least $5,000 across all of your Chase accounts.

You’ll Need to Pay Taxes on Your Bonus

While you don’t need to pay taxes on credit card signup bonuses, bank bonuses are considered taxable income. As a result, Chase will issue you a 1099-INT tax form come tax time. Once you receive this form, you’ll use it to claim your bank bonus as taxable income.

Open Your New Chase Account in Person or Online

Chase previously only had the option to open an account in person, but you now have the availability to do it directly online, as well. If you want to earn a signup bonus, simply visit a local branch in person to get your account set up or begin online in minutes.

If you don’t have one in your hometown, your only option may be the online version. But, heck, for $250 in bonuses, it might be worth driving up to an hour away if you wanted to speak to someone in person first.

Why Everyone Should Sign Up for Chase Banking

Sign-up bonuses aside, Chase offers a slew of perks for people who need top-notch banking and all of the “extras.” There is a reason Chase has such an awesome reputation within the banking world. The reason? They’re absolutely awesome!

Here are a few reasons why anyone could benefit from these accounts, signup bonus or not:

Chase Has World-Class Customer Service

If you have ever called a bank with an issue before, you know how troublesome and stressful it can be. But with Chase banking and all Chase products, really, the opposite is true. When you call Chase, you’re connected with a professional banker who can actually help with your issue.

You’re almost never routed to another country, either; with Chase, you’ll almost always get help from someone within your local area or just a few states away. And since Chase customer service is open 24/7, you’ll never have to wait to talk to someone.

Chase Bill-Pay Cannot Be Beaten

If you’re looking for a way to keep track of your bills online, look no further than Chase bill-pay.

With your Chase checking and savings accounts connected to your account, you can monitor your bills, keep track of when you paid, and monitor your monthly spending. If you have Chase credit cards, you can pay them online with a direct transfer from your Chase checking or savings account as well.

Plus, you can log into your Chase account to see how much you have spent on credit at any time.

Chase Bank Deposits Are Easy

Whether you live near a Chase branch or not, you may not have time to visit your bank as much as you’d like.

Fortunately, Chase offers Chase QuickDepositSM. With this feature, you can deposit a check by taking a picture of it with your mobile device and downloading it with their app.

Your deposit will process the same as if you had visited the bank yourself, and you can usually access your money the next day.

Chase Branches Are Everywhere

If you are someone who would rather visit a physical bank branch at least part of the time, Chase may be perfect for you, depending on where you live.

With more than 5,300 brick-and-mortar branches nationwide, it’s easy to find one nearby if you live in a region of the country where Chase operates As an added bonus, you’ll have access to more than 15,000 ATMs if you need to access cash quickly.

Chase Has Awesome Account Alerts & Notifications

If your goal is staying on top of your spending habits, Chase account alerts and notifications can help. With these features, you can sign up to receive a notification if your bank balance drops below a certain amount or if your account is overdrawn.

You can also set it up so you’re notified if a large transaction comes through your account. Better yet, you set all of the parameters for these notifications so they are tailored to your specific preferences.

The Bottom Line

If you want to earn some extra money this year, why not give Chase banking bonuses a try? By opening a few new accounts and keeping money on deposit or setting up direct deposit, you can earn several hundred dollars in cold, hard cash.

Other than the fact that some banks offer higher interest rates, there is really no downside to pursuing these offers.

And if you want to earn more money over the long term, you can always switch to an online bank that offers better interest rates down the line. In the meantime, though, these huge bank bonuses are more than worth it. Related:

Have you ever earned a bank bonus before? Why or why not?