Many people in the U.S. get their health insurance through their work. As a result, job loss results not only in the loss of income but also in the loss of valuable health care benefits.

Paying for health care is not just expensive; if you have a break in health coverage, it can be more difficult to get coverage down the road.

In order to help alleviate this issue and provide a transition for workers who lose their jobs, it is possible to use the COBRA program to get access to your company’s health plan.

Last December, when I resigned from my old firm and embarked into the realm of the 1099 Independent Contractor, I was formally introduced to COBRA Health Insurance.

I’ve helped many clients plan their transition periods between job changes and layoffs, but you never really learn the ropes until you are actually in the situation.

Luckily, I didn’t have to be under COBRA insurance for too long since my new firm offered a group plan.

For those who may take an extended period of time before they can get covered again, here’s all the information you will need to know about COBRA Health Insurance.

The first thing you need to understand is that COBRA is not a health insurance plan. Many people often get that confused.

So, what is COBRA insurance exactly? It is a law that was put into place with the Consolidated Omnibus Budget Reconciliation Act (COBRA).

The Act, first enacted in 1985 and revised in 1999, was put in place to protect you and your family if you lose your employer-sponsored health benefits.

More specifically, to help those suffering from job loss during the 2008 recession, Congress passed a 65% subsidy for laid-off workers in 2009 under former President Barack Obama.

This way, workers could receive assistance paying COBRA insurance premiums for 15 months while looking for work.

The final three months were paid by the laid-off employee. This subsidy expired on June 1, 2010, though, meaning that those laid off since the end of May 2010 do not have this subsidy. COBRA insurance is still available to those who want access to an employer health plan, but the subsidy is gone after being extended more than once.

Hence, when I changed jobs, COBRA was there to take care of me and my family in case of a medical emergency.

If you qualify for COBRA coverage, then you have the option of continuing your employer-sponsored health plan for a limited period of time. COBRA requires that three requirements be met before you can qualify for COBRA coverage:

- Your employer is obligated to provide COBRA coverage;

- You are a Qualified Beneficiary; and

- A Qualifying Event has occurred

Under COBRA, you may be responsible for paying up to 102% of the health insurance premium on your own.

There is an important item to be aware of here. If your former employer paid a substantial portion of your health insurance coverage, you are now responsible for the whole premium payment.

However, you may find that your premium goes higher without your employer picking up part of the tab.

In my case, that was more than double what I had been accustomed to paying. Basically, the better your insurance coverage is, the more that you will probably have to pay under COBRA.

What Are the Employer Requirements Under COBRA

Employers are only obligated to offer COBRA coverage if:

- They offer an employer-sponsored health insurance plan and

- They have at least 20 employees

If you are a Federal employee, you do not qualify for COBRA Insurance. You will need to contact your human resources department to see about continuing your health insurance coverage.

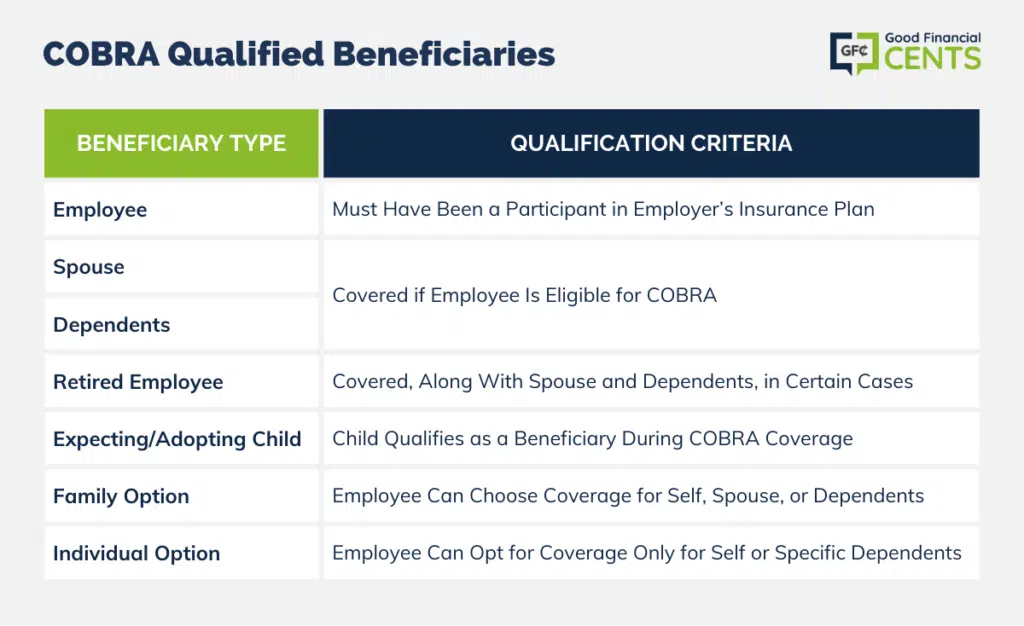

COBRA Qualified Beneficiaries

If you didn’t take part in your employer’s insurance plan, you will not qualify for coverage.

COBRA coverage may be offered to employees, an employee’s spouse, or an employee’s dependents. In certain cases, this includes a retired employee and the retired employee’s spouse and dependents.

If you are expecting a child or adopting a child during the period in which you are receiving coverage through COBRA, then that child will also qualify as a beneficiary.

You can choose to accept coverage under COBRA just for yourself or for your family. You can also choose to forego COBRA for yourself and just cover your spouse or dependent children.

Qualifying Events for COBRA

For the Employee

- If you leave your job voluntarily, this includes retirement

- If your work hours are reduced so that you are no longer eligible for health benefits under your employer’s policy

- If you lose your job for any reason other than gross misconduct

The Employee’s Spouse

- If the employee’s work hours are reduced

- If the employee leaves the job for any reason other than gross misconduct

- If the employee becomes entitled to Medicare

- Divorce or legal separation

- Death of the employee

Any Dependent Children

- If the employee’s work hours are reduced

- If the employee leaves the job for any reason other than gross misconduct

- If the child loses dependent child status under the employer-sponsored health plan’s rules

- If the employee becomes entitled to Medicare

- Divorce or legal separation

- Death of the employee

Non-qualifying Events for COBRA

Please note that the Qualifying Events for COBRA are events that affect your employment status only.

For example, if your employer decides to change the type of insurance coverage they provide, that will not trigger a qualifying event. Consequently, you will not qualify for COBRA Coverage.

COBRA Coverage

Your health insurance coverage under COBRA must be identical to the coverage your employer offers its current employees.

Generally, this means that you should get the same coverage after the Qualifying Event as you did before. I know in my case, I did qualify for the same type of coverage, so there was no worry if something went wrong.

If your employer reduces coverage to its current employees or cancels its employer-sponsored health insurance benefits altogether, then your coverage will be affected.

You will be entitled only to the same benefits as current employees have. This means that if your employer cancels its sponsored plan, then you will no longer be entitled to COBRA.

Providing Notice – The Plan Provider’s Responsibilities

When you become a participant in your employer’s sponsored health insurance plan, the plan administrator must provide you with an “Initial Notice” that outlines your rights under COBRA.

When a Qualifying Event occurs, your employer must provide you with a “Specific Notice” that you are qualified to elect continuing coverage under COBRA. Typically, you will get this notice in the mail.

Be on the lookout for this. My notice came about a month after I had separated from my employer.

Providing Notice – Your Responsibilities

You are responsible for notifying your plan administrator after certain Qualifying Events occur. These Qualifying Events are divorce, legal separation, or loss of “Dependent Child” status.

The length of time you have to report these Qualifying Events depends on your plan’s rules. Many plans require notice to be made within 60 days of the Qualifying Event.

Selecting COBRA

By law, when a Qualifying Event occurs, your employer must provide you with notice that COBRA is available. You may be informed in person, or you may receive this notice in the mail.

Once you receive notice, you have 60 days to choose COBRA continuation coverage. If you select COBRA, then your coverage will be retroactive to the day you lost your health insurance benefits due to the Qualifying Event.

If you initially reject COBRA continuation coverage, you still have a chance to change your mind. As long as you are within the 60-day window, you can inform your employer that you do want COBRA continuation coverage. Your coverage will begin from the day you inform your employer.

COBRA Term

COBRA coverage continues for 18 months. If you initially elect COBRA, then your coverage will begin on the first day that you would have lost your health insurance benefits due to the Qualifying Event.

If you initially rejected COBRA but changed your mind within the 60-day window, then your coverage will begin on the day you notified your employer.

The COBRA term can be shortened if:

- You do not pay your premiums on a timely basis

- Your employer ceases to maintain any group health plan

- You obtain coverage with another employer

- A beneficiary becomes entitled to Medicare benefits

The COBRA term can be extended if you become disabled within the first 60 days of COBRA continuation coverage. To qualify for this extension, you must submit a ruling from the Social Security Administration that says you have become disabled.

If you qualify, then you and your family may extend your COBRA coverage for an additional 11 months, but you may be required to pay up to 150% of the premium cost for those additional 11 months.

A spouse or dependent may extend the COBRA continuation period to a maximum of 18 months under certain circumstances.

These circumstances include divorce or separation from the covered employee, the death of the employee, a child’s loss of dependent status, or if the employee becomes eligible for Medicare within the continuation period.

Filing a Claim for Health Benefits Under COBRA

Health insurance plans are required to explain how to obtain benefits and must include written procedures for processing claims. Claims procedures must be described in the Summary Plan Description.

You should submit a claim for benefits in accordance with your plan’s rules for filing claims. If the claim is denied, you must be given notice of the denial in writing, generally within 90 days after the claim is filed.

You will have at least 60 days to appeal a denial, and you must receive a decision on the appeal generally within 60 days after that.

You will have at least 60 days to appeal a denial, and you must receive a decision on the appeal generally within 60 days after that.

Contact the plan administrator for more information on filing a claim for benefits. Complete plan rules are available from your employer or your insurance company. There can be charges up to 25 cents a page for copies of plan rules.

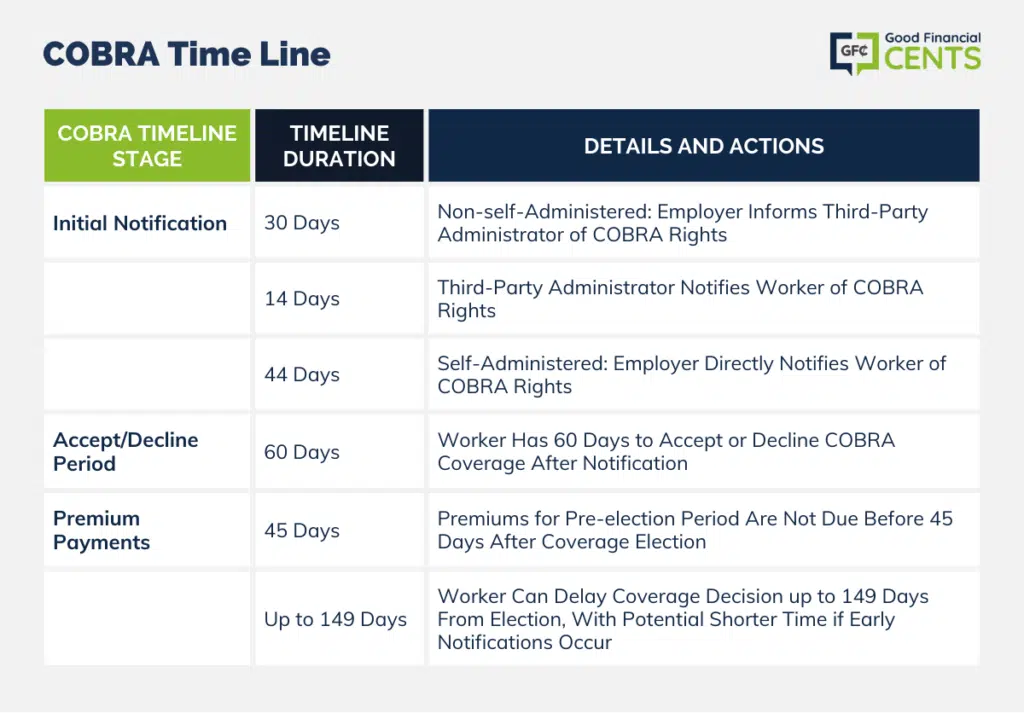

COBRA Time Line

- The first 44 days—Employers that do not self-administer their health insurance coverage (typically small employers) have 30 days to notify the third-party administrator of the plan of the worker’s COBRA rights after the worker leaves his or her job.

The third-party administrator then has 14 additional days to notify the worker of his or her COBRA rights. Employers that self-administer their own group health plans (typically large firms) have 44 days to notify workers of their COBRA rights.

- The next 60 days—After receiving notification of his or her rights (as described above), a worker has 60 days to accept or decline COBRA coverage.

- The final 45 days—Premium payments for periods before the election of coverage cannot be required before 45 days after a worker elects to accept coverage.

But if a worker decides not to pay at the time the premium is finally due, nothing is lost except the coverage. Thus, a worker who is entitled to COBRA coverage can wait—sometimes for as many as 149 days—to see if taking coverage is in his or her best interest.

The 149-day period could be shortened if employers or third-party administrators provide notifications in less than the maximum time allowed within the 44-day period described above.

For example, if employers or third-party administrators provided a very quick notification, a worker could have slightly more than 105 days to act.

The Bottom Line: COBRA Insurance Overview

If you can’t afford COBRA insurance, consider your other options. There are websites and insurance brokers that can help you compare health plans, and it’s possible to find an individual or family plan that costs less than COBRA — and isn’t tied to your job.

If you had a high deductible plan at your employer and have been taking advantage of a Health Savings Account, you can tap into this to help pay for costs. You can also check your savings accounts to see how much you have for medical expenses.

Paying for health care is always an expensive proposition, and with no more COBRA subsidies and an extension unlikely, it is up to you to see what you can do until you find another job with health benefits.

Thanks for this COBRA info. Question: can I get COBRA coverage for my Dental insurance? And my Vision insurance?

Mary Cooley

When you get COBRA, can you choose less medical benefits from what you had while you were working for your previous company? Another words if you had coverage for 5 different options, can you have only the 3 out of the five with COBRA?

Thanks