Whether a mom is working or not, it doesn’t take away the fact that they need to have life insurance.

I’m amazed when I talk to married couples where the husband has ample life insurance coverage on him, but they have nothing on the wife. They don’t take into consideration the dramatic financial impact if something were to happen to her, and this isn’t just for working moms too.

Life insurance coverage is one of the best ways of ensuring that loved ones can replace income, pay off debts, and come up with the funds that are needed for costly final expenses – without further disrupting their lives.

Table of Contents

Do Stay-At-Home Moms Need Life Insurance Coverage?

While many insurance agents and financial planners tend to focus on the breadwinner of the family when offering life insurance protection, they often tend to forget just how costly it would be to replace a stay-at-home mom.

A stay-at-home mom is an extremely valuable part of a family – and, in many ways, is the center of the home. She takes care of the entire family by cooking, cleaning, running errands, taking the children to and from school, and taking care of the kids when they are sick.

So, what would happen if a stay-at-home mom were no longer there? With all that a stay-at-home mom does for her family, it would cost a great deal to hire somebody to come in and replace each and every one of the duties that she does.

Life Insurance for Working Moms

Moms who are working will also need to be covered with life insurance protection. There can be many different reasons for this. In addition to the many duties that will need to be replaced, there is also likely income that will need to be replaced as well.

In many cases, families that have two income earners are counting on both spouses’ incomes to ensure that the monthly living expenses can be met. Should one of those incomes suddenly disappear, it may require a drastic reduction in lifestyle for the rest of the family.

If, however, a good solid life insurance policy is in place, this can help to replace the income that was lost, allowing the survivors to maintain their current lifestyle. This can be helpful in an already difficult time in their lives.

When discussing working moms, it is also important to add business owner moms into this area. Today, there are numerous women who are starting businesses of their own. In doing so, not only are they creating jobs and bringing in income, but they may also be taking on debt in the process of getting their companies off the ground.

For any mom who is also a business owner, having life insurance coverage is essential. This important protection could step in to pay off debt balances and keep income flowing for loved ones and survivors.

It could also help in the business area, as well. For example, having life insurance coverage on the business owner’s mom’s life could allow the business enough liquidity to keep it afloat while a replacement is being sought.

Alternatively, the proceeds from the life insurance policy may also be used to keep the company going while a suitable buyer is found. In this case, some or all of the policy proceeds could be provided to the business owner’s mom’s survivors as a portion of the business sale price.

Policies for Single Moms

Single moms should also consider the purchase of life insurance coverage. While nobody likes to think about what would happen if they were no longer here, the truth is that accidents and illness can and do happen – and it is always best to have your survivors be prepared.

Leaving children without a mother is extremely difficult to think about. However, leaving children in financial hardship would be even worse. In the case of single moms, the financial protection that is provided through life insurance could be the sole financial support for your child’s (or children’s) present and future needs.

Types of Life Insurance Available

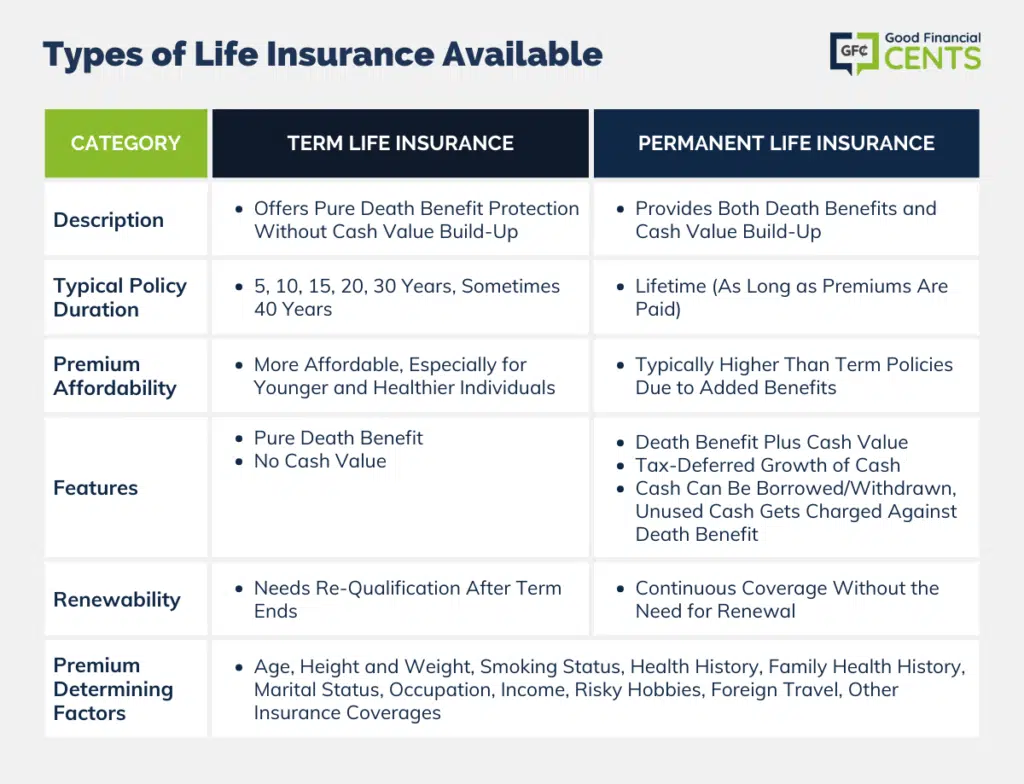

There are many different types of life insurance that are available in the marketplace today that could be considered for moms who are in need of coverage. Certainly, for those who are seeking purely cheap life insurance, term coverage will typically be the way to go. This is because term life offers just pure death benefit protection without any cash value or savings build-up.

Term policies have often been referred to as the most basic type of life insurance on the market. Because of this, these policies are typically the most affordable in terms of premium – especially if the insured is young and in good health at the time of application. This can be a great way to obtain a large amount of death benefit for a low premium price.

If, however, the policy expires after its period has elapsed, and the insured still requires life insurance coverage, it will be necessary to re-qualify for coverage at the person’s then-current age and health condition. Because the insured will be older at that time, it is likely that the premium on the new life insurance coverage will be quite a bit higher.

A mom may alternatively choose to go with a permanent life insurance policy. Although the premiums on these types of policies are not as cheap as the term, they have somewhat more to offer in that they provide both death benefits as well as cash value build-up. Here, the cash within the policy is allowed to grow on a tax-deferred basis. This means that the cash inside the policy is allowed to grow without being taxed until the time it is withdrawn.

If the policyholder keeps the cash inside of the policy for a long period, the cash could essentially grow and compound a great deal.

The cash value that is in a permanent life insurance policy may be borrowed or withdrawn by the policyholder for any need that they see fit. And the cash does not need to be repaid. However, it is important to note that any balance that is not repaid will be charged against the death benefit that is paid out to the policy’s beneficiary at the time of the insured’s death.

The cost of either of these types of policies will depend on a number of different factors. Some of the premium-related criteria will typically include the following:

- Age

- Height and Weight

- Smoking Status

- Overall Health History

- Family Health History

- Marital Status

- Occupation and Income

The life insurance underwriters will also review whether the applicant participates in any risky or dangerous hobbies, such as skydiving or scuba diving. Likewise, they will also inquire about any regular foreign travel that is participated in, if applicable.

Another question that is typically asked by life insurance underwriters is whether or not any other life insurance is already in place – and if there is, what is the total face amount of the coverage?

How Much Life Insurance Do Moms Need?

Once it is determined that a mom needs life insurance, it is important also to decide how much coverage will be needed. There are many different “rules of thumb” for figuring out the ideal amount of coverage.

There are also other criteria to factor in, such as final expenses. Today, the average cost of a funeral can exceed $10,000 in most areas of the country. When adding together the price of a burial plot, casket, transportation, flowers, the memorial service itself, and other related expenses – it can truly add up. These are funds that will typically be required very quickly – so a life insurance policy is one of the best ways of obtaining them.

Without life insurance, many families must pay final expenses by dipping into savings, selling off other assets, or using high-interest credit. Unfortunately, this can put many people into deeper financial hardship.

In the case of a stay-at-home mom, additional factors must also be added to the life insurance coverage figure. For example, it should be determined how much it would cost to replace somebody for doing the following duties:

- Cooking

- Cleaning

- Childcare

- Carpool

- Shopping

These costs must also be multiplied by the number of years in which they will be performed. In deciding the time frame for the coverage, you will be able to get a good idea of whether the coverage would be better served through a term or a permanent life insurance policy.

It is easy to see how the amount of life insurance for moms can actually come out to be a high figure – which can show just how much more moms do that is so very valuable to us – and difficult to replace.

Although it may be difficult to discuss replacing all the things that a loving mother can provide, not having a plan can essentially be much more dangerous when it comes to the future of your children.

Having a good solid financial plan in place with life insurance coverage can help to ensure that duties will still go on and that even though difficult emotionally, a drastic financial change in lifestyle will not have to take place.

Tips for Getting the Cheapest Rates

If you know you need coverage, here are some tips on getting cheap life insurance for moms.

1. They Already Have an Advantage

Females having a longer life expectancy will already get cheaper rates. I demonstrated this in another blog post that compared the difference in life insurance prices for males versus females. So getting cheap life insurance for your mom isn’t going to be all that hard because it’s already going to be cheaper than dad anyway.

2. Don’t Procrastinate

Even though life insurance is cheaper for women than men, it still goes up over time. So, by putting it off, you run the risk of either age or health conditions affecting how much your insurance premium is going to be. If you want to keep the life insurance cheap, do not get passed; get coverage now.

3. Do It Before You Have Kids

As mentioned above, it makes sense to get life insurance coverage when you’re young, but most people don’t think about it until after they have children. Some moms will want to apply for life insurance while they’re pregnant. While typically, pregnancy does not affect your getting life insurance coverage, it’s more advisable to apply in the first trimester. Complications can arise during pregnancy, preeclampsia, hypertension, and excessive weight gain that could either jack up your insurance rates or prevent you from getting approved.

If you have suffered from any of those conditions during pregnancy, then take some time to get back to your pre-pregnancy condition. That’s why it’s more advisable to apply for life insurance before pregnancy even becomes an issue.

As you can see, it is possible for moms to get cheap life insurance. It’s all about working with an independent life insurance agent that will guide you through the process.

How and Where to Find Cheap Life Insurance Policies

If you’re looking for life insurance policies for moms, the best place to start is with a company or an agency that has access to more than just one life insurance carrier. By doing so, you will be able to directly compare several different insurers, policies, benefits, and premium quotes in order to determine which one will be the very best for your specific needs, coverage goals, and situation.

When you are ready to begin searching for the right policy, we can help. We work with many of the top life insurance companies in the industry today – and we can help you obtain all of the important information that you need to make a well-informed purchase decision. When you’re ready to begin the process, all you have to do is fill out the form on this page and submit it.

We understand that buying life insurance can, at times, seem somewhat overwhelming. There are many details to keep track of – and you want to be sure that you are purchasing the right type and amount of coverage. Our trained experts will help you to ensure that you are going in the right direction for what is best for you. So, contact us today – we’re here to help.