A Contributory IRA, otherwise known as a traditional IRA, is a retirement savings account that allows individuals to make contributions from their earned income.

The contributions made to the account may be tax-deductible or non-deductible, depending on the individual’s income level and participation in an employer-sponsored retirement plan.

Contributory IRA accounts are held by custodians, such as banks, brokerage firms, and mutual fund companies. The custodians are responsible for maintaining the accounts, processing contributions and withdrawals, and providing investment options.

Table of Contents

- The Contribution Limits of Contributory IRA

- Taxation of Contributory IRA Contributions

- Taxation of Contributory IRA Withdrawals

- Eligibility for Contributory IRA

- Advantages of Contributory IRA

- Disadvantages of Contributory IRA

- How to Open a Contributory IRA Account

- How to Choose the Right Contributory IRA Provider

- Managing Your Contributory IRA Account

- Diversifying Your Contributory IRA Portfolio

- Planning for Required Minimum Distributions (RMDs)

- How to Maximize Your Contributory IRA Savings

- Contributory IRA vs Roth IRA

- The Bottom Line – Contributory IRA Rules

The Contribution Limits of Contributory IRA

For 2025, the contribution limit for a Contributory IRA is $7,000. Individuals who are 50 years or older may make an additional catch-up contribution of $1,000, bringing the total contribution limit to $8,000.

The contribution limit may be reduced or eliminated for individuals who have high incomes or who participate in an employer-sponsored retirement plan.

Here are the contribution limits for the last seven years:

Contribution Limits for the Last Seven Years

| YEAR | CONTRIBUTION LIMIT | CATCH-UP CONTRIBUTION (AGE 50 AND OLDER) |

|---|---|---|

| 2017 | $5,500 | $1,000 |

| 2018 | $5,500 | $1,000 |

| 2019 | $6,000 | $1,000 |

| 2020 | $6,000 | $1,000 |

| 2021 | $6,000 | $1,000 |

| 2022 | $6,000 | $1,000 |

| 2023 | $6,500 | $1,000 |

Taxation of Contributory IRA Contributions

Contributions made to a Traditional IRA may be tax-deductible or non-deductible. Tax-deductible contributions reduce the individual’s taxable income, while non-deductible contributions do not.

The deductibility of contributions depends on the individual’s income level and participation in an employer-sponsored retirement plan.

Individuals who are not covered by an employer-sponsored retirement plan can make tax-deductible contributions regardless of their income level.

Taxation of Contributory IRA Withdrawals

Withdrawals from a Traditional IRA are taxed as ordinary income. The tax rate depends on the individual’s income level at the time of withdrawal.

Withdrawals made before age 59 1/2 may be subject to a 10% early withdrawal penalty in addition to the income tax.

Eligibility for Contributory IRA

To be eligible for a Contributory IRA, an individual must have earned income, such as wages, salaries, tips, or self-employment income. The individual must be under the age of 73 to make contributions to a Traditional IRA.

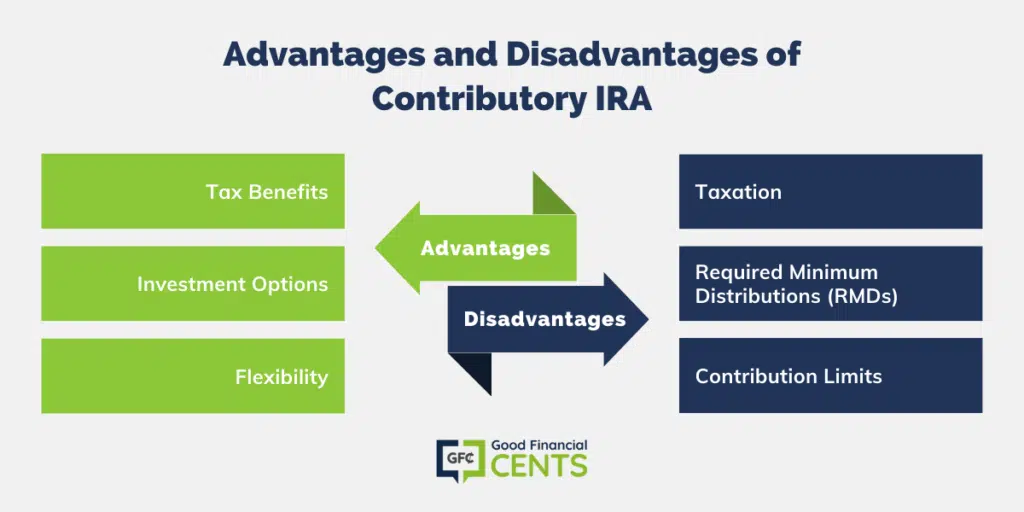

Advantages of Contributory IRA

- Tax Benefits: Contributory IRA offers tax benefits to individuals who make tax-deductible contributions. The contributions reduce the individual’s taxable income, resulting in lower taxes.

- Investment Options: Contributory IRA offers a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Individuals can choose the investment options that best suit their retirement goals and risk tolerance.

- Flexibility: Contributory IRA offers flexibility in terms of contributions and withdrawals. Individuals can choose how much to contribute and when to withdraw the funds.

There are no age requirements for contributions, and withdrawals can be made at any time, subject to taxes and penalties.

Disadvantages of Contributory IRA

- Taxation: While Contributory IRA offers tax benefits, withdrawals from the account are taxed as ordinary income. This means that individuals may end up paying higher taxes in retirement, depending on their income level and tax rate at the time of withdrawal.

- Required Minimum Distributions (RMDs): Individuals must start taking RMDs from their Contributory IRA account at age 73.

The RMD amount is based on the individual’s age and account balance and must be taken annually. Failure to take the RMD can result in a penalty of 50% of the required amount.

- Contribution Limits: The contribution limits for a Contributory IRA are relatively low compared to other retirement savings accounts. This means that individuals may not be able to save as much for retirement as they would like.

How to Open a Contributory IRA Account

Opening a Contributory IRA account is a simple process. Individuals can open an account with a bank, brokerage firm, or mutual fund company. The custodian will provide the necessary forms and instructions for opening the account.

To open a Contributory IRA account, individuals will need to provide their personal information, including name, address, Social Security number, and employment information. They will also need to choose the type of IRA account they want to open and provide the initial contribution.

How to Choose the Right Contributory IRA Provider

When choosing a Contributory IRA provider, individuals should consider several factors, including:

- Fees: Different providers charge different fees for maintaining the account and providing investment options. Individuals should choose a provider with low fees to maximize their savings.

- Investment Options: Individuals should choose a provider that offers a wide range of investment options to meet their retirement goals and risk tolerance.

- Customer Service: Individuals should choose a provider with excellent customer service to ensure that their questions and concerns are addressed promptly.

- Reputation: Individuals should choose a provider with a good reputation in the industry to ensure that their funds are safe and secure.

Best IRA Accounts

Here’s our list of the top IRA accounts to begin investing.

Managing Your Contributory IRA Account

Managing a Contributory IRA account is an ongoing process. Individuals should regularly review their account statements, investment performance, and contribution limits to ensure that they are on track to meet their retirement goals.

To manage their account effectively, individuals should:

- Monitor their investment performance: Individuals should regularly review the performance of their investment options and make changes as necessary to maximize their returns and minimize their risks.

- Update their beneficiary information: Individuals should update their beneficiary information regularly to ensure that their funds go to the intended beneficiaries in case of death.

- Plan for RMDs: Individuals should plan for RMDs to avoid penalties and ensure that they have enough funds to cover their retirement expenses.

Diversifying Your Contributory IRA Portfolio

Diversification is an essential strategy for maximizing the returns of a Contributory IRA account while minimizing risks. Diversification involves investing in a variety of asset classes, such as stocks, bonds, and cash, to spread out the risk and reduce the impact of market volatility.

To diversify their Contributory IRA portfolio, individuals should:

- Choose a mix of asset classes: Individuals should choose a mix of asset classes based on their risk tolerance and investment goals.

- Rebalance their portfolio: Individuals should regularly rebalance their portfolio to maintain the desired asset allocation and minimize the risks.

- Consider professional advice: Individuals may consider seeking professional advice from a financial advisor to help them diversify their portfolio effectively.

Planning for Required Minimum Distributions (RMDs)

As mentioned earlier, individuals must start taking RMDs from their Contributory IRA account at age 73. To plan for RMDs effectively, individuals should:

- Understand the RMD rules: Individuals should understand the RMD rules and how they apply to their individual retirement accounts. Taxpayers who are over the age of 73 must begin taking money out of traditional and Roth IRA accounts each year.

- Calculate the RMD amount: Individuals should calculate the RMD amount using the IRS’s life expectancy tables and their account balance.

- Plan for taxes: Individuals should plan for the taxes on their RMDs to avoid surprises and maximize their after-tax income.

- Consider alternative strategies: Individuals may consider alternative strategies, such as Roth conversions or charitable contributions, to minimize their RMDs’ impact on their taxes and retirement income.

How to Maximize Your Contributory IRA Savings

To maximize their Contributory IRA savings, individuals should:

- Contribute regularly: Individuals should contribute regularly to their accounts to take advantage of the tax benefits and compound interest.

- Start early: Individuals should contribute to their accounts as early as possible to maximize their savings.

- Maximize their contributions: Individuals should maximize their contributions to the account every year to take advantage of the contribution limits and maximize their tax benefits.

- Choose the right investment options: Individuals should choose the investment options that best suit their retirement goals and risk tolerance to maximize their returns and minimize their risks.

- Avoid penalties: Individuals should avoid penalties by following the contribution and withdrawal rules and taking their RMDs on time.

Contributory IRA vs Roth IRA

Contributory IRAs and Roth IRAs are two types of retirement savings accounts that offer different tax benefits and rules.

Contributory IRA offers tax-deductible contributions and taxable withdrawals, while Roth IRA offers tax-free withdrawals and non-deductible contributions.

To choose between a Contributory IRA and a Roth IRA, individuals should consider their income level, tax rate, and retirement goals.

Roth IRAs may be more beneficial for individuals with low income or high tax rates, while Contributory IRAs may be more beneficial for individuals with high income or low tax rates.

Contributory IRA vs. Roth IRA

| IRA TYPE | KEY FEATURES | CONTRIBUTION LIMITS | TAX BENEFITS | WITHDRAWAL RULES |

|---|---|---|---|---|

| Traditional IRA | Contributions May Be Tax-Deductible; Earnings Grow Tax-Deferred; Withdrawals Are Taxed as Ordinary Income | $7,000/Year ($8,000/Year for Those Age 50 and Older) | Tax-Deductible Contributions for Eligible Participants; Tax-Deferred Growth | Penalty-Free Withdrawals at Age 59 1/2; Required Minimum Distributions (RMDs) Starting at Age 73 |

| Roth IRA | Contributions Are Made With After-Tax Dollars; Earnings Grow Tax-Free; Qualified Withdrawals Are Tax-Free | $7,000/Year ($8,000/Year for Those Age 50 and Older) | Tax-Free Qualified Withdrawals; No RMDs | Contributions Are Always Penalty-Free; Withdrawals of Earnings May Be Subject to Penalties if Taken Before Age 59 1/2 |

| Non-deductible IRA | Contributions Are Made With After-Tax Dollars; Earnings Grow Tax-Deferred; Withdrawals Are Taxed as Ordinary Income (Only Earnings Are Taxed) | $7,000/Year ($8,000/Year for Those Age 50 and Older) | Tax-Deferred Growth | Penalty-Free Withdrawals at Age 59 1/2; Required Minimum Distributions (RMDs) Starting at Age 73 |

The Bottom Line – Contributory IRA Rules

Contributory IRA is a powerful tool for saving for retirement. It offers tax benefits, investment options, and flexibility to meet individuals’ retirement goals. However, it also has some disadvantages, such as taxation on withdrawals and RMD requirements.

To maximize the benefits of a Contributory IRA, individuals should contribute regularly, choose the right investment options, and plan for taxes and RMDs.