Churchill Mortgage was founded on March 1, 1992, in Brentwood, Tennessee. It is currently a privately owned company with over 400 employees. As its name suggests, Churchill Mortgage Corporation provides services in the mortgage business alone.

Table of Contents

- Churchill Bank Mortgage Facts

- History of Churchill Bank

- Churchill Bank Loan Specifics

- Churchill Bank Mortgage Customer Experience

- Churchill Bank Lender Reputation

- Churchill Bank Mortgage Qualifications

- Churchill Bank Phone Number & Additional Details

- The Bottom Line – Churchill Bank Mortgage Rates Review

Churchill Bank Mortgage Facts

- A privately owned mortgage company that was founded in 1992

- Provides service to customers in 36 U.S. states and the District of Columbia

- Offers its customers a variety of mortgage products, including conventional, FHA, VA, and USDA loans.

- Allows its customers to pre-qualify for a mortgage using their online application

- Has plenty of helpful online resources, including various calculators to assist with the mortgage and home-buying process

- Advertises a debt-free homeownership strategy with low monthly costs and useful options for people who cannot put 20 percent down on their home

History of Churchill Bank

Since its founding only 26 years ago, Churchill Mortgage Corporation has created quite an impact on the mortgage industry, offering its services in 36 U.S. states and the District of Columbia.

They provide plenty of mortgage options, such as conventional, FHA, VA, and USDA home loans.

Churchill Mortgage Corporation has won a decent amount of awards for a lender that hasn’t been around for a long time.

They most notably won a “Best in Business” award, as well as various corporate awards for executives at Churchill Mortgage.

Its customer reviews are typically positive, but they vary from site to site.

For some people, they can be the best mortgage lending option, but other customers will need to keep searching.

In 2023, Churchill Bank continues to thrive as a cornerstone of the Eugene-Springfield community. The bank has expanded its reach to include six branches across the region, offering a comprehensive range of financial products and services to meet the diverse needs of its customers.

Churchill Bank Loan Specifics

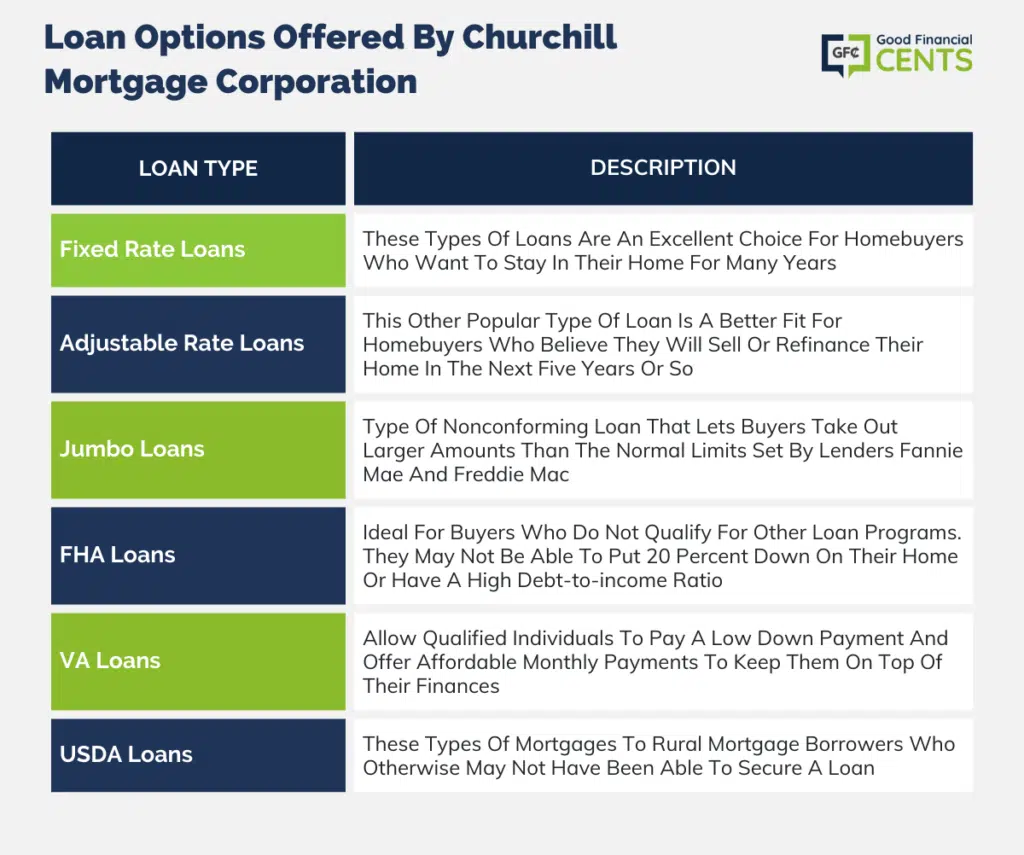

Churchill Mortgage Corporation offers home loans to a variety of customers.

They support homebuyers who can afford to put 20 percent down on their home with conventional loans, and they provide solutions to buyers who cannot afford to put this much down with government-backed programs.

Fixed Rate Loans

These types of loans are an excellent choice for homebuyers who want to stay in their home for many years. They come with predictable monthly rates, which do not change over the loan’s term. This is desirable for buyers who want to be able to budget their finances ahead of schedule.

Adjustable Rate Loans

This other popular type of loan is a better fit for homebuyers who believe they will sell or refinance their home in the next five years or so. ARMs start with a fixed rate for a specific number of years. After this time, the rates will fluctuate based on market trends.

Jumbo Loans

A jumbo loan is a type of nonconforming loan that lets buyers take out larger amounts than the normal limits set by lenders Fannie Mae and Freddie Mac. According to the Federal Housing Finance Agency, the minimum jumbo loan amount is currently set at $766,550.

Churchill Bank offers jumbo mortgages for homebuyers who want to buy more expensive properties but do not have the funds to pay a substantial down payment.

FHA Loan

FHA loans are ideal for buyers who do not qualify for other loan programs. They may not be able to put 20 percent down on their home or have a high debt-to-income ratio.

The Federal Housing Administration created these types of loans to allow these individuals the opportunity to buy a property with small down payments.

VA Loans

Veterans, military members, and their spouses may qualify for VA loans with Churchill Mortgage. These types of mortgages allow qualified individuals to pay a low down payment and offer affordable monthly payments to keep them on top of their finances.

USDA Loans

Churchill Mortgage offers these types of mortgages to rural mortgage borrowers who otherwise may not have been able to secure a loan. The Rural Housing Service manages and qualifies individuals for these loans, allowing for a flexible credit score and debt-to-income ratio.

Churchill Bank Mortgage Customer Experience

Churchill Bank gives customers the ability to pre-qualify online for a mortgage with its intuitive online application form. This is a good choice for customers who would rather fill out a sheet than spend time on the phone.

Once your application has been processed, your mortgage processor will request your credit score, title report, and documents verifying your assets and employment history.

Churchill Mortgage Corporation offers other helpful resources for its current and prospective borrowers.

They have an online mortgage calculator that can help you figure out how much house you can afford, how much you will pay in monthly costs for your mortgage, and how much you could save by paying off your loans on a bi-weekly schedule.

Churchill Bank has not appeared in the Consumer Financial Protection Bureau’s (CFPB) Monthly Complaint Report, indicating that it has not received a significant number of consumer complaints.

This absence of complaints suggests that the bank generally maintains positive customer relationships and addresses any concerns promptly and effectively.

Churchill Bank Lender Reputation

Churchill Mortgage is a corporation that has been serving 36 states and the District of Columbia for over 25 years.

The National Mortgage Licensing System number for this company varies based on the different branches. To find out the NMLS to a location near you, check out Churchill’s licensing information.

Customer reviews for this lender vary immensely. LendingTree reviewers give Churchill Mortgage five out of five stars.

The BBB does not currently accredit Churchill Mortgage Corporation, but it has an A+ rating on their Brentwood, TN location. There is only one BBB customer review, at one star, and only three customer complaints.

Since it is a relatively new mortgage company, Churchill Mortgage has not won a ton of awards. However, in 2013, Nashville Business News named it a “Best in Business” winner to recognize the company’s dedication to the city of Nashville.

Churchill Mortgage Corporation seems to be free of any recent scandals, but its name is close to another bank that fell to bankruptcy.

The Churchill Mortgage Investment Group in New York’s Rockland County took investments from hundreds of people before going into debt in 1997 and closing for good.

Churchill Bank Mortgage Qualifications

Churchill Mortgage Corporation has the same mortgage qualifications as other lenders in the U.S. They state that their minimum credit score requirement is 620.

Individuals should see lower costs the higher their credit score is. Buyers with a credit score of about 760 can expect the best mortgage rates.

| Credit Score | Quality | Ease of Approval |

|---|---|---|

| 760+ | Excellent | Easy |

| 700-759 | Good | Somewhat easy |

| 621-699 | Fair | Moderate |

| 620 and below | Poor | Somewhat difficult |

| n/a | No credit score | Difficult |

Churchill Bank Phone Number & Additional Details

- Homepage URL: https://www.churchillmortgage.com/

- Company Phone: 1-615-370-8888

- Headquarters Address: 761 Old Hickory Blvd, Suite 203, Brentwood, TN 37027-4519

- States Serviced: 36 U.S. states and D.C.

Churchill Bank is only one of the thousands of options out there. Maybe they work for you, maybe they don’t. Either way, we’re here to help!

The Bottom Line – Churchill Bank Mortgage Rates Review

Churchill Mortgage, established in 1992, has carved its niche as a privately owned mortgage company serving 36 U.S. states and D.C. They offer a variety of mortgage options, including conventional, FHA, VA, and USDA loans.

While their customer reviews vary, Churchill Mortgage maintains a generally positive reputation. They prioritize customer relationships, offering online pre-qualification and a host of useful resources, including mortgage calculators.

Their qualifications align with industry standards, including a minimum credit score of 620. Overall, Churchill Mortgage presents a credible option, albeit with a modest awards history and a name association with a past bankruptcy case.

How We Review Mortgage Lenders

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment.

Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Churchill Bank Mortgage Rates Review

Summary of Churchill Bank Mortgage Rates

Churchill Mortgage, a privately owned mortgage company established in 1992, caters to homebuyers in 36 U.S. states and the District of Columbia. Their comprehensive mortgage offerings encompass conventional, FHA, VA, and USDA loans, accommodating a wide spectrum of customers. One notable feature is their online pre-qualification tool, simplifying the initial application process. Churchill Mortgage distinguishes itself by emphasizing customer relationships and providing resources like mortgage calculators to assist buyers in making informed decisions.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Diverse Mortgage Options

- Online Pre-Qualification

- Customer-Centric Approach

Cons

- Limited Availability

- Minimal Awards History

- Name Association